Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could you thoroughly explain 6 in Excel with =FORMATTEXT Virginia will receive $2 million today and $3 million one year from today. Virginia does not

Could you thoroughly explain 6 in Excel with =FORMATTEXT

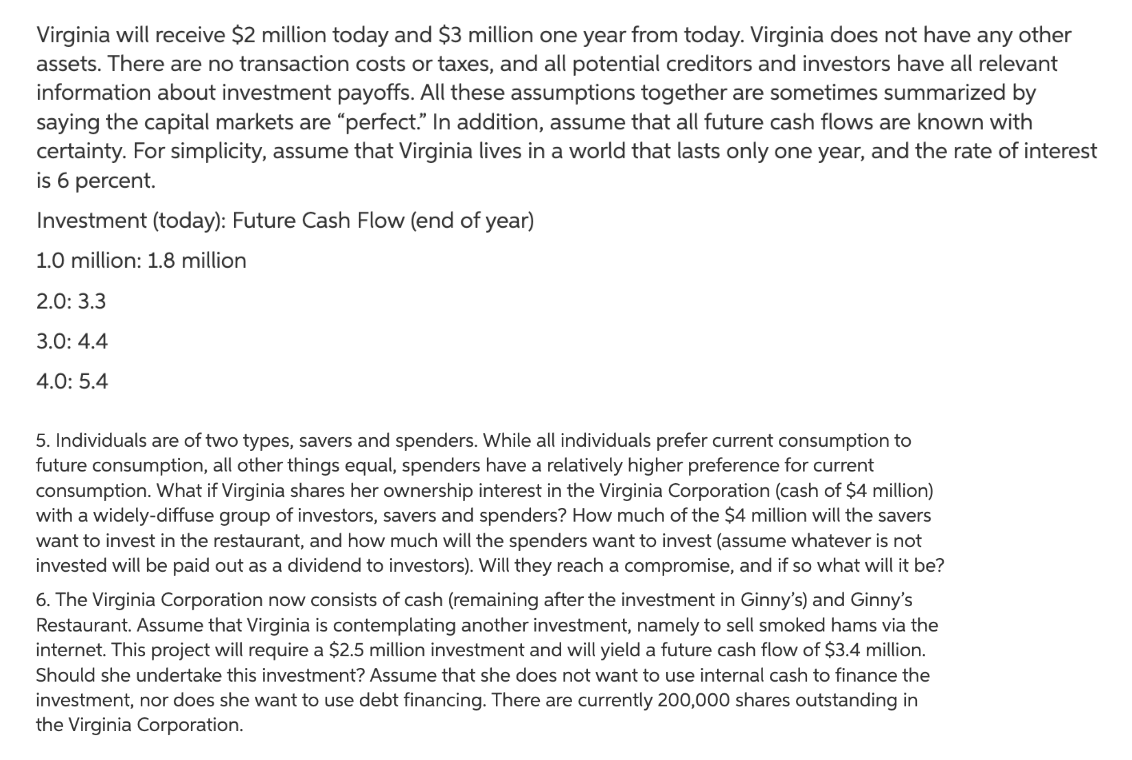

Virginia will receive $2 million today and $3 million one year from today. Virginia does not have any other assets. There are no transaction costs or taxes, and all potential creditors and investors have all relevant information about investment payoffs. All these assumptions together are sometimes summarized by saying the capital markets are "perfect." In addition, assume that all future cash flows are known with certainty. For simplicity, assume that Virginia lives in a world that lasts only one year, and the rate of interest is 6 percent. Investment (today): Future Cash Flow (end of year) 1.0 million: 1.8 million 2.0: 3.3 3.0: 4.4 4.0: 5.4 5. Individuals are of two types, savers and spenders. While all individuals prefer current consumption to future consumption, all other things equal, spenders have a relatively higher preference for current consumption. What if Virginia shares her ownership interest in the Virginia Corporation (cash of \$4 million) with a widely-diffuse group of investors, savers and spenders? How much of the $4 million will the savers want to invest in the restaurant, and how much will the spenders want to invest (assume whatever is not invested will be paid out as a dividend to investors). Will they reach a compromise, and if so what will it be? 6. The Virginia Corporation now consists of cash (remaining after the investment in Ginny's) and Ginny's Restaurant. Assume that Virginia is contemplating another investment, namely to sell smoked hams via the internet. This project will require a $2.5 million investment and will yield a future cash flow of $3.4 million. Should she undertake this investment? Assume that she does not want to use internal cash to finance the investment, nor does she want to use debt financing. There are currently 200,000 shares outstanding in the Virginia CorporationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started