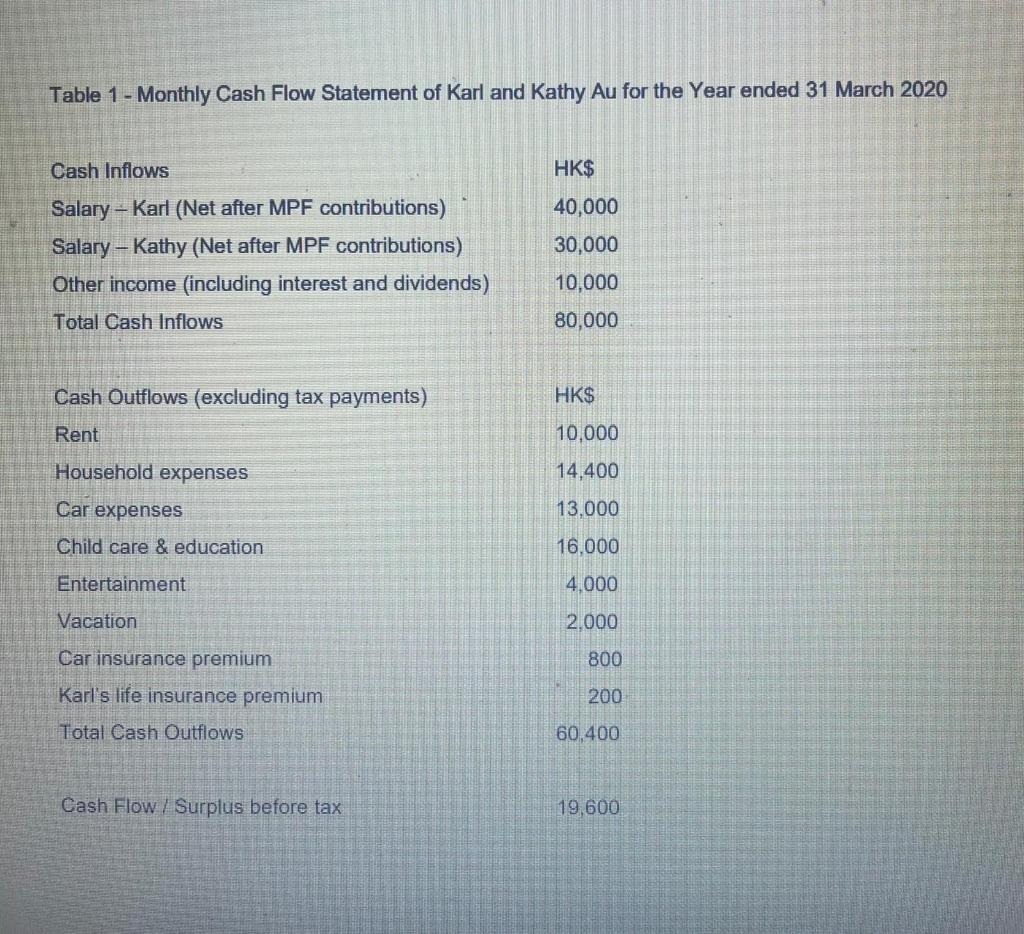

