Could you please create a Consolidated Balance Sheet with the given information:

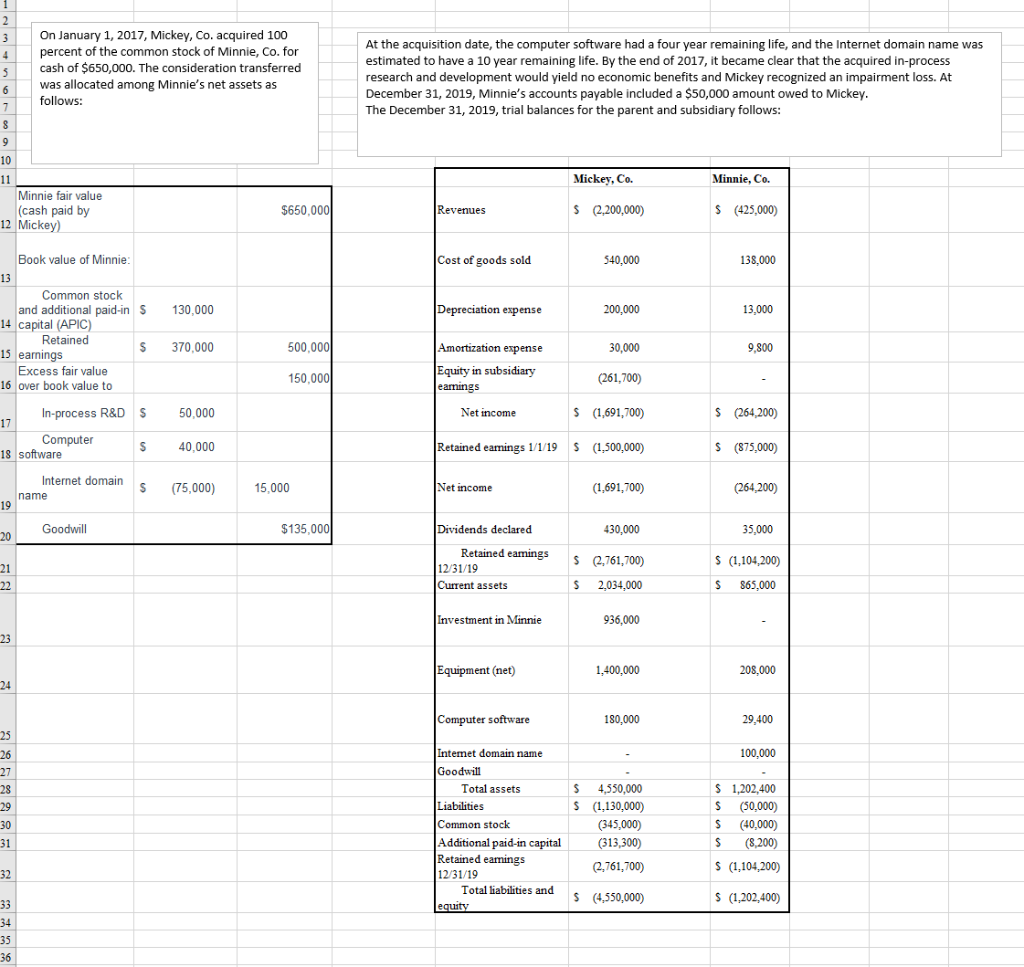

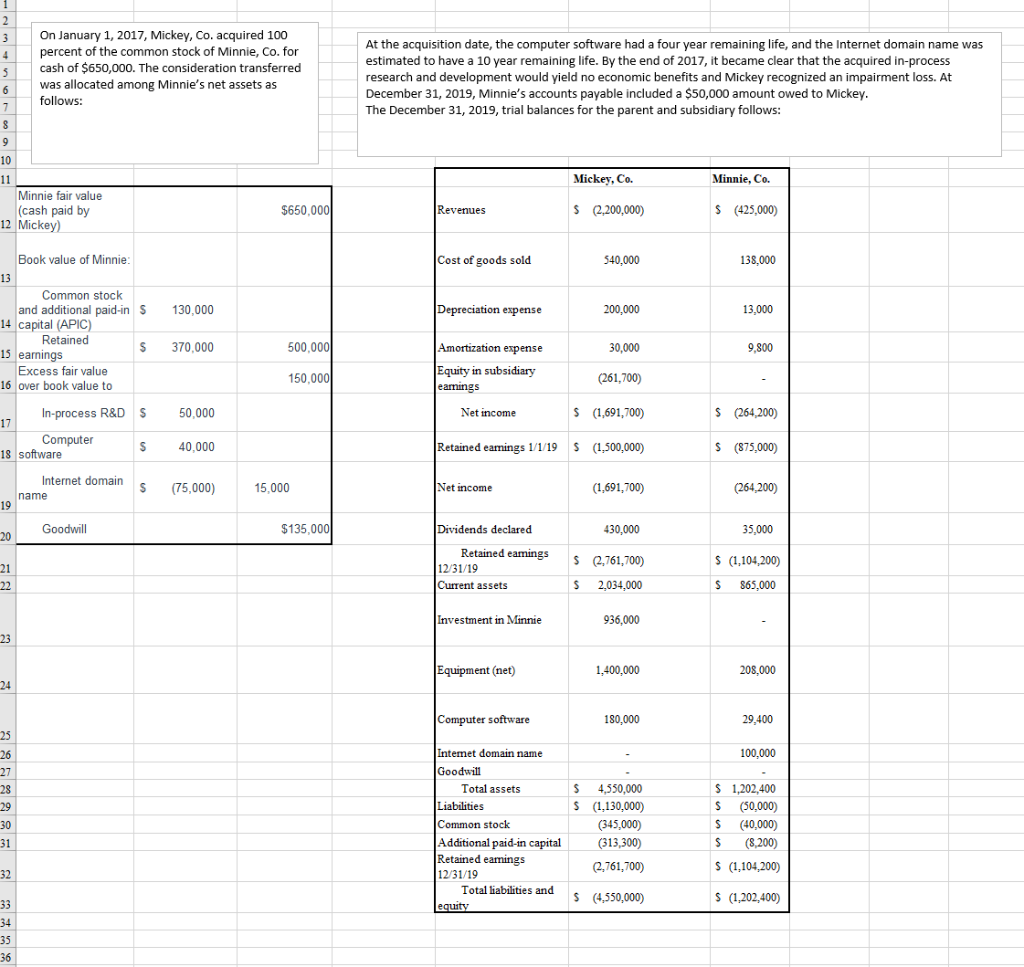

On January 1, 2017, Mickey, Co. acquired 100 percent of the common stock of Minnie, Co. for cash of $650,000. The consideration transferred was allocated among Minnie's net assets as follows: At the acquisition date, the computer software had a four year remaining life, and the Internet domain name was estimated to have a 10 year remaining life. By the end of 2017, it became clear that the acquired in-process research and development would yield no economic benefits and Mickey recognized an impairment loss. At December 31, 2019, Minnie's accounts payable included a $50,000 amount owed to Mickey. The December 31, 2019, trial balances for the parent and subsidiary follows: 10 Mickey, Co. Minnie, Co. Minnie fair value (cash paid by 12 Mickey) $650,000 Revenues $ 2,200,000) $ (425,000) Book value of Minnie: Cost of goods sold 540,000 138,000 130,000 Depreciation expense 200,000 13.000 370,000 500,000 30,000 9,800 Common stock and additional paid-in $ 14 capital (APIC) Retained $ 15 earnings Excess fair value 16 over book value to In-process R&D $ 17 Computer $ 18 software Amortization expense Equity in subsidiary earnings 150,000 (261,700) 50,000 Net income $ (1,691,700) $ (264,200) 40,000 Retained earnings 1/1/19 $ (1,500,000) $ (875.000) Internet domain name s (75,000) 15,000 Net income (1,691,700) (264,200) Goodwill $135,000 Dividends declared 430,000 35,000 $ 2,761,700) Retained eamings 12/31/19 Current assets S (1,104,200) S 865,000 $ 2,034.000 Investment in Minnie 936,000 Equipment (net) 1,400,000 208,000 Computer software 180,000 29,400 100,000 $ $ Intemet domain name Goodwill Total assets Liabilities Common stock Additional paid-in capital Retained earnings 12/31/19 Total liabilities and equity 4,550,000 (1,130,000) (345,000) (313,300) (2,761,700) $ 