Answered step by step

Verified Expert Solution

Question

1 Approved Answer

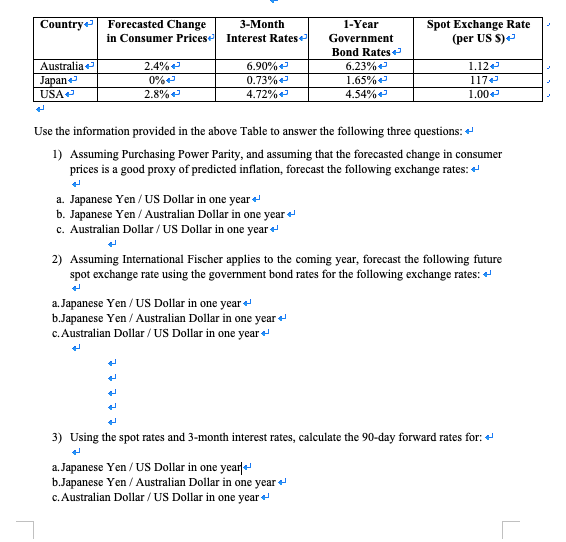

Country Forecasted Change in Consumer Prices 3-Month Interest Rates 1-Year Government Bond Rates Spot Exchange Rate (per US $) Australia 2.4% 6.90% 6.23% 1.12 Japan

| Country | Forecasted Change in Consumer Prices | 3-Month Interest Rates | 1-Year Government Bond Rates | Spot Exchange Rate (per US $) |

| Australia | 2.4% | 6.90% | 6.23% | 1.12 |

| Japan | 0% | 0.73% | 1.65% | 117 |

| USA | 2.8% | 4.72% | 4.54% | 1.00 |

Use the information provided in the above Table to answer the following three questions:

- Assuming Purchasing Power Parity, and assuming that the forecasted change in consumer prices is a good proxy of predicted inflation, forecast the following exchange rates:

- Japanese Yen / US Dollar in one year

- Japanese Yen / Australian Dollar in one year

- Australian Dollar / US Dollar in one year

- Assuming International Fischer applies to the coming year, forecast the following future spot exchange rate using the government bond rates for the following exchange rates:

- Japanese Yen / US Dollar in one year

- Japanese Yen / Australian Dollar in one year

- Australian Dollar / US Dollar in one year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started