Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could you please help me with the wrong values in the orange highlighted box Question 1 of 6 13.28/22 View Policies Show Attempt History Current

Could you please help me with the wrong values in the orange highlighted box

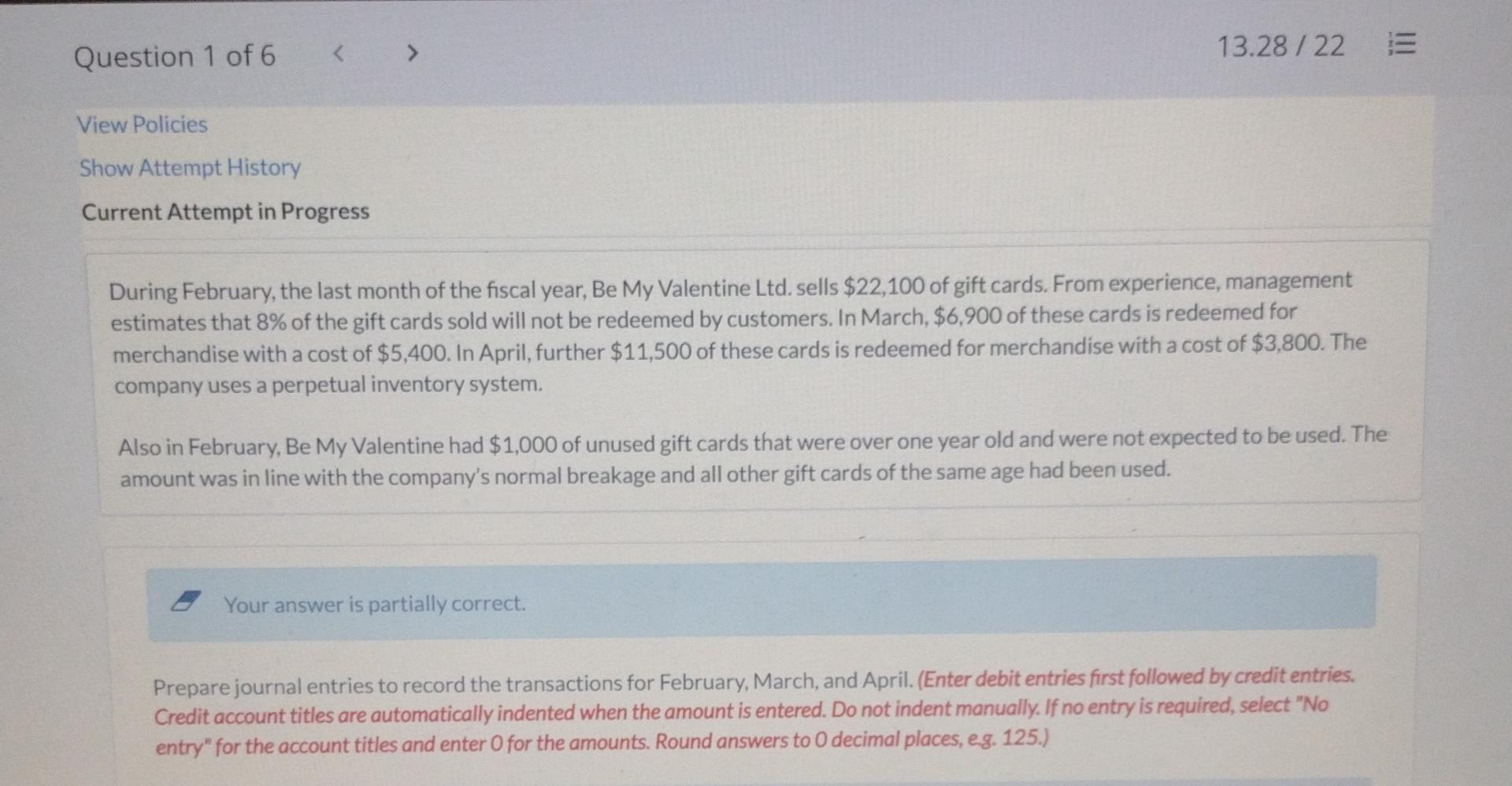

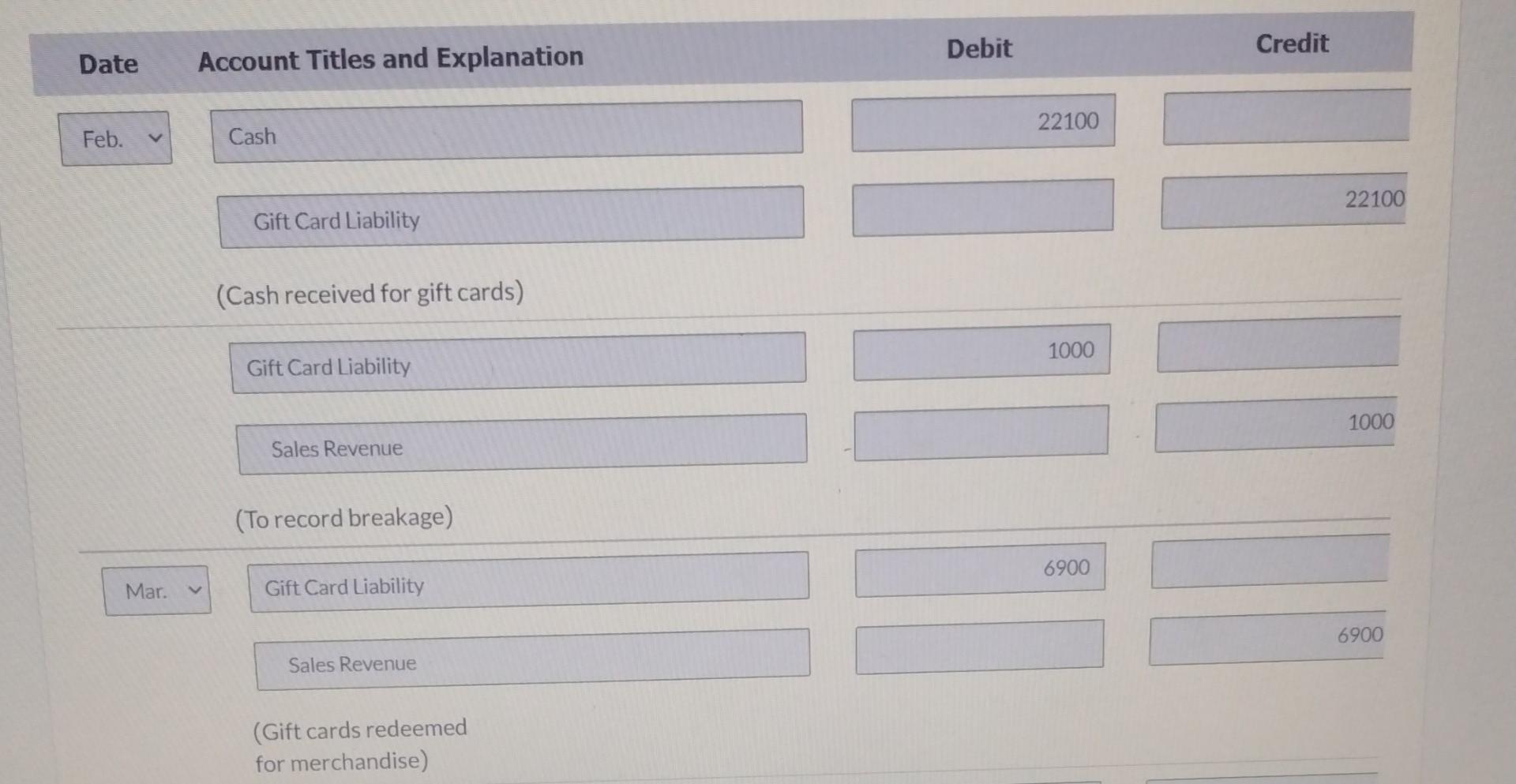

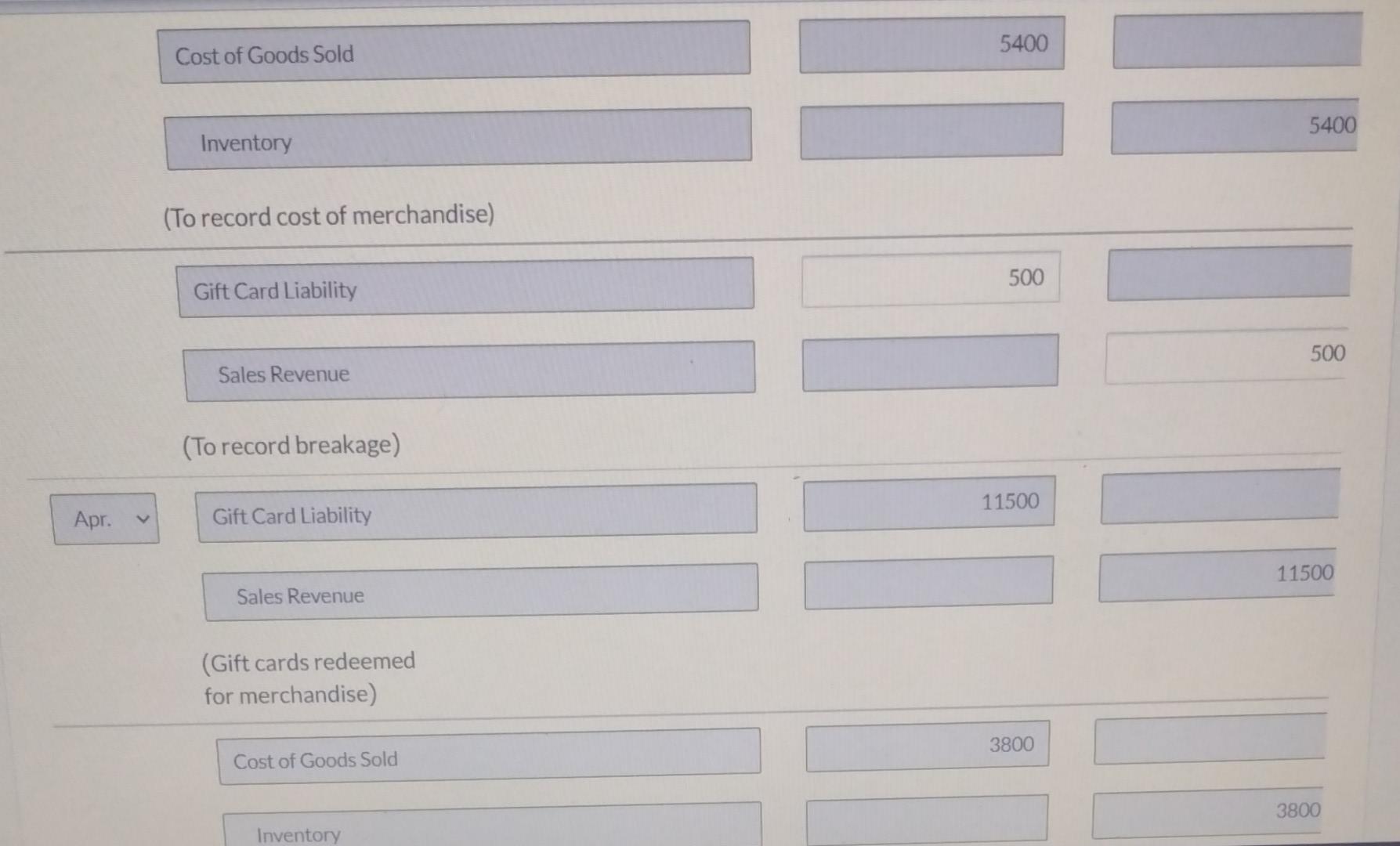

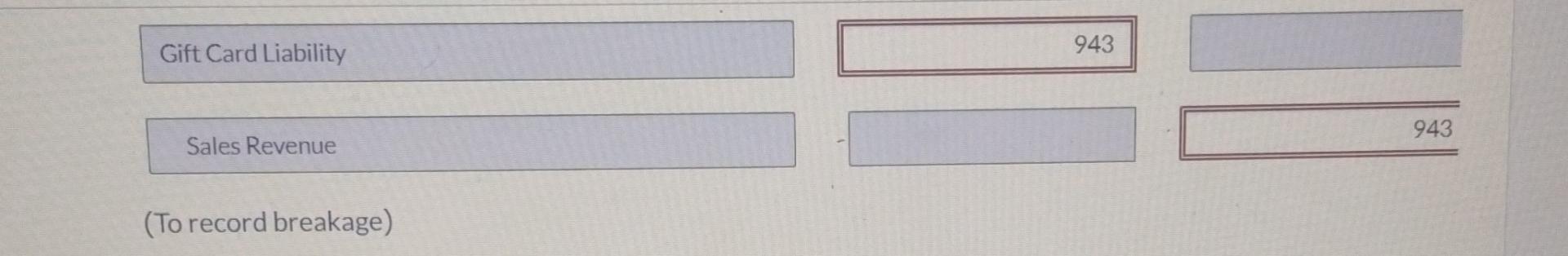

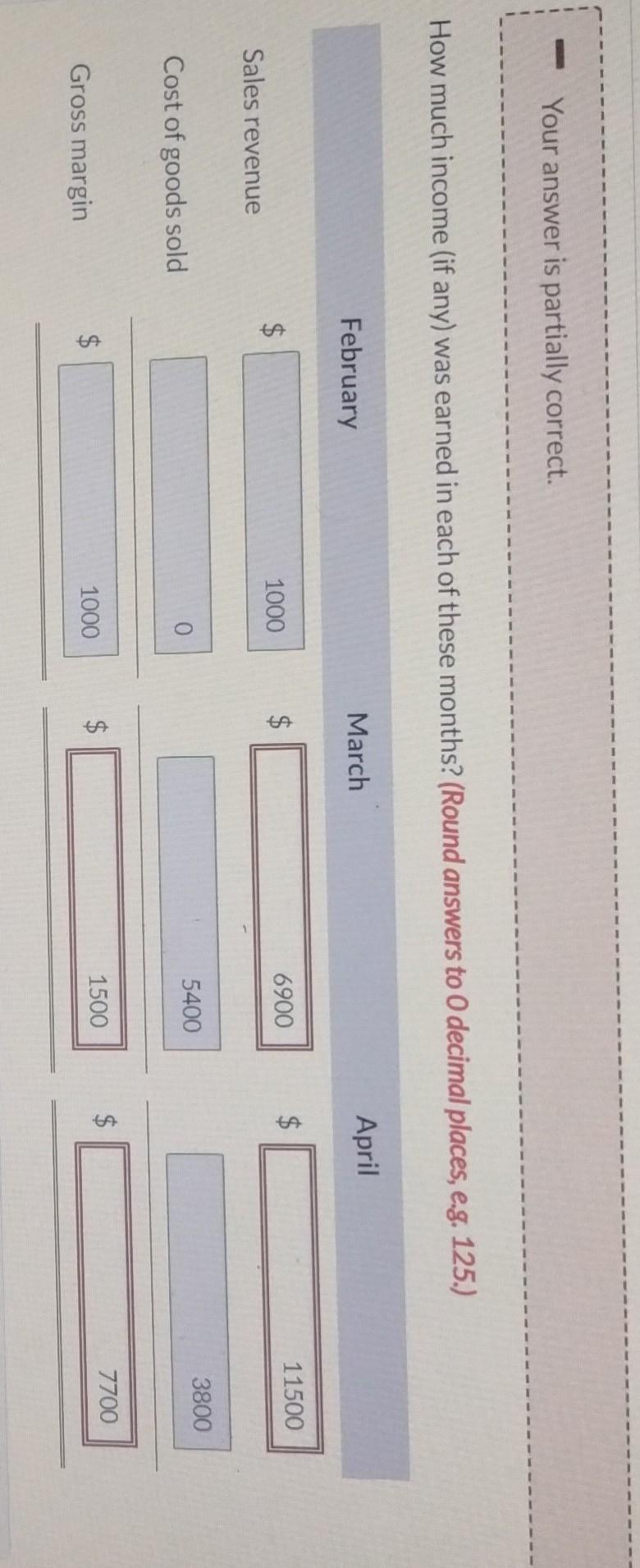

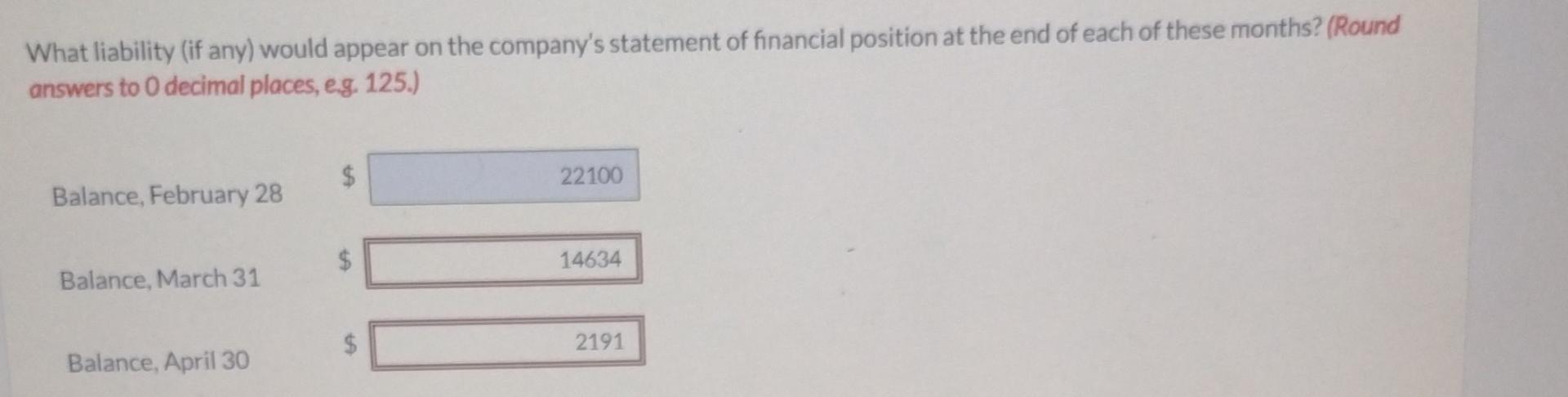

