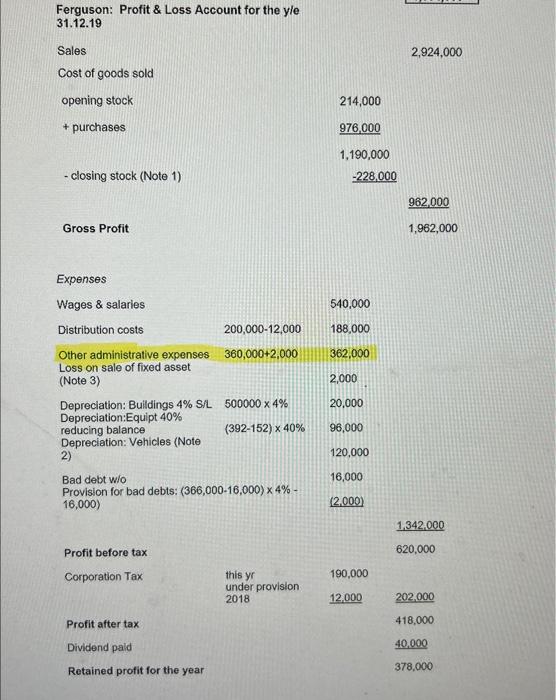

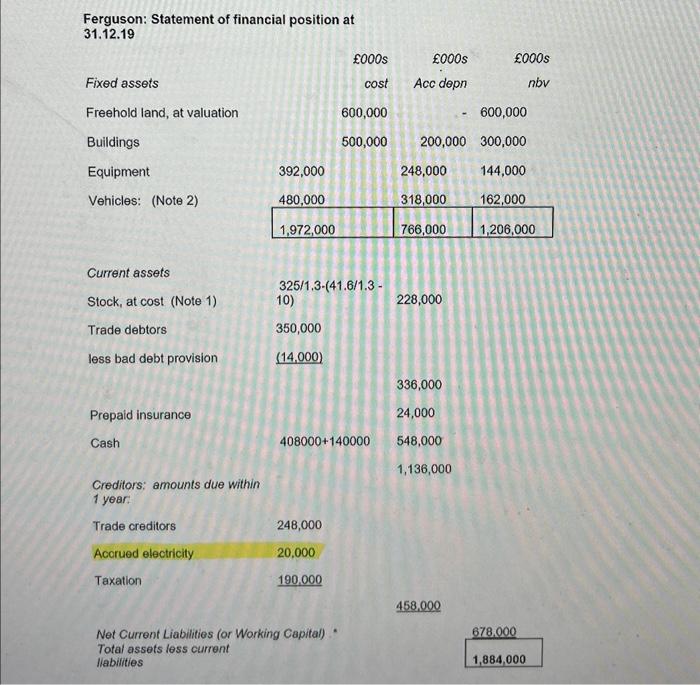

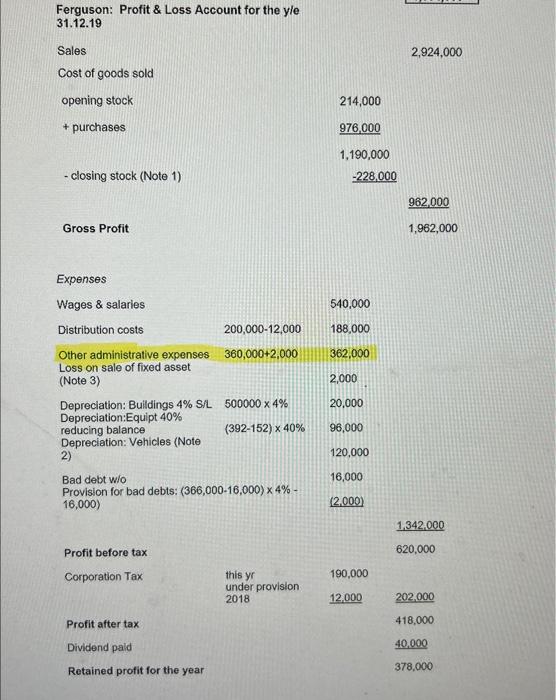

Could you please explain why accrued electricity expense ia only 20,000? Why is only 2,000 included in admin expense for the electricity invoice? I need the double entry for adjustment 7 explained, the notes say these are the correct balance sheet and income statement, but i don't get this one part.

thank you!

