Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could you please help me with 78 and 79 please 78. Peter, age 52, is a single father of three children. He has 8-year-old twin

Could you please help me with 78 and 79 please

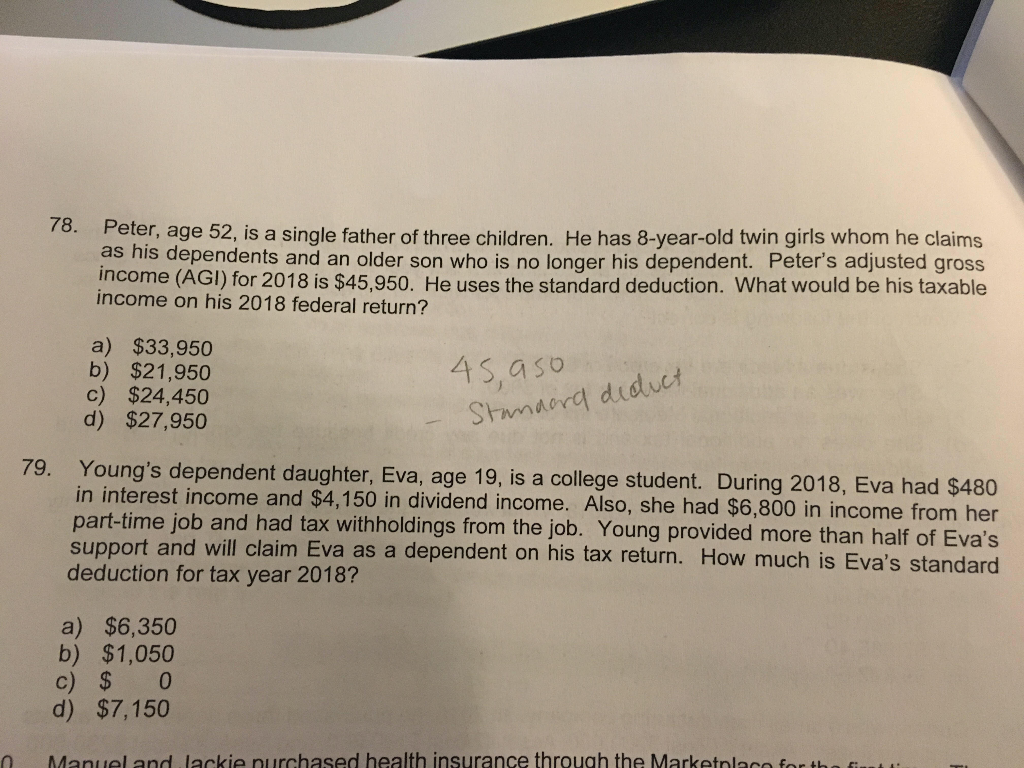

78. Peter, age 52, is a single father of three children. He has 8-year-old twin girls whom he claims as his dependents and an older son who is no longer his dependent. Peter's adjusted gross income (AGI) for 2018 is $45,950. He uses the standard deduction. What would be his taxable income on his 2018 federal return? a) $33,950 b) $21,950 c) $24,450 d) $27,950 45,aso Stanaord diduct 79. Young's dependent daughter, Eva, age 19, is a college student. During 2018, Eva had $480 in interest income and $4,150 in dividend income. Also, she had $6,800 in income from her part-time job and had tax withholdings from the job. Young provided more than half of Eva's support and will claim Eva as a dependent on his tax return. How much is Eva's standard deduction for tax year 2018? a) $6,350 b) $1,050 c) $ 0 d) $7,150 Manuel and Jackie purchased health insurance through the Marketplace for the fireStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started