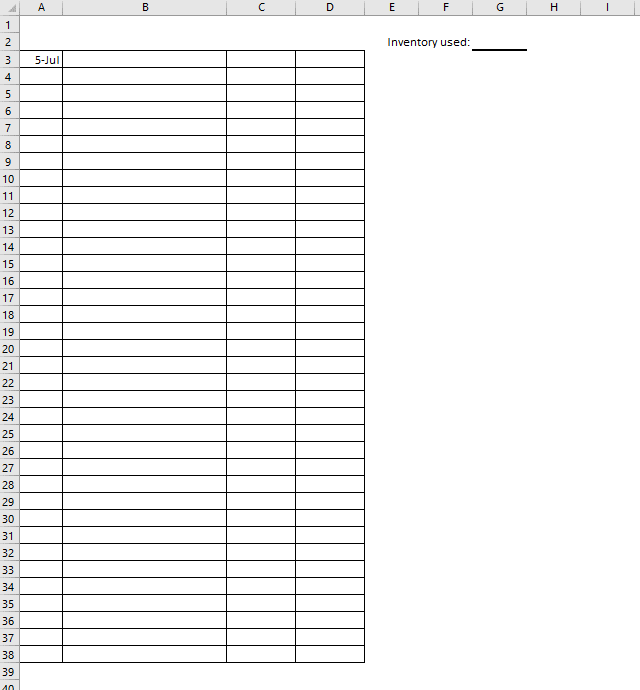

Could you please work this entire problem out from start to finish? I am completely lost and do not know where to start. The first image shows the problem itself and the following images show the sheet used for answering the problem. (Two copies of the second picture would be needed to fully answer the question, one for FIFO and one for LIFO)