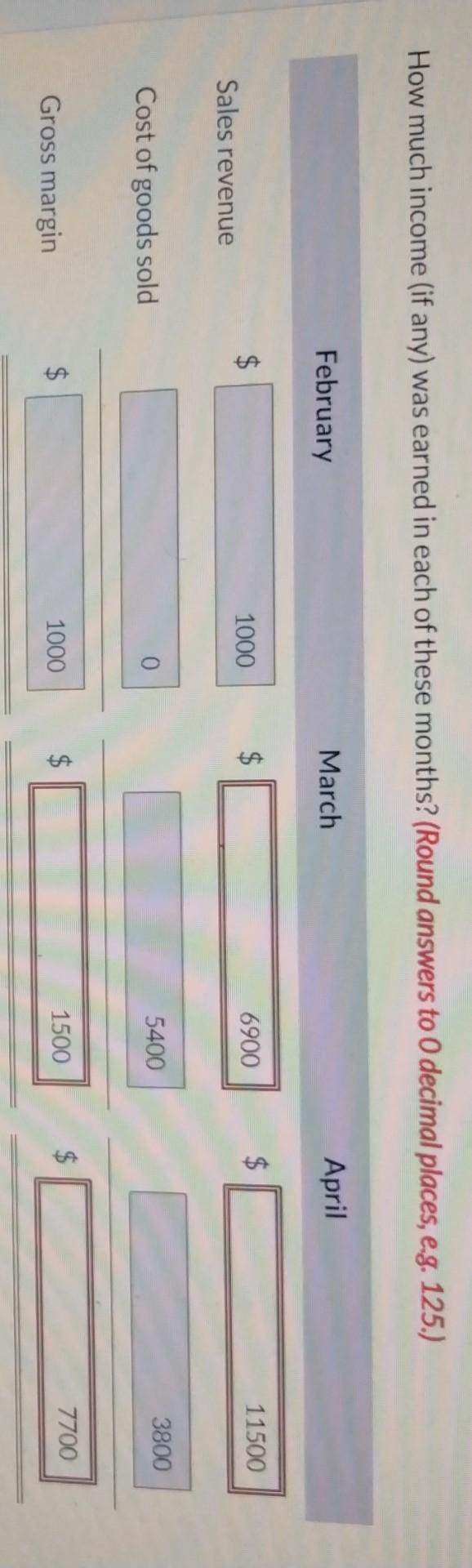

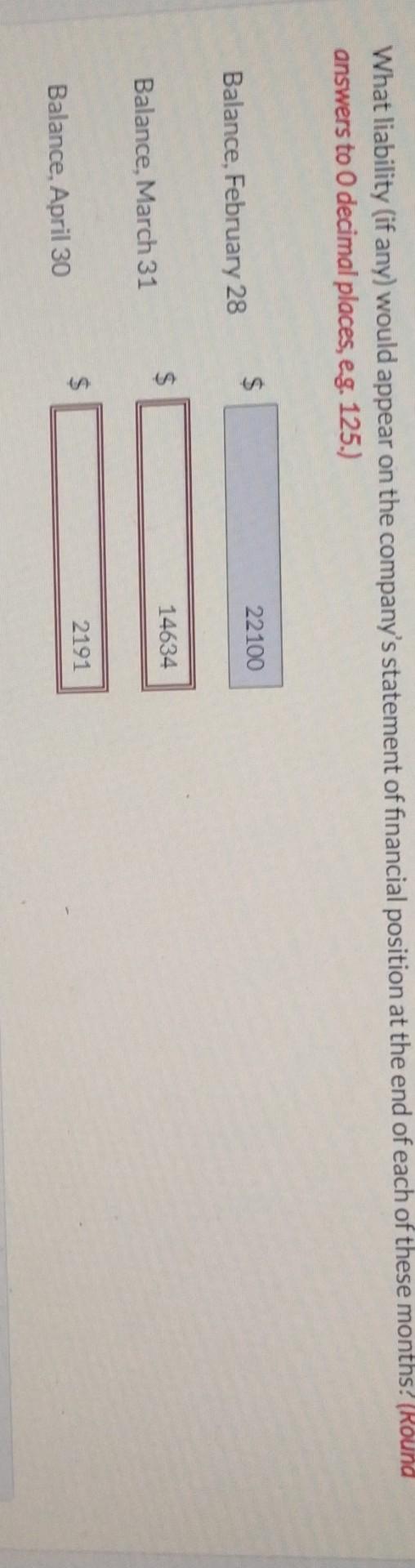

Question 1 of 6 13.28/22 View Policies Show Attempt History Current Attempt in Progress During February, the last month of the fiscal year, Be My Valentine Ltd. sells $22,100 of gift cards. From experience, management estimates that 8% of the gift cards sold will not be redeemed by customers. In March, $6,900 of these cards is redeemed for merchandise with a cost of $5,400. In April, further $11,500 of these cards is redeemed for merchandise with a cost of $3,800. The company