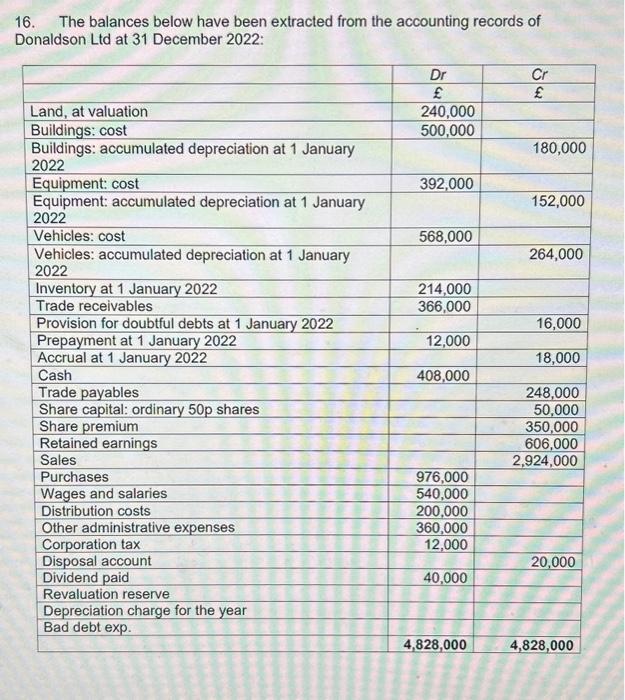

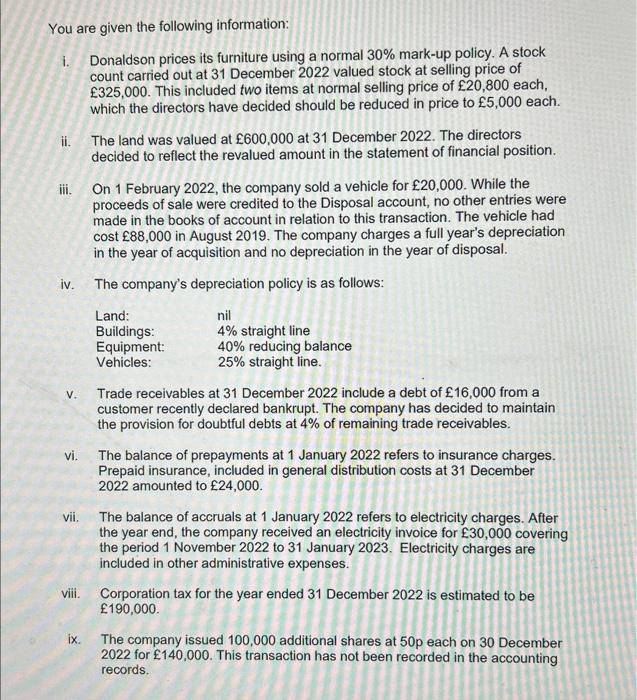

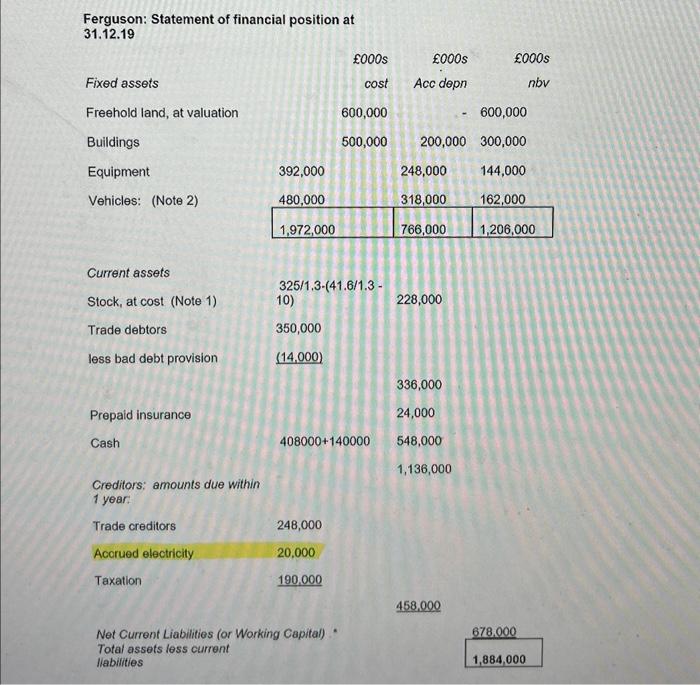

You are given the following information: i. Donaldson prices its furniture using a normal 30% mark-up policy. A stock count carried out at 31 December 2022 valued stock at selling price of 325,000. This included two items at normal selling price of 20,800 each, which the directors have decided should be reduced in price to 5,000 each. ii. The land was valued at 600,000 at 31 December 2022. The directors decided to reflect the revalued amount in the statement of financial position. iii. On 1 February 2022, the company sold a vehicle for 20,000. While the proceeds of sale were credited to the Disposal account, no other entries were made in the books of account in relation to this transaction. The vehicle had cost 88,000 in August 2019 . The company charges a full year's depreciation in the year of acquisition and no depreciation in the year of disposal. iv. The company's depreciation policy is as follows: \begin{tabular}{ll} Land: & nil \\ Buildings: & 4% straight line \\ Equipment: & 40% reducing balance \\ Vehicles: & 25% straight line. \end{tabular} v. Trade receivables at 31 December 2022 include a debt of 16,000 from a customer recently declared bankrupt. The company has decided to maintain the provision for doubtful debts at 4% of remaining trade receivables. vi. The balance of prepayments at 1 January 2022 refers to insurance charges. Prepaid insurance, included