Could you please explain how to solves these problems?

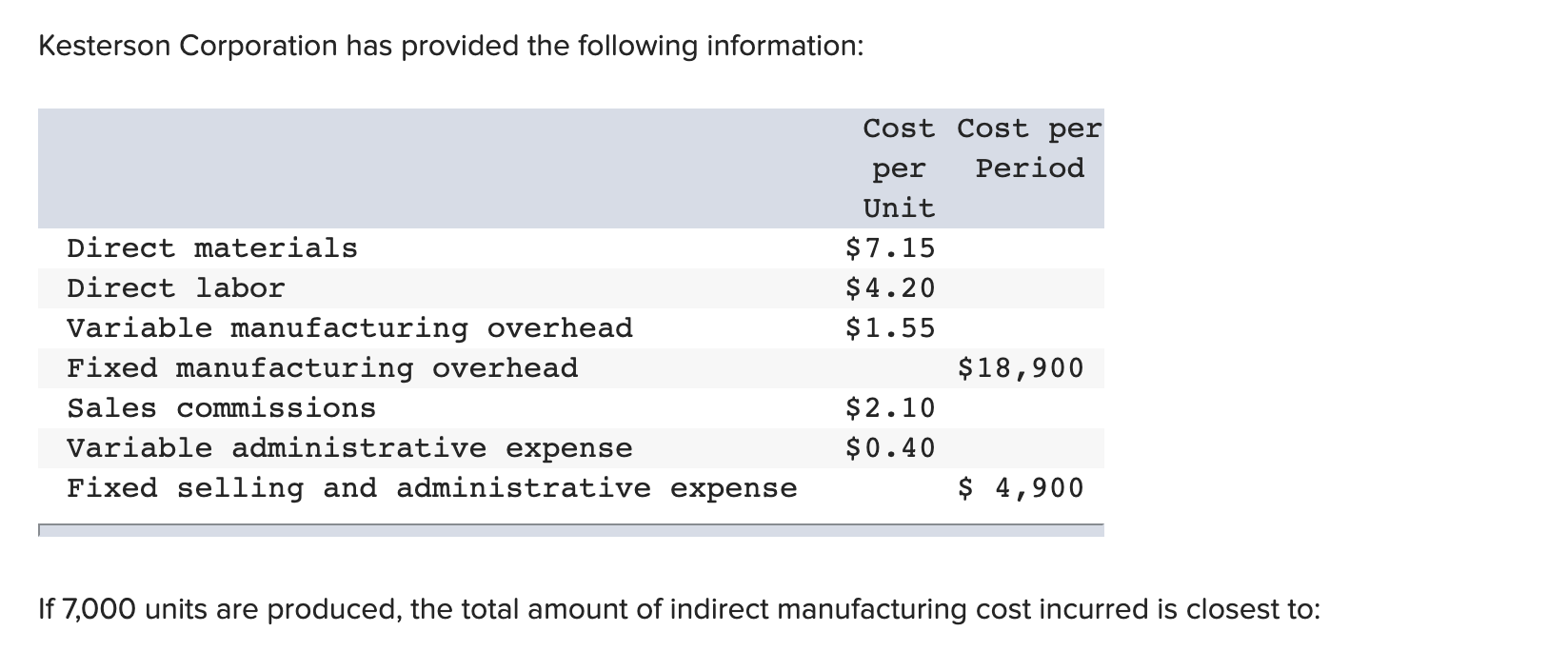

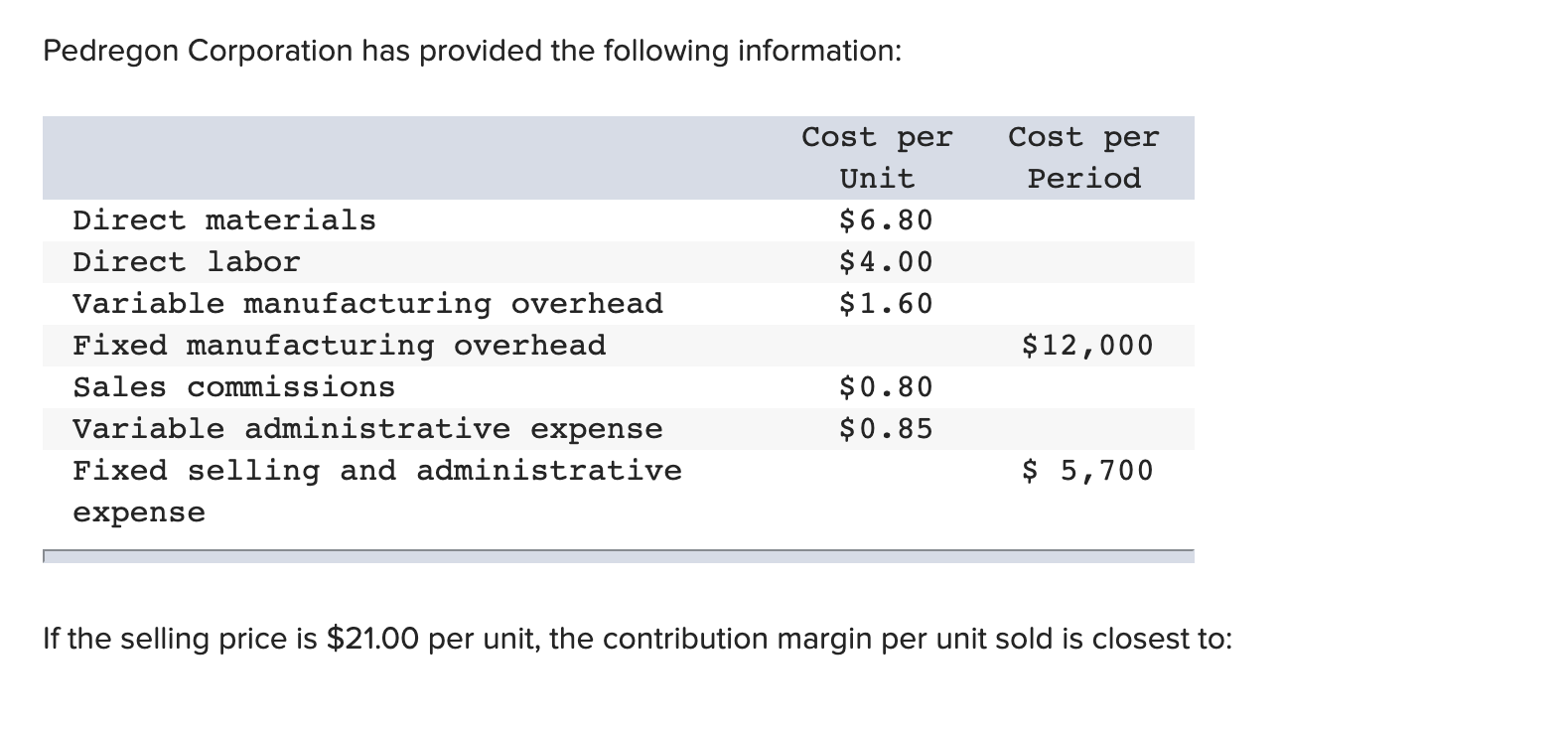

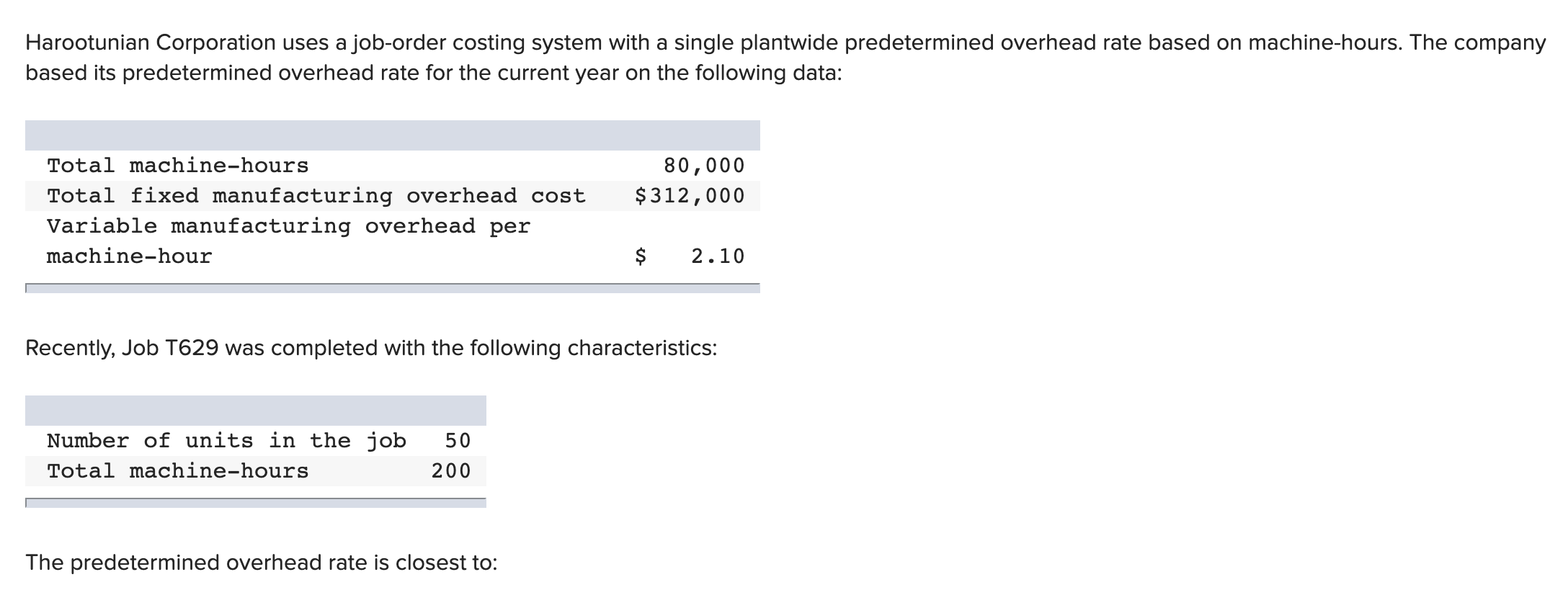

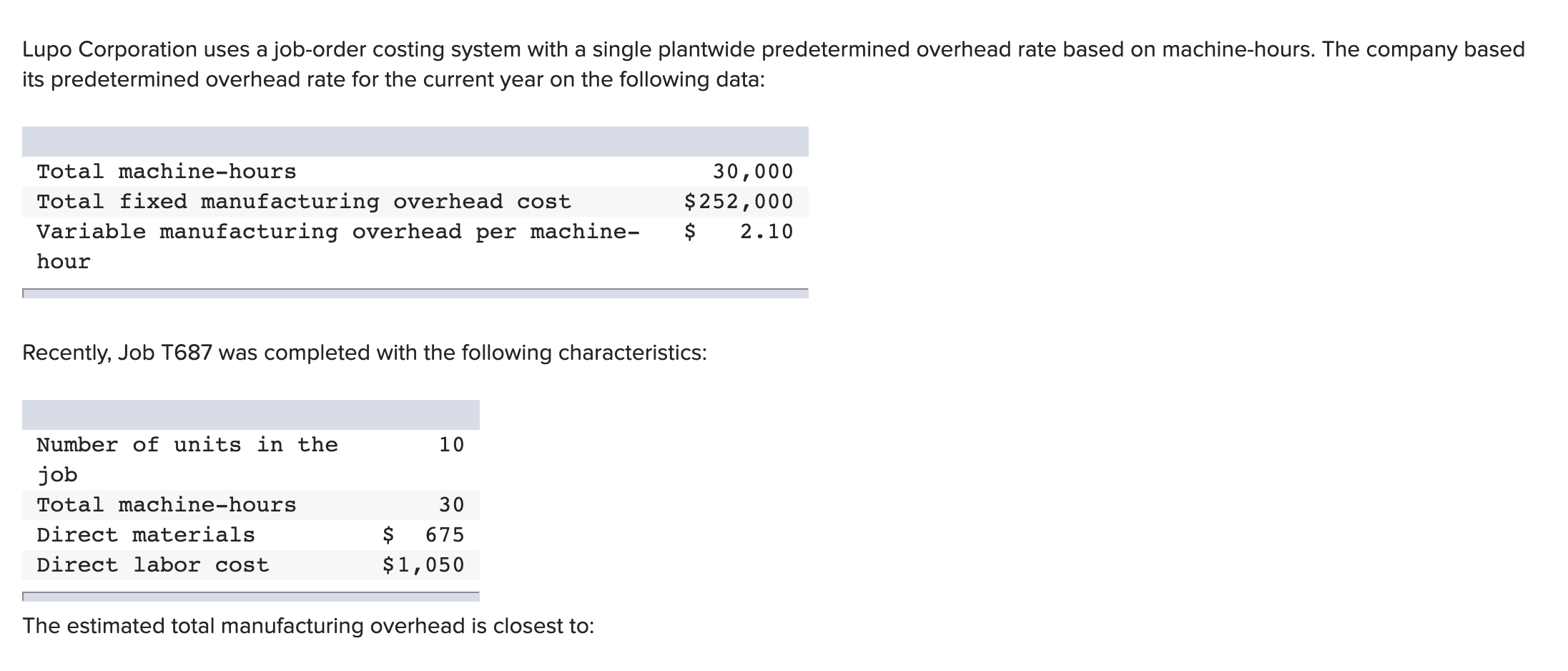

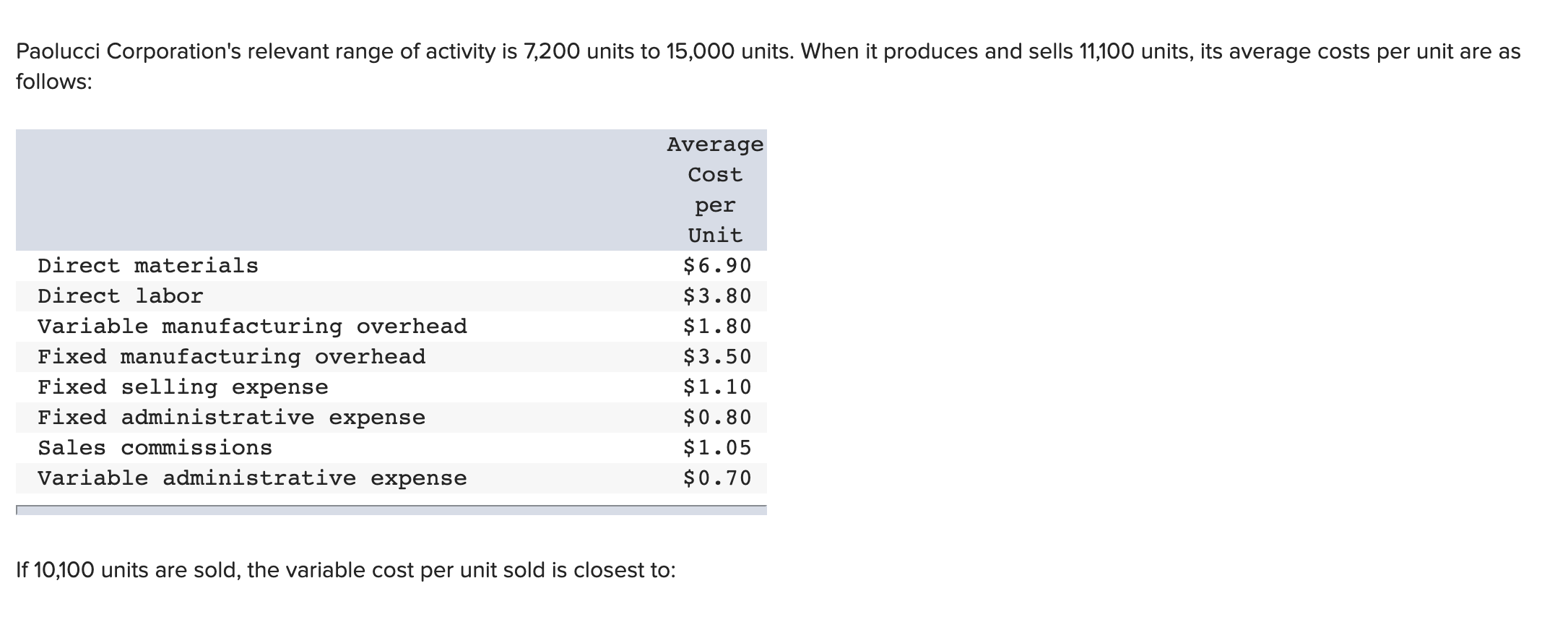

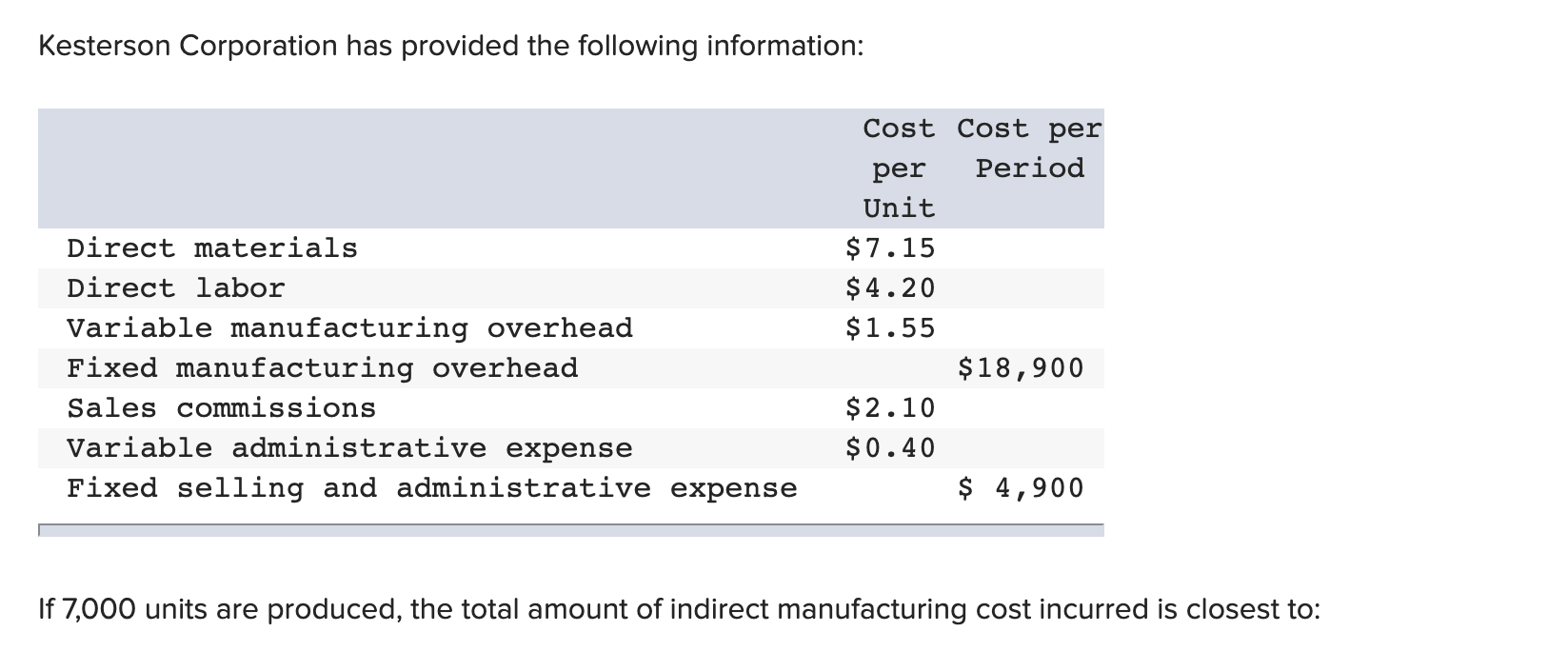

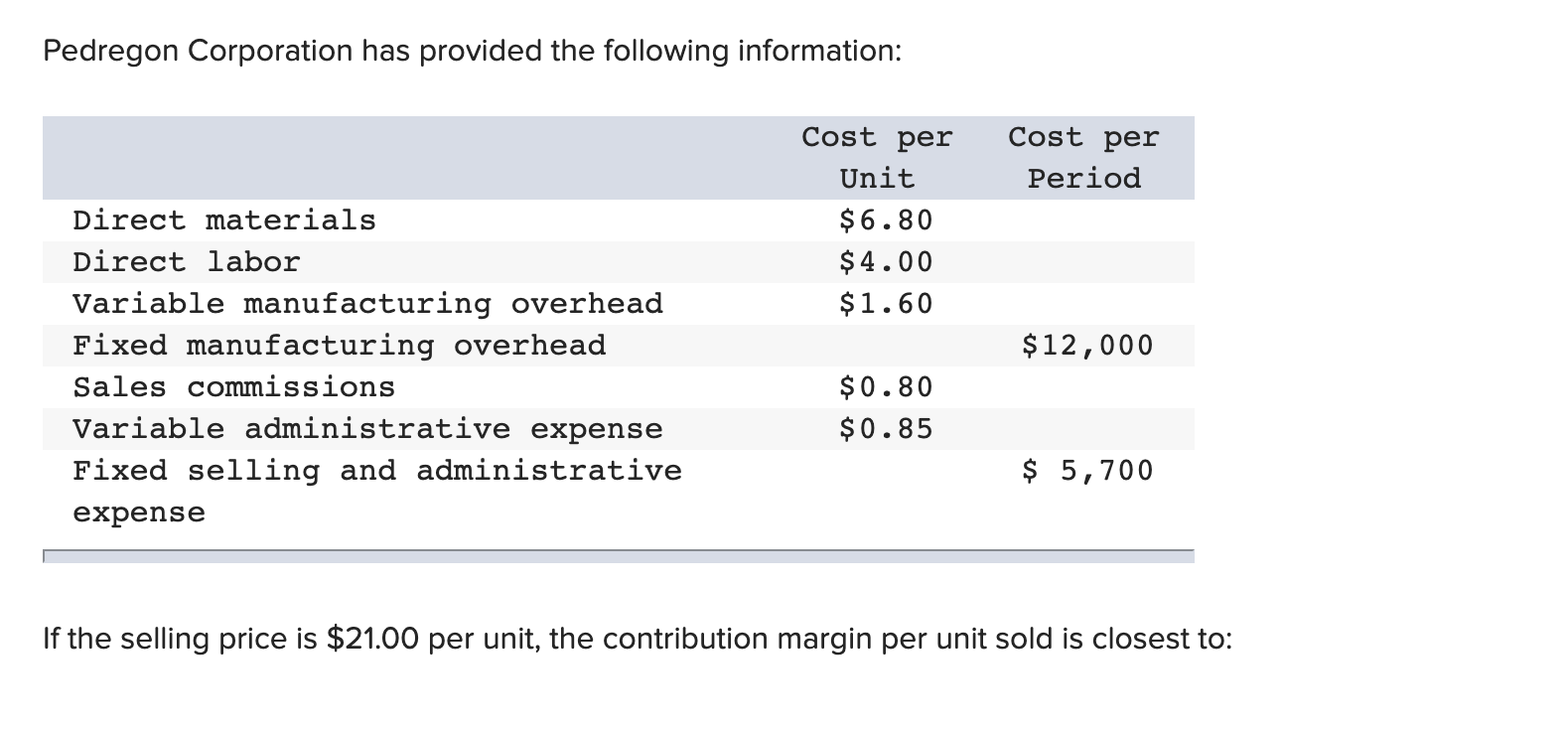

