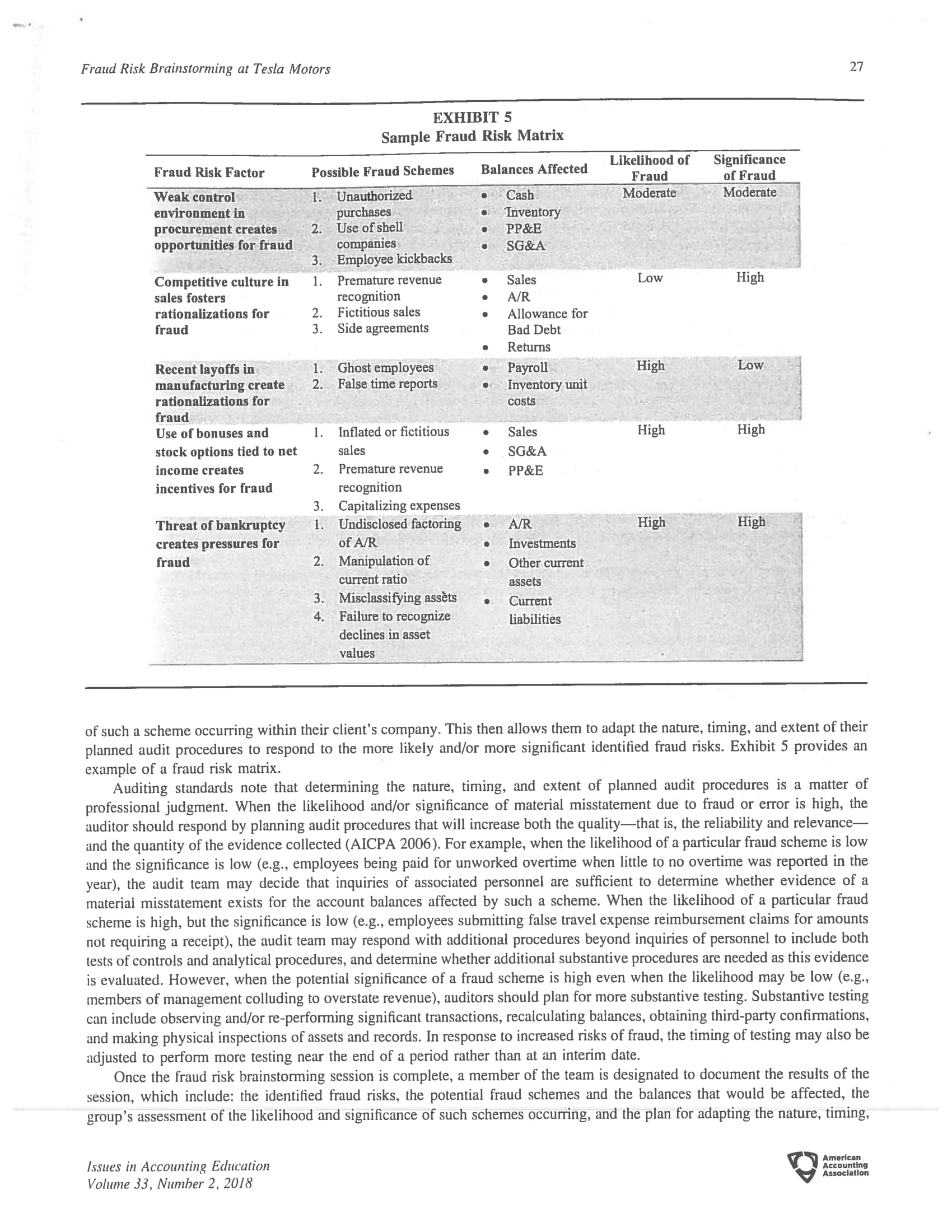

Could you please help me with only part II. Professor only requires us to do the one similar to exhibit 5 Sample Fraud Risk Matrix. Thank you so much.

Professor told us that he doesn't need us to do the things found in Appendix A. Please just fill out the one similar to Exhibit 5 Sample Fraud Risk Matrix because it is the only one professor needs. Thank you.