in general distribution costs at 31 December 2022 amounted to 24,000. vii. The balance of accruals at 1 January 2022 refers to electricity charges. After the year end, the company received an electricity invoice for 30,000 covering the period 1 November 2022 to 31 January 2023. Electricity charges are included in other administrative expenses. viii. Corporation tax for the year ended 31 December 2022 is estimated to be 190,000. ix. The company issued 100,000 additional shares at 50 peach on 30 December 2022 for 140,000. This transaction has not been recorded in the accounting records. Ferguson: Statement of financial position at 31.12.19 Net Current Liabilities (or Working Capital) Total assets less current liabilities Ferguson: Profit \& Loss Account for the yle 31.12.19 Sales 2,924,000 Cost of goods sold opening stock 214,000 + purchases 976,000 1,190,000 - closing stock (Note 1) 228,000 962,000 Gross Profit 1,962,000 Expenses Wages \& salaries 540,000 Distribution costs 200,000-12,000 188,000 Other administrative expenses 360,000+2,000 362,000 Loss on sale of fixed asset (Note 3) 2,000 Depreciation: Buildings 4% S/L 5000004% 20,000 Depreciation:Equipt 40\% reducing balance (392152)40% 96,000 Depreciation: Vehicles (Note 120,000 Bad debt w/o 16,000 Provision for bad debts: (366,00016,000)4% - (2.000) 16,000) 1,342,000 Profit before tax 620,000 Corporation Tax this yr 190,000 under provision 2018 12,000 202,000 Profit after tax 418,000 Dividend pald 40,000 Retained profit for the year 378.000