Answered step by step

Verified Expert Solution

Question

1 Approved Answer

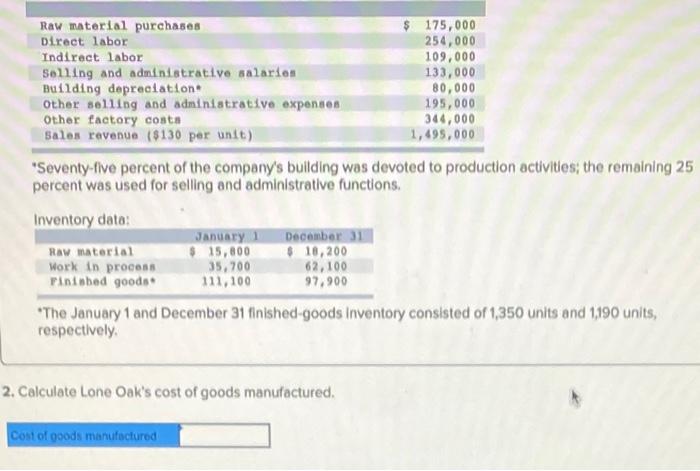

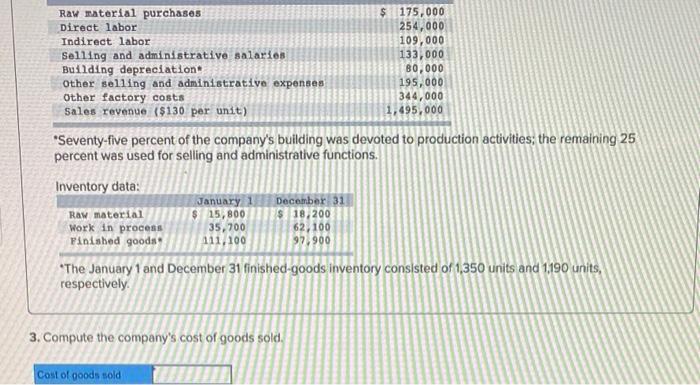

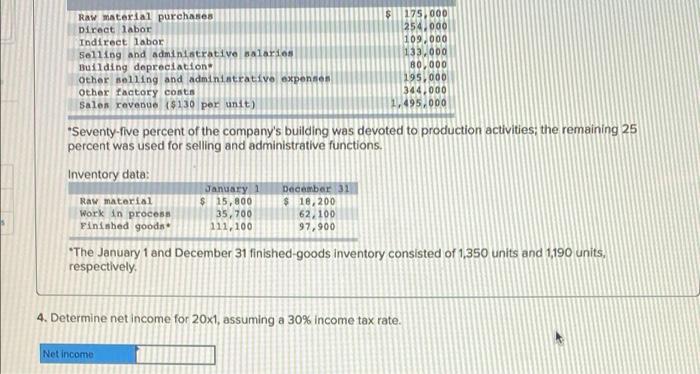

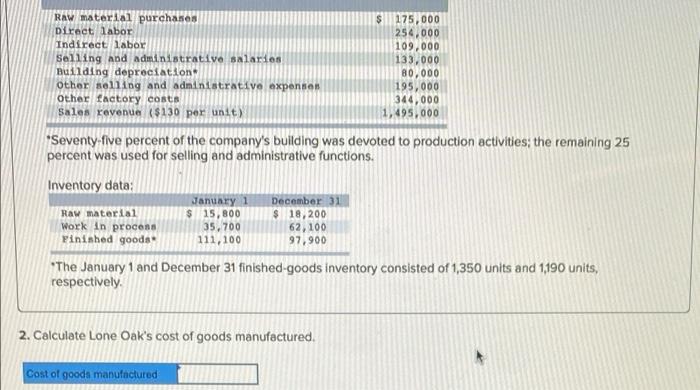

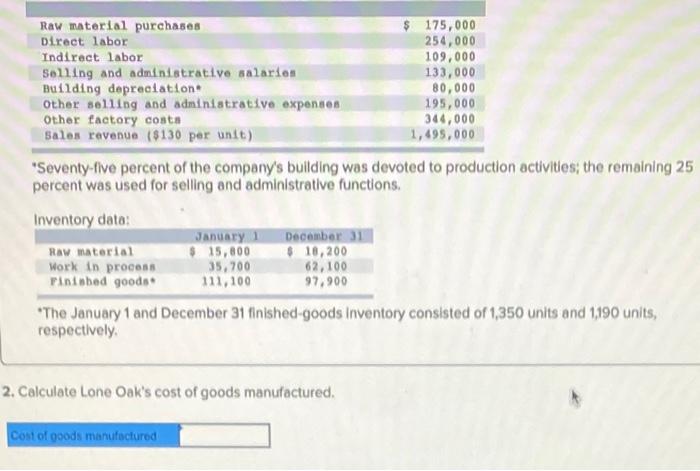