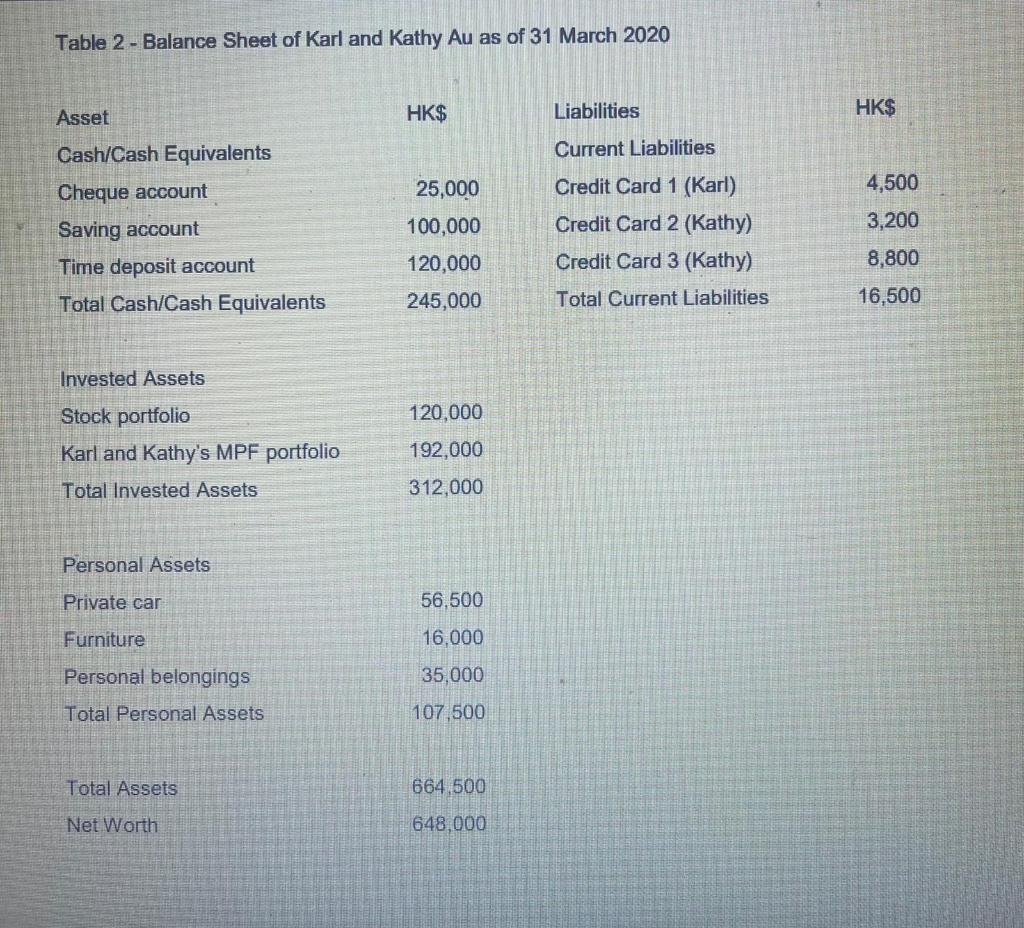

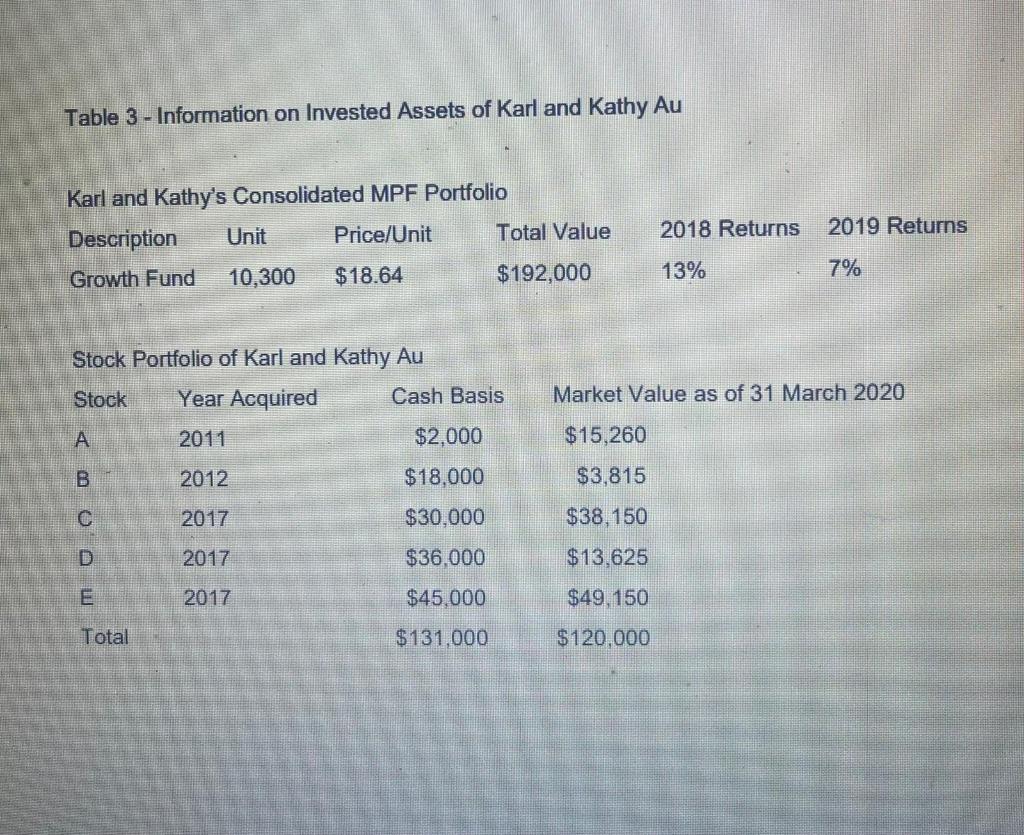

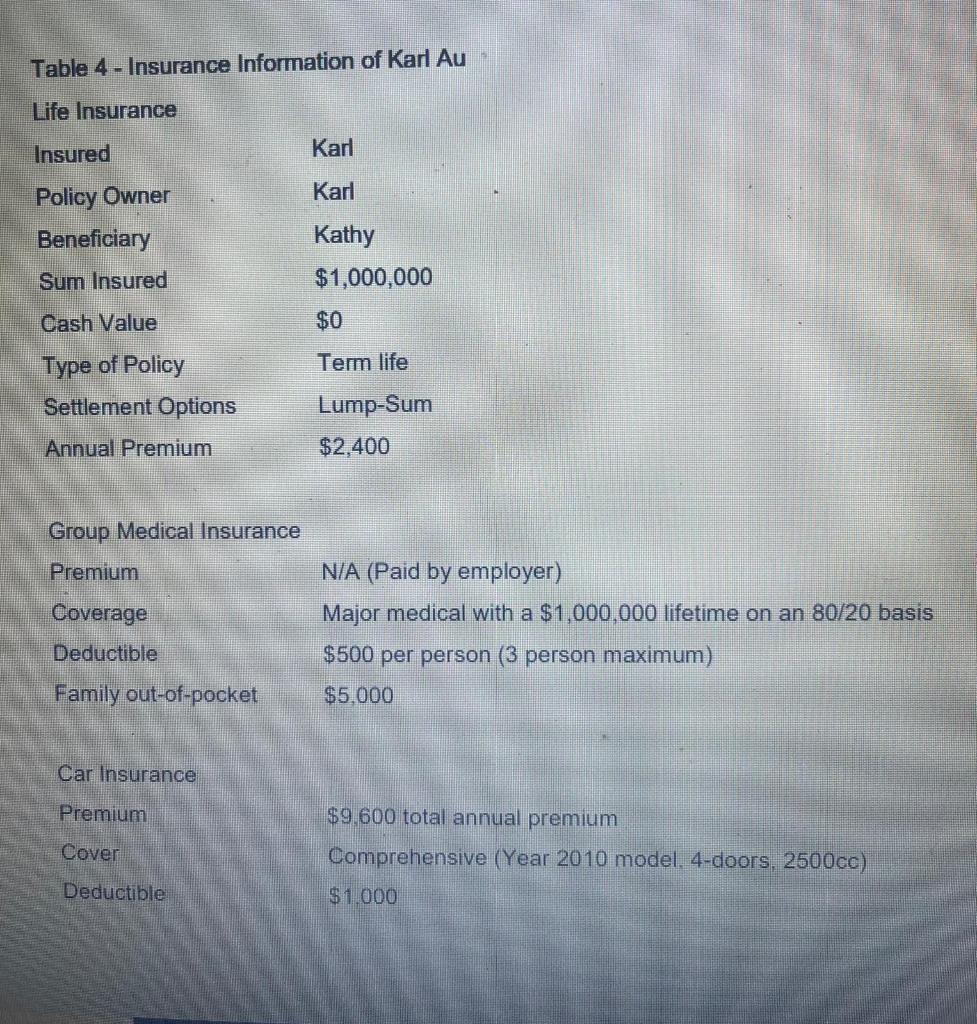

