Answered step by step

Verified Expert Solution

Question

1 Approved Answer

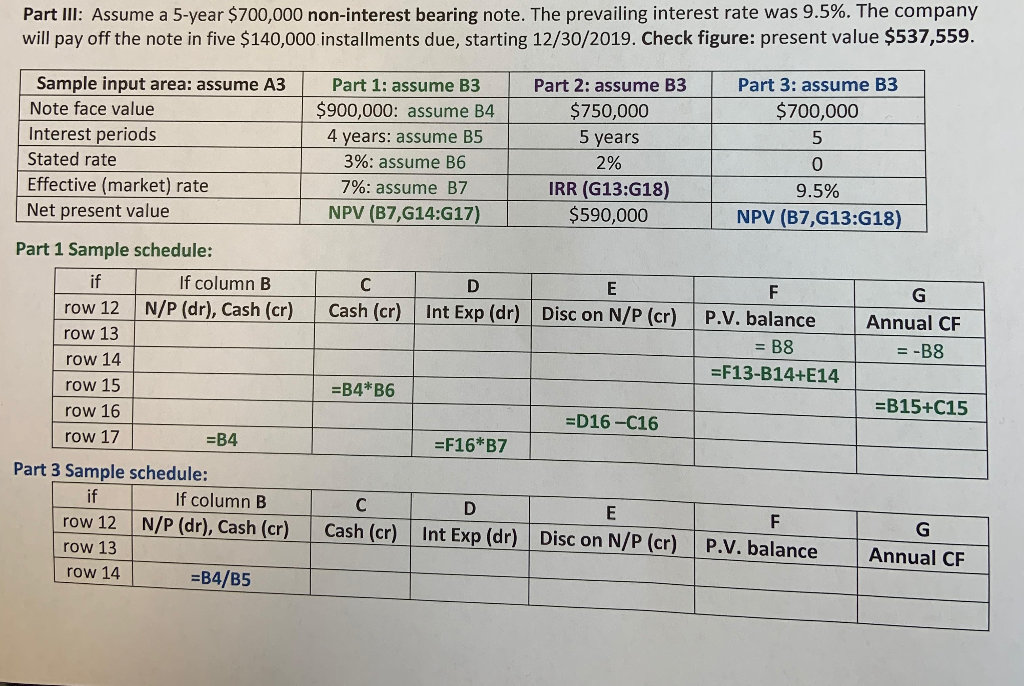

Could someone please help me with this last question. Below it is an example schedule of how it should look like but I have been

Could someone please help me with this last question. Below it is an example schedule of how it should look like but I have been trying to understand this question for over an hour and i'm not making much headway. Under the "Part 3" sample scedule.

Part III: Assume a 5-year $700,000 non-interest bearing note. The prevailing interest rate was 9.5%. The company will pay off the note in five $140,000 installments due, starting 12/30/2019. Check figure: present value $537,559. Part 3: assume B3 $700,000 5 Sample input area: assume A3 Note face value Interest periods Stated rate Effective (market) rate Net present value Part 1: assume B3 $900,000: assume B4 4 years: assume B5 3%: assume B6 7%: assume B7 NPV (B7,G14:G17) Part 2: assume B3 $750,000 5 years 2% IRR (G13:G18) $590,000 O 9.5% NPV (B7,613:G18) Cash (cr) Int Exp (dr) Disc on N/P (cr) Part 1 Sample schedule: if If column B row 12 N/P (dr), Cash (cr) row 13 row 14 row 15 row 16 row 17 =B4 P.V. balance = B8 =F13-B14+E14 Annual CF = -B8 =B4*B6 =B15+C15 =D16 -C16 =F16*B7 Part 3 Sample schedule: if If column B row 12 N/P (dr), Cash (cr) row 13 row 14 =B4/B5 toplemente com C Cash (cr) cachon inte ens van Dic on JP lernp. v. balance D Int Exp (dr) Disc on N/P (cr) P.V. balance Annual ce Annual CF Part III: Assume a 5-year $700,000 non-interest bearing note. The prevailing interest rate was 9.5%. The company will pay off the note in five $140,000 installments due, starting 12/30/2019. Check figure: present value $537,559. Part 3: assume B3 $700,000 5 Sample input area: assume A3 Note face value Interest periods Stated rate Effective (market) rate Net present value Part 1: assume B3 $900,000: assume B4 4 years: assume B5 3%: assume B6 7%: assume B7 NPV (B7,G14:G17) Part 2: assume B3 $750,000 5 years 2% IRR (G13:G18) $590,000 O 9.5% NPV (B7,613:G18) Cash (cr) Int Exp (dr) Disc on N/P (cr) Part 1 Sample schedule: if If column B row 12 N/P (dr), Cash (cr) row 13 row 14 row 15 row 16 row 17 =B4 P.V. balance = B8 =F13-B14+E14 Annual CF = -B8 =B4*B6 =B15+C15 =D16 -C16 =F16*B7 Part 3 Sample schedule: if If column B row 12 N/P (dr), Cash (cr) row 13 row 14 =B4/B5 toplemente com C Cash (cr) cachon inte ens van Dic on JP lernp. v. balance D Int Exp (dr) Disc on N/P (cr) P.V. balance Annual ce Annual CFStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started