Answered step by step

Verified Expert Solution

Question

1 Approved Answer

could you please tell me how we got these, just from Req. E - G. Will rate! me balance sheet of Hamilton Corp. reported the

could you please tell me how we got these, just from Req. E - G. Will rate!

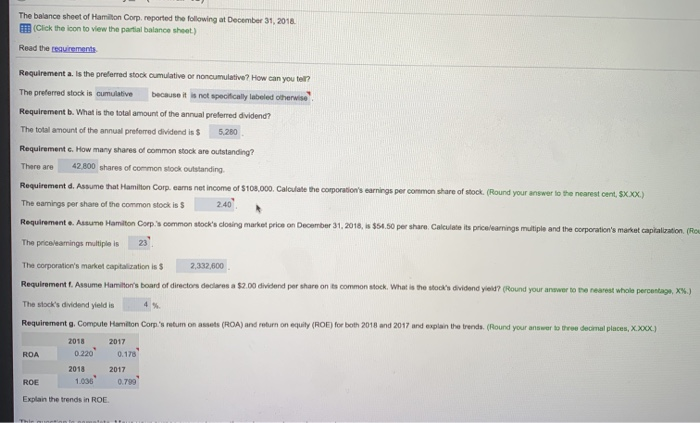

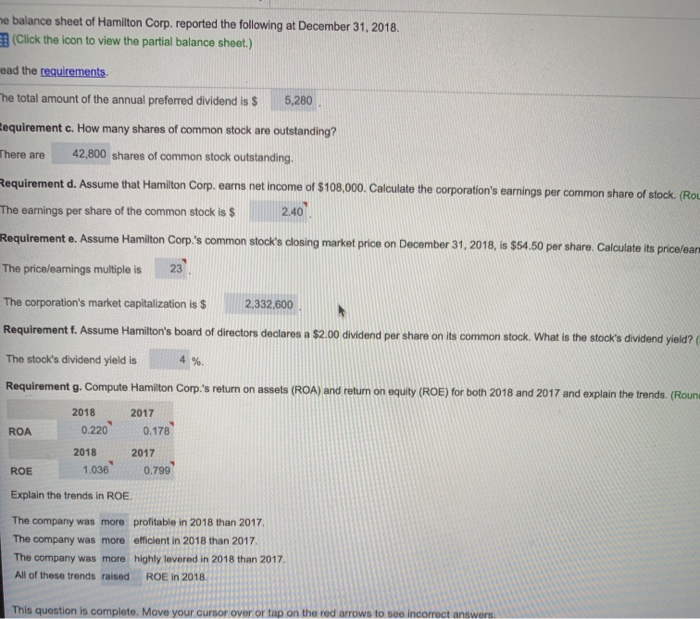

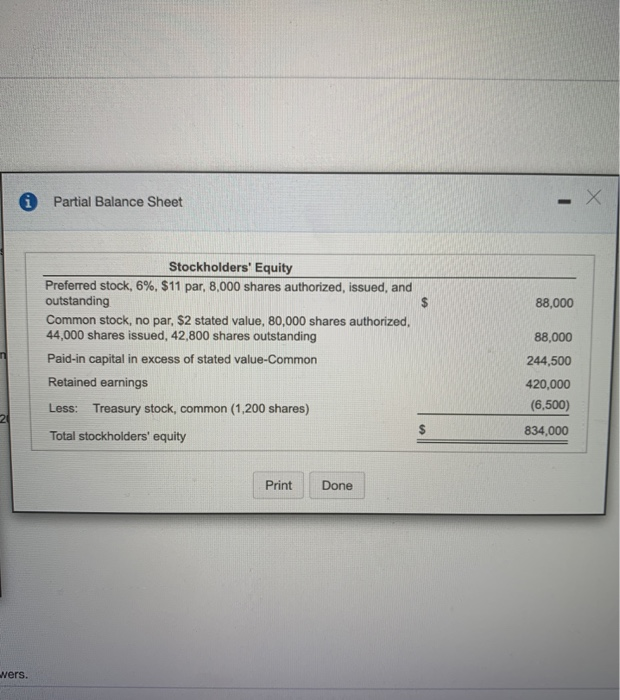

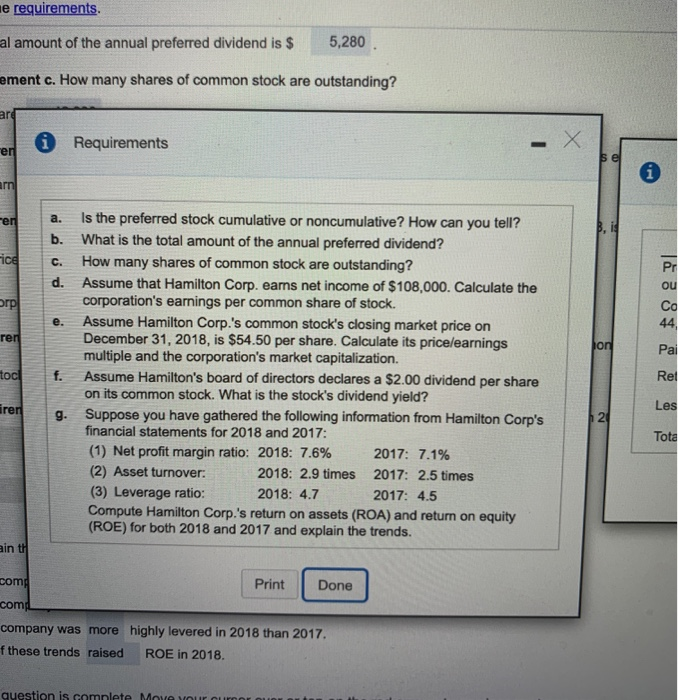

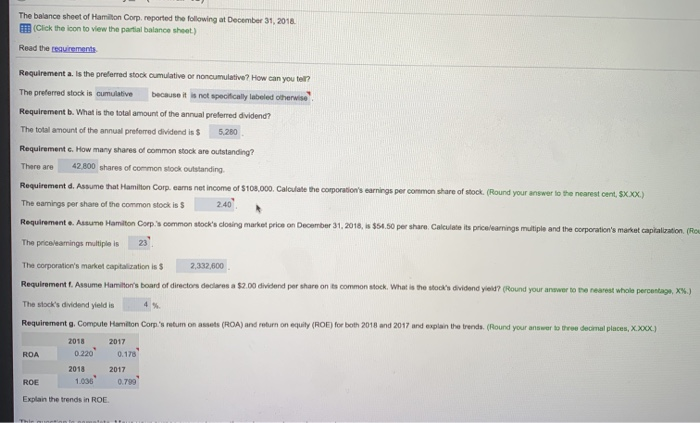

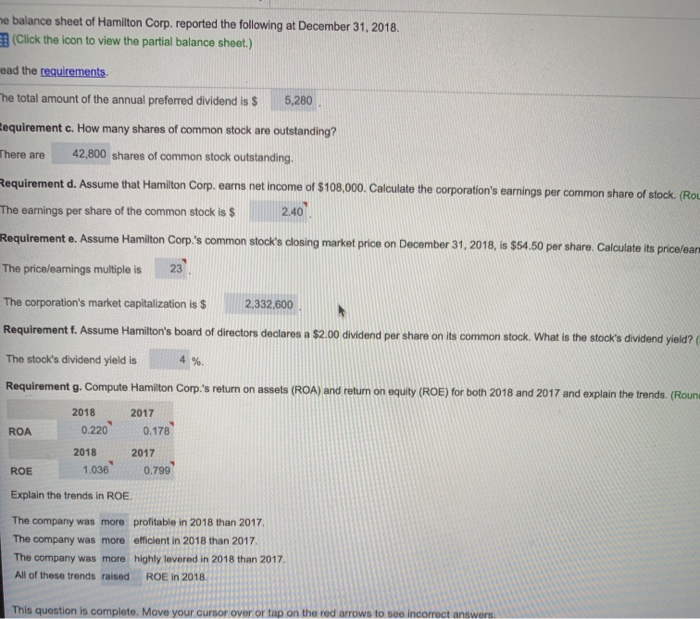

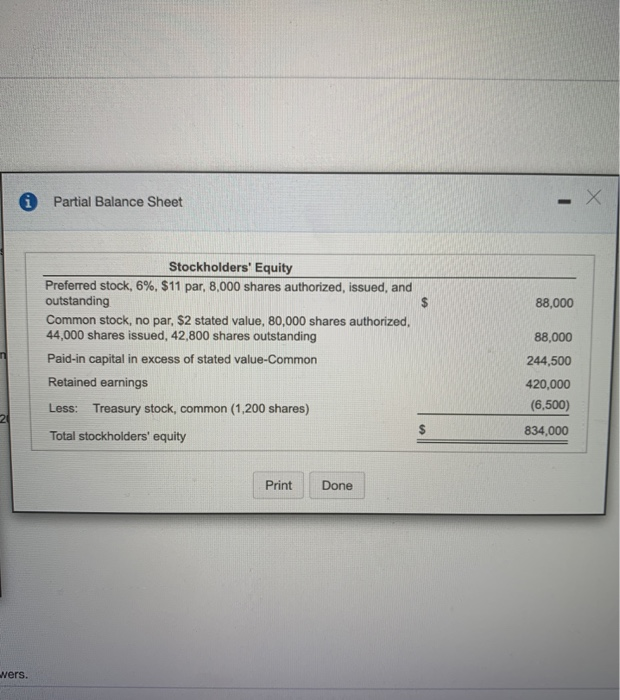

me balance sheet of Hamilton Corp. reported the following at December 31, 2018. (Click the icon to view the partial balance sheet.) ead the requirements The total amount of the annual preferred dividend is $ 5,280 Requirement c. How many shares of common stock are outstanding? There are 42,800 shares of common stock outstanding. Requirement d. Assume that Hamilton Corp. earns net income of $108,000. Calculate the corporation's earnings per common share of stock. (Rou The earnings per share of the common stock is $ Requirement e. Assume Hamilton Corp.'s common stock's closing market price on December 31, 2018, is $54.50 per share. Calculate its pricelearn The price/earnings multiple is 23 2.40 4 % The corporation's