Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. S Corporation is a calendar year taxpayer which elected S corporation status in its first year of operation. S's common stock is owned

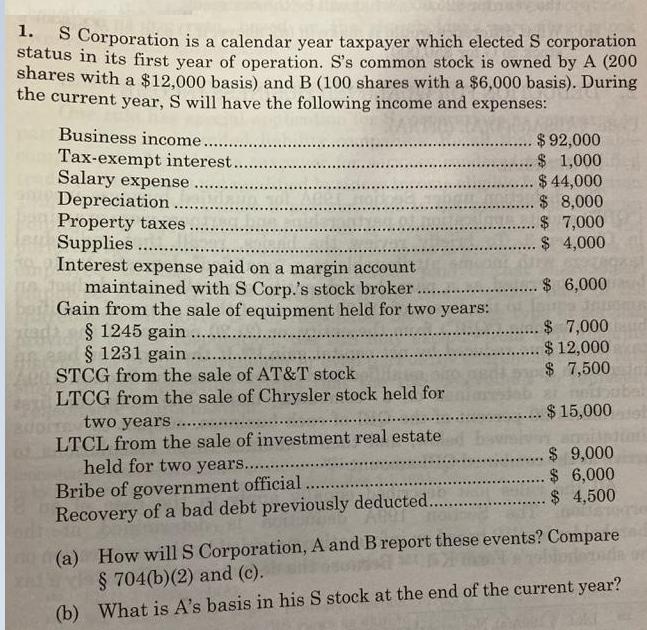

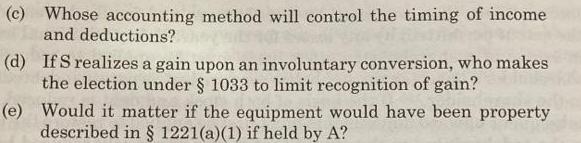

1. S Corporation is a calendar year taxpayer which elected S corporation status in its first year of operation. S's common stock is owned by A (200 shares with a $12,000 basis) and B (100 shares with a $6,000 basis). During the current year, S will have the following income and expenses: Business income........ Tax-exempt interest.............. Salary expense Depreciation $ 92,000 $ 1,000 $ 44,000 $8,000 $ 7,000 Property taxes Supplies..... $ 4,000 Interest expense paid on a margin account $ 6,000 maintained with S Corp.'s stock broker....... Gain from the sale of equipment held for two years: 1245 gain.... $ 7,000 1231 gain $ 12,000 ******* STCG from the sale of AT&T stock $7,500 LTCG from the sale of Chrysler stock held for $15,000 two years ******* LTCL from the sale of investment real estate bumiy solpatork $ 9,000 held for two years..... $ 6,000 Bribe of government official. $ 4,500 Recovery of a bad debt previously deducted... (a) How will S Corporation, A and B report these events? Comparend 704(b)(2) and (c). (b) What is A's basis in his S stock at the end of the current year? (c) Whose accounting method will control the timing of income and deductions? (d) If S realizes a gain upon an involuntary conversion, who makes the election under 1033 to limit recognition of gain? (e) Would it matter if the equipment would have been property described in 1221(a)(1) if held by A?

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a S Corporation will report the business income taxexempt interest salary expense depreciation prope...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started