Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could you please answer all of these questions please, I really appreciate that. Thank you so much. Thumbs up :) Sean Ltd. is a company

Could you please answer all of these questions please, I really appreciate that. Thank you so much. Thumbs up :)

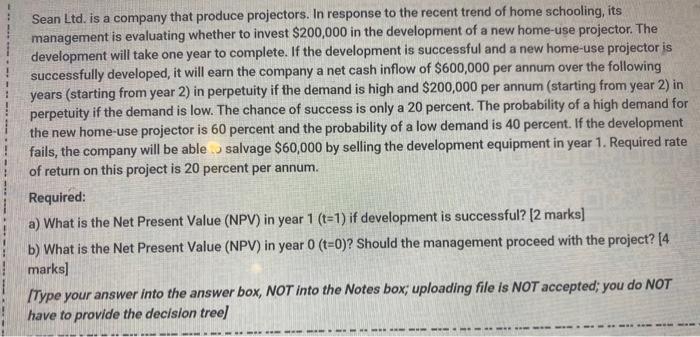

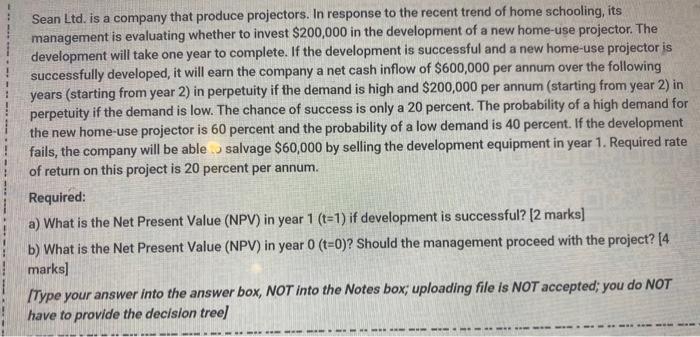

Sean Ltd. is a company that produce projectors. In response to the recent trend of home schooling, its management is evaluating whether to invest $200,000 in the development of a new home-use projector. The development will take one year to complete. If the development is successful and a new home-use projector is successfully developed, it will earn the company a net cash inflow of $600,000 per annum over the following years (starting from year 2) in perpetuity if the demand is high and $200,000 per annum (starting from year 2) in perpetuity if the demand is low. The chance of success is only a 20 percent. The probability of a high demand for the new home-use projector is 60 percent and the probability of a low demand is 40 percent. If the development fails, the company will be able u salvage $60,000 by selling the development equipment in year 1. Required rate of return on this project is 20 percent per annum. Required: a) What is the Net Present Value (NPV) in year 1 (t=1) if development is successful? [2 marks] b) What is the Net Present Value (NPV) in year 0 (t=0)? Should the management proceed with the project? [4 marks) IType your answer into the answer box, NOT into the Notes box, uploading file is NOT accepted; you do NOT have to provide the decision tree) Sean Ltd. is a company that produce projectors. In response to the recent trend of home schooling, its management is evaluating whether to invest $200,000 in the development of a new home-use projector. The development will take one year to complete. If the development is successful and a new home-use projector is successfully developed, it will earn the company a net cash inflow of $600,000 per annum over the following years (starting from year 2) in perpetuity if the demand is high and $200,000 per annum (starting from year 2) in perpetuity if the demand is low. The chance of success is only a 20 percent. The probability of a high demand for the new home-use projector is 60 percent and the probability of a low demand is 40 percent. If the development fails, the company will be able u salvage $60,000 by selling the development equipment in year 1. Required rate of return on this project is 20 percent per annum. Required: a) What is the Net Present Value (NPV) in year 1 (t=1) if development is successful? [2 marks] b) What is the Net Present Value (NPV) in year 0 (t=0)? Should the management proceed with the project? [4 marks) IType your answer into the answer box, NOT into the Notes box, uploading file is NOT accepted; you do NOT have to provide the decision tree)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started