market capitalization is $ 2,332,600 Requirement f. Assume Hamilton's board of directors declares a $2.00 dividend per share on its common stock. What is the stock's dividend yield? The stock's dividend yield is Requirement g. Compute Hamilton Corp.'s return on assets (ROA) and return on equity (ROE) for both 2018 and 2017 and explain the trends. (Roun 2018 2017 ROA 0.220 0.178 2018 2017 ROE 0.799 Explain the trends in ROE The company was more profitable in 2018 than 2017 The company was more efficient in 2018 than 2017 The company was more highly lovered in 2018 than 2017 All of these trends raised 1.036 ROE in 2018 This question is complete. Move your cursor over or tap on the red arrows to see incorrect answers Partial Balance Sheet - X 88,000 Stockholders' Equity Preferred stock, 6%, $11 par, 8,000 shares authorized, issued, and outstanding Common stock, no par, $2 stated value, 80,000 shares authorized, 44,000 shares issued, 42,800 shares outstanding Paid-in capital in excess of stated value-Common Retained earnings Less: Treasury stock, common (1,200 shares) 88,000 244,500 420,000 (6,500) 834,000 $ Total stockholders' equity Print Done wers e requirements. al amount of the annual preferred dividend is $ 5,280 mement c. How many shares of common stock are outstanding? are Requirements en an ten a. b. ice C. d. Pr ou orp e. 44 rer lon Pai toch f. Is the preferred stock cumulative or noncumulative? How can you tell? What is the total amount of the annual preferred dividend? How many shares of common stock are outstanding? Assume that Hamilton Corp. ears net income of $108,000. Calculate the corporation's earnings per common share of stock. Assume Hamilton Corp.'s common stock's closing market price on December 31, 2018, is $54.50 per share. Calculate its pricelearnings multiple and the corporation's market capitalization. Assume Hamilton's board of directors declares a $2.00 dividend per share on its common stock. What is the stock's dividend yield? Suppose you have gathered the following information from Hamilton Corp's financial statements for 2018 and 2017: (1) Net profit margin ratio: 2018: 7.6% 2017: 7.1% (2) Asset turnover: 2018: 2.9 times 2017: 2.5 times (3) Leverage ratio: 2018: 4.7 2017: 4.5 Compute Hamilton Corp.'s return on assets (ROA) and return on equity (ROE) for both 2018 and 2017 and explain the trends. Rel aren Les g. 2 Tota aint com Print Done com company was more highly levered in 2018 than 2017 f these trends raised ROE in 2018 question is comnlete Move your curar un

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started