Could you please answer Question 1, 2, 3, 4, 5, 6. Could you please show full working out. Could you please answer accordingly to the question marks. i will give a 100% review and 5 stars thank you

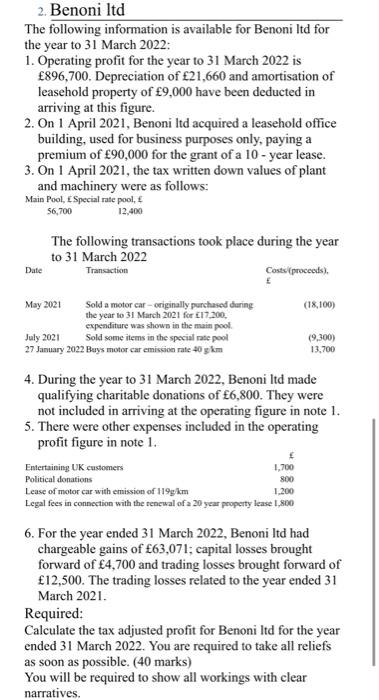

2. Benoni ltd The following information is available for Benoni Itd for the year to 31 March 2022: 1. Operating profit for the year to 31 March 2022 is 896,700. Depreciation of 21,660 and amortisation of leasehold property of 9,000 have been deducted in arriving at this figure. 2. On 1 April 2021, Benoni Itd acquired a leasehold office building, used for business purposes only, paying a premium of 90,000 for the grant of a 10-year lease. 3. On 1 April 2021, the tax written down values of plant and machinery were as follows: Main Pool, Special rate pool, 56,700 12,400 The following transactions took place during the year to 31 March 2022 Transaction Costs (proceeds) Date (9.300) May 2021 Sold a motor car originally purchased during (18,100) the year to 31 March 2021 for 17.200, expenditure was shown in the main pool July 2021 Sold some items in the special rate pool 27 January 2022 Buys motor car emission rate 40 km 13.700 4. During the year to 31 March 2022, Benoni Itd made qualifying charitable donations of 6,800. They were not included in arriving at the operating figure in note I. 5. There were other expenses included in the operating profit figure in note 1 Entertaining UK customers 1,700 Political donations 800 Lease of motor car with emission of 119 km 1.200 Legal fees in connection with the renewal of a 20 year property lease 1,800 6. For the year ended 31 March 2022, Benoni Itd had chargeable gains of 63,071; capital losses brought forward of 4,700 and trading losses brought forward of 12,500. The trading losses related to the year ended 31 March 2021. Required: Calculate the tax adjusted profit for Benoni Itd for the year ended 31 March 2022. You are required to take all reliefs as soon as possible. (40 marks) You will be required to show all workings with clear narratives. 2. Benoni ltd The following information is available for Benoni Itd for the year to 31 March 2022: 1. Operating profit for the year to 31 March 2022 is 896,700. Depreciation of 21,660 and amortisation of leasehold property of 9,000 have been deducted in arriving at this figure. 2. On 1 April 2021, Benoni Itd acquired a leasehold office building, used for business purposes only, paying a premium of 90,000 for the grant of a 10-year lease. 3. On 1 April 2021, the tax written down values of plant and machinery were as follows: Main Pool, Special rate pool, 56,700 12,400 The following transactions took place during the year to 31 March 2022 Transaction Costs (proceeds) Date (9.300) May 2021 Sold a motor car originally purchased during (18,100) the year to 31 March 2021 for 17.200, expenditure was shown in the main pool July 2021 Sold some items in the special rate pool 27 January 2022 Buys motor car emission rate 40 km 13.700 4. During the year to 31 March 2022, Benoni Itd made qualifying charitable donations of 6,800. They were not included in arriving at the operating figure in note I. 5. There were other expenses included in the operating profit figure in note 1 Entertaining UK customers 1,700 Political donations 800 Lease of motor car with emission of 119 km 1.200 Legal fees in connection with the renewal of a 20 year property lease 1,800 6. For the year ended 31 March 2022, Benoni Itd had chargeable gains of 63,071; capital losses brought forward of 4,700 and trading losses brought forward of 12,500. The trading losses related to the year ended 31 March 2021. Required: Calculate the tax adjusted profit for Benoni Itd for the year ended 31 March 2022. You are required to take all reliefs as soon as possible. (40 marks) You will be required to show all workings with clear narratives