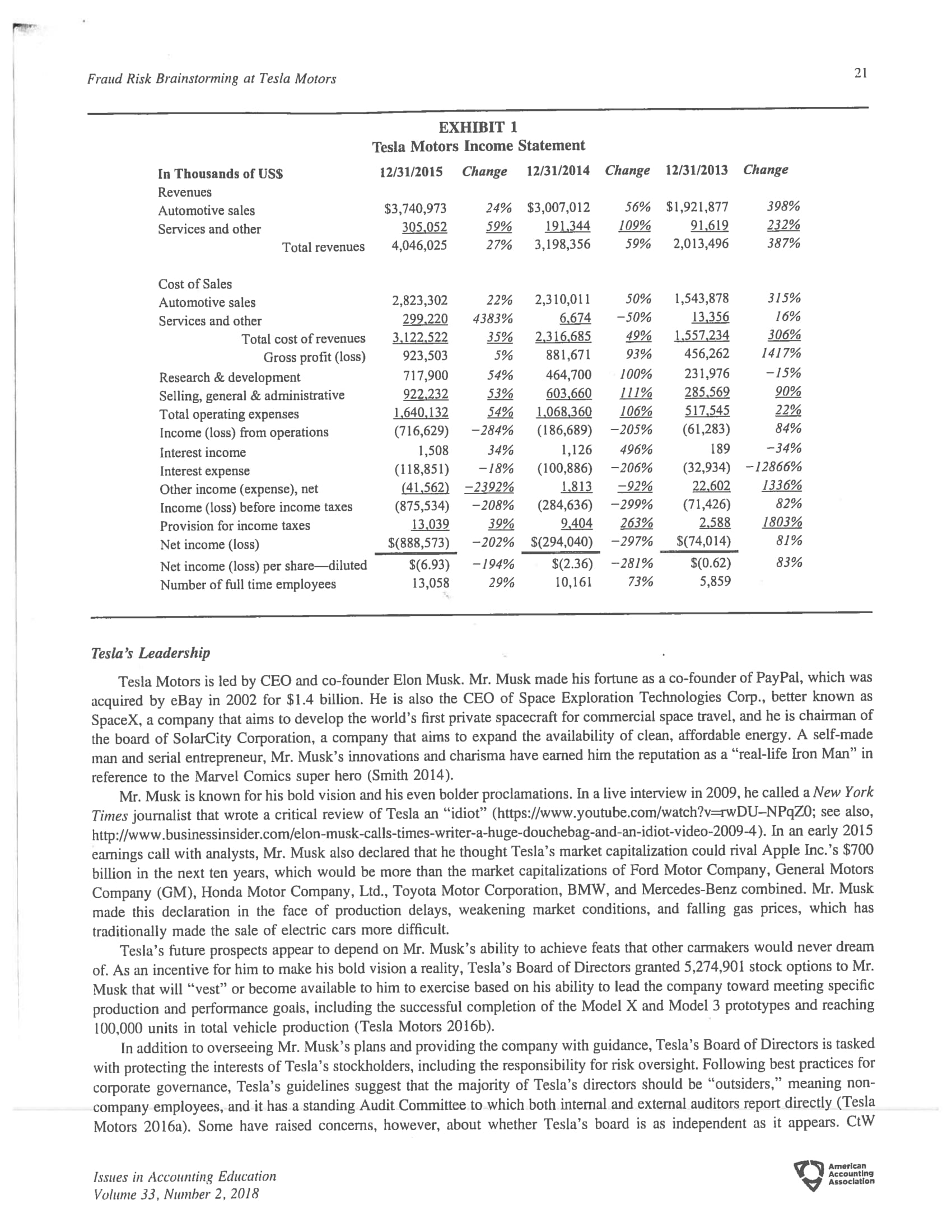

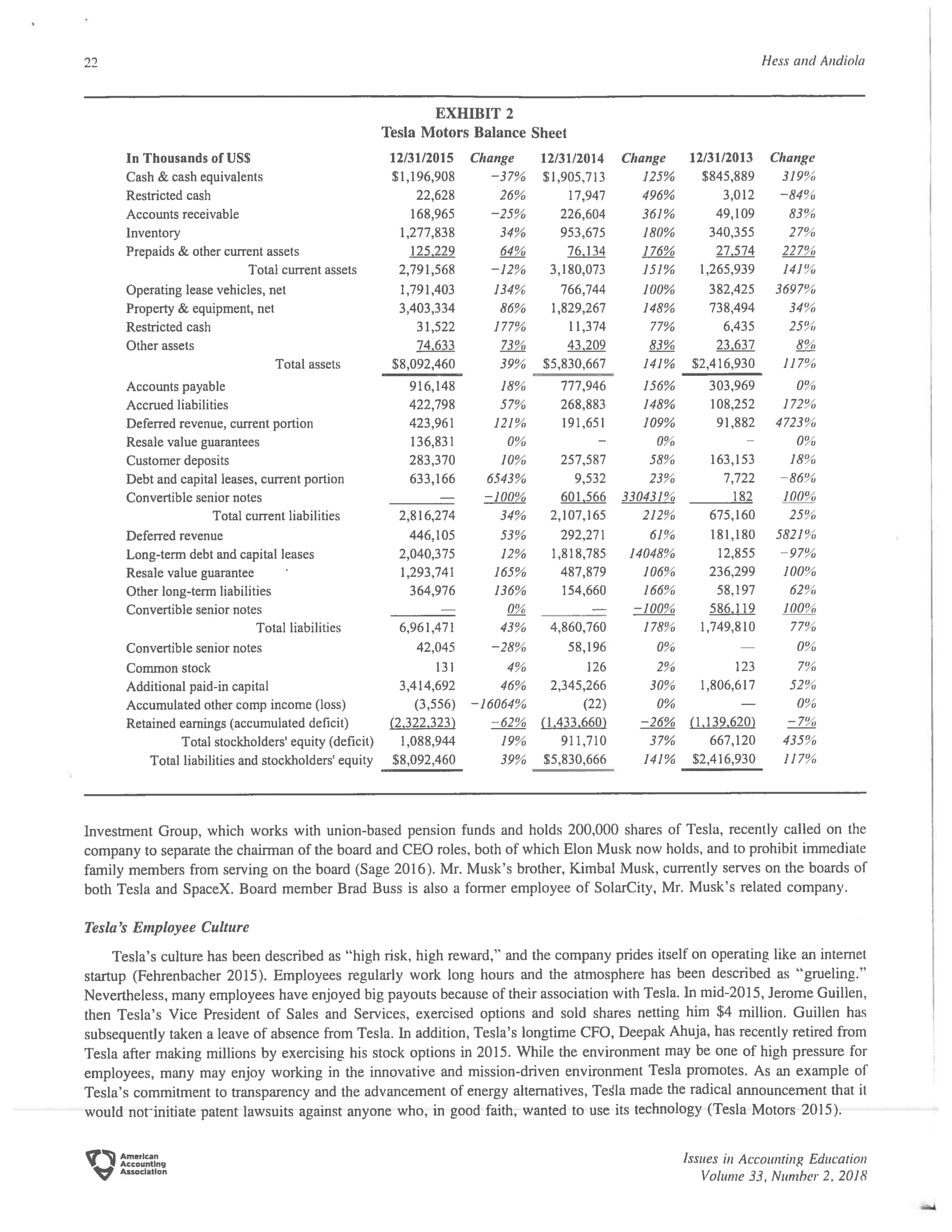

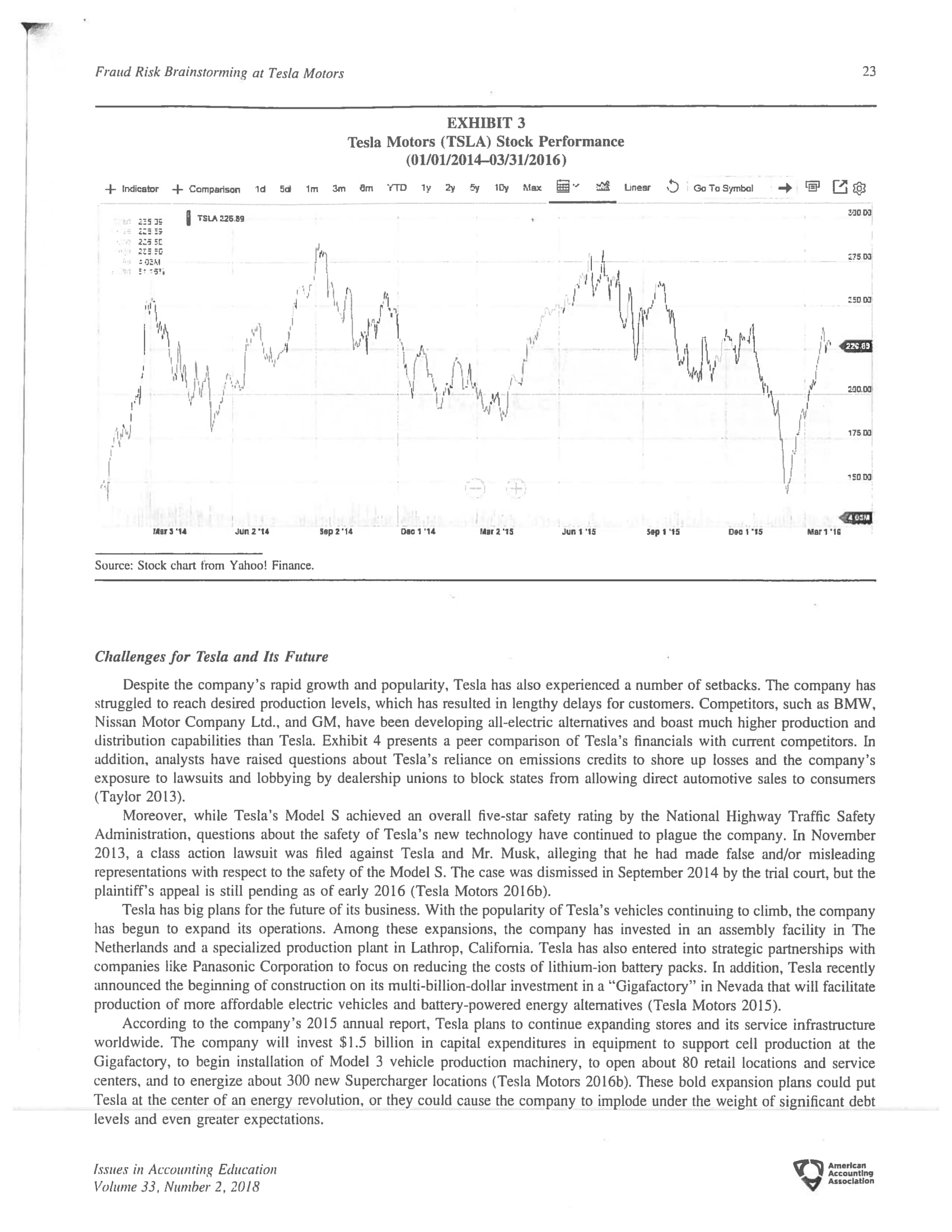

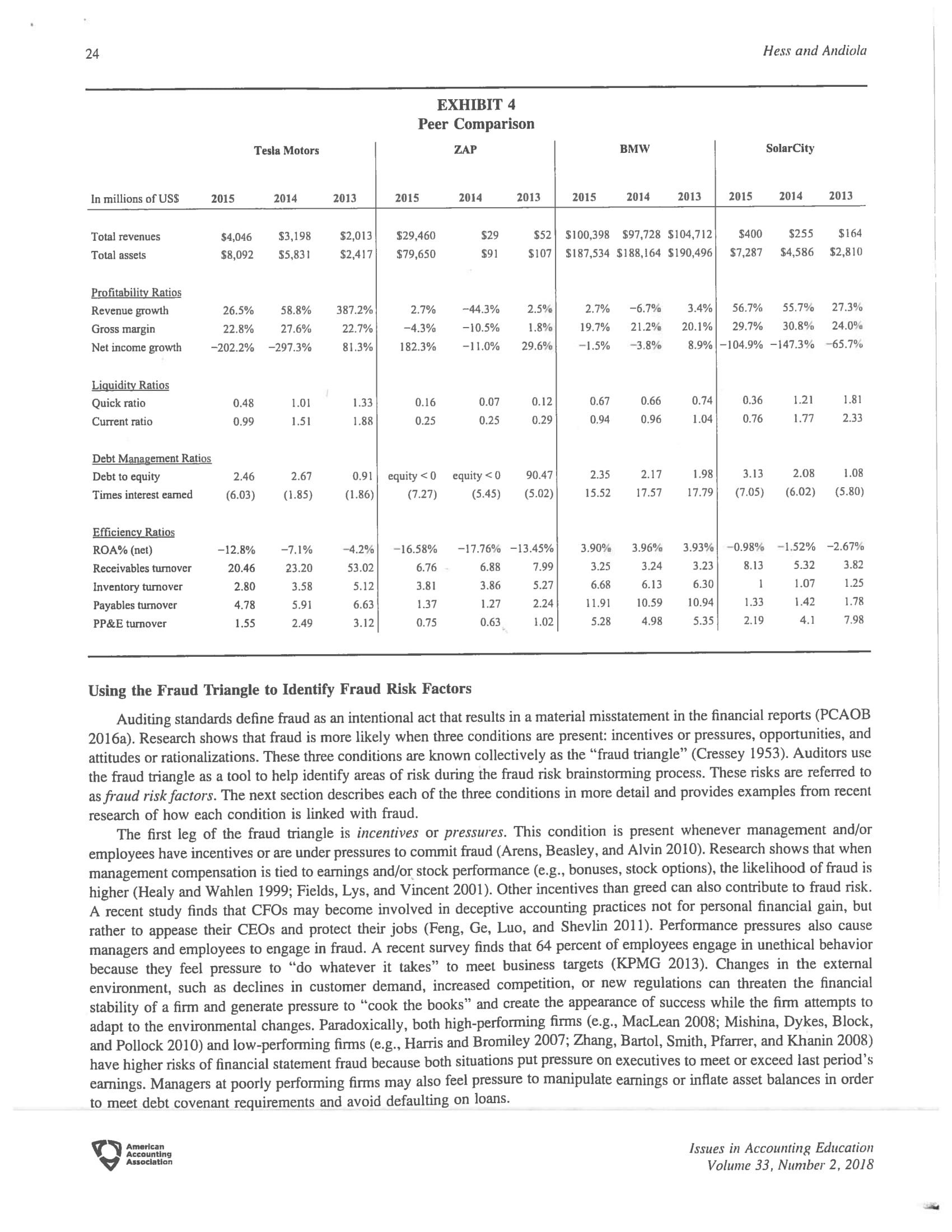

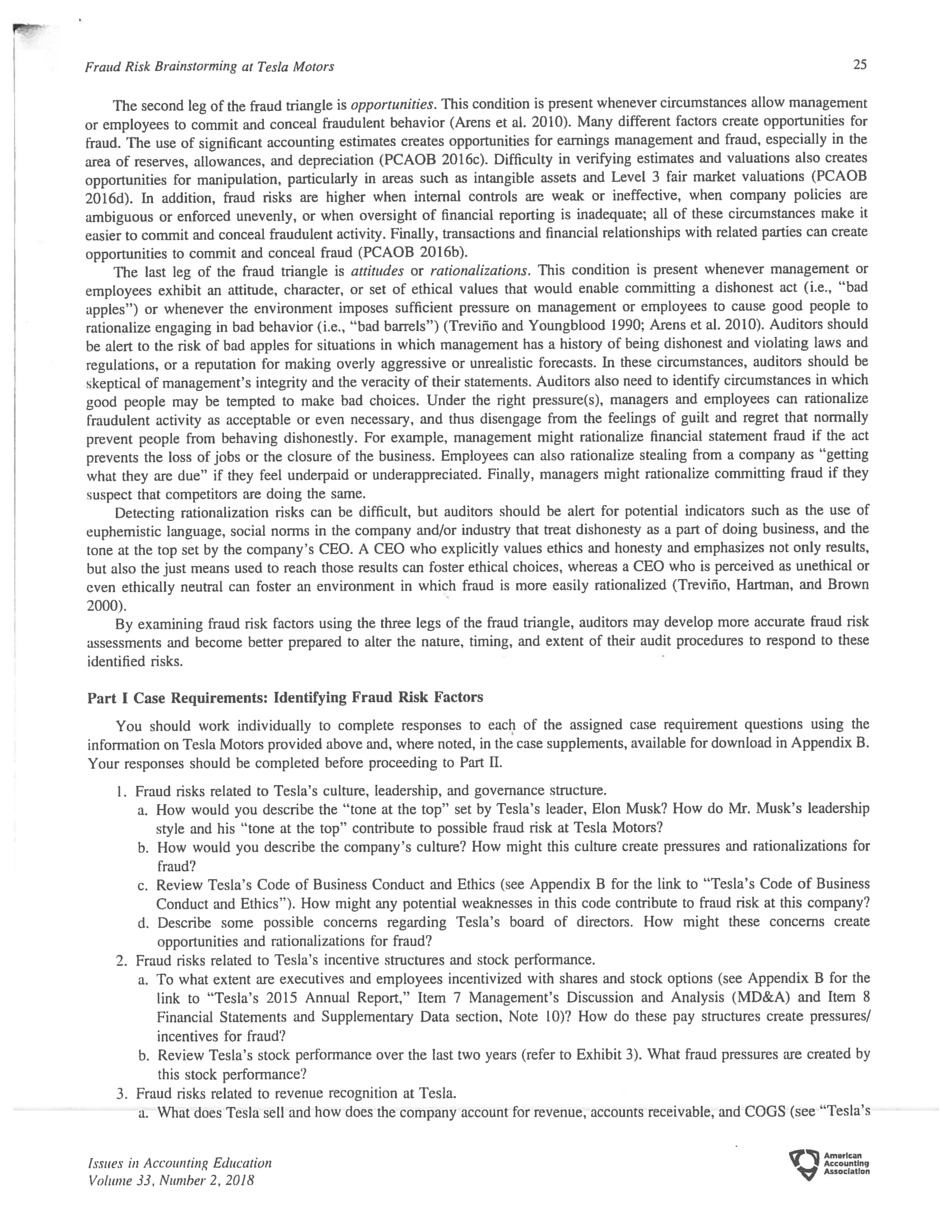

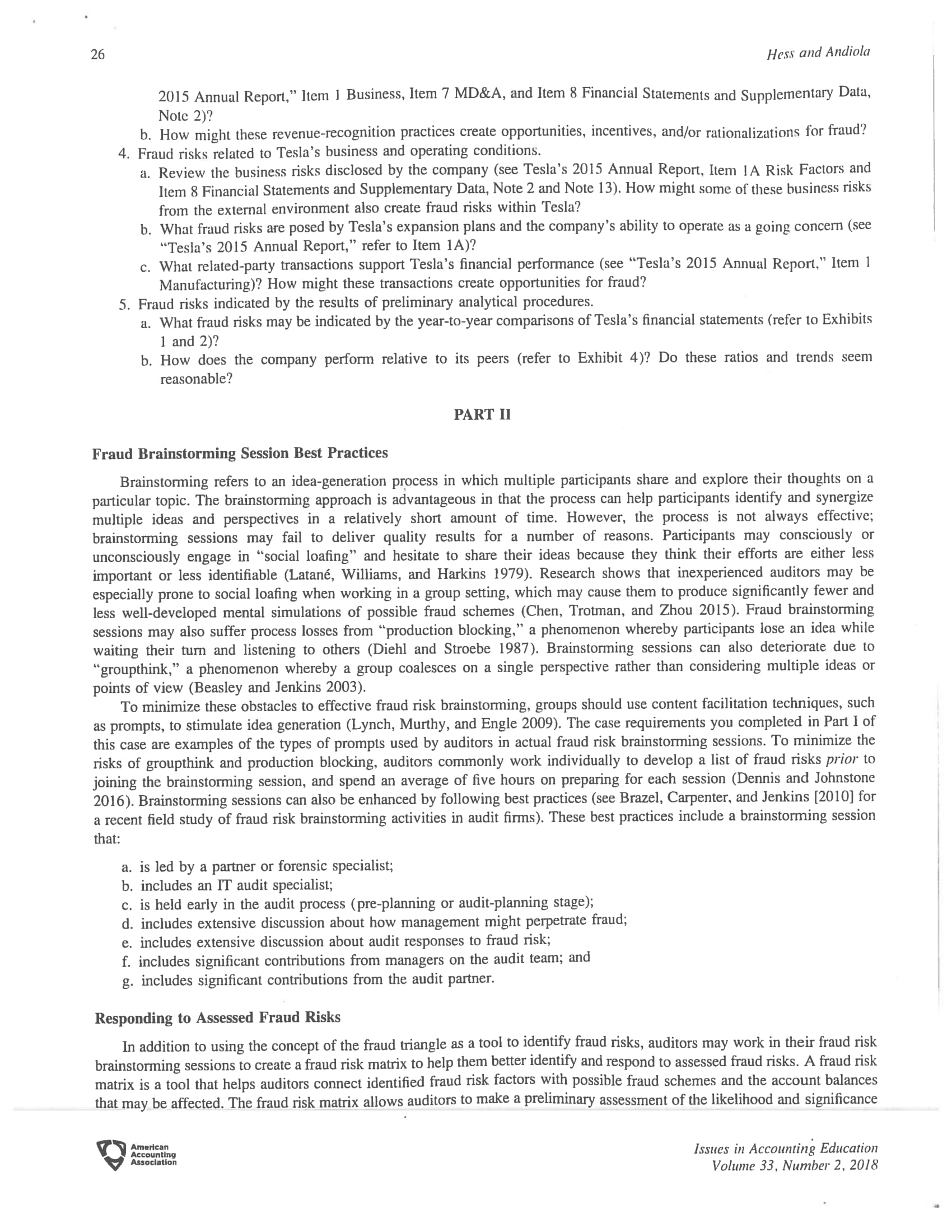

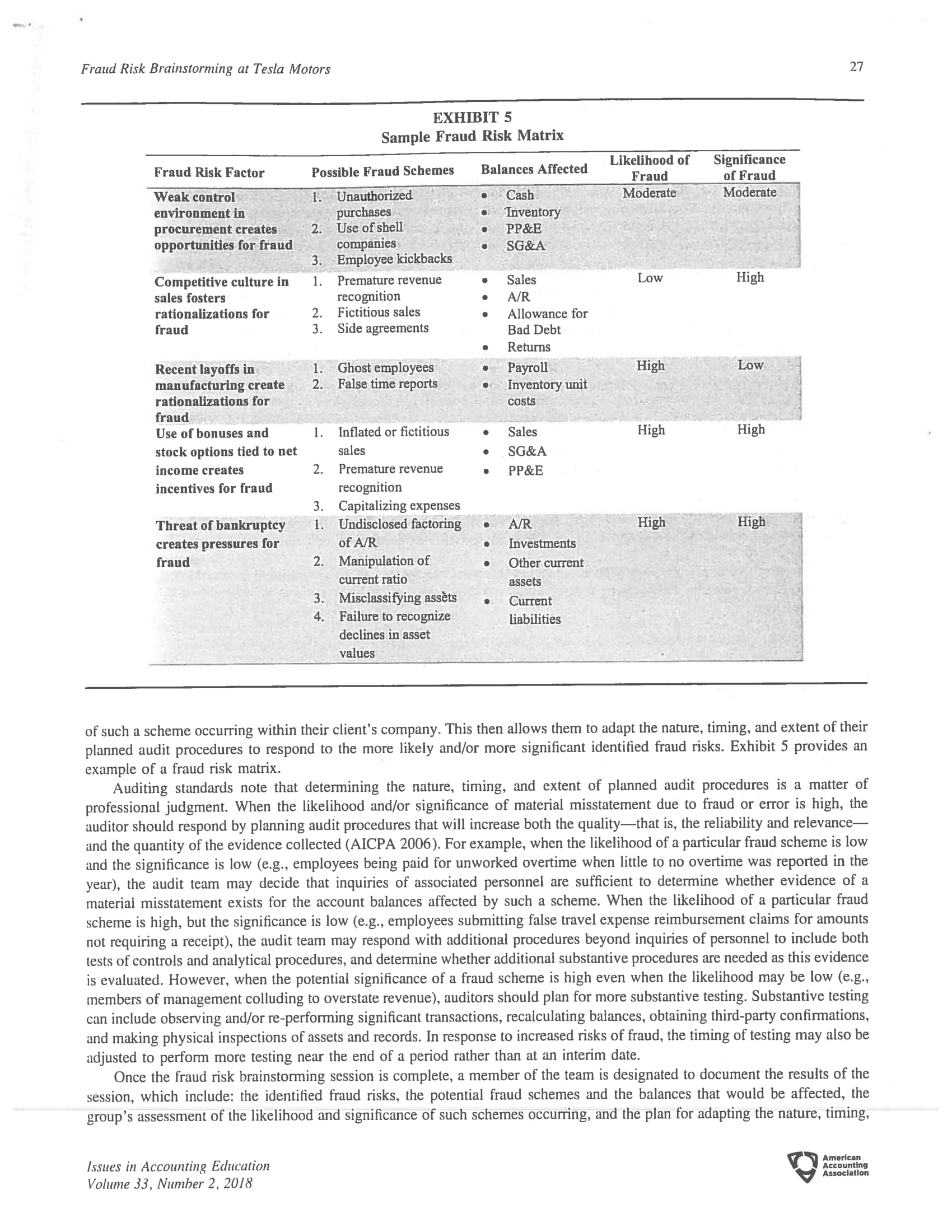

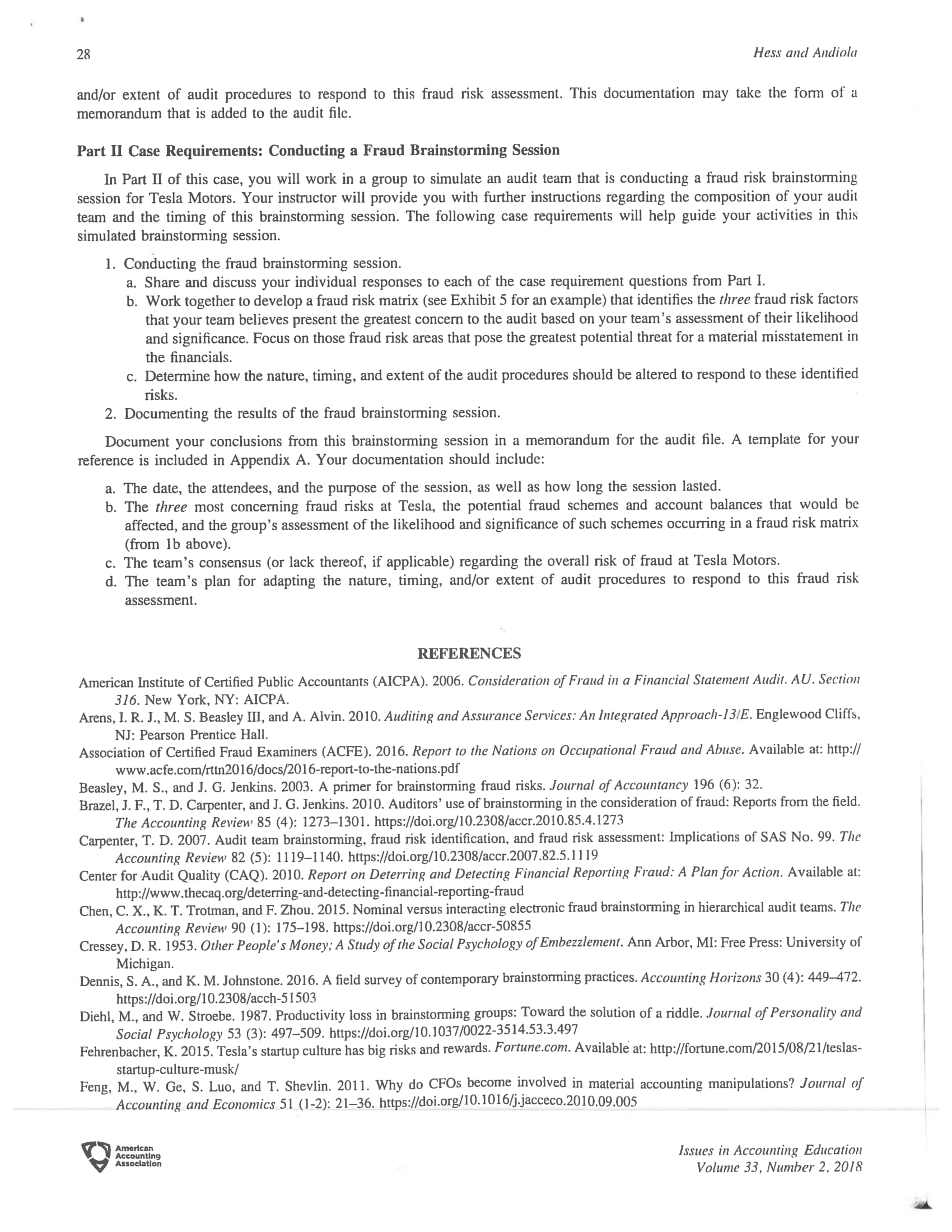

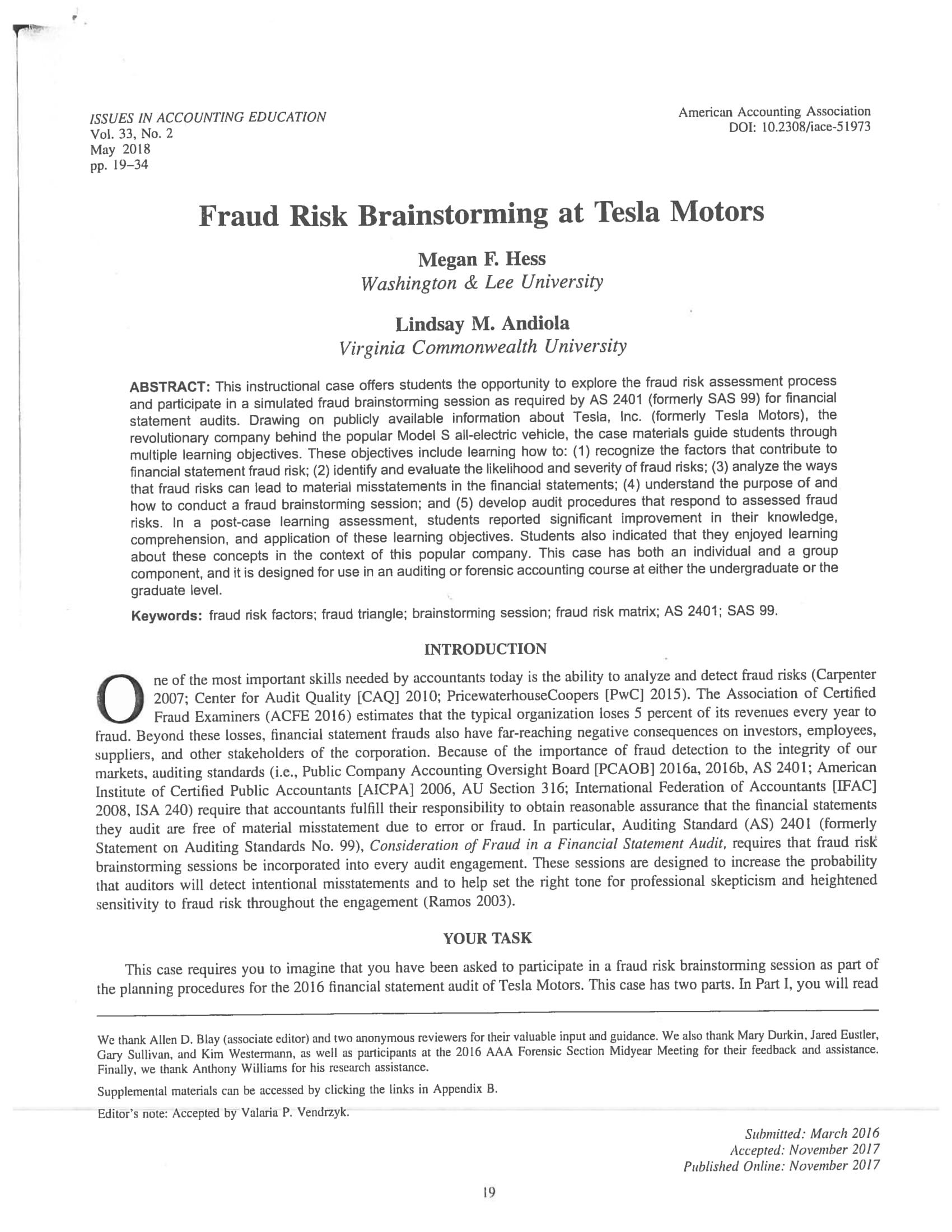

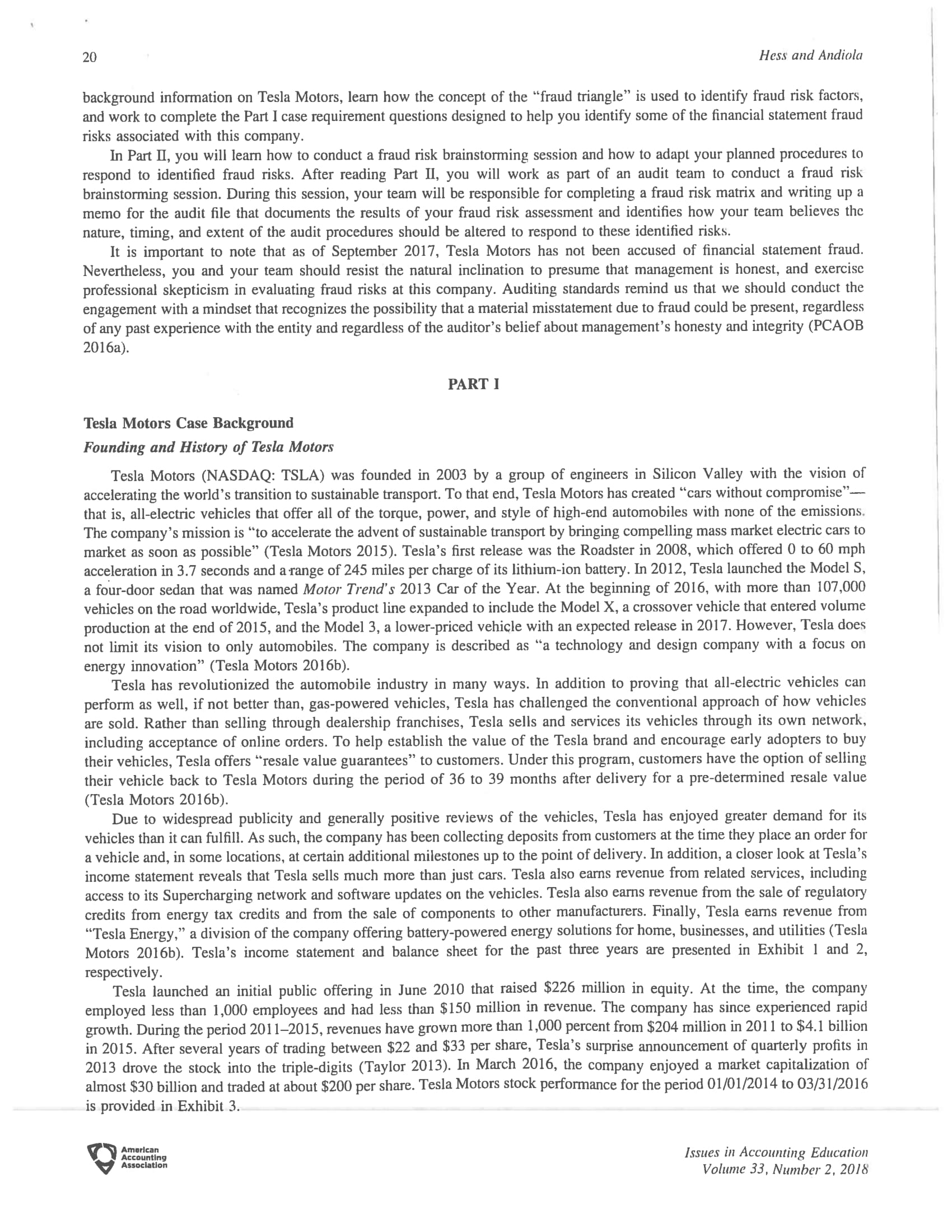

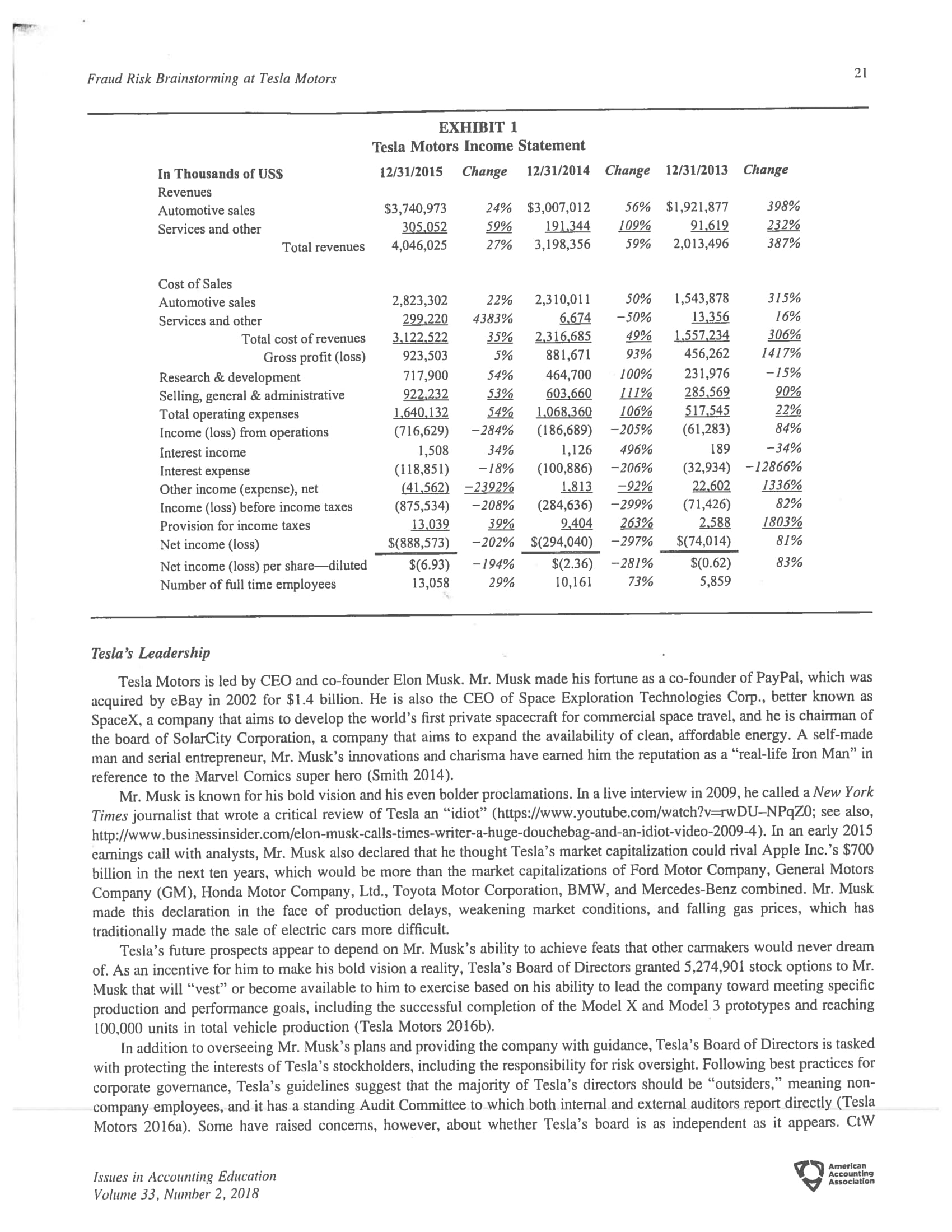

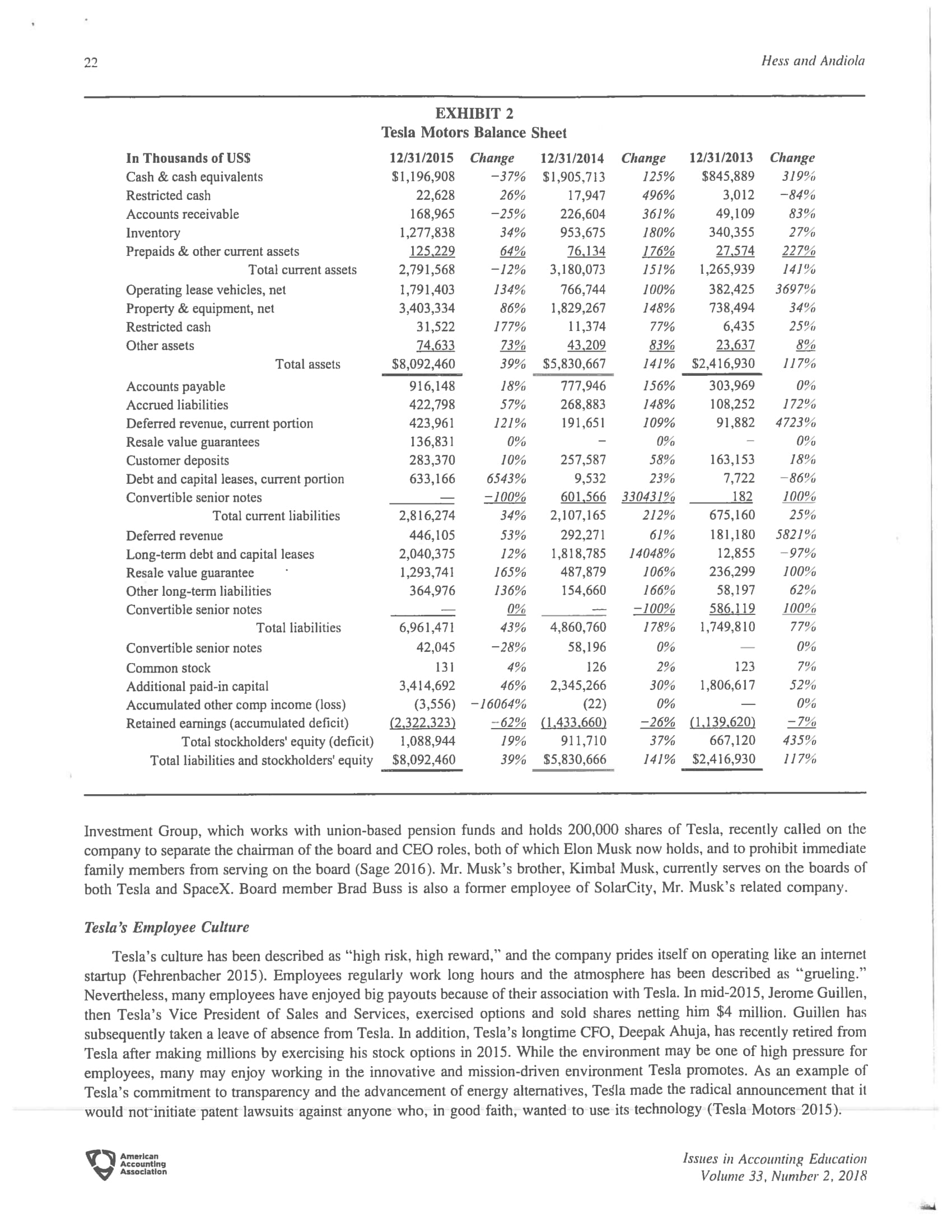

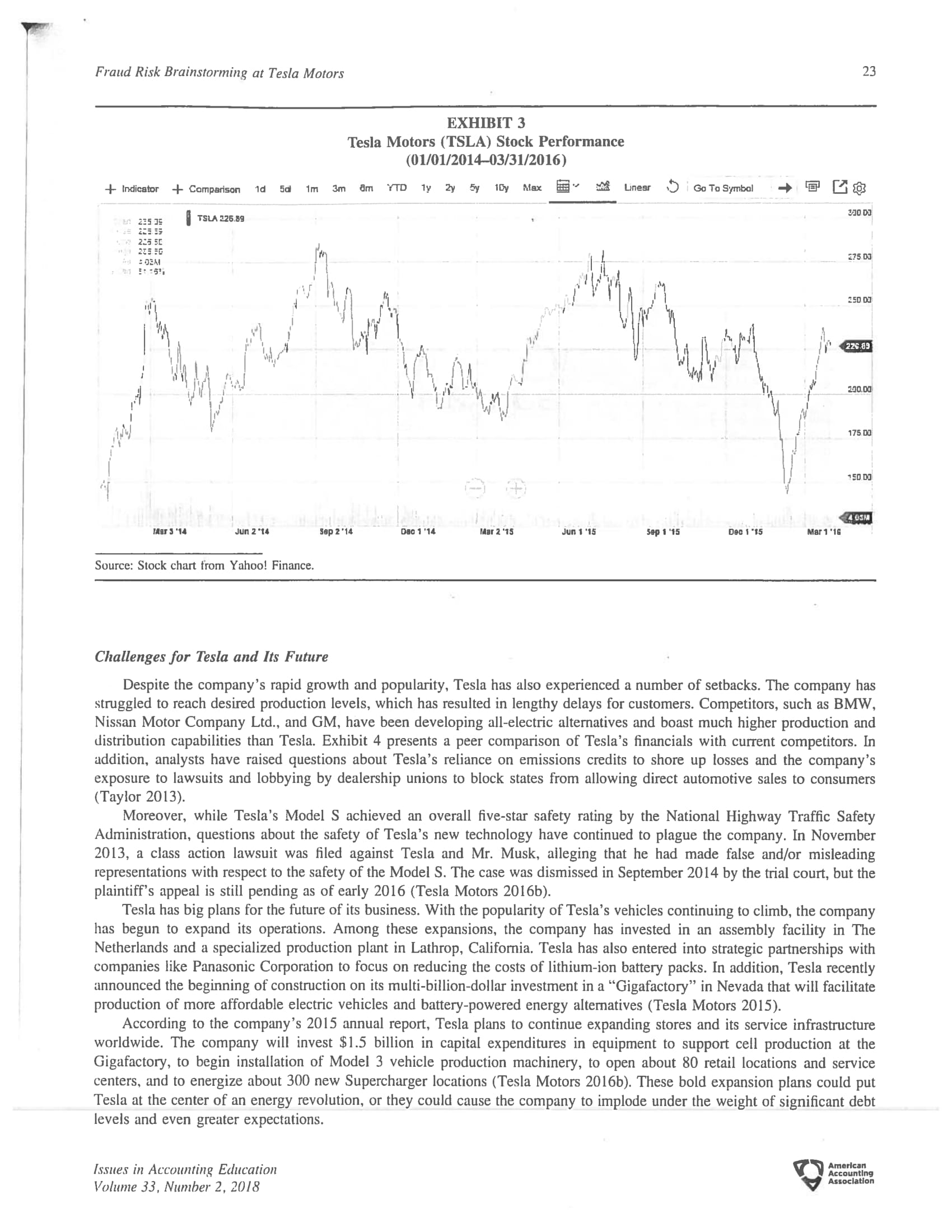

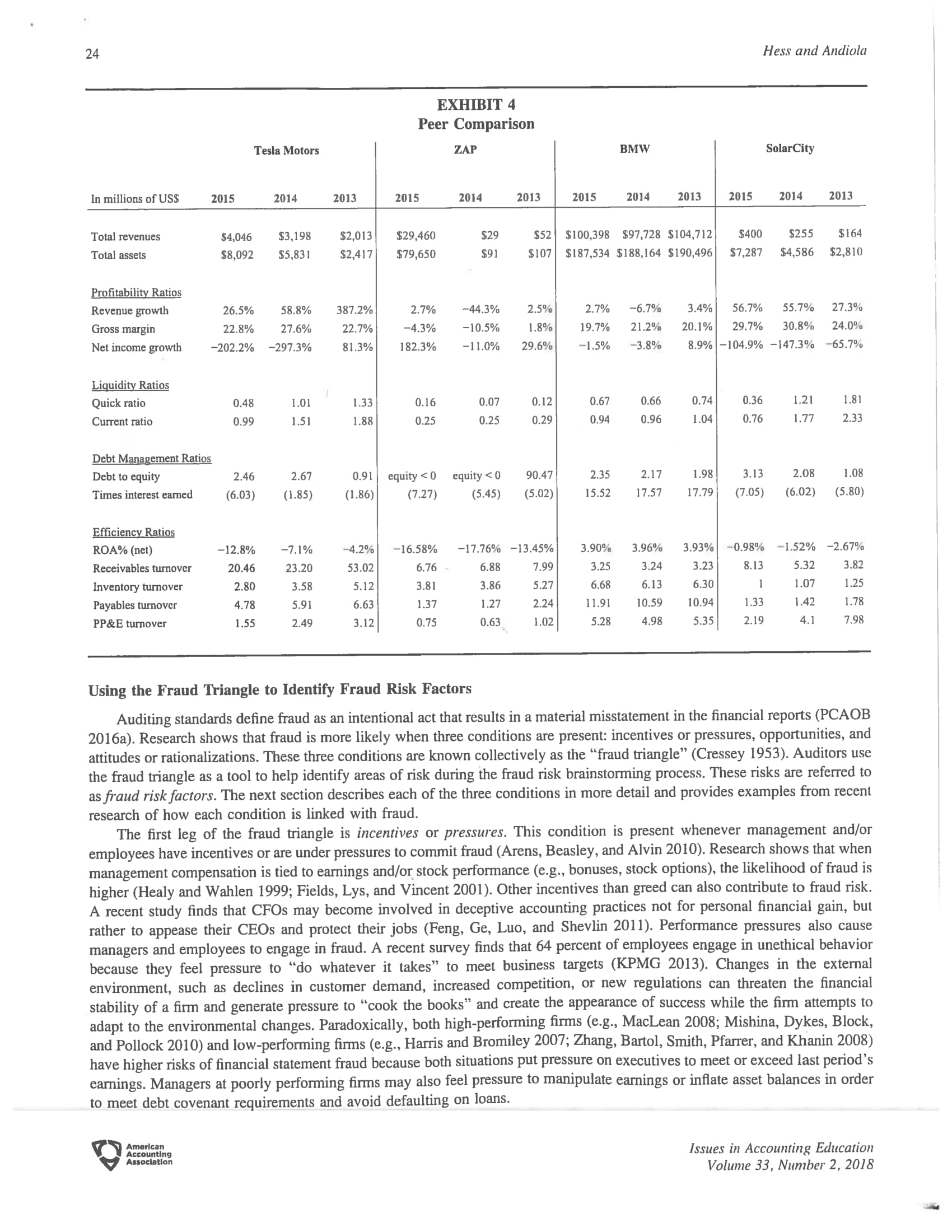

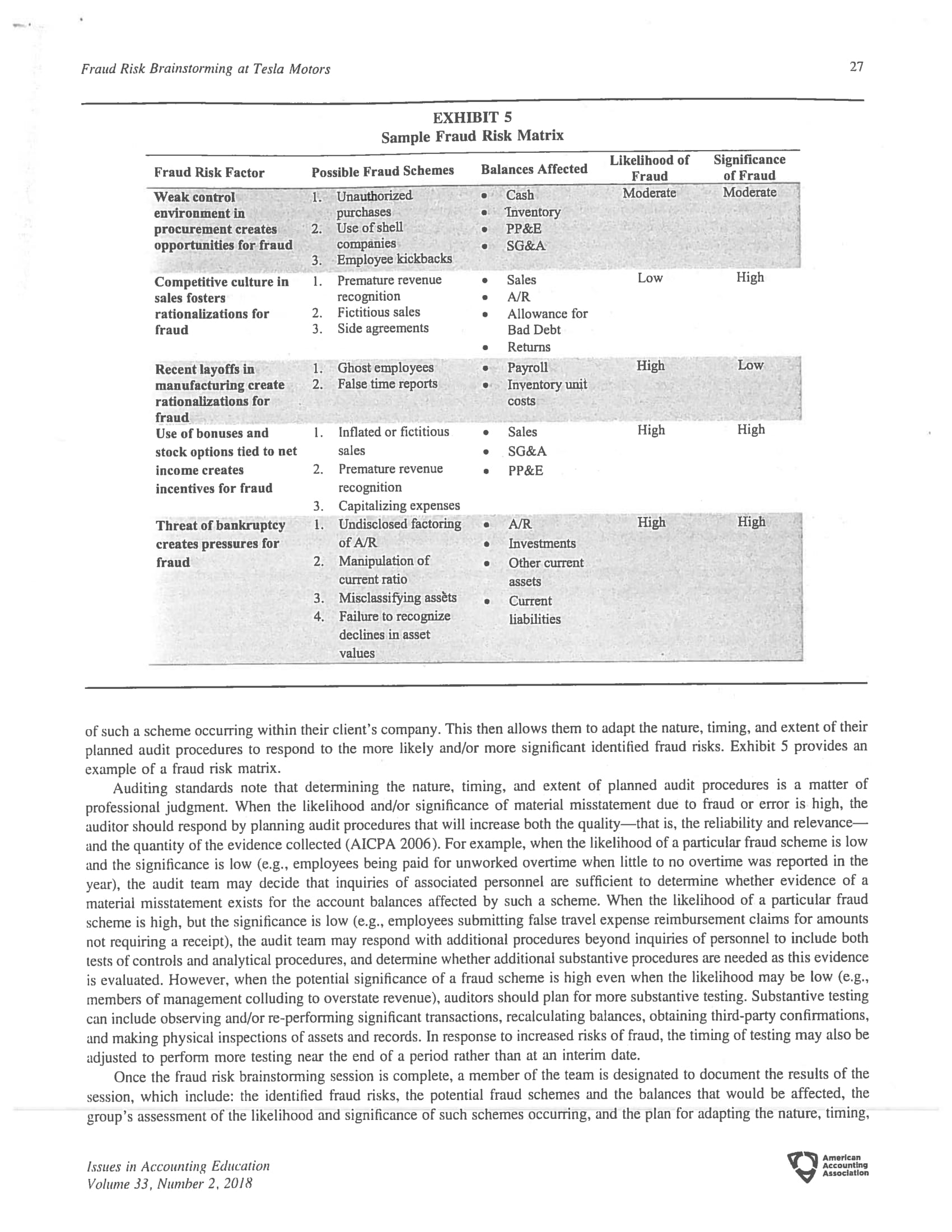

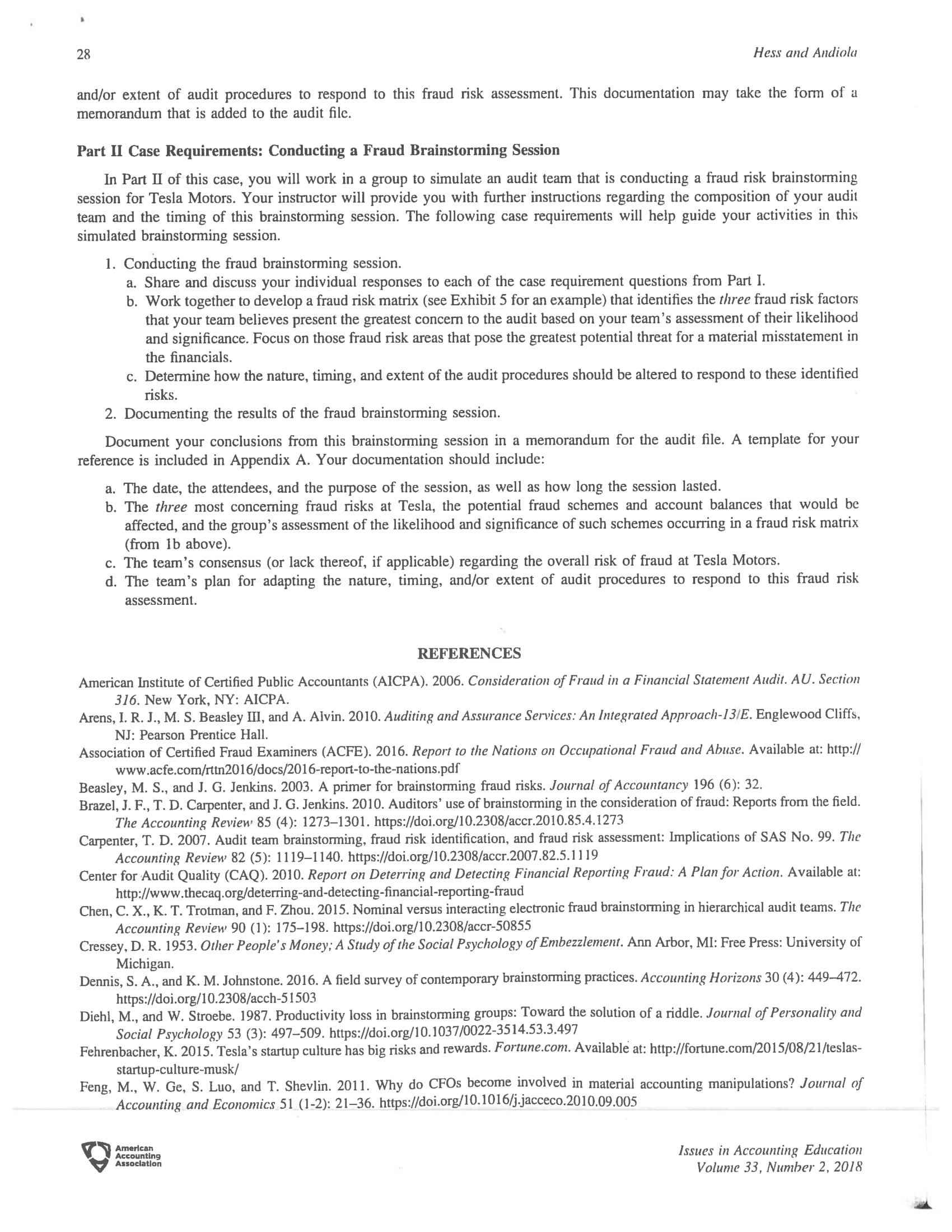

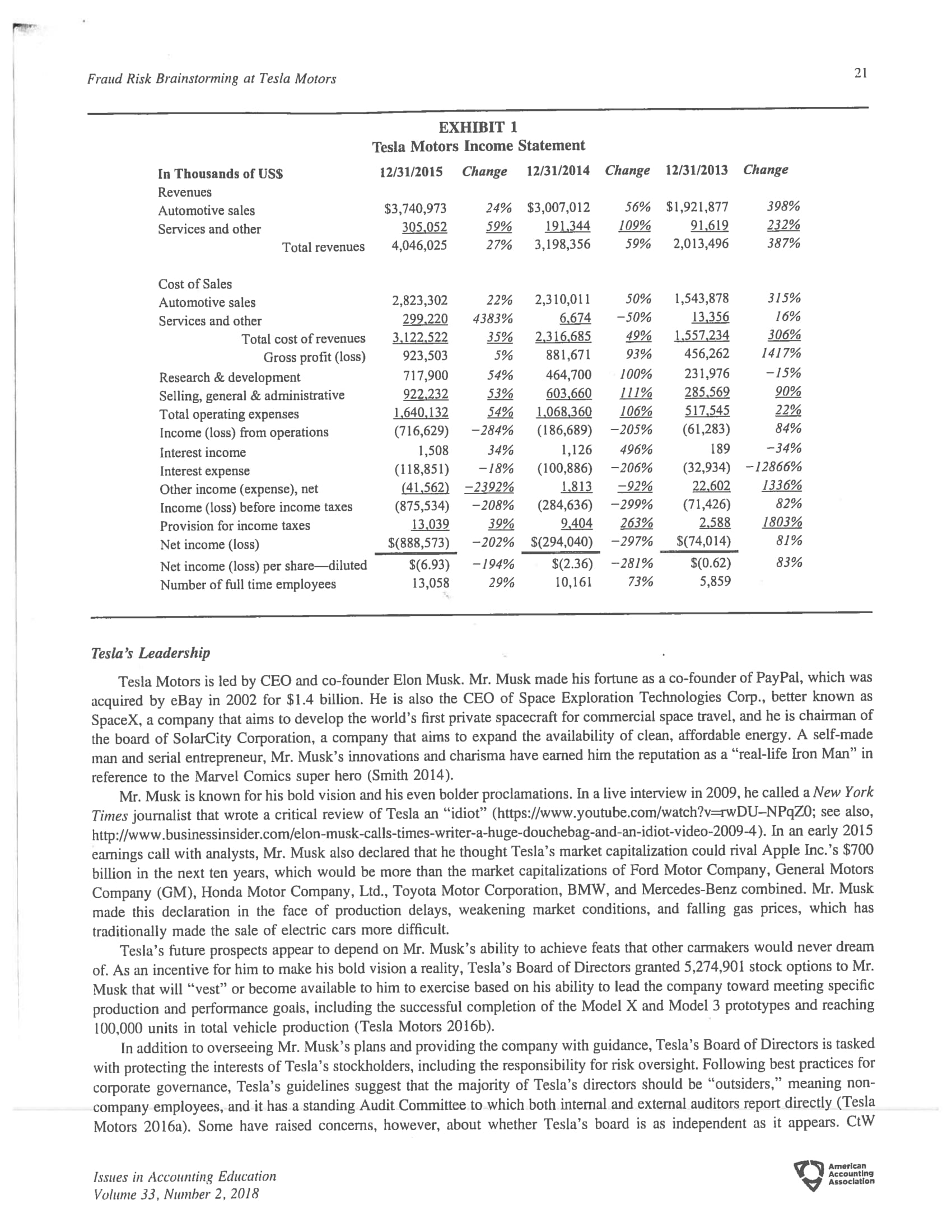

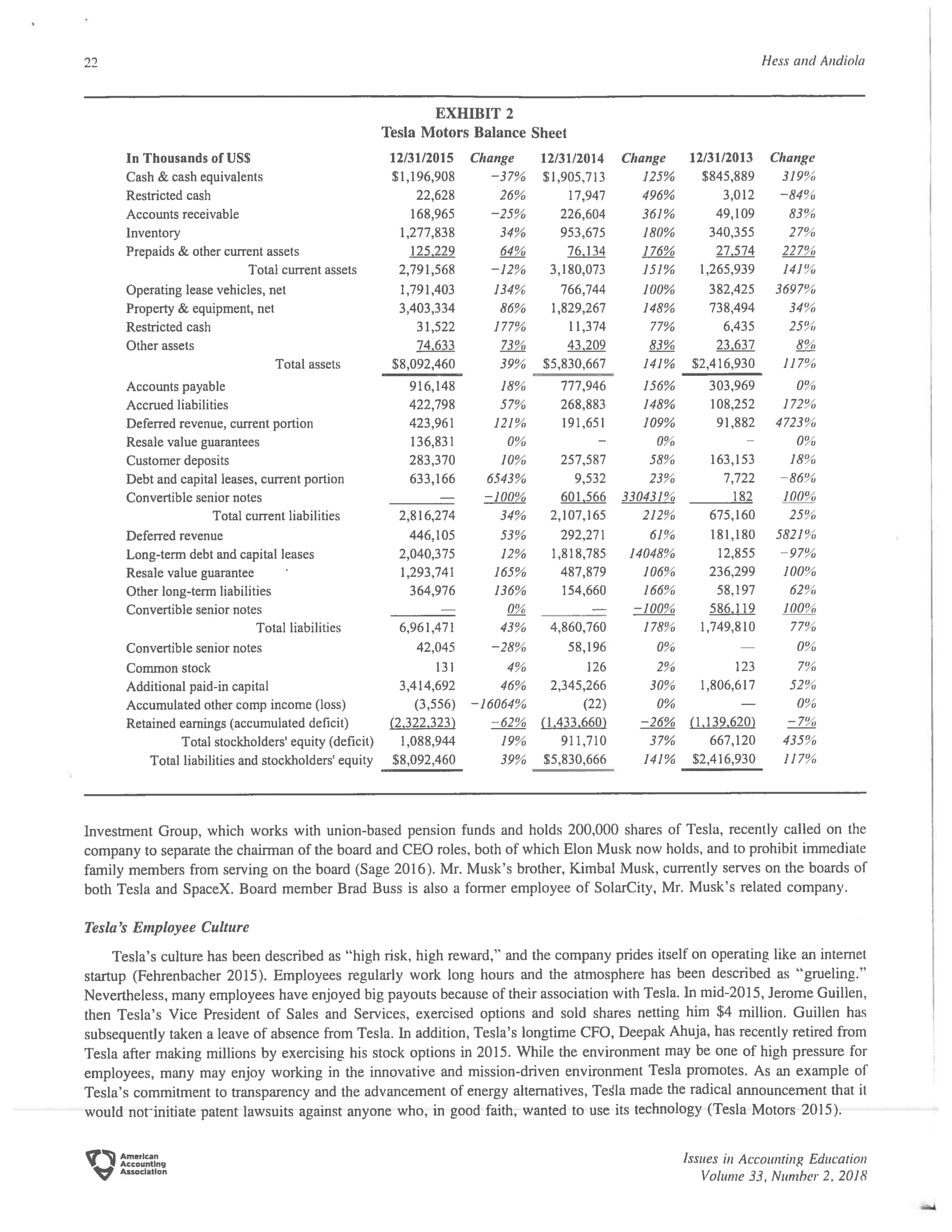

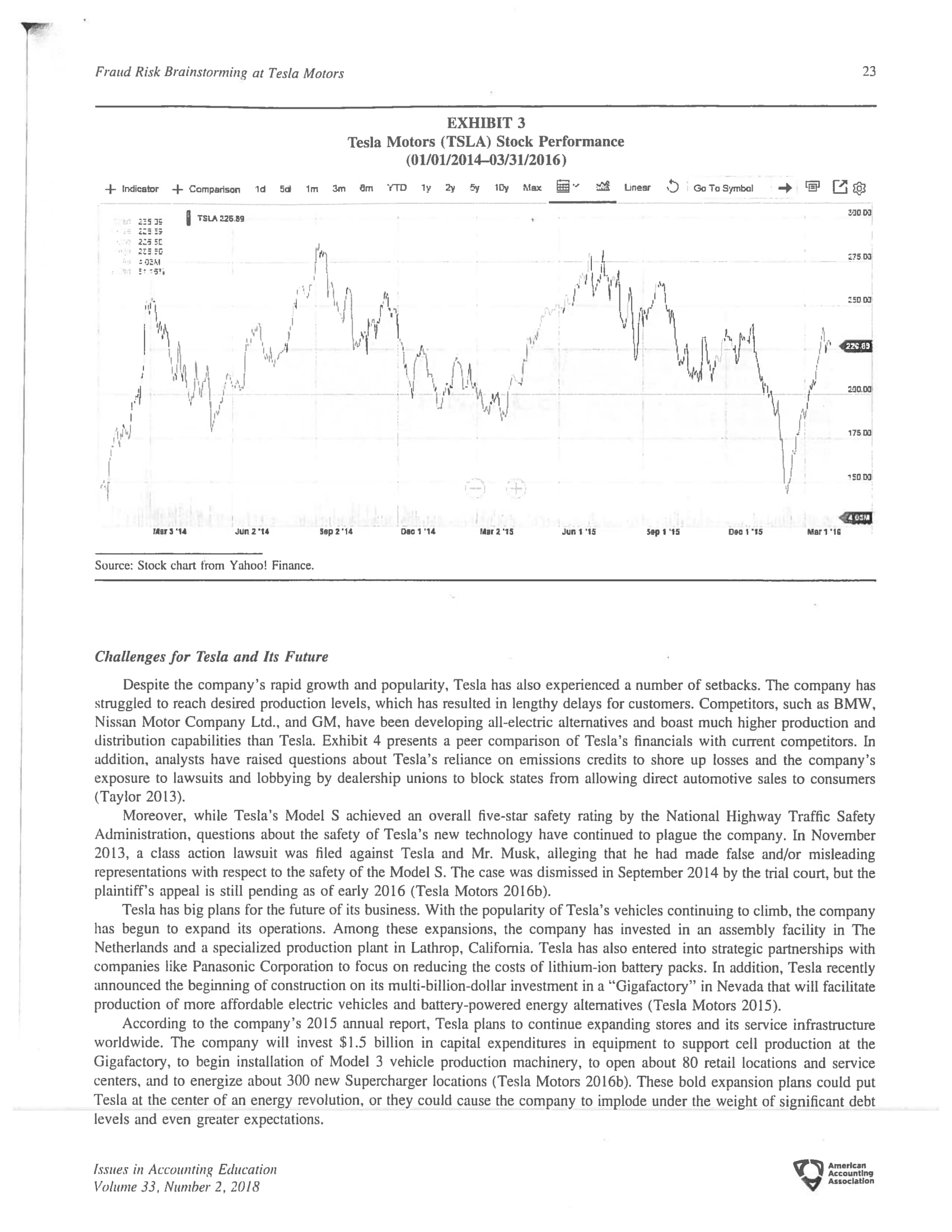

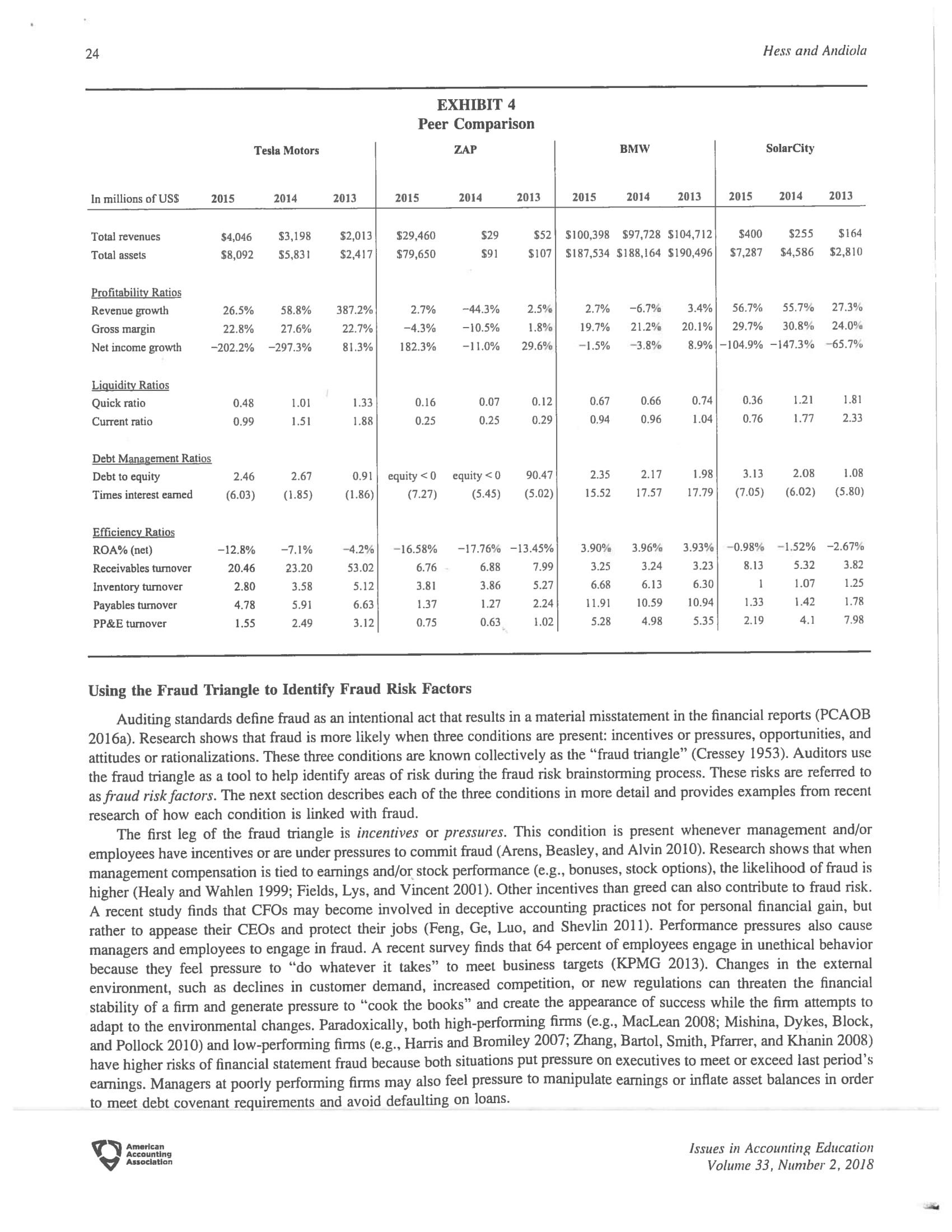

ISSUES IN ACCOUNTING EDUCATION American Accounting Association Vol. 33, No, 2 DOI: 10.2308/iace-5197'3 May 2018 pp. 1934 Fraud Risk Brainstorming at Tesla Motors Megan F. Hess Washington & Lee University Lindsay M. Audiola Virginia Commonwealth University ABSTRACT: This instructional case offers students the opportunity to explore the fraud risk assessment process and participate in a simulated fraud brainstorming session as required by AS 2401 (formerly SAS 99) for nancial statement audits. Drawing on publicly available information about Tesla, Inc. (formerly Tesla Motors), the revolutionary company behind the popular Model S all-electric vehicle. the case materials guide students through multiple learning objectives. These objectives include learning how to: (1) recognize the factors that contribute to nancial statement fraud risk; (2) identify and evaluate the likelihood and severity of fraud risks: (3) analyze the ways that fraud risks can lead to material misstatements in the nancial statements: (4) understand the purpose of and how to conduct a fraud brainstorming session; and (5) develop audit procedures that respond to assessed fraud risks. In a post-case learning assessment, students reported signicant improvement in their knowledge, comprehension, and application of these learning objectives. Students also indicated that they enjoyed learning about these concepts in the context of this popular company. This case has both an individual and a group component, and it is designed for use in an auditing or forensic accounting course at either the undergraduate or the graduate level. Keywords: fraud risk factors; fraud triangle; brainstorming session; fraud risk matrix; AS 2401; SAS 99. INTRODUCTION ne of the most important skills needed by accountants today is the ability to analyze and detect fraud risks (Carpenter O 2007; Center for Audit Quality [CAQ] 2010; PricewaterhouseCoopers [PwC] 2015). The Association of Certied Fraud Examiners (ACFE 2016) estimates that the typical organization loses 5 percent of its revenues every year to fraud. Beyond these losses, nancial statement frauds also have far-reaching negative consequences on investors, employees, suppliers, and other stakeholders of the corporation. Because of the importance of fraud detection to the integrity of our markets. auditing standards (i.e., Public