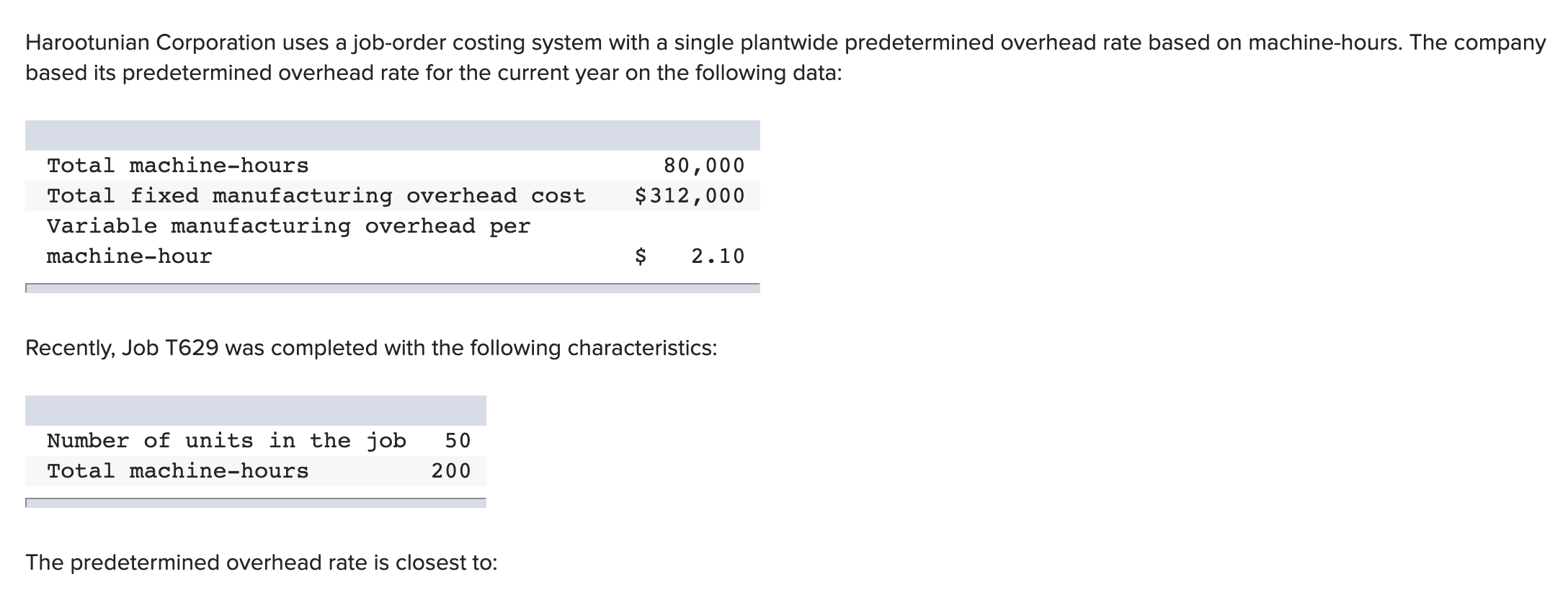

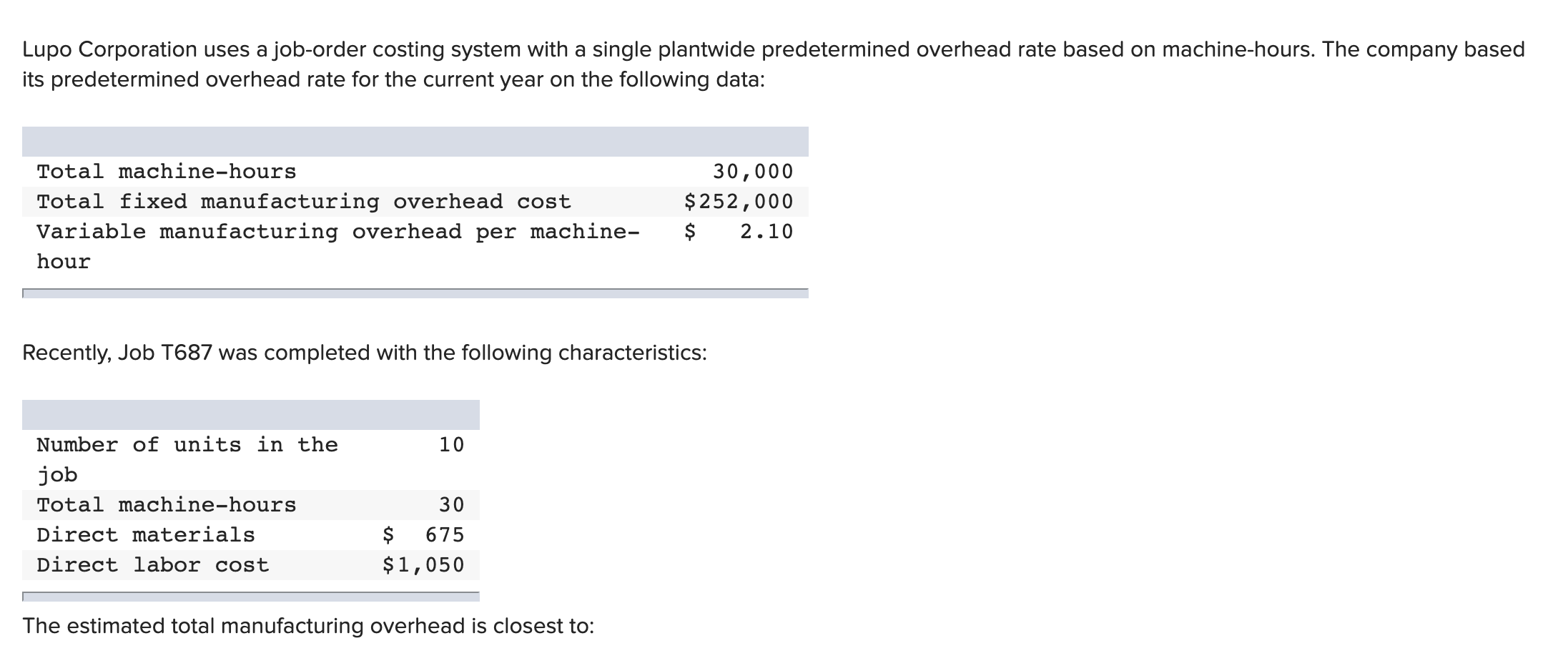

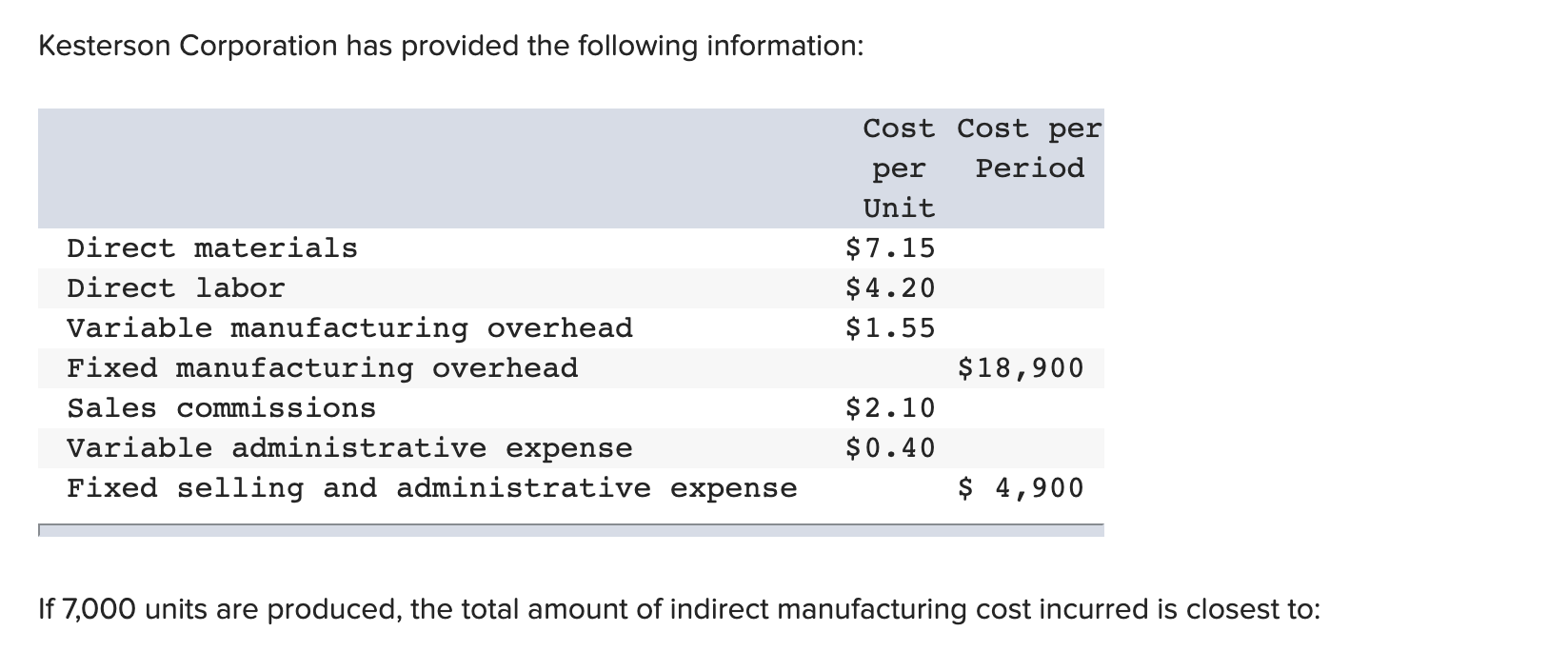

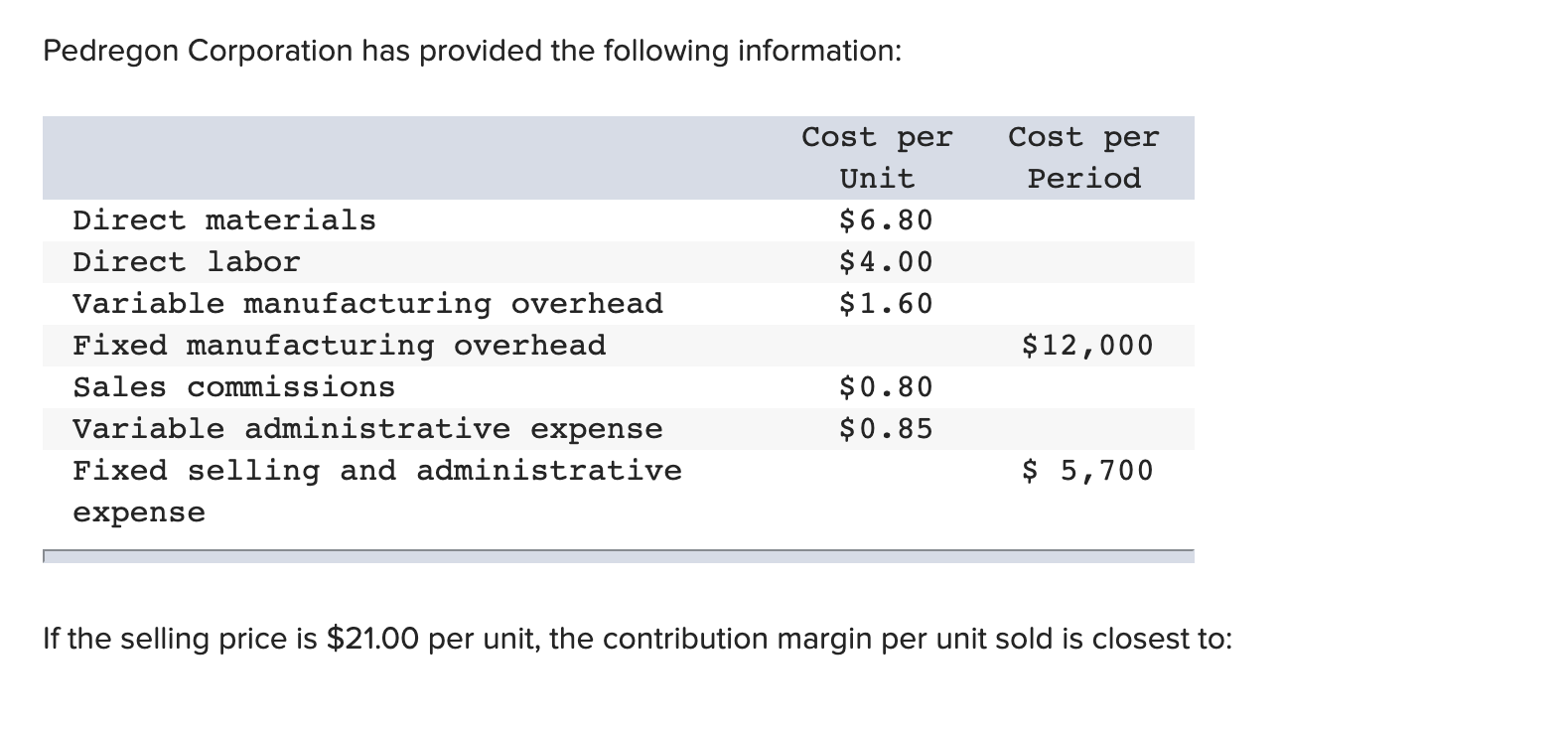

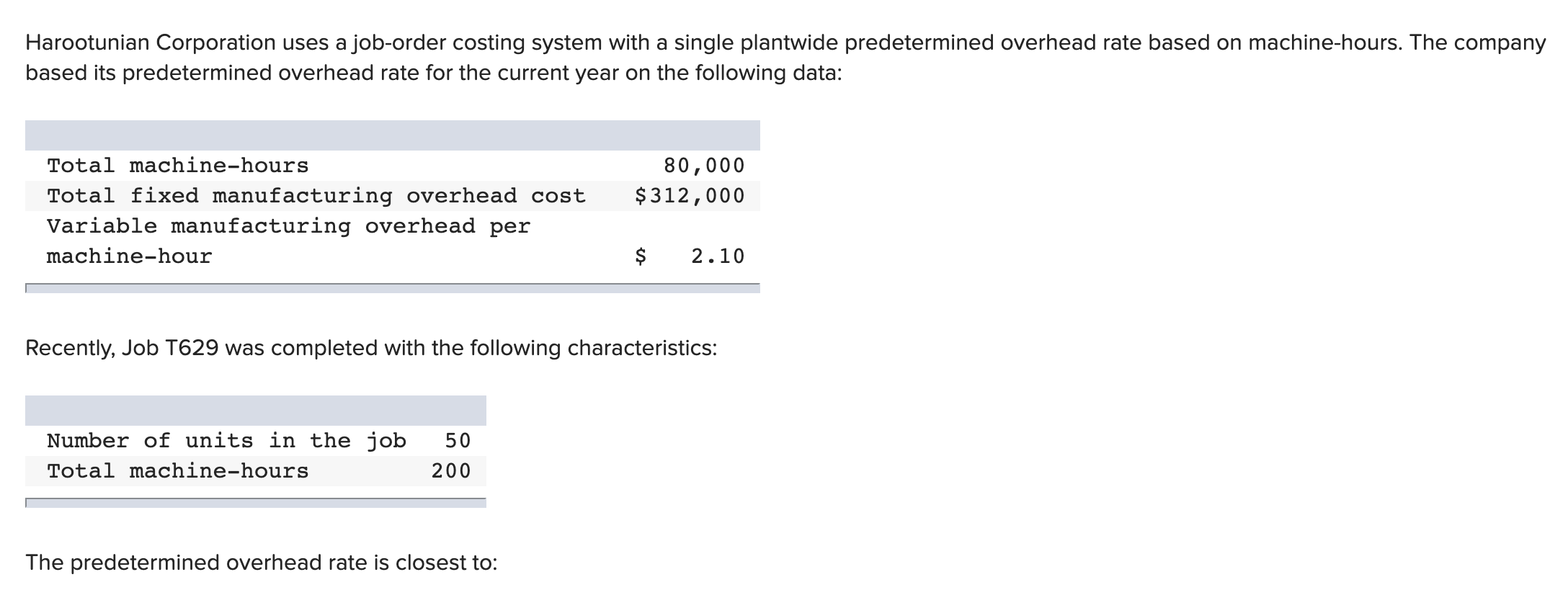

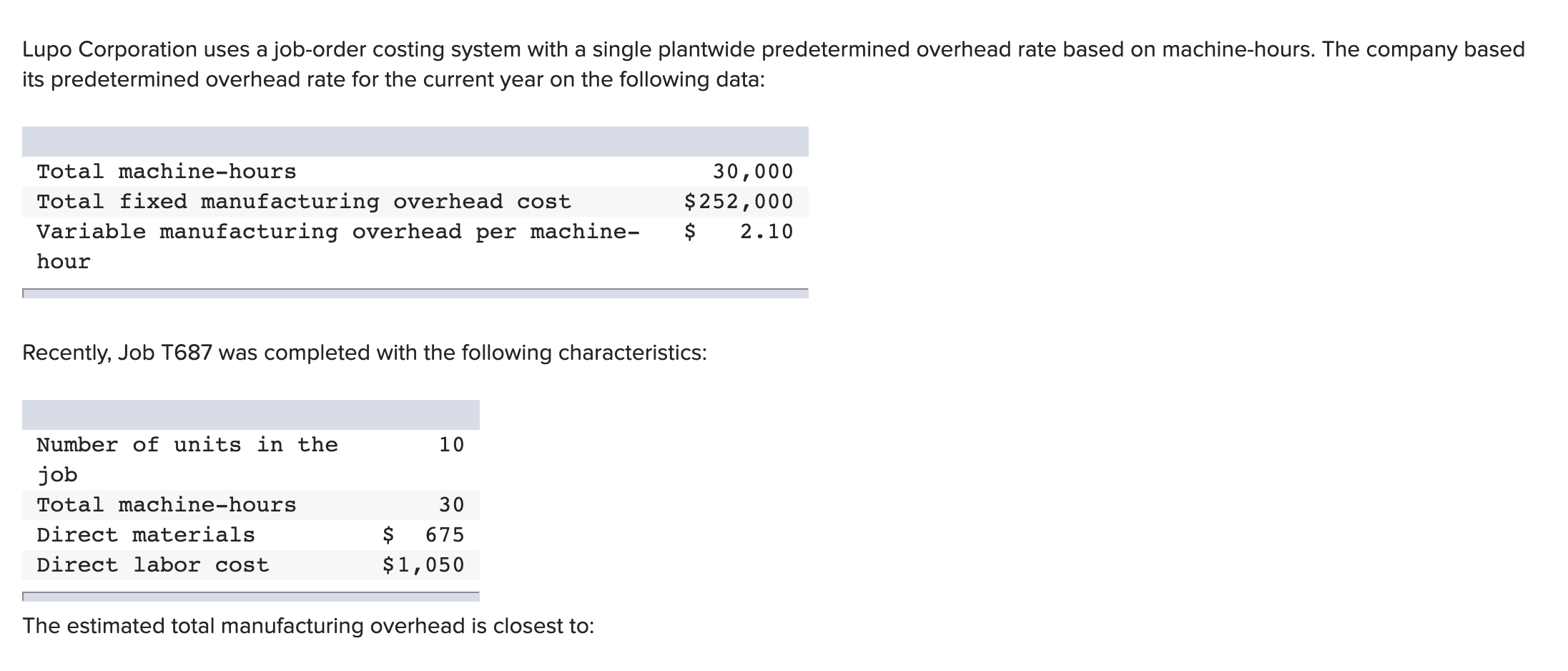

Paolucci Corporation's relevant range of activity is 7,200 units to 15,000 units. When it