1,202,400 S (50.000) $ (40,000) S (8,200) $ (1,104,200) $ 4,550,000) $ (1,202,400) On January 1, 2017, Mickey, Co. acquired 100 percent of the common stock of Minnie, Co. for cash of $650,000. The consideration transferred was allocated among Minnie's net assets as follows: At the acquisition date, the computer software had a four year remaining life, and the Internet domain name was estimated to have a 10 year remaining life. By the end of 2017, it became clear that the acquired in-process research and development would yield no economic benefits and Mickey recognized an impairment loss. At December 31, 2019, Minnie's accounts payable included a $50,000 amount owed to Mickey. The December 31, 2019, trial balances for the parent and subsidiary follows: 10 Mickey, Co. Minnie, Co. Minnie fair value (cash paid by 12 Mickey) $650,000 Revenues $ 2,200,000) $ (425,000) Book value of Minnie: Cost of goods sold 540,000 138,000 130,000 Depreciation expense 200,000 13.000 370,000 500,000 30,000 9,800 Common stock and additional paid-in $ 14 capital (APIC) Retained $ 15 earnings Excess fair value 16 over book value to In-process R&D $ 17 Computer $ 18 software Amortization expense Equity in subsidiary earnings 150,000 (261,700) 50,000 Net income $ (1,691,700) $ (264,200) 40,000 Retained earnings 1/1/19 $ (1,500,000) $ (875.000) Internet domain name s (75,000) 15,000 Net income (1,691,700) (264,200) Goodwill $135,000 Dividends declared 430,000 35,000 $ 2,761,700) Retained eamings 12/31/19 Current assets S (1,104,200) S 865,000 $ 2,034.000 Investment in Minnie 936,000 Equipment (net) 1,400,000 208,000 Computer software 180,000 29,400 100,000 $ $ Intemet domain name Goodwill Total assets Liabilities Common stock Additional paid-in capital Retained earnings 12/31/19 Total liabilities and equity 4,550,000 (1,130,000) (345,000) (313,300) (2,761,700) $ 1,202,400 S (50.000) $ (40,000) S (8,200) $ (1,104,200) $ 4,550,000) $ (1,202,400)