Company Accounting Oversight Board [PCAOB] 2016a, 2016b. AS 2401; American Institute of Certied Public Accountants [AICPA] 2006, AU Section 316; International Federation of Accountants [IFAC] 2008, ISA 240) require that accountants fulll their responsibility to obtain reasonable assurance that the nancial statements they audit are free of material misstatement due to error or fraud. In particular. Auditing Standard (AS) 2401 (formerly Statement on Auditing Standards No. 99), Consideration of Fraud in a Financial Statement Audit, requires that fraud risk brainstorming sessions be incorporated into every audit engagement. These sessions are designed to increase the probability that auditors will detect intentional misstatements and to help set the right tone for professional skepticism and heightened sensitivity to fraud risk throughout the engagement (Ramos 2003). YOUR TASK This case requires you to imagine that you have been asked to participate in a fraud risk brainstorming session as part of the planning procedures for the 2016 nancial statement audit of Tesla Motors. This case has two parts. In Part 1. you will read _____________ We thank Allen D. Blay (associate editor) and two anonymous reviewers for their valuable input and guidance. We also thank Mary Durkin. Jared Eustler. Gary Sullivan. and Kim Westen'nann. as well as participants at the 20l6 AAA Forensic Section Midyear Meeting for their feedback and assistance. Finally. we thank Anthony Williams for his research assistance. Supplemental materials can be accessed by clicking the links in Appendix B. Editor's note: Accepted by Valeria P. Vendrzyk. Submitted: March 2016 Accepted: November 2017 Published Onr'iue: November 2017 19 20 Hess and Audio/t1 background information on Tesla Motors, learn how the concept of the "fraud triangie" is used to identify fraud risk factors, and work to complete the Part 1 case requirement questions designed to help you identify some of the nancial statement fraud risks associated with this company. In Part [1, you will learn how to conduct a fraud risk brainstorming session and how to adapt your planned procedures to respond to identied fraud risks. After reading Part II, you will work as part of an audit team to conduct a fraud risk brainstorming session. During this session, your team will be responsible for completing a fraud risk matrix and writing up a memo for the audit le that documents the results of your fraud risk assessment and identies how your team believes the nature, timing, and extent of the audit procedures should be altered to respond to these identied risks. It is important to note that as of September 2017, Tesla Motors has not been accused of nancial statement fraud. Nevertheless, you and your team should resist the natural inclination to presume that management is honest, and exercise professional skepticism in evaluating fraud risks at this company. Auditing standards remind us that we should conduct the engagement with a mindset that recognizes the possibility that a material misstatement due to fraud could be present, regardless of any past experience with the entity and regardless of the auditor's belief about management's honesty