Question

Callista Cordez had an eventful year in 2020. For the first part of the year she was employed as a sales consultant in a womens

Callista Cordez had an eventful year in 2020. For the first part of the year she was employed as a sales consultant in a women’s clothing store. Part way through the year, she inherited a large sum of money from her grandfather. She invested a good portion of the inheritance, but she decided to use some of the remaining funds to leave her employment and pursue a different career path. She is now self-employed as an artist, specializing in painting people’s pets from photographs that they supply. She has rented a small space to use as her art studio. She advertises mainly through local newspapers, social media and word of mouth and business has been steady.

Callista is not particularly interested in the business side of things and definitely not interested in doing her own income taxes. She was referred to you by a mutual friend and she is hoping that you will do her income taxes for 2020. She gives you the following details and you have agreed to get back to her next week with a calculation of her minimum Net Income for Tax Purposes for 2020.

Prepare this calculation using the aggregating formula from the Income Tax Act. List any of her information that you do not include in your calculation, no explanation necessary.

Employment

She worked for High Rise Womens’ Fashions from January 1, 2020 through April 30, 2020. In that time period she earned a salary of $12,800. She had payroll deductions for Canada Pension Plan premium and Employment Insurance premium ($690) as well as for Union dues ($384).

Business

She set up her business effective June 1, 2020. She signed a lease that started June 1, 2020 and runs for 3 years, with a 3-year renewal option. She purchased accounting software and she has been tracking her income and expenses. She has provided you with an Income Statement for the period June 1, 2020 through December 31, 2020. Refer to Appendix A for this. All amounts include HST. Callista has not registered her business for HST for 2020.

Investments

Callista engaged a financial planner to assist her in making investment decisions related to the inheritance money that she received. She paid $11,700 in investment management fees for these services.

During 2020, she realized the following investment income.

Eligible dividends from taxable Canadian public corporations $12,000

Non-eligible dividends from Canadian private corporations 1,000

Dividends from foreign corporations (net of 10% foreign income tax withholding at source) 3,600

She invested $50,000 of her inheritance in a one-year guaranteed investment certificate to have some cash available “just in case”. The GIC was purchased July 1, 2020 and matures June 30, 2021. The interest rate is 1.25%. All of the interest is payable on maturity.

Finally, she purchased a condominium unit on July 1, 2020 at a cost of $465,000. This cost is all for the unit, no land cost is included. She has been renting the unit at $2,100 monthly since August 1, 2020. She has received total rental payments of $10,500. Her cash costs related to this rental total $5,600 (utilities, property taxes, insurance, advertising for tenants and general repairs).

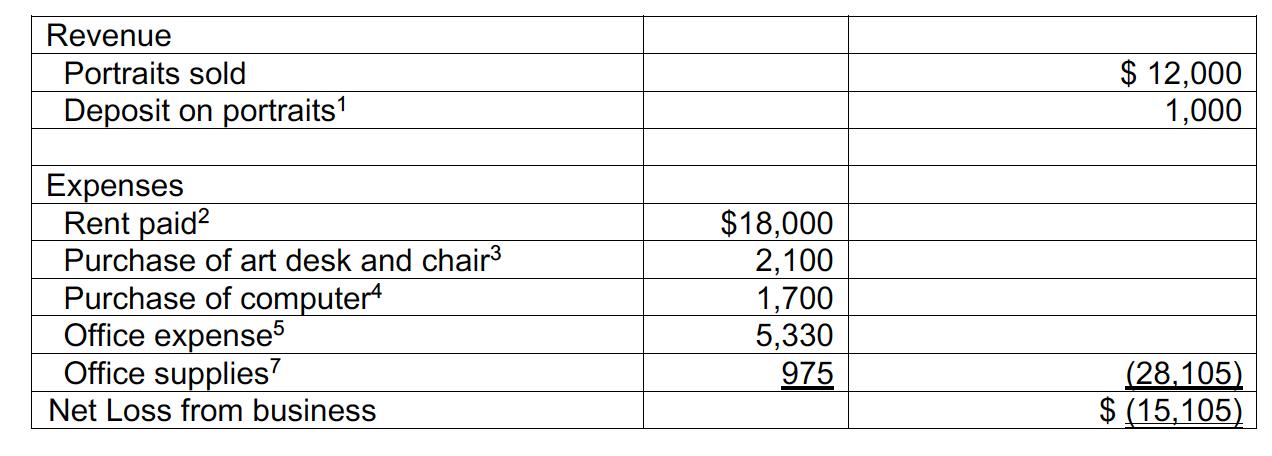

APPENDIX A

Callista Cordez Financial Statements for May 1, 2020 through December 31, 2020

Notes:

1. She requires a deposit of $200 on all projects. She has 5 projects that she has not started, but for which she has deposits as of December 31, 2020. If for some reason the project is cancelled, she refunds the deposit.

2. $2,000 rent was paid monthly (May through December) plus a last month’s deposit for April 2023 of $2,000

3. She purchased a large drafting table and accompanying chair; she does all of her painting at this table.

4. She uses this exclusively for the business. The purchase price includes the computer as well as WINDOWS operating system software.

5. The office expense includes:

• renovations to the space6 $4,200

• monthly subscription to Quick books accounting software 140

• annual subscription to Microsoft Office software 115

• interest on a business operating loan 375

• fees to set up the business operating loan 500 $5,330

6. She renovated the rented space to create separate reception and working areas and a small kitchen.

7. Office supplies includes her paints, paint brushes and canvasses for the paintings, as well as some paper, pens and sketching pencils.

Revenue Portraits sold Deposit on portraits Expenses Rent paid Purchase of art desk and chair Purchase of computer Office expense5 Office supplies Net Loss from business $18,000 2,100 1,700 5,330 975 $ 12,000 1,000 (28,105) $(15,105)

Step by Step Solution

3.55 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Calculating Callistas Minimum Net Income for Tax Purposes for 2020 Callistas minimum net income for tax purposes for 2020 is calculated using the aggregating formula from the Income Tax Act This calcu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started