Answered step by step

Verified Expert Solution

Question

1 Approved Answer

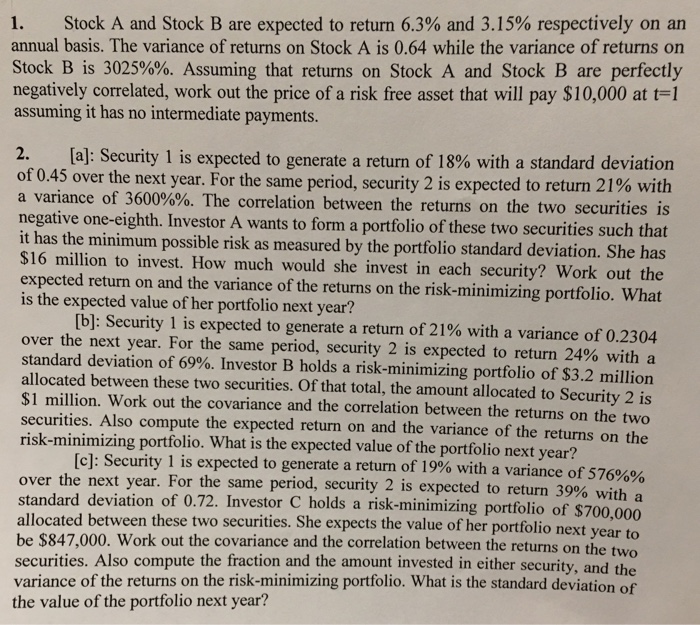

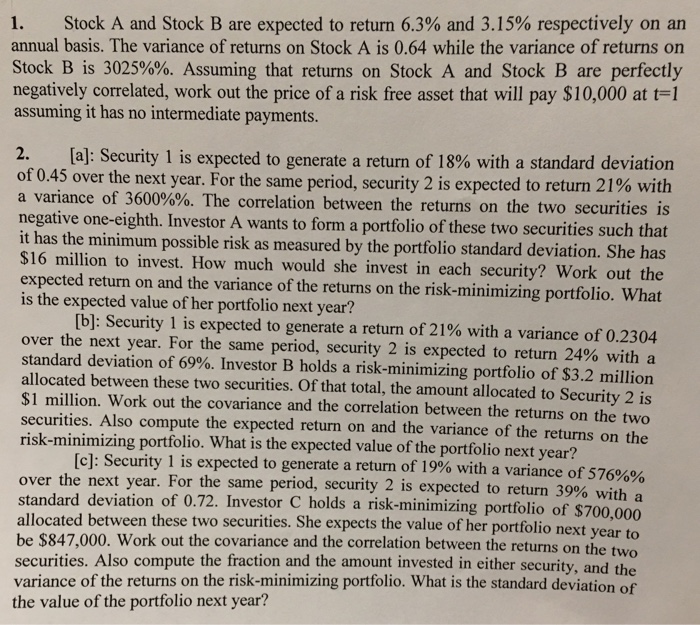

Could you please show work? Thank you! 1. Stock A and Stock B are expected to return 6.3% and 3.15% respectively on an annual basis.

Could you please show work? Thank you!

1. Stock A and Stock B are expected to return 6.3% and 3.15% respectively on an annual basis. The variance of returns on Stock A is 0.64 while the variance of returns on Stock B is 3025%%. Assuming that returns on Stock A and Stock B are perfectly negatively correlated, work out the price of a risk free asset that will pay $10,000 at t-l assuming it has no intermediate payments 2, [a]. Security l is expected to generate a return of 18% with a standard deviation of 0.45 over the next year. For the same period, security 2 is expected to return 21% with a variance of 3600%%. T negativ it has the minimum possible risk as measured by the portfolio standard dev $16 million to invest. How much would she invest in each security? Work out the expected return on and the variance of the returns on the risk-minimizing portfolio is the expected value of her portfolio next year? he correlation between the returns on the two securities is e one-eighth. Investor A wants to form a portfolio of these two securities such that iation. She has . What [b]. Security l is expected to generate a return of 21% with a variance of 0.2304 over the next year. For the same period, security 2 is expected to return 24% with a standard deviation of 69%. Investor B holds a risk-minimizing portfolio of $3.2 million allocated between these two securities. Of that total, the amount allocated to Security 2 is $1 million. Work out the covariance and the correlation between the returns on the two securities. Also compute the expected return on and the variance of the returns on the risk-minimizing portfolio. What is the expected value of the portfolio next year? [c]: Securit y l is expected to generate a return of 19% with a variance of 576% 00 9% with a Investor C holds a risk-minimizing portfolio of $700,000 over the next year. For the same period, security 2 is expected to return 3 standard deviation of 0.72. allocated between these two securities. She expects the value of her portfolio next y be $847,000. Work out the covariance and the correlat securities. Also compute the fraction and the amount invested in either security, and variance of the returns on the risk-minimizing portfolio. What is the standard deviation of the value of the portfolio next year? ion between the returns on the two

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started