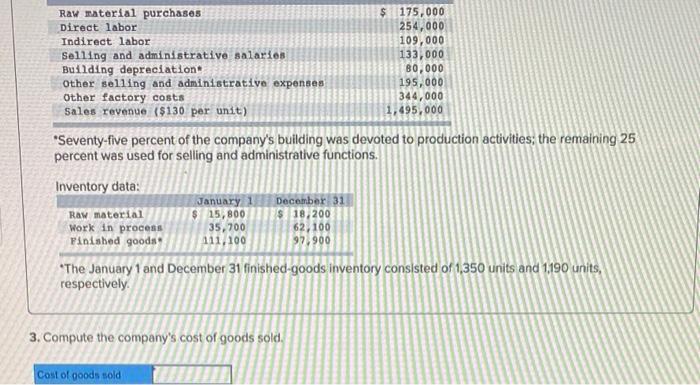

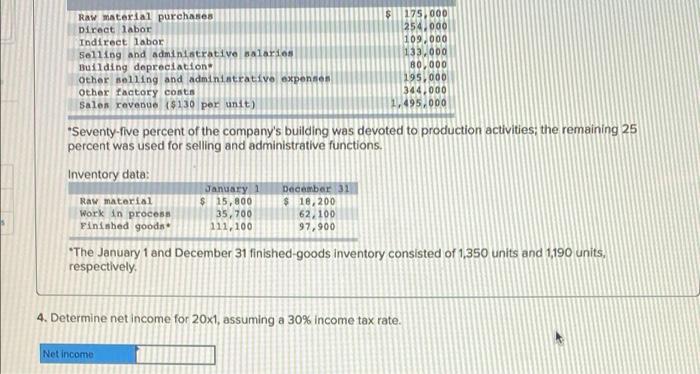

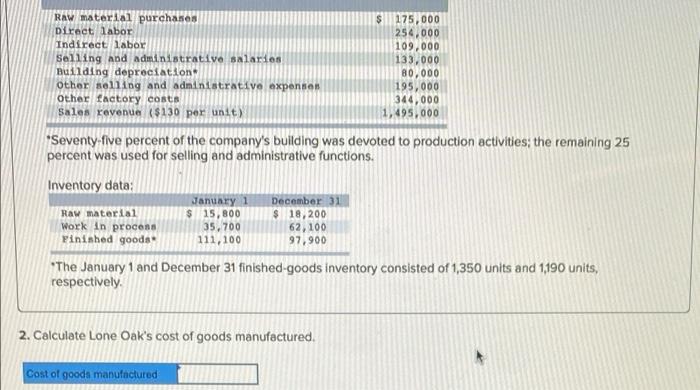

Could use some help please Raw material purchases $ 175,000 Direct labor 254,000 Indirect labor 109,000 Selling and administrative salaries 133,000 Building depreciation 80,000 Other

