Question

Could you please help me solve the accounting below? Please see the attached file. Please help to do it step-by-step with all the workings and

Could you please help me solve the accounting below? Please see the attached file. Please help to do it step-by-step with all the workings and solutions. Thank you very much!

[The following information applies to the questions displayed below.]

Cohen & Boyd, Inc., publishers of movie and song trivia books, made the following errors in adjusting the accounts at year-end (December 31):

a. Did not accrue $1,200 owed to the company by another company renting part of the building as a storage facility.

b. Did not record $15,200 depreciation on the equipment costing $123,000.

c. Failed to adjust the Unearned Fee Revenue account to reflect that $1,700 was earned by the end of the year.

d. Recorded a full year of accrued interest expense on a $21,000, 12 percent note payable that has been outstanding only since November 1.

e. Failed to adjust Prepaid Insurance to reflect that $590 of insurance coverage has been used.

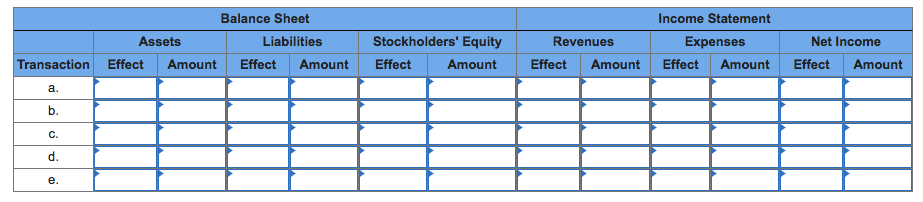

Using the following headings, indicate the effect of each error and the amount of the effect (that is, the difference between the entry that was or was not made and the entry that should have been made). Use O if the effect overstates the item, U if the effect understates the item. (Reminder: Assets = Liabilities + Stockholders Equity; Revenues Expenses = Net Income; and Net Income accounts are closed to Retained Earnings, a part of Stockholders Equity.) (Select "NE" for no effect.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started