could you help me with this accounting program. the answers should have the formulas as well thanks.

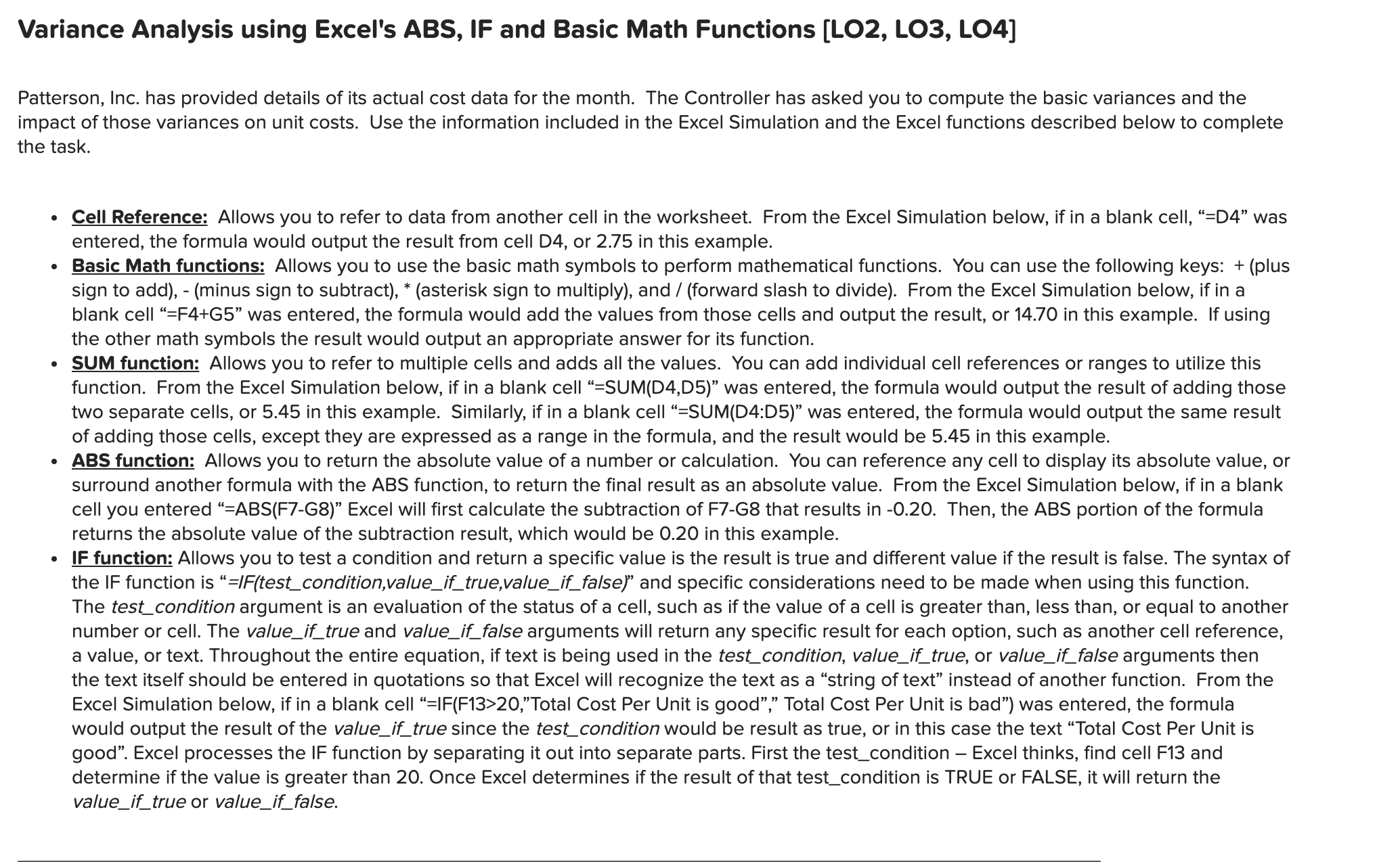

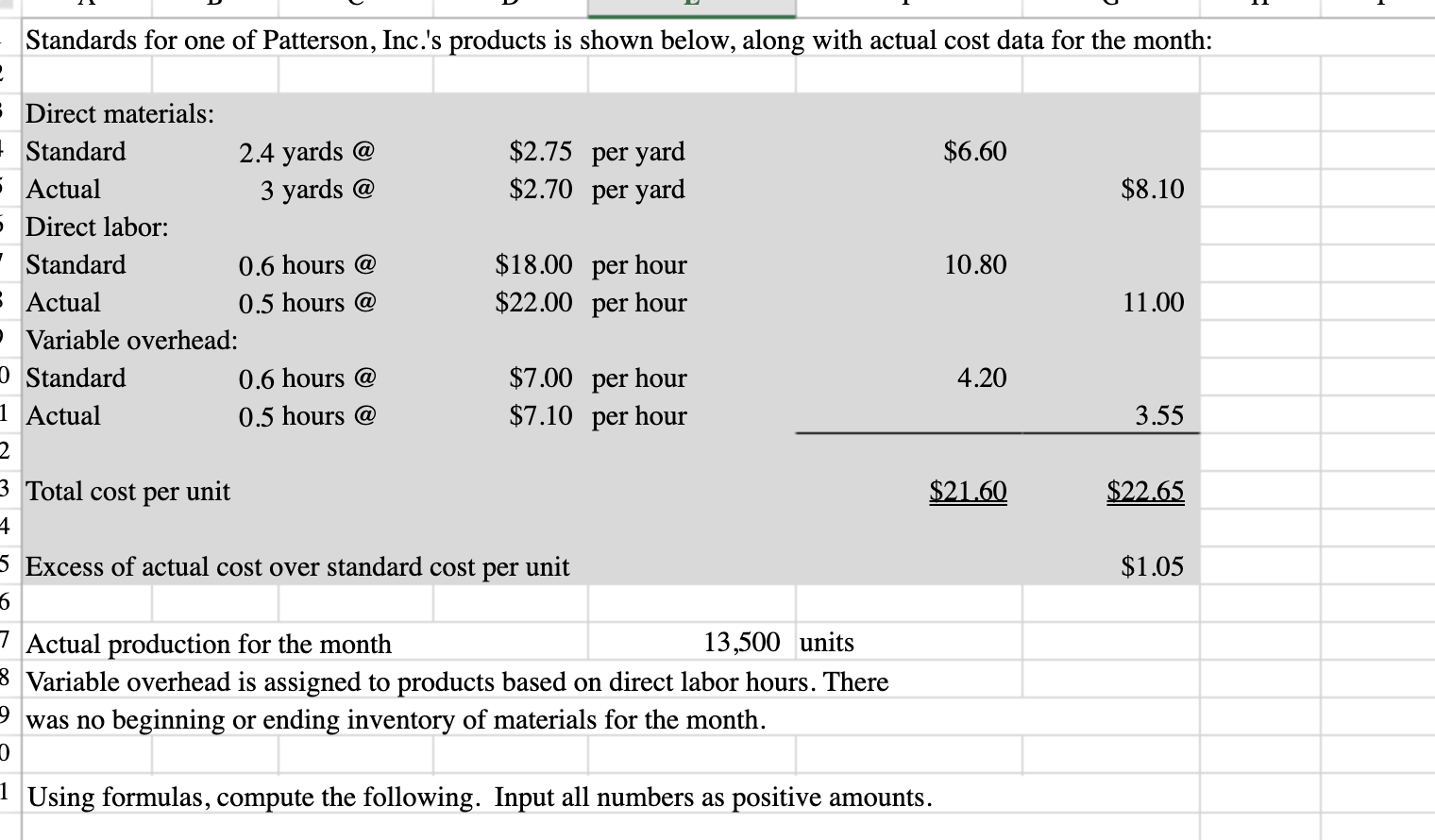

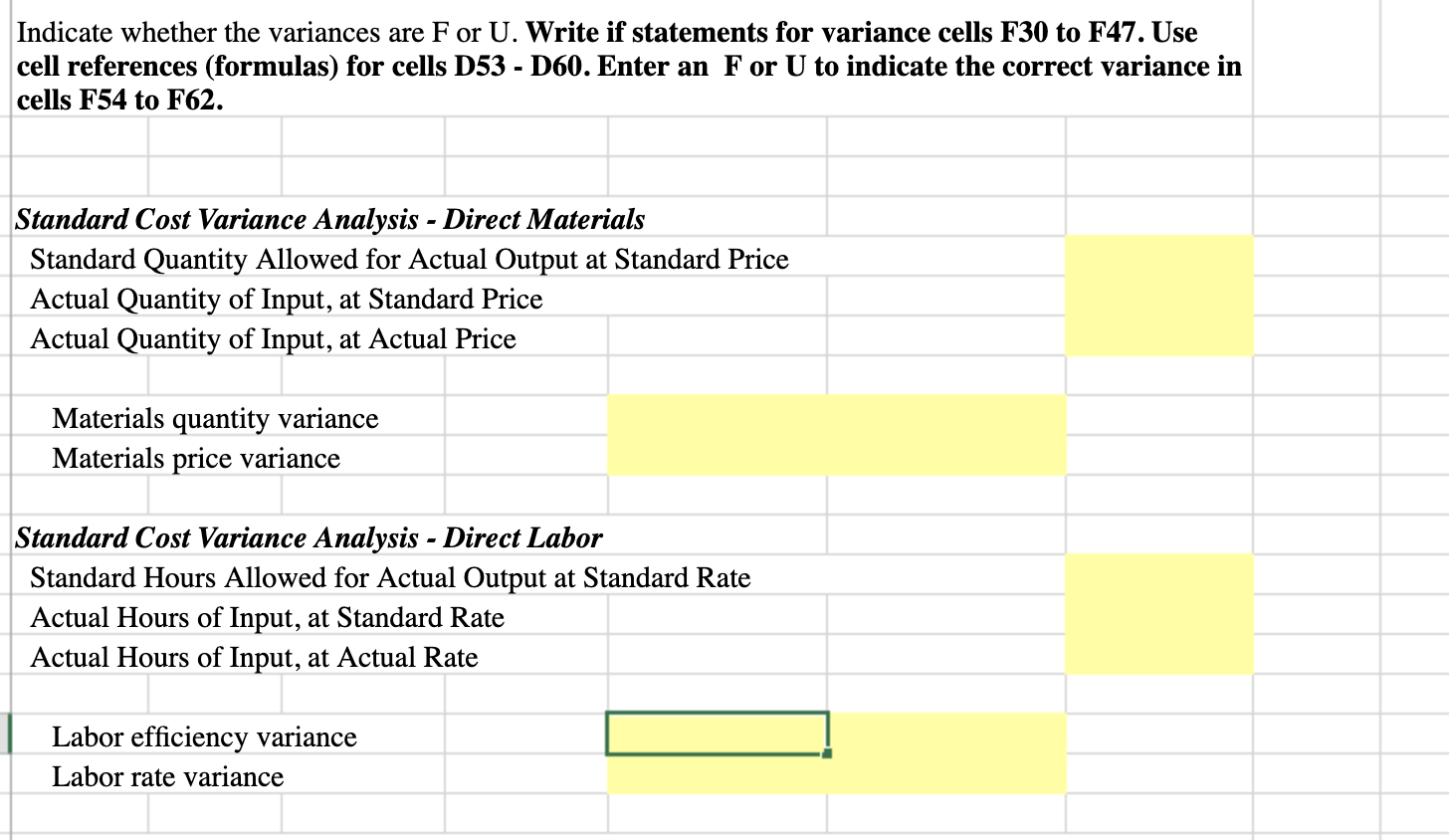

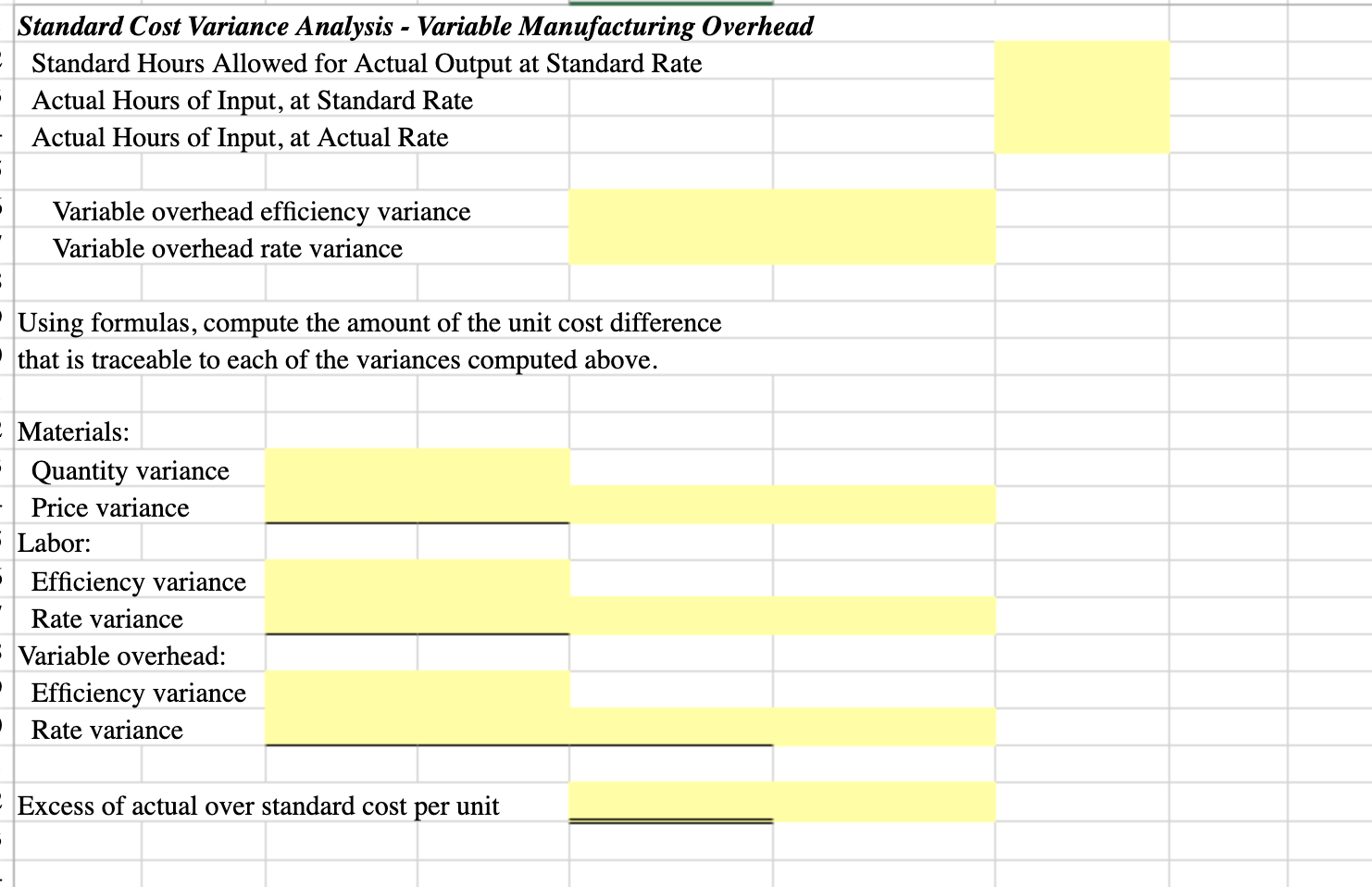

Variance Analysis using Excel's ABS, IF and Basic Math Functions [L02, L03, L04] Patterson, Inc. has provided details of its actual cost data for the month. The Controller has asked you to compute the basic variances and the impact of those variances on unit costs. Use the information included in the Excel Simulation and the Excel functions described below to complete the task. . Cell Reference: Allows you to refer to data from another cell in the worksheet. From the Excel Simulation below, if in a blank cell, \"=D4\" was entered, the formula would output the result from cell D4, or 2.75 in this example. - Basic Math functions: Allows you to use the basic math symbols to perform mathematical functions. You can use the following keys: + (plus sign to add), - (minus sign to subtract), * (asterisk sign to multiply), and / (fonNard slash to divide). From the Excel Simulation below, if in a blank cell \"=F4+GS\" was entered, the formula would add the values from those cells and output the result, or 14.70 in this example. If using the other math symbols the result would output an appropriate answer for its function. . SUM function: Allows you to refer to multiple cells and adds all the values. You can add individual cell references or ranges to utilize this function. From the Excel Simulation below, ifin a blank cell \"=SUM(D4,DS)" was entered, the formula would output the result of adding those two separate cells, or 5.45 in this example. Similarly, if in a blank cell "=SUM(D4:D5)" was entered, the formula would output the same result of adding those cells. except they are expressed as a range in the formula, and the result would be 5.45 in this example. ' ABS function: Allows you to return the absolute value of a number or calculation. You can reference any cell to display its absolute value, or surround another formula with the ABS function, to return the final result as an absolute value. From the Excel Simulation below, if in a blank cell you entered \"=ABS(F7-GS)\" Excel will first calculate the subtraction of F7-68 that results in -O.20. Then, the ABS portion of the formula returns the absolute value of the subtraction result, which would be 0.20 in this example. - IF function: Allows you to test a condition and return a specific value is the result is true and different value if the result is false. The syntax of the IF function is \"=lF(rest_Condition,value_if_true,value_if_false)\" and specic considerations need to be made when using this function. The test_condition argument is an evaluation of the status of a cell, such as ifthe value of a cell is greater than, less than, or equal to another number or cell. The value_if_ true and value_if_ false arguments will return any specic result for each option, such as another cell reference, a value, or text. Throughout the entire equation, if text is being used in the test_condition, value_if_ true, or value_if_ false arguments then the text itself should be entered in quotations so that Excel will recognize