Answered step by step

Verified Expert Solution

Question

1 Approved Answer

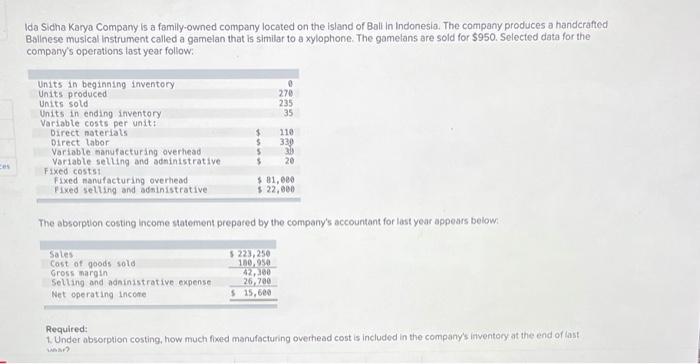

Could you please post the steps used to find your final answer. 1. 2. 2. 2. 3. Ida Sidha Karya Company is a family-owned company

Could you please post the steps used to find your final answer.

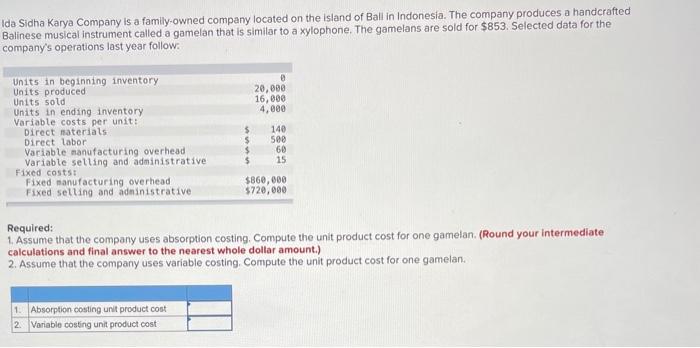

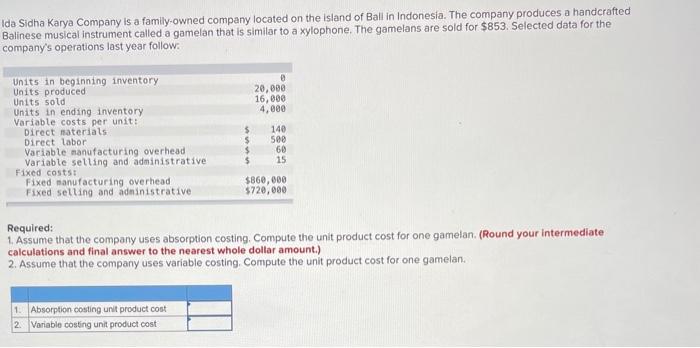

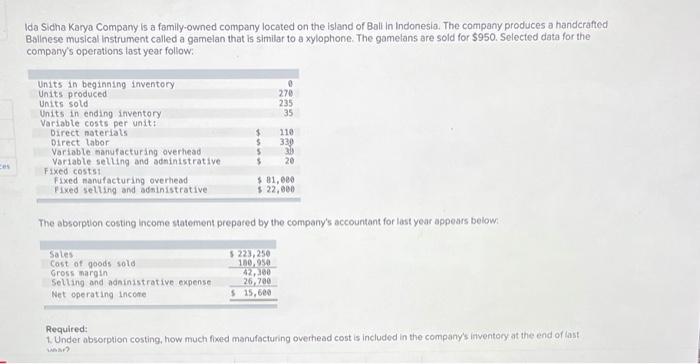

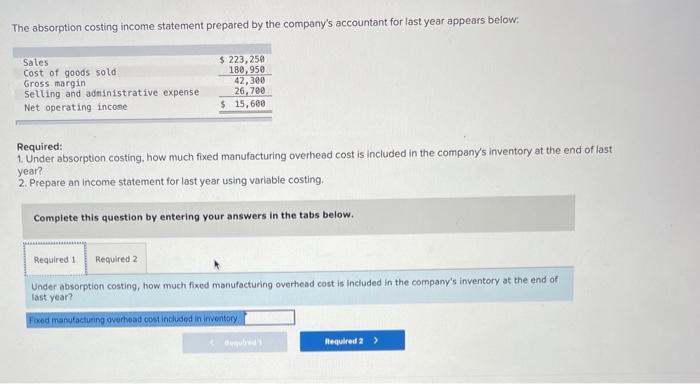

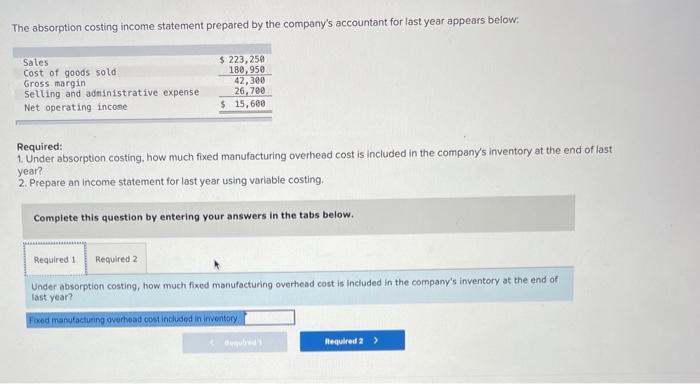

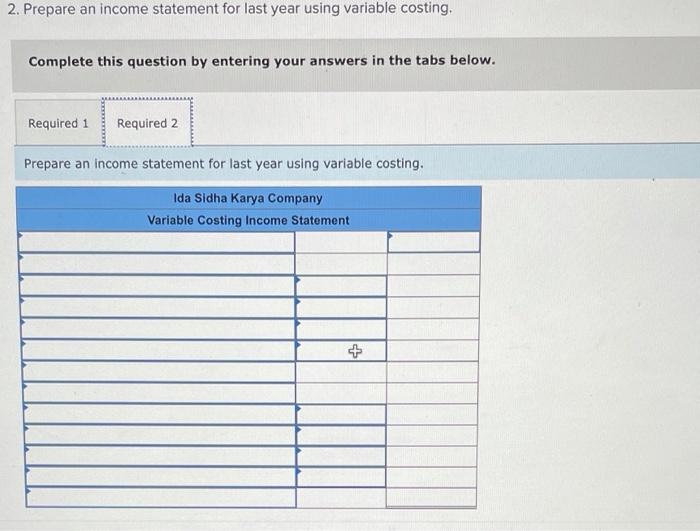

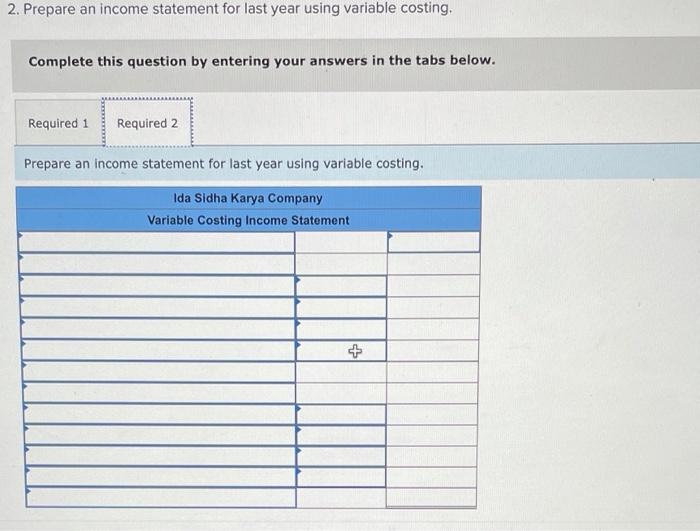

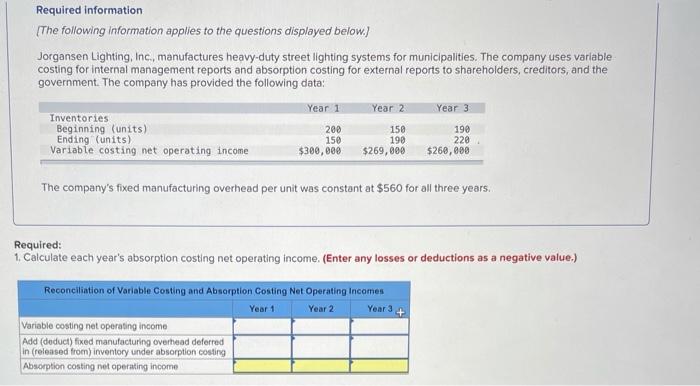

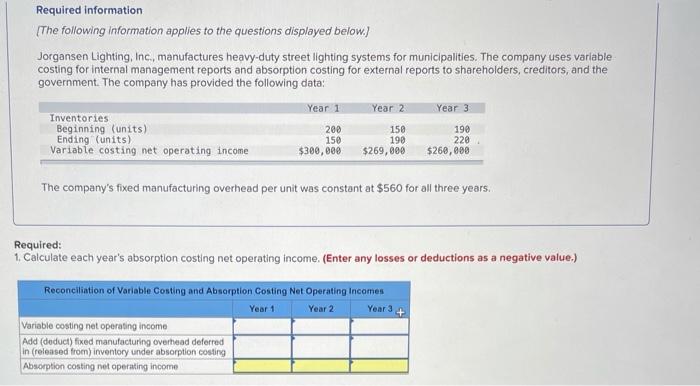

Ida Sidha Karya Company is a family-owned company located on the island of Ball in Indonesia. The company produces a handcrafted Balinese musical instrument called a gamelan that is similar to a xylophone. The gamelans are sold for $853. Selected data for the company's operations last year follow. 20,000 16,000 4,000 Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs: Fixed manufacturing overhead Fixed selling and administrative $ $ $ 140 see 60 15 $860,000 $720,000 Required: 1. Assume that the company uses absorption costing, Compute the unit product cost for one gamelan (Round your intermediate calculations and final answer to the nearest whole dollar amount.) 2. Assume that the company uses variable costing, Compute the unit product cost for one gamelan. 