Answered step by step

Verified Expert Solution

Question

1 Approved Answer

could you please solve it and explain step by step how to do it ? thank you :) Question 3: The buyer and the seller

could you please solve it and explain step by step how to do it ? thank you :)

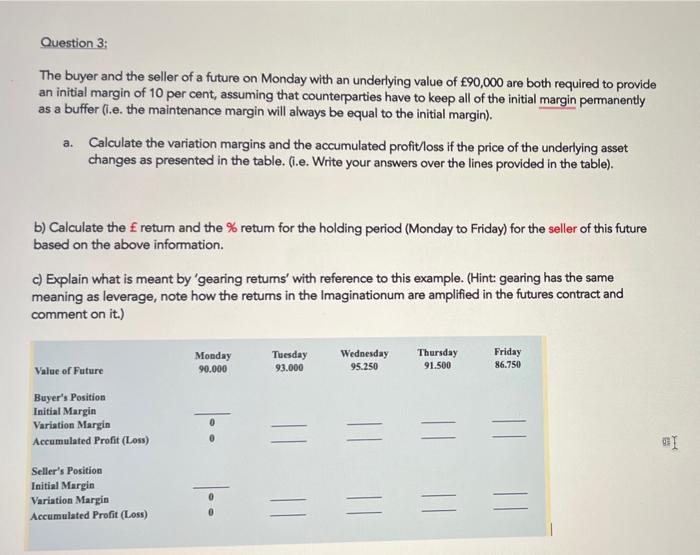

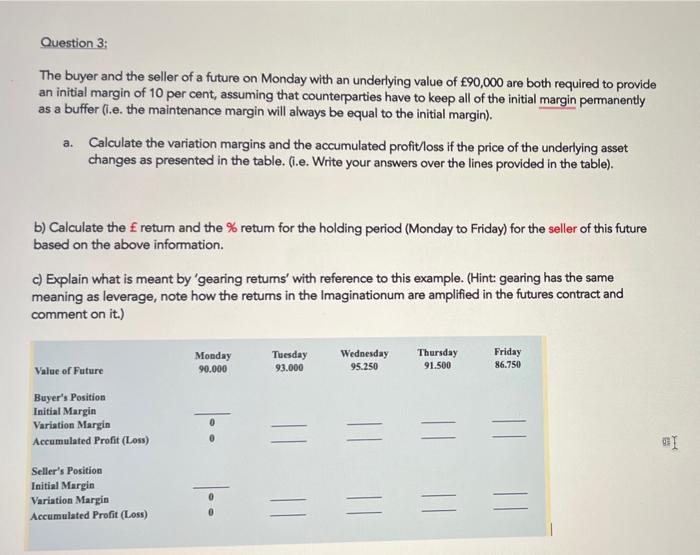

Question 3: The buyer and the seller of a future on Monday with an underlying value of 90,000 are both required to provide an initial margin of 10 per cent, assuming that counterparties have to keep all of the initial margin permanently as a buffer (i.e. the maintenance margin will always be equal to the initial margin). a. Calculate the variation margins and the accumulated profit/loss if the price of the underlying asset changes as presented in the table. (i.e. Write your answers over the lines provided in the table). b) Calculate the fretum and the % retum for the holding period (Monday to Friday) for the seller of this future based on the above information. c) Explain what is meant by 'gearing retums' with reference to this example. (Hint: gearing has the same meaning as leverage, note how the returns in the Imaginationum are amplified in the futures contract and comment on it.) Thursday Monday 90.000 Tuesday 93.000 Wednesday 95.250 Friday 86.750 91.500 Value of Future Buyer's Position Initial Margin Variation Margin Accumulated Profit (Loss) : = Seller's Position Initial Margin Variation Margin Accumulated Profit (Loss) : = 11 11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started