and integrity (PCAOB 2016a). PART ] Tesla Motors Case Background Founding and History of Tesla Motors Tesla Motors (NASDAQ: TSLA) was founded in 2003 by a group of engineers in Silicon Valley with the vision of accelerating the world's transition to sustainable transport. To that end, Tesla Motors has created \"ears without compromise"- that is, all-electric vehicles that offer all of the torque, power, and style of highend automobiles with none of the emissions. The company's mission is \"to accelerate the advent of sustainable transport by bringing compelling mass market electric cars to market as soon as possible\" (Tesla Motors 2015). Tesla's rst release was the Roadster in 2008, which offered 0 to 60 mph acceleration in 3.7 seconds and arange of 245 miles per charge of its lithiumion battery. In 2012, Tesla launched the Model S, a four-door sedan that was named Motor Trend's 2013 Car of the Year. At the beginning of 2016, with more than 107,000 vehicles on the road worldwide, Tesla's product line expanded to include the Model X, a crossover vehicle that entered volume production at the end of 2015, and the Model 3, a lower-priced vehicle with an expected release in 2017. However, Tesla does not limit its vision to only automobiles. The company is described as \"a technology and design company with a focus on energy irmovation\" (Tesla Motors 2016b). Tesla has revolutionized the automobile industry in many ways. in addition to proving that all-electric vehicles can perform as well, if not better than, gas-powered vehicles, Tesla has challenged the conventional approach of how vehicles are sold. Rather than selling through dealership franchises, Tesla sells and services its vehicles through its own network. including acceptance of online orders. To help establish the value of the Tesla brand and encourage early adopters to buy their vehicles, Tesla offers \"resale value guarantees" to customers. Under this program. customers have the option of selling their vehicle back to Tesla Motors during the period of 36 to 39 months after delivery for a pre-determined resale value (Tesla Motors 2016b). Due to widespread publicity and generally positive reviews of the vehicles, Tesla has enjoyed greater demand for its vehicles than it can fulli. As such, the company has been collecting deposits from customers at the time they place an order for a vehicle and, in some locations. at certain additional milestones up to the point of delivery. In addition, a closer look at Tesla's income statement reveals that Tesla sells much more than just cars. Tesla also cams revenue from related services, including access to its Supercharging network and software updates on the vehicles. Tesla aiso earns revenue from the sale of regulatory credits from energy tax credits and from the sale of components to other manufacturers. Finally, Tesla earns revenue from \"Tesla Energy,\" a division of the company offering battery-powered energy solutions for home, businesses, and utilities (Tesia Motors 2016b). Tesla's income statement and balance sheet for the past three years are presented in Exhibit 1 and 2, respectively. Tesla launched an initial public offering in June 2010 that