Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could you explain how to get the numbers in the answer sheet. All of them just makes no sense to me. Thank you. b) Alpha

Could you explain how to get the numbers in the answer sheet. All of them just makes no sense to me. Thank you.

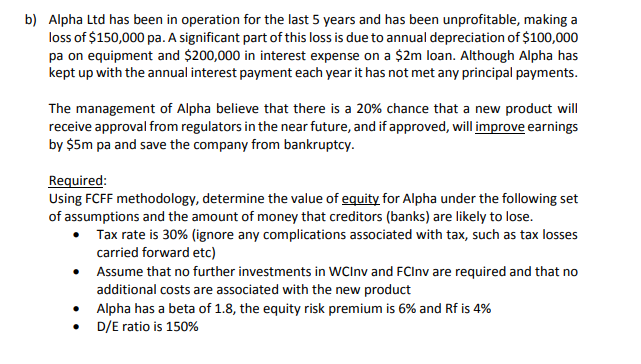

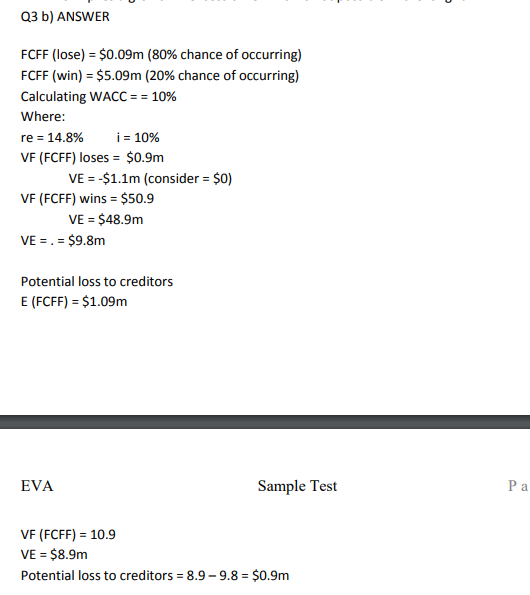

b) Alpha Ltd has been in operation for the last 5 years and has been unprofitable, making a loss of $150,000 pa. A significant part of this loss is due to annual depreciation of $100,000 pa on equipment and $200,000 in interest expense on a $2m loan. Although Alpha has kept up with the annual interest payment each year it has not met any principal payments. The management of Alpha believe that there is a 20% chance that a new product will receive approval from regulators in the near future, and if approved, will improve earnings by $5m pa and save the company from bankruptcy. Required: Using FCFF methodology, determine the value of equity for Alpha under the following set of assumptions and the amount of money that creditors (banks) are likely to lose. Tax rate is 30% (ignore any complications associated with tax, such as tax losses carried forward etc) Assume that no further investments in Cinv and FCInv are required and that no additional costs are associated with the new product Alpha has a beta of 1.8, the equity risk premium is 6% and Rf is 4% D/E ratio is 150% Q3b) ANSWER FCFF (lose) = $0.09m (80% chance of occurring) FCFF (win) = $5.09m (20% chance of occurring) Calculating WACC == 10% Where: re = 14.8% i = 10% VF (FCFF) loses = $0.9m VE = -$1.1m (consider = $0) VF (FCFF) wins = $50.9 VE = $48.9m VE = . = $9.8m Potential loss to creditors E (FCFF) = $1.09m EVA Sample Test Pa VF (FCFF) = 10.9 VE = $8.9m Potential loss to creditors = 8.9-9.8 = $0.9m b) Alpha Ltd has been in operation for the last 5 years and has been unprofitable, making a loss of $150,000 pa. A significant part of this loss is due to annual depreciation of $100,000 pa on equipment and $200,000 in interest expense on a $2m loan. Although Alpha has kept up with the annual interest payment each year it has not met any principal payments. The management of Alpha believe that there is a 20% chance that a new product will receive approval from regulators in the near future, and if approved, will improve earnings by $5m pa and save the company from bankruptcy. Required: Using FCFF methodology, determine the value of equity for Alpha under the following set of assumptions and the amount of money that creditors (banks) are likely to lose. Tax rate is 30% (ignore any complications associated with tax, such as tax losses carried forward etc) Assume that no further investments in Cinv and FCInv are required and that no additional costs are associated with the new product Alpha has a beta of 1.8, the equity risk premium is 6% and Rf is 4% D/E ratio is 150% Q3b) ANSWER FCFF (lose) = $0.09m (80% chance of occurring) FCFF (win) = $5.09m (20% chance of occurring) Calculating WACC == 10% Where: re = 14.8% i = 10% VF (FCFF) loses = $0.9m VE = -$1.1m (consider = $0) VF (FCFF) wins = $50.9 VE = $48.9m VE = . = $9.8m Potential loss to creditors E (FCFF) = $1.09m EVA Sample Test Pa VF (FCFF) = 10.9 VE = $8.9m Potential loss to creditors = 8.9-9.8 = $0.9mStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started