Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Country X has countercyclical measure for all self-use residential properties as follows. The maximum loan to value ratio (LTV cap) for all self-use residential

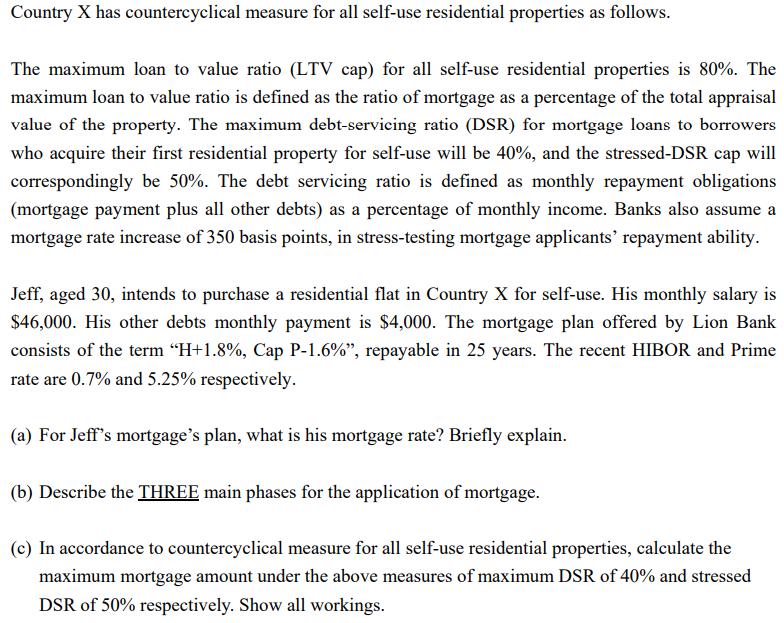

Country X has countercyclical measure for all self-use residential properties as follows. The maximum loan to value ratio (LTV cap) for all self-use residential properties is 80%. The maximum loan to value ratio is defined as the ratio of mortgage as a percentage of the total appraisal value of the property. The maximum debt-servicing ratio (DSR) for mortgage loans to borrowers who acquire their first residential property for self-use will be 40%, and the stressed-DSR cap will correspondingly be 50%. The debt servicing ratio is defined as monthly repayment obligations (mortgage payment plus all other debts) as a percentage of monthly income. Banks also assume a mortgage rate increase of 350 basis points, in stress-testing mortgage applicants' repayment ability. Jeff, aged 30, intends to purchase a residential flat in Country X for self-use. His monthly salary is $46,000. His other debts monthly payment is $4,000. The mortgage plan offered by Lion Bank consists of the term "H+1.8%, Cap P-1.6%", repayable in 25 years. The recent HIBOR and Prime rate are 0.7% and 5.25% respectively. (a) For Jeff's mortgage's plan, what is his mortgage rate? Briefly explain. (b) Describe the THREE main phases for the application of mortgage. (c) In accordance to countercyclical measure for all self-use residential properties, calculate the maximum mortgage amount under the above measures of maximum DSR of 40% and stressed DSR of 50% respectively. Show all workings.

Step by Step Solution

★★★★★

3.36 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a The mortgage rate for Jeffs mortgage plan is 18 with a cap of 16 This means that the interest rate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started