1. Absorption costing unit product cost 2. Variable costing unit product cost Ida Sidha Karya Company is a family-owned company located on the island of Ball In Indonesia. The company produces a handcrafted Balinese musical Instrument called a gamelan that is similar to a xylophone. The gamelans are sold for $950. Selected data for the company's operations last year follow: 270 235 35 Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit Direct naterials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs Fixed manufacturing overhead Fixed selling and administrative $ $ 110 330 31 20 $ $ 81,000 $ 22,000 The absorption costing Income statement prepared by the company's accountant for list year appears below: Sales Cost of goods sold Gross margin Selling and adninistrative expense Net operating income 3 223,250 100,950 42,300 26,700 $ 15,600 Required: Under absorption costing, how much fixed manufacturing overhead cost is included in the company's inventory at the end of last The absorption costing income statement prepared by the company's accountant for last year appears below: Sales Cost of goods sold Gross margin Selling and administrative expense Net operating income $ 223,250 180,950 42,300 26,700 $ 15,600 Required: 1. Under absorption costing, how much fixed manufacturing overhead cost is included in the company's inventory at the end of last year? 2. Prepare an income statement for last year using variable costing, Complete this question by entering your answers in the tabs below. Required 1 Required 2 Under absorption costing, how much fixed manufacturing overhead cost is included in the company's inventory at the end of last year? Fixed manufacturing overhead cost included in Inventory Required 2 > 2. Prepare an income statement for last year using variable costing. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare an income statement for last year using variable costing. Ida Sidha Karya Company Variable Costing Income Statement + Required information The following information applies to the questions displayed below.) Jorgansen Lighting, Inc., manufactures heavy-duty street lighting systems for municipalities. The company uses variable costing for internal management reports and absorption costing for external reports to shareholders, creditors, and the government. The company has provided the following data: Year 1 Year 2 Year 3 Inventories Beginning (units) Ending (units) Variable costing net operating income 200 150 $300,000 150 190 $269,000 190 220 $260,000 The company's fixed manufacturing overhead per unit was constant at $560 for all three years. Required: 1. Calculate each year's absorption costing net operating income (Enter any losses or deductions as a negative value.) Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Year 1 Year 2 Years + Variable costing net operating income Add (deduct) fixed manufacturing overhead deferred in (released from) inventory under absorption costing Absorption costing net operating income 1.

2.

2.

2.

3.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started