Answered step by step

Verified Expert Solution

Question

1 Approved Answer

COURSE: DIPLOMA IN ACCOUNTING SUBJECT: TAXATION I NEED ANSWER FOR ALL. Tutorial 1: Introduction to Malaysian Tax 1. Why a country should impose tax? 2.

COURSE: DIPLOMA IN ACCOUNTING

SUBJECT: TAXATION

I NEED ANSWER FOR ALL.

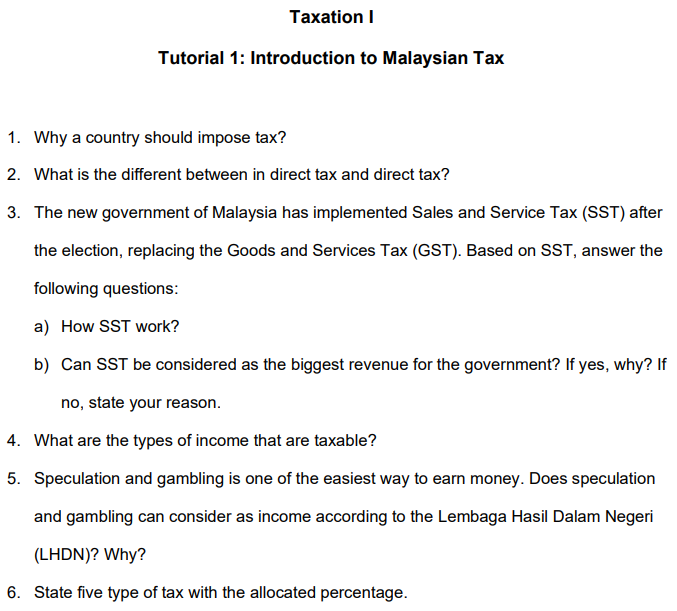

Tutorial 1: Introduction to Malaysian Tax 1. Why a country should impose tax? 2. What is the different between in direct tax and direct tax? 3. The new government of Malaysia has implemented Sales and Service Tax (SST) after the election, replacing the Goods and Services Tax (GST). Based on SST, answer the following questions: a) How SST work? b) Can SST be considered as the biggest revenue for the government? If yes, why? If no, state your reason. 4. What are the types of income that are taxable? 5. Speculation and gambling is one of the easiest way to earn money. Does speculation and gambling can consider as income according to the Lembaga Hasil Dalam Negeri (LHDN)? Why? 6. State five type of tax with the allocated percentage

Tutorial 1: Introduction to Malaysian Tax 1. Why a country should impose tax? 2. What is the different between in direct tax and direct tax? 3. The new government of Malaysia has implemented Sales and Service Tax (SST) after the election, replacing the Goods and Services Tax (GST). Based on SST, answer the following questions: a) How SST work? b) Can SST be considered as the biggest revenue for the government? If yes, why? If no, state your reason. 4. What are the types of income that are taxable? 5. Speculation and gambling is one of the easiest way to earn money. Does speculation and gambling can consider as income according to the Lembaga Hasil Dalam Negeri (LHDN)? Why? 6. State five type of tax with the allocated percentage Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started