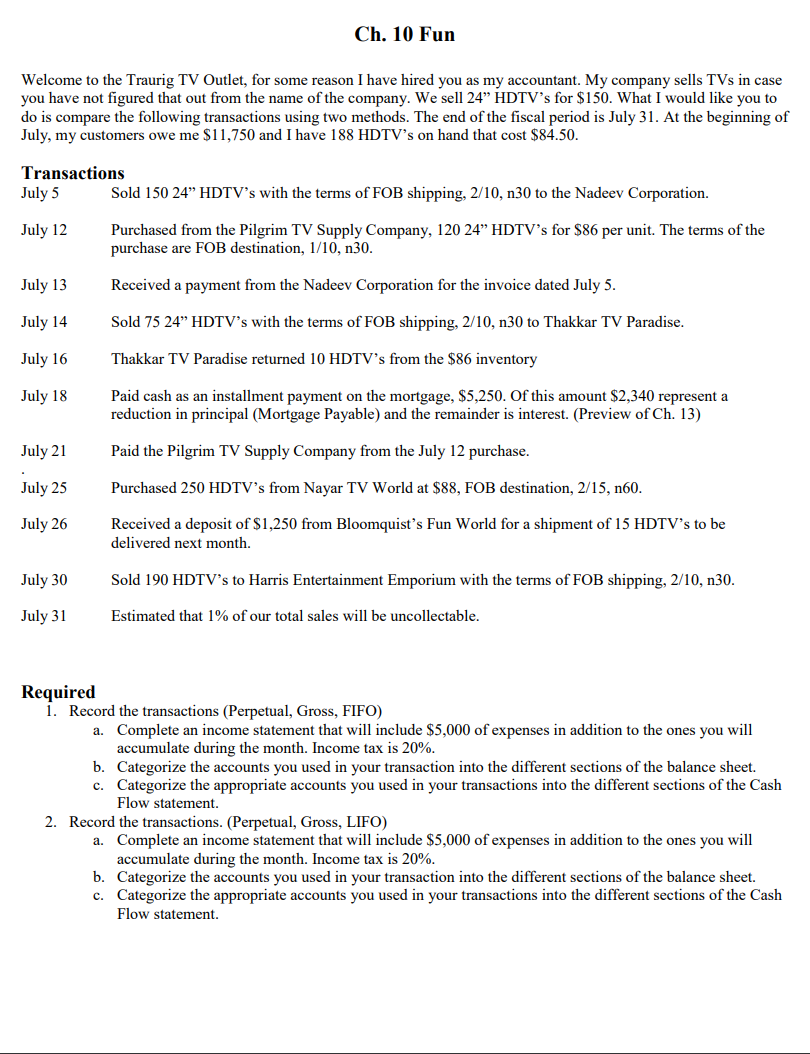

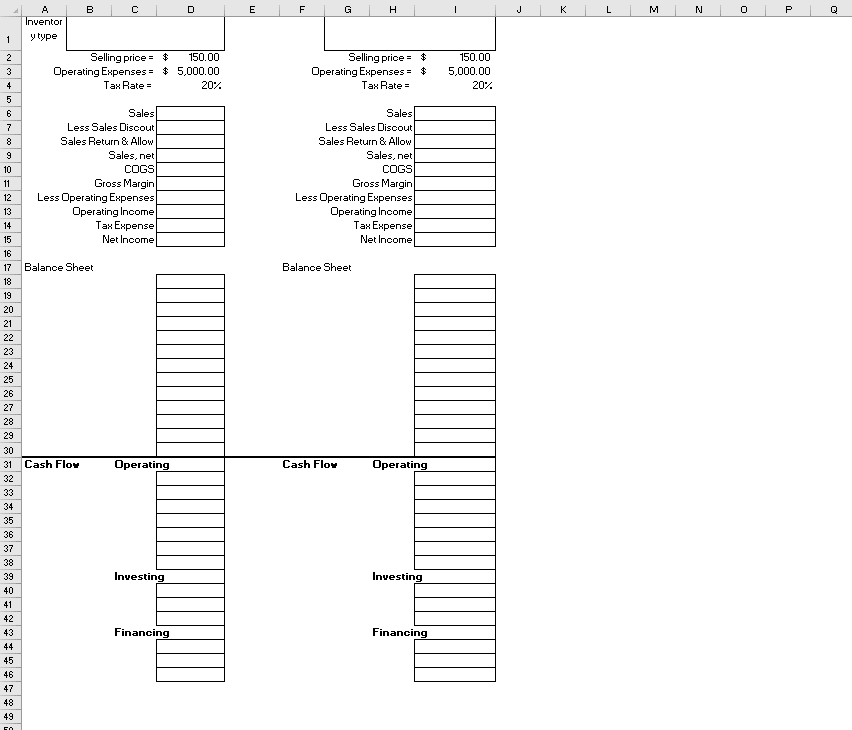

Ch. 10 Fun Welcome to the Traurig TV Outlet, for some reason I have hired you as my accountant. My company sells TVs in case you have not figured that out from the name of the company. We sell 24" HDTV's for $150. What I would like you to do is compare the following transactions using two methods. The end of the fiscal period is July 31. At the beginning of July, my customers owe me $11,750 and I have 188 HDTV's on hand that cost $84.50. Transactions July 5 Sold 150 24" HDTV's with the terms of FOB shipping, 2/10, n30 to the Nadeev Corporation. July 12 Purchased from the Pilgrim TV Supply Company, 120 24" HDTV's for $86 per unit. The terms of the purchase are FOB destination, 1/10, n30. July 13 Received a payment from the Nadeev Corporation for the invoice dated July 5. July 14 Sold 75 24" HDTV's with the terms of FOB shipping, 2/10, n30 to Thakkar TV Paradise. July 16 Thakkar TV Paradise returned 10 HDTV's from the $86 inventory July 18 Paid cash as an installment payment on the mortgage, $5,250. Of this amount $2,340 represent a reduction in principal (Mortgage Payable) and the remainder is interest. (Preview of Ch. 13) July 21 Paid the Pilgrim TV Supply Company from the July 12 purchase. July 25 Purchased 250 HDTV's from Nayar TV World at $88, FOB destination, 2/15, n60. July 26 Received a deposit of $1,250 from Bloomquist's Fun World for a shipment of 15 HDTV's to be delivered next month. July 30 Sold 190 HDTV's to Harris Entertainment Emporium with the terms of FOB shipping, 2/10, n30. July 31 Estimated that 1% of our total sales will be uncollectable. Required 1. Record the transactions (Perpetual, Gross, FIFO) a. Complete an income statement that will include $5,000 of expenses in addition to the ones you will accumulate during the month. Income tax is 20%. b. Categorize the accounts you used in your transaction into the different sections of the balance sheet. c. Categorize the appropriate accounts you used in your transactions into the different sections of the Cash Flow statement. 2. Record the transactions. (Perpetual, Gross, LIFO) a. Complete an income statement that will include $5,000 of expenses in addition to the ones you will accumulate during the month. Income tax is 20%. b. Categorize the accounts you used in your transaction into the different sections of the balance sheet. c. Categorize the appropriate accounts you used in your transactions into the different sections of the Cash Flow statement.\fF Q A B C E F G H J K L M N 0 Inventor y type Selling price = $ 150.00 Selling price = $ 150.00 Operating Expenses = $ 5,000.00 Operating Expenses = 5,000.00 Tax Rate = 20% Tax Rate = 20% Sales Sales Less Sales Discout Less Sales Discout Sales Return & Allow Sales Return & Allow Sales, net Sales, net COGS COGS Gross Margin Gross Margin Less Operating Expenses Less Operating Expenses Operating Income Operating Income Tax Expense Tak Expense 15 Net Income Net Income Balance Sheet Balance Sheet 20 21 22 23 24 31 Cash Flow Operating Cash Flow Operating 32 3:3 34 35 36 37 38 39 Investing Investing 40 41 42 43 Financing Financing 48 49