raised $226 million in equity. At the time, the company employed less than 1,000 employees and had less than $150 million in revenue. The company has since experienced rapid gTOWth. During the period 20112015. revenues have grown more than 1,000 percent from $204 million in 201 l to $4.1 billion in 2015. After several years of trading between $22 and $33 per share, Tesla's surprise announcement of quarterly prots in 2013 drove the stock into the triple-digits (Taylor 2013). In March 2016, the company enjoyed a market capitalization of almost $30 billion and traded at about $200 per share. Tesla Motors stock performance for the period 01/01/2014 to 03/31/2016 is provided in Exhibit 3. V 33:33\" Issues in Accounting Education V cm on Volume 33, Number 2. 2018 Fraud Risk Brainstorming at Tesla Motors 21 EXHIBIT 1 Tesla Motors Income Statement In Thousands of USS 12/31/2015 Change 12/31/2014 Change 12/31/2013 Change Revenues Automotive sales $3,740,973 24% $3,007,012 56% $1,921,877 398% Services and other 305,052 59% 191.344 109% 91,619 232% Total revenues 4,046,025 27% 3,198,356 59% 2,013,496 387% Cost of Sales Automotive sales 2,823,302 22% 2,310,011 50% 1,543,878 315% Services and other 299,220 4383% 6,674 -50% 13,356 16% Total cost of revenues 3,122.522 35% 2,316,685 49% 1,557,234 306% Gross profit (loss) 923,503 5% 881,671 93% 456,262 1417% Research & development 717,900 54% 464,700 100% 231,976 -15% Selling, general & administrative 922,232 53% 603,660 1 1 1% 285,569 90% Total operating expenses 1,640,132 54% 1,068,360 106% 517,545 22% Income (loss) from operations (716,629) -284% (186,689) -205% (61,283) 84% Interest income 1,508 34% 1,126 496% 189 -34% Interest expense (118,851) -18% (100,886) -206% (32,934) -12866% Other income (expense), net (41,562) -2392% 1,813 -92% 22,602 1336% Income (loss) before income taxes (875,534) -208% (284,636) -299% (71,426) 82% Provision for income taxes 13,039 39% 9.404 263% 2,588 1803% Net income (loss $(888,573) -202% $(294,040) -297% $(74,014) 81% Net income (loss) per share-diluted $(6.93) -194% 5(2.36) -281% $(0.62) 83% Number of full time employees 13,058 29% 10,161 73% 5,859 Tesla's Leadership Tesla Motors is led by CEO and co-founder Elon Musk. Mr. Musk made his fortune as a co-founder of PayPal, which was acquired by eBay in 2002 for $1.4 billion. He is also the CEO of Space Exploration Technologies Corp., better known as SpaceX, a company that aims to develop the world's first private spacecraft for commercial space travel, and he is chairman of the board of SolarCity Corporation, a company that aims to expand the availability of clean, affordable energy. A self-made man and serial entrepreneur, Mr. Musk's innovations and charisma have earned him the reputation as a "real-life Iron Man" in reference to the Marvel Comics super hero (Smith 2014). Mr. Musk is known for his bold vision and his even bolder proclamations. In a live interview in 2009, he called a New York Times journalist that wrote a critical review of Tesla an "idiot" (https://www.youtube.com/watch?v=TwDU-NPqZO; see also, http://www.businessinsider.com/elon-musk-calls-times-writer-a-huge-douchebag-and-an-idiot-video-2009-4). In an early 