Could use some help please

Raw material purchases $ 175,000 Direct labor 254,000 Indirect labor 109,000 Selling and administrative salaries 133,000 Building depreciation 80,000 Other selling and administrative expenses 195,000 Other factory costa 344,000 Sales revenue ($130 per unit) 1,495,000 "Seventy-five percent of the company's building was devoted to production activities, the remaining 25 percent was used for selling and administrative functions. Inventory data: January December 31 Raw material $. 15,800 $ 18,200 Work in process 35,700 62,100 Pinised goods 111,100 97,900 *The January 1 and December 31 finished goods Inventory consisted of 1,350 units and 1190 units, respectively 2. Calculate Lone Oak's cost of goods manufactured, Cost of goods manufactured Raw material purchases $ 175,000 Direct labor 254,000 Indirect labor 109,000 Selling and administrative salarios 133,000 Building depreciation B0,000 Other selling and administrative expenses 195,000 Other factory costs 344,000 Sales revenue ($130 per unit) 1,495,000 "Seventy-five percent of the company's building was devoted to production activities; the remaining 25 percent was used for selling and administrative functions. Inventory data: January December 31 Raw material $ 15,800 $ 18,200 Work in process 35,700 62,100 Finished goods 111,100 97,900 'The January 1 and December 31 finished-goods inventory consisted of 1,350 units and 1,190 units, respectively. 3. Compute the company's cost of goods sold. Cost of goods sold Raw material purchases Direct labor Indirect labor Selling and administrative salarios Building depreciation Other selling and administrativo expension Other factory conta Salon revenue ($130 per unit) $ 175,000 254.000 109.000 133.000 80,000 195,000 344,000 1,495.000 "Seventy-five percent of the company's building was devoted to production activities, the remaining 25 percent was used for selling and administrative functions. Inventory data: January 1 December 31 Raw material $ 15,800 $ 18,200 Work in process 35,700 62.100 Finished goods 111,100 97,900 *The January 1 and December 31 finished-goods inventory consisted of 1,350 units and 1190 units, respectively 4. Determine net income for 20x1, assuming a 30% Income tax rate. Net income Raw material purchases Direct labor Indirect labor Selling and administrative salarios Building depreciation Other selling and administrativo expenso Other factory costs Sales revenue ($130 per unit) $175,000 254.000 109,000 133.000 80,000 195,000 344,000 1,495,000 "Seventy-five percent of the company's building was devoted to production activities, the remaining 25 percent was used for selling and administrative functions. Inventory data; Raw material Work in process Finished goods January 1 $ 15,800 35,700 111,100 December 31 $ 18,200 62, 100 97,900 "The January 1 and December 31 finished-goods inventory consisted of 1,350 units and 1190 units, respectively. 2. Calculate Lone Oak's cost of goods manufactured Cost of goods manufactured Raw material purchases Direct labor Indirect labor Selling and administrative salarios Building depreciation. Other selling and administrative expenses Other factory costs Sales revenue ($130 per unit) S 175,000 254 000 109,000 133,000 80,000 195.000 344,000 1,495,000 *Seventy-five percent of the company's building was devoted to production activities, the remaining 25 percent was used for selling and administrative functions. Inventory data: Raw material Work in process Finished goods January 1 $ 15,800 35 700 111,100 December 31 $ 18,200 62, 100 97,900 *The January 1 and December 31 finished-goods inventory consisted of 1.350 units and 1.190 units, respectively 3. Compute the company's cost of goods sold. Cost of goods sold Raw material purchases $ 175,000 Direct labor 254,000 Indirect labor 109,000 Selling and administrative salaries 133,000 Building depreciation 80,000 Other selling and administrative expenses 195,000 other factory costs 344,000 Sales revenue ($130 per unit) 1,495,000 "Seventy-five percent of the company's building was devoted to production activities; the remaining 25 percent was used for selling and administrative functions. Inventory data: Raw material Work in process Finished goods January 1 $ 15,800 35,700 111,100 December 31 $ 18,200 62,100 97,900 *The January 1 and December 31 finished-goods inventory consisted of 1,350 units and 1190 units, respectively. 4. Determine net income for 20x1, assuming a 30% income tax rate. Net Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started