Answered step by step

Verified Expert Solution

Question

1 Approved Answer

could you help me do this ccounting project 7 step```````````````````````````````````` 14 cleaning miscellaneous pcnse). 9 Recorded photo work done for a customer on account. 9

could you help me do thisccounting project 7 step````````````````````````````````````

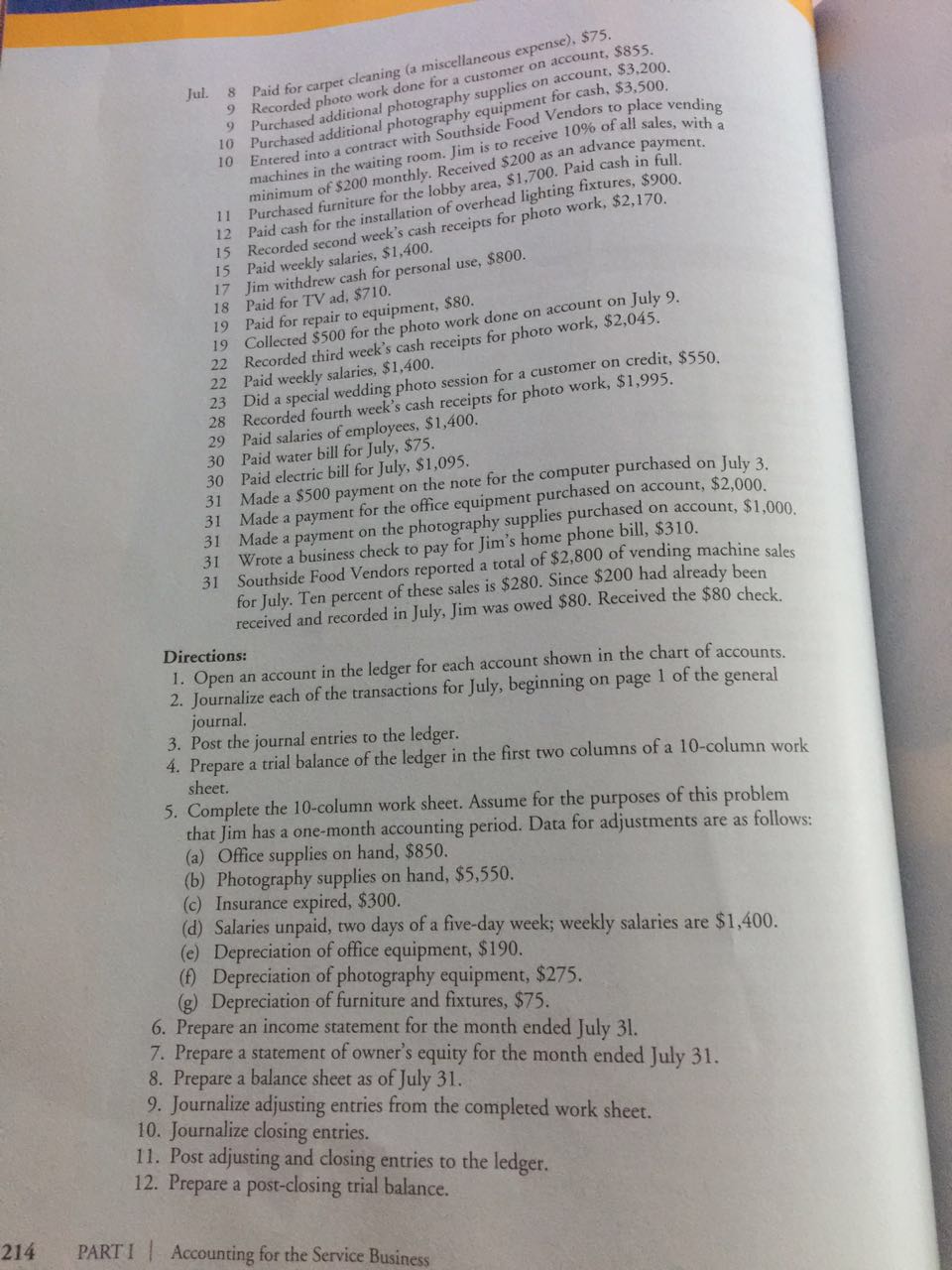

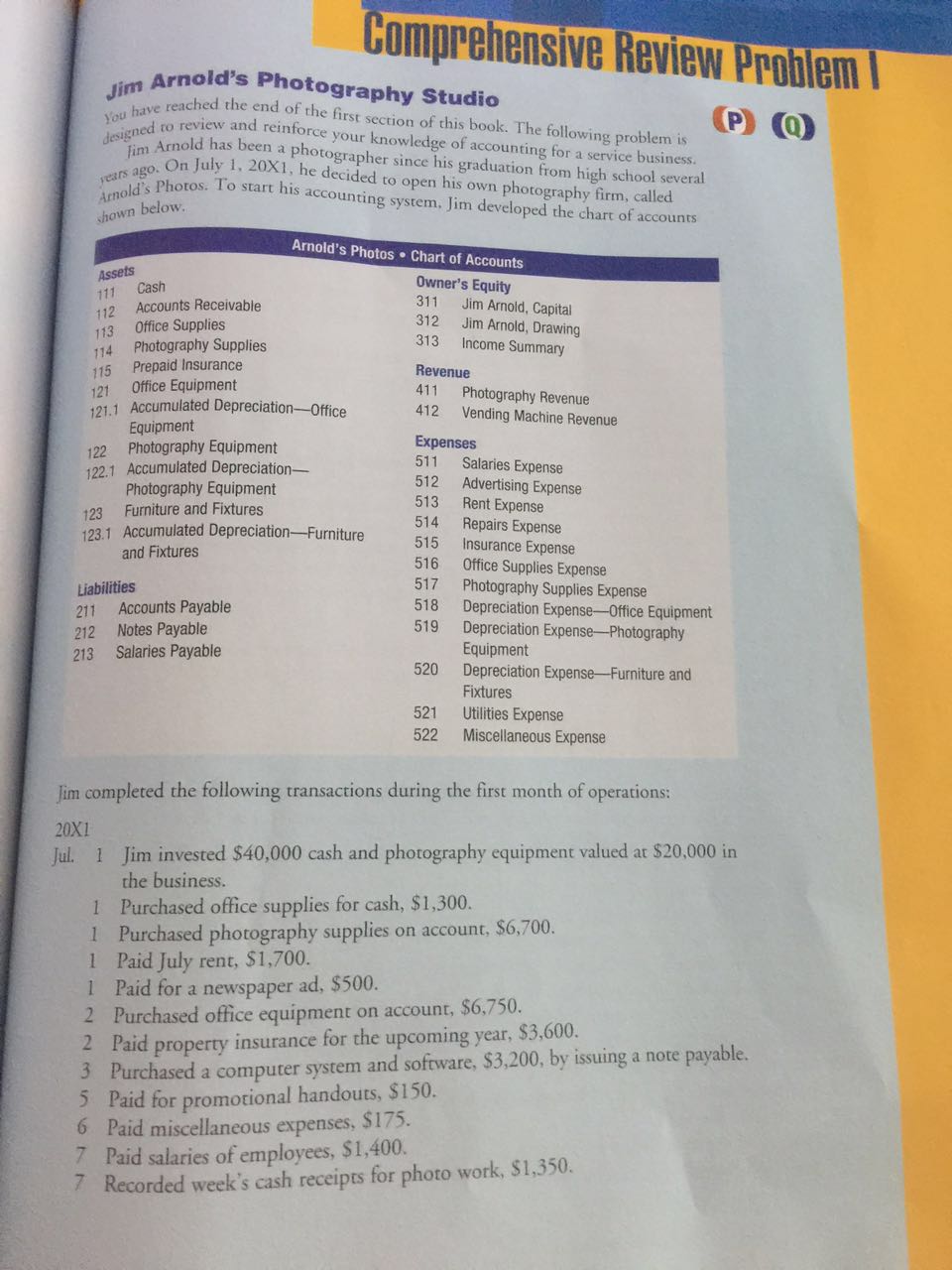

14 cleaning miscellaneous pcnse). 9 Recorded photo work done for a customer on account. 9 purchased photography on account. S3.200. Jul. 8 Paid for cari*t 10 with Southside Food Vendors to place vending machines the room. is to of-all with a minimum of $200 monthly. Received S200 as an II Purchased furniture for the lobby area. Sl.roo. paid cash in full. 12 paid cash for rhe installation of overhead lighting Recorded cash receipts for photo work. $2,170. 1 paid weekly salaries. S I ,400. 17 Jim withdrew cash for personal use, $800. 18 paid for TV ad, $710. 19 Collected $500 for photo work done on account on July 9. 22 Recorded third week's receipts for photo work, $2,045. 23 Did a special wedding photo session for a customer on credit, $550. 28 Recorded fourth week's cash receipts for photo work, S 1,995. 29 paid salaries Of employees. S | ,400. 30 paid water bill for July, $75. 30 paid electric bill for July, S I 31 Made payment on the note for the computer purchased on July 3. 31 Made a payment for the office equipment purchased on account, $2,000. 31 Made a payment on the photography supplies purchased on account, S 1,000 31 Wrote a business check to pay for Jim's home phone bill, $310. 