Answered step by step

Verified Expert Solution

Question

1 Approved Answer

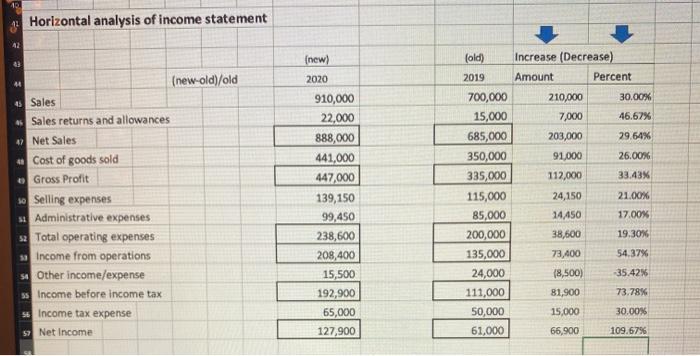

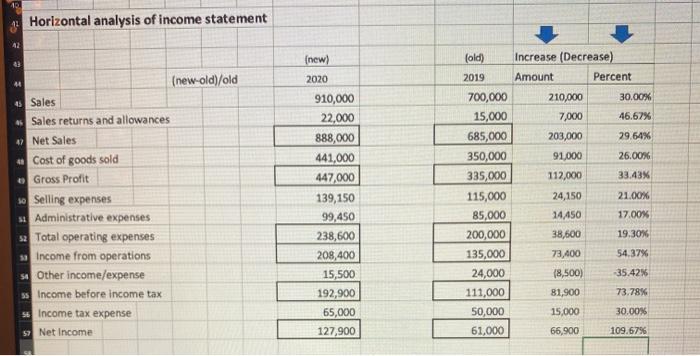

Could you please double check my work? Thank you! Horizontal analysis of income statement (new-old)/old Sales Sales returns and allowances 4 Net Sales Cost of

Could you please double check my work? Thank you!

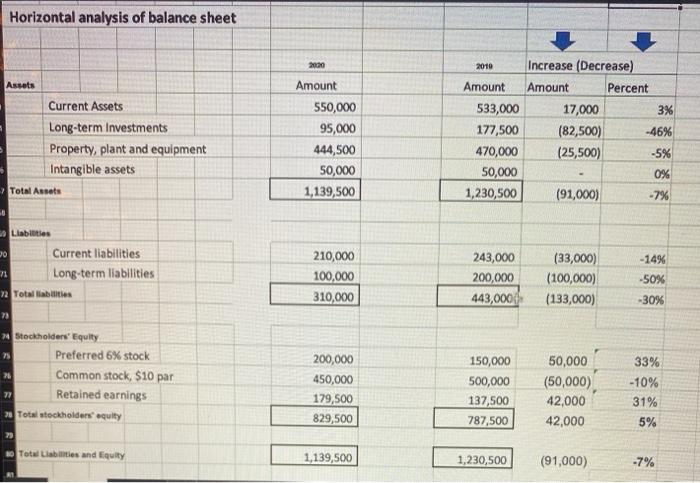

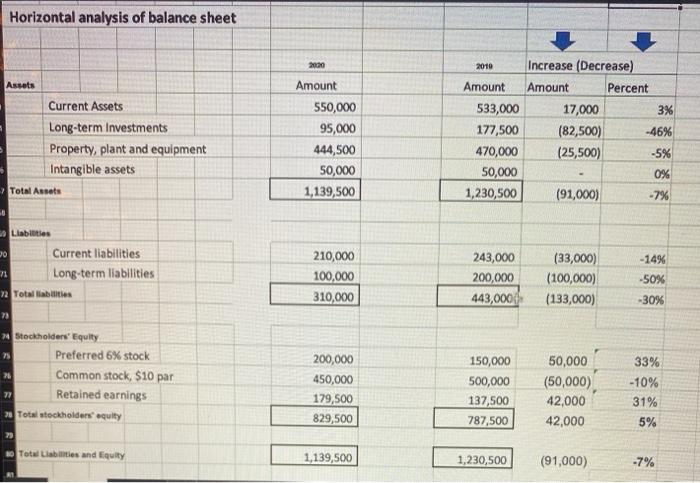

Horizontal analysis of income statement (new-old)/old Sales Sales returns and allowances 4 Net Sales Cost of goods sold Gross Profit 40 Selling expenses Administrative expenses 52 Total operating expenses 32 Income from operations s1 Other income/expense 55 Income before income tax 56 Income tax expense 57 Net Income (new) 2020 910,000 22,000 888,000 441,000 447,000 139,150 99,450 238,600 208,400 15,500 192,900 65,000 127,900 (old) Increase (Decrease) 2019 Amount Percent 700,000 210,000 30.00% 15,000 7,000 46.67% 685,000 203,000 29.64% 350,000 91,000 26.00% 335,000 112,000 33.43% 115,000 24,150 21.00% 85,000 14450 17.00% 200,000 38,600 19.30% 135,000 73,400 54.37% 24,000 18,500) 35.42% 111,000 81,900 73.78% 50,000 15,000 30.00% 61.000 66,900 109.67% Horizontal analysis of balance sheet 2020 Assets Current Assets Long-term Investments Property, plant and equipment Intangible assets Amount 550,000 95,000 444,500 50,000 1,139,500 2010 Increase (Decrease) Amount Amount Percent 533,000 17,000 3% 177,500 (82,500) -46% 470,000 (25,500) -5% 50,000 0% 1,230,500 (91,000) -7% Total Assets so Liabilities -14% 20 Current liabilities 71 Long-term liabilities 2 Total liabilities 210,000 100,000 310,000 243,000 200,000 443,000 (33,000) (100,000) (133,000) -50% -30% 73 7 33% stockholders' Equity Preferred 6% stock Common stock, $10 par Retained earnings Total stockholders' equity 200,000 450,000 179,500 829,500 150,000 500,000 137,500 787,500 50,000 (50,000) 42,000 42,000 -10% 31% 5% 80 Total Liabilities and Equity 1,139,500 1,230,500 (91,000) -7%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started