Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could you explain the answer to me please, just make no sense by just looking at them. b) From the following information determine the value

Could you explain the answer to me please, just make no sense by just looking at them.

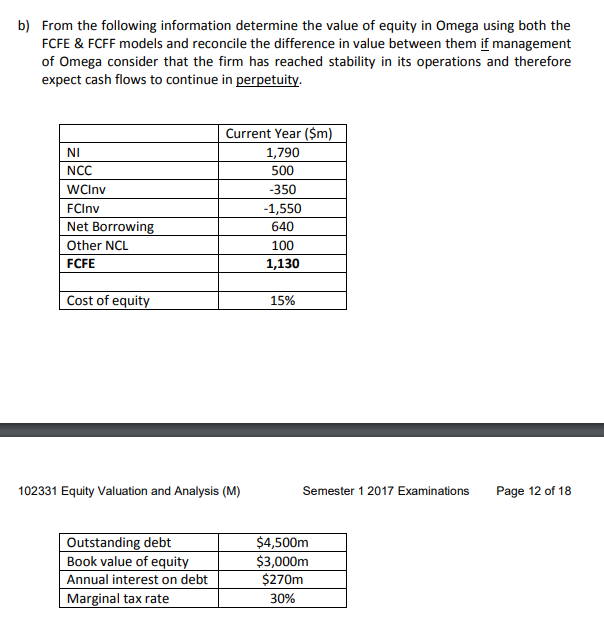

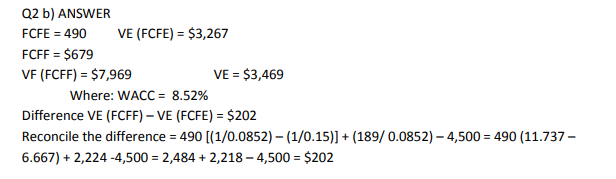

b) From the following information determine the value of equity in Omega using both the FCFE & FCFF models and reconcile the difference in value between them if management of Omega consider that the firm has reached stability in its operations and therefore expect cash flows to continue in perpetuity. NI NCC WCiny FCInv Net Borrowing Other NCL FCFE Current Year ($m) 1,790 500 -350 -1,550 640 100 1,130 Cost of equity 15% 102331 Equity Valuation and Analysis (M) Semester 1 2017 Examinations Page 12 of 18 Outstanding debt Book value of equity Annual interest on debt Marginal tax rate $4,500m $3,000m $270m 30% Q2 b) ANSWER FCFE = 490 VE (FCFE) = $3,267 FCFF = $679 VF (FCFF) = $7,969 VE = $3,469 Where: WACC = 8.52% Difference VE (FCFF) VE (FCFE) = $202 Reconcile the difference = 490 [(1/0.0852) - (1/0.15)) + (189/ 0.0852) 4,500 = 490 (11.737 - 6.667) + 2,224-4,500 = 2,484 +2,218 - 4,500 = $202 b) From the following information determine the value of equity in Omega using both the FCFE & FCFF models and reconcile the difference in value between them if management of Omega consider that the firm has reached stability in its operations and therefore expect cash flows to continue in perpetuity. NI NCC WCiny FCInv Net Borrowing Other NCL FCFE Current Year ($m) 1,790 500 -350 -1,550 640 100 1,130 Cost of equity 15% 102331 Equity Valuation and Analysis (M) Semester 1 2017 Examinations Page 12 of 18 Outstanding debt Book value of equity Annual interest on debt Marginal tax rate $4,500m $3,000m $270m 30% Q2 b) ANSWER FCFE = 490 VE (FCFE) = $3,267 FCFF = $679 VF (FCFF) = $7,969 VE = $3,469 Where: WACC = 8.52% Difference VE (FCFF) VE (FCFE) = $202 Reconcile the difference = 490 [(1/0.0852) - (1/0.15)) + (189/ 0.0852) 4,500 = 490 (11.737 - 6.667) + 2,224-4,500 = 2,484 +2,218 - 4,500 = $202Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started