31 Southside Food Vendors reported a total of $2,800 Of vending machine sales for July. Ten percent of these sales is $280. Since $200 had already been received and recorded in July, Jim was owed $80. Received the $80 check. Directions: l. Open an account in the ledger for each account shown in the chart of accounts. 2. Journalize each of the transactions for July, beginning on page I Of the general journal. 3. Post the journal entries to the ledger. 4. Prepare a trial balance of the ledger in the first two columns of a 10-column work sheet. 5. Complete the 10-column work sheet. Assume for the purposes of this problem that Jim has a one-month accounting period. Data for adjustments are as follows: (a) Office supplies on hand, $850. (b) Photography supplies on hand, $5,550. (c) Insurance expired, $300. (d) Salaries unpaid, two days ofa five-day week; weekly salaries are Sl ,400. (e) Depreciation of office equipment, S 190. (f) Depreciation of photography equipment, $275. (g) Depreciation of furniture and fixtures, $75. 6. Prepare an income statement for the month ended July 31. 7. Prepare a statement of owner's equity for the month ended July 31. 8. Prepare a balance sheet as of July 31. 9. Journalize adjusting entries from the completed work sheet. 10. Journalize closing entries. II. Post adjusting and closing entries to the ledger. 12. Prepare a post-closing trial balance. PART I I Accounting for the Service Business

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started