2015 earnings call with analysts, Mr. Musk also declared that he thought Tesla's market capitalization could rival Apple Inc.'s $700 billion in the next ten years, which would be more than the market capitalizations of Ford Motor Company, General Motors Company (GM), Honda Motor Company, Lid., Toyota Motor Corporation, BMW, and Mercedes-Benz combined. Mr. Musk made this declaration in the face of production delays, weakening market conditions, and falling gas prices, which has traditionally made the sale of electric cars more difficult. Tesla's future prospects appear to depend on Mr. Musk's ability to achieve feats that other carmakers would never dream of. As an incentive for him to make his bold vision a reality, Tesla's Board of Directors granted 5,274,901 stock options to Mr. Musk that will "vest" or become available to him to exercise based on his ability to lead the company toward meeting specific production and performance goals, including the successful completion of the Model X and Model 3 prototypes and reaching 100,000 units in total vehicle production (Tesla Motors 2016b). In addition to overseeing Mr. Musk's plans and providing the company with guidance, Tesla's Board of Directors is tasked with protecting the interests of Tesla's stockholders, including the responsibility for risk oversight. Following best practices for corporate governance, Tesla's guidelines suggest that the majority of Tesla's directors should be "outsiders," meaning non- company employees, and it has a standing Audit Committee to which both internal and external auditors report directly (Tesla Motors 2016a). Some have raised concerns, however, about whether Tesla's board is as independent as it appears. CtW Issues in Accounting Education Americain Association Volume 33, Number 2, 201822 Hess and Andiola EXHIBIT 2 Tesla Motors Balance Sheet In Thousands of US$ 12/31/2015 Change 12/31/2014 Change 12/31/2013 Change Cash & cash equivalents $1,196,908 -37% $1,905,713 125% $845,889 319% Restricted cash 22,628 26% 17,947 496% 3,012 -84% Accounts receivable 168,965 -25% 226,604 361% 49,109 83% Inventory 1,277,838 34% 53,675 180% 340,355 27% Prepaids & other current assets 125,229 64% 76,134 76% 27,574 227% Total current assets 2,791,568 -12% 3,180,073 151% 1,265,939 141% Operating lease vehicles, net 1,791,403 134% 766,744 100% 382,425 3697% Property & equipment, net 3,403,334 36% 1,829,267 148% 738,494 34% Restricted cash 31,522 177% 11,374 77% 6,435 25% Other assets 74.633 73% 43,209 83% 23,637 8% Total assets $8,092,460 39% $5,830,667 141% $2,416,930 1 17% Accounts payable 916,148 18% 777,946 156% 303,969 0% Accrued liabilities 422,798 57% 268,883 148% 108,252 172% Deferred revenue, current portion 423,961 121% 191,651 109% 91,882 4723% Resale value guarantees 136,831 0% 0% Customer deposits 283,370 10% 257,587 58% 163,153 18% Debt and capital leases, current portion 633,166 6543% 9,532 23% 7,722 -86% Convertible senior notes -100% 601,566 330431% 182 100% Total current liabilities 2,816,274 34% 2, 107,165 212% 575,160 25% Deferred revenue 446,105 53% 292,271 61% 181,180 5821% Long-term debt and capital leases 2,040,375 12% 1,818,785 14048% 12,855 -97% Resale value