Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could you please solve problem 2. I want to compare my answer. Emphasis Heading 1 I NormalStrong Subtitle Trtle 1No Spac... SubtleE Styles 1. A

Could you please solve problem 2. I want to compare my answer.

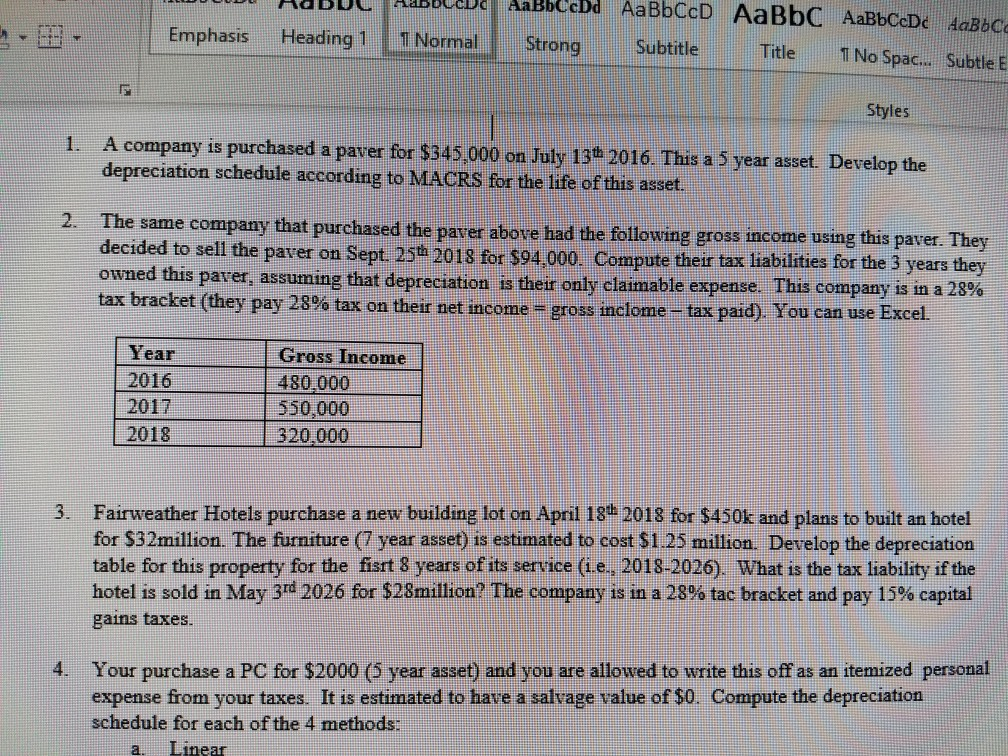

Emphasis Heading 1 I NormalStrong Subtitle Trtle 1No Spac... SubtleE Styles 1. A company is purchased a paver for $345.000 on July 13t 2016. This a 5 year asset. Develop the depreciation schedule according to MACRS for the life of this asset The same company that purchased the paver abo decided to sell the paver on Sept. 25th 2018 for $94,000. Compute their tax liabilities fo owned this pare, assuming that depreciation is their only claimable expense. This company is in a 28% tax bracket (they pay 28% tax on ve had the following gross income using this paver. They sell the paver on Sept 25h 2018 for $94,000. Compute their tax liabilities for the 3 years they their net income- gross inclome- tax paid) You can use Excel. income gross Year 2016 2017 2018 Gross Income 480 000 550,000 320,000 3. Fairweather Hotels purchase a new building lot on April 13t 2018 for $450k and plans to built an hotel for $32million. The furniture (7 year asset) is estimated to cost S1.25 million. Develop the depreciation table for this property for the fisrt 8 years of its service (ie, 2018-2026). What is the tax liability if the hotel is sold in May 3rd 2026 for $28million? The company is in a 20% tac bracket and pay 15% capital gains taxes. Your purchase a PC for $2000 (5 year asset) and you are allowed to write this off as an itemized personal expense from your taxes. It is estimated to have a salvage value of S0. Compute the depreciatiorn schedule for each of the 4 methods 4. a. inearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started