the text as a \"string of text\" instead of another function. From the Excel Simulation below, if in a blank cell "=IF(F13>20,\"Tota| Cost Per Unit is good\Standards for one of Patterson, Inc.'s products is shown below, along with actual cost data for the month: Direct materials: Standard 2.4 yards @ $2.75 per yard $6.60 Actual 3 yards @ $2.70 per yard $8.10 Direct labor: Standard 0.6 hours @ $18.00 per hour 10.80 Actual 0.5 hours @ $22.00 per hour 11.00 Variable overhead: Standard 0.6 hours @ $7.00 per hour 4.20 Actual 0.5 hours @ $7.10 per hour 3.55 Total cost per unit $21.60 $22.65 Excess of actual cost over standard cost per unit $1.05 Actual production for the month 13,500 units Variable overhead is assigned to products based on direct labor hours. There was no beginning or ending inventory of materials for the month. Using formulas, compute the following. Input all numbers as positive amounts.Indicate whether the variances are F or U. Write if statements for variance cells F30 to F47. Use cell references (formulas) for cells D53 - D60. Enter an F or U to indicate the correct variance in cells F54 to F62. Standard Cost Variance Analysis - Direct Materials Standard Quantity Allowed for Actual Output at Standard Price Actual Quantity of Input, at Standard Price Actual Quantity of Input, at Actual Price Materials quantity variance Materials price variance Standard Cost Variance Analysis - Direct Labor Standard Hours Aowed for Actual Output at Standard Rate Actual Hours of Input, at Standard Rate Actual Hours of Input, at Actual Rate Labor efciency variance I ll Labor rate variance Standard Cost Variance Analysis - Variable Manufacturing Overhead Standard Hours Allowed for Actual Output at Standard Rate Actual Hours of Input, at Standard Rate Actual Hours of Input, at Actual Rate Variable overhead efficiency variance Variable overhead rate variance Using formulas, compute the amount of the unit cost difference that is traceable to each of the variances computed above. Materials: Quantity variance Price variance Labor: Efficiency variance Rate variance Variable overhead: Efficiency variance Rate variance Excess of actual over standard cost per unit