uses a perpetual inventory system. Also in February, Be My Valentine had $1,000 of unused gift cards that were over one year old and were not expected to be used. The amount was in line with the company's normal breakage and all other gift cards of the same age had been used. Your answer is partially correct. Prepare journal entries to record the transactions for February, March, and April. (Enter debit entries first followed by credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. Round answers to 0 decimal places, eg. 125.) Debit Credit Date Account Titles and Explanation 22100 Feb. Cash 22100 Gift Card Liability (Cash received for gift cards) 1000 Gift Card Liability 1000 Sales Revenue (To record breakage) 6900 Mar. Gift Card Liability 6900 Sales Revenue (Gift cards redeemed for merchandise) 5400 Cost of Goods Sold 5400 Inventory (To record cost of merchandise) 500 Gift Card Liability 500 Sales Revenue (To record breakage) 11500 Apr. Gift Card Liability 11500 Sales Revenue (Gift cards redeemed for merchandise) 3800 Cost of Goods Sold 3800 Inventory Gift Card Liability 943 943 Sales Revenue (To record breakage) Your answer is partially correct. How much income (if any) was earned in each of these months? (Round answers to 0 decimal places, e.g. 125.) February March April 11500 1000 6900 $ Sales revenue 5400 3800 Cost of goods sold $ 7700 $ ta 1500 $ Gross margin 1000 What liability (if any) would appear on the company's statement of financial position at the end of each of these months? (Round answers to 0 decimal places, eg. 125.) $ 22100 Balance, February 28 14634 Balance, March 31 $ 2191 Balance, April 30 How much income (if any) was earned in each of these months? (Round answers to 0 decimal places, e.g. 125.) February March April $ 1000 $ 6900 $ 11500 Sales revenue 0 Cost of goods sold 3800 5400 Gross margin $ 7700 1000 $ 1500 What liability (if any) would appear on the company's statement of financial position at the end of each of these months! (Round answers to 0 decimal places, eg. 125.) $ 22100 Balance, February 28 $ 14634 Balance, March 31 $ 2191 Balance, April 30

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started