Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could you please answer this question? I am in a hurry a little bit, so fast answer would be appreciated! Thank you! BE 2 Question

Could you please answer this question?

I am in a hurry a little bit, so fast answer would be appreciated!

Thank you!

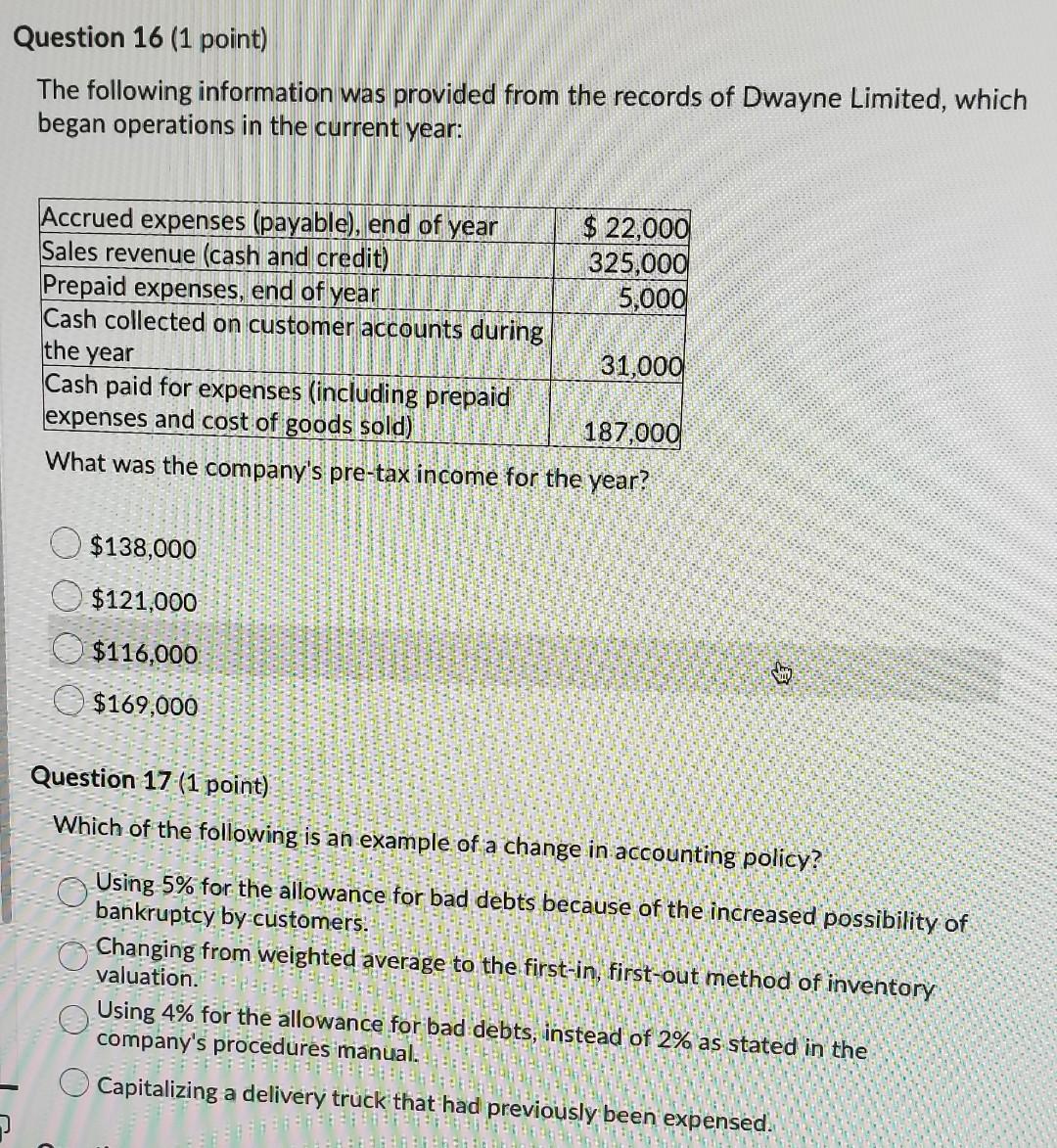

BE 2 Question 16 (1 point) The following information was provided from the records of Dwayne Limited, which began operations in the current year: Accrued expenses (payable), end of year $ 22,000 Sales revenue (cash and credit) 325,000 Prepaid expenses, end of year 5,000 Cash collected on customer accounts during the year 31,000 Cash paid for expenses (including prepaid expenses and cost of goods sold) 187,000 What was the company's pre-tax income for the year? 23 $138,000 $121,000 2 $116,000 SON $169,000 36 Question 17 (1 point) Which of the following is an example of a change in accounting policy? ANSEN SO Using 5% for the allowance for bad debts because of the increased possibility of bankruptcy by customers. Changing from weighted average to the first-in, first-out method of inventory valuation. Using 4% for the allowance for bad debts, instead of 2% as stated in the company's procedures manual. Capitalizing a delivery truck that had previously been expensed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started