Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could you explain how you got this answer? Thanks FIN 330 Project 3 Questions (1) - Word Layout References Mailings Review View Help Tell me

Could you explain how you got this answer? Thanks

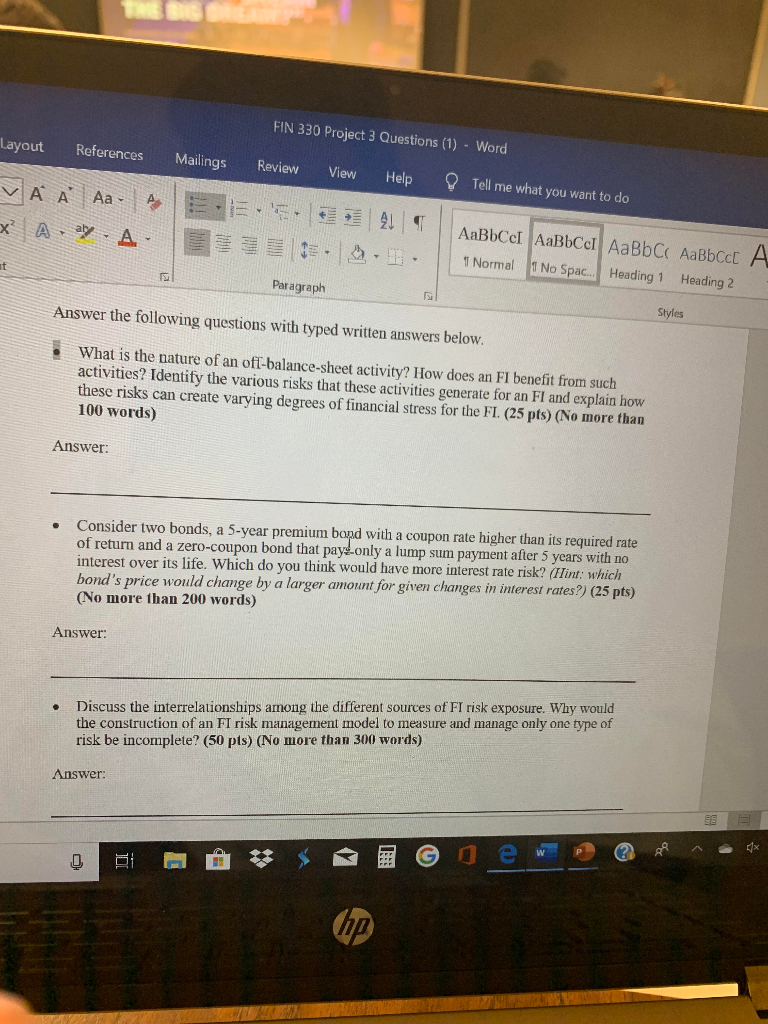

FIN 330 Project 3 Questions (1) - Word Layout References Mailings Review View Help Tell me what you want to do VA Aa- A * A aly. A DE. . . AaBbCcI AaBbccI AaBb C AaBb c A 1 Normal 1 No Spac... Heading 1 Heading 2 Paragraph Answer the following questions with typed written answers below. Styles What is the nature of an off-balance-sheet activity? How does an FI benefit from such activities? Identify the various risks that these activities generate for an FI and explain how these risks can create varying degrees of financial stress for the FI. (25 pts) (No more than 100 words) Answer: Consider two bonds, a 5-year premium bond with a coupon rate higher than its required rate of return and a zero-coupon bond that paydonly a lump sum payment after 5 years with no interest over its life. Which do you think would have more interest rate risk? (Hint: which bond's price would change by a larger amount for given changes in interest rates?) (25 pts) (No more than 200 words) Answer: Discuss the interrelationships among the different sources of FI risk exposure. Why would the construction of an FI risk management model to measure and manage only one type of risk be incomplete? (50 pts) (No more than 300 words) Answer: 0 Ri @ $ ew @ Rn. FIN 330 Project 3 Questions (1) - Word Layout References Mailings Review View Help Tell me what you want to do VA Aa- A * A aly. A DE. . . AaBbCcI AaBbccI AaBb C AaBb c A 1 Normal 1 No Spac... Heading 1 Heading 2 Paragraph Answer the following questions with typed written answers below. Styles What is the nature of an off-balance-sheet activity? How does an FI benefit from such activities? Identify the various risks that these activities generate for an FI and explain how these risks can create varying degrees of financial stress for the FI. (25 pts) (No more than 100 words) Answer: Consider two bonds, a 5-year premium bond with a coupon rate higher than its required rate of return and a zero-coupon bond that paydonly a lump sum payment after 5 years with no interest over its life. Which do you think would have more interest rate risk? (Hint: which bond's price would change by a larger amount for given changes in interest rates?) (25 pts) (No more than 200 words) Answer: Discuss the interrelationships among the different sources of FI risk exposure. Why would the construction of an FI risk management model to measure and manage only one type of risk be incomplete? (50 pts) (No more than 300 words) Answer: 0 Ri @ $ ew @ RnStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started