produces and sells 11,100 units, its average costs per unit are as MHOW$ Average Cost per Unit Direct materials $6.90 Direct labor $3.80 Variable manufacturing overhead $1.80 Fixed manufacturing overhead $3.50 Fixed selling expense $1.10 Fixed administrative expense $0.80 Sales commissions $1.05 Variable administrative expense $0.70 ' If 10,100 units are sold, the variable cost per unit sold is closest to: Kesterson Corporation has provided the following information: Cost Cost per per Period Unit Direct materials $7.15 Direct labor $ 4 . 2 0 Variable manufacturing overhead $1.55 Fixed manufacturing overhead $18,900 Sales commissions $2.10 Variable administrative expense $0.40 Fixed selling and administrative expense $ 4,900 I If 7,000 units are produced, the total amount of indirect manufacturing cost incurred is closest to: Pedregon Corporation has provided the following information: Cost per Cost per Unit Period Direct materials $6.80 Direct labor $4.00 Variable manufacturing overhead $1.60 Fixed manufacturing overhead $12,000 Sales commissions $0.80 Variable administrative expense $0.85 Fixed selling and administrative $ 5,700 expense ' If the selling price is $21.00 per unit, the contribution margin per unit sold is closest to: Harootunian Corporation uses ajob-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data: Total machinehours 80,000 Total fixed manufacturing overhead cost $312,000 Variable manufacturing overhead per machinehour $ 2 . 10 Recently, Job T629 was completed with the following characteristics: Number of units in the job 50 Total machinehours 200 The predetermined overhead rate is closest to: Lupo Corporation uses ajob-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data: Total machinehours 30,000 Total fixed manufacturing overhead cost $252,000 Variable manufacturing overhead per machine $ 2.10 hour Recently, Job T687 was completed with the following characteristics: Number of units in the 10 job Total machinehours 30 Direct materials $ 675 Direct labor cost $ 1 , 050 The estimated total manufacturing overhead is closest to