guarantee 1,293,741 165% 487,879 106% 236,299 100% Other long-term liabilities 364,976 136% 154,660 166% 58,197 62% Convertible senior notes 0% -100% 586.119 100% Total liabilities 6,961,471 43% 4,860,760 178% 1,749,810 77% Convertible senior notes 42,045 -28% 58, 196 0% 0% Common stock 131 4% 126 2% 123 7% Additional paid-in capital 3,414,692 46% 2,345,266 30% 1,806,617 52% Accumulated other comp income (loss) (3,556) -16064% 22) 0% 0% Retained earnings (accumulated deficit) (2,322,323) 62% (1,433,660) -26% (1,139,620) -7% Total stockholders' equity (deficit) 1,088,944 19% 911,710 37% 667,120 435% Total liabilities and stockholders' equity $8,092,460 39% $5,830,666 141% $2,416,930 117% Investment Group, which works with union-based pension funds and holds 200,000 shares of Tesla, recently called on the company to separate the chairman of the board and CEO roles, both of which Elon Musk now holds, and to prohibit immediate family members from serving on the board (Sage 2016). Mr. Musk's brother, Kimbal Musk, currently serves on the boards of both Tesla and SpaceX. Board member Brad Buss is also a former employee of SolarCity, Mr. Musk's related company. Tesla's Employee Culture Tesla's culture has been described as "high risk, high reward," and the company prides itself on operating like an internet startup (Fehrenbacher 2015). Employees regularly work long hours and the atmosphere has been described as "grueling." Nevertheless, many employees have enjoyed big payouts because of their association with Tesla. In mid-2015, Jerome Guillen, then Tesla's Vice President of Sales and Services, exercised options and sold shares netting him $4 million. Guillen has subsequently taken a leave of absence from Tesla. In addition, Tesla's longtime CFO, Deepak Ahuja, has recently retired from Tesla after making millions by exercising his stock options in 2015. While the environment may be one of high pressure for employees, many may enjoy working in the innovative and mission-driven environment Tesla promotes. As an example of Tesla's commitment to transparency and the advancement of energy alternatives, Tesla made the radical announcement that it would not initiate patent lawsuits against anyone who, in good faith, wanted to use its technology (Tesla Motors 2015). Issues in Accounting Education Association Volume 33, Number 2, 2018Fraud Risk Brainstorming at Tesla Motors 23 EXHIBIT 3 Tesla Motors (TSLA) Stock Performance (01/01/2014-03/31/2016) | Indicator + Comparison 1d 5 1m 3m am YTD ly 2y 5y 1Dy Max Linear Go To Symbol 20 295 25 TSLA 326.89 310 DJ 225 5C 275 03 350 07 226.89 240.00 175.DO 50 DO Tear S '14 Jun 2 '14 Sep 2'14 Dec 1 '14 Mar 2 '15 Jun 1 '15 Sop 1 '15 Dec 1 "15 Mar 1 '16 Source: Stock chart from Yahoo! Finance. Challenges for Tesla and Its Future Despite the company's rapid growth and popularity, Tesla has also experienced a number of setbacks. The company has struggled to reach desired production levels, which has resulted in lengthy delays for customers. Competitors, such as BMW, Nissan Motor Company Lid., and GM, have been developing all-electric alternatives and boast much higher production and distribution capabilities than Tesla. Exhibit 4 presents a peer comparison of Tesla's financials with current competitors. In addition, analysts have raised questions about Tesla's reliance on emissions credits to shore up losses and the company's exposure to lawsuits and lobbying by dealership unions to block states from allowing direct automotive sales to consumers (Taylor 2013). Moreover, while Tesla's Model S achieved an overall five-star safety rating by the National Highway Traffic Safety Administration, questions about the safety of Tesla's new technology have continued to plague the company. In November 2013, a class action lawsuit was filed against Tesla and Mr. Musk, alleging that he had made false and/or misleading representations with respect to the safety of the Model S. The case was dismissed in September 2014 by the trial court, but the plaintiff's appeal is still pending as of early 2016 (Tesla Motors 2016b). Tesla has big plans for the future of its business. With the popularity of Tesla's vehicles continuing to climb, the company has begun to expand its operations. Among these expansions, the company has invested in an assembly facility in The Netherlands and a specialized production plant in Lathrop, California. Tesla has also entered into strategic partnerships with companies like Panasonic Corporation to focus on reducing the costs of lithium-ion battery packs. In addition, Tesla recently announced the beginning of construction on its multi-billion-dollar investment in a "Gigafactory" in Nevada that will facilitate production of more affordable electric vehicles and battery-powered energy alternatives (Tesla Motors 2015). According to the company's 2015 annual report, Tesla plans to continue expanding stores and its service infrastructure worldwide. The company will invest $1.5 billion in capital expenditures in equipment to support cell production at the Gigafactory, to begin installation of Model 3 vehicle production machinery, to open about 80 retail locations and service centers, and to energize about 300 new Supercharger locations (Tesla Motors 2016b). These bold expansion plans could put Tesla at the center of an energy revolution, or they could cause the company to implode under the weight of significant debt levels and even greater expectations. Issues in Accounting Education Amounting Volume 33, Number 2, 2018 Association24 Hess and Andiola EXHIBIT 4 Peer Comparison Tesla Motors ZAP BMW SolarCity In millions of US$ 2015 2014 2013 2015 2014 2013 2015 2014 2013 2015 2014 2013 Total revenues $4,046 $3,198 $2,013 $29,460 $29 $52 $100,398 $97,728 $104,712 $400 $255 $164 Total assets $8,092 $5,831 $2,417 $79,650 $91 $107 $187,534 $188,164 $190,496 $7,287 $4,586 $2,810 Profitability Ratios Revenue growth 26.5% 58.8% 387.2% 2.7% -44.3% 2.5% 2.7% -6.7% 3.4% 56.7% 55.7% 27.3% Gross margin 22.8% 27.6% 22.7% -4.3% -10.5% 1.8% 19.7% 21.2% 20.1% 29.7% 30.8% 24.0% Net income growth -202.2% -297.3% 81.3% 182.3% -11.0% 29.6% -1.5% -3.8% 8.9% -104.9% -147.3% -65.7% Liquidity Ratios Quick ratio 0.48 1.01 1.33 0.16 0.07 0.12 0.67 0.66 0.74 0.36 1.21 1.81 Current ratio 0.99 1.51 1.88 0.25 0.25 0.29 0.94 0.96 1.04 0.76 1.77 2.33 Debt Management Ratios Debt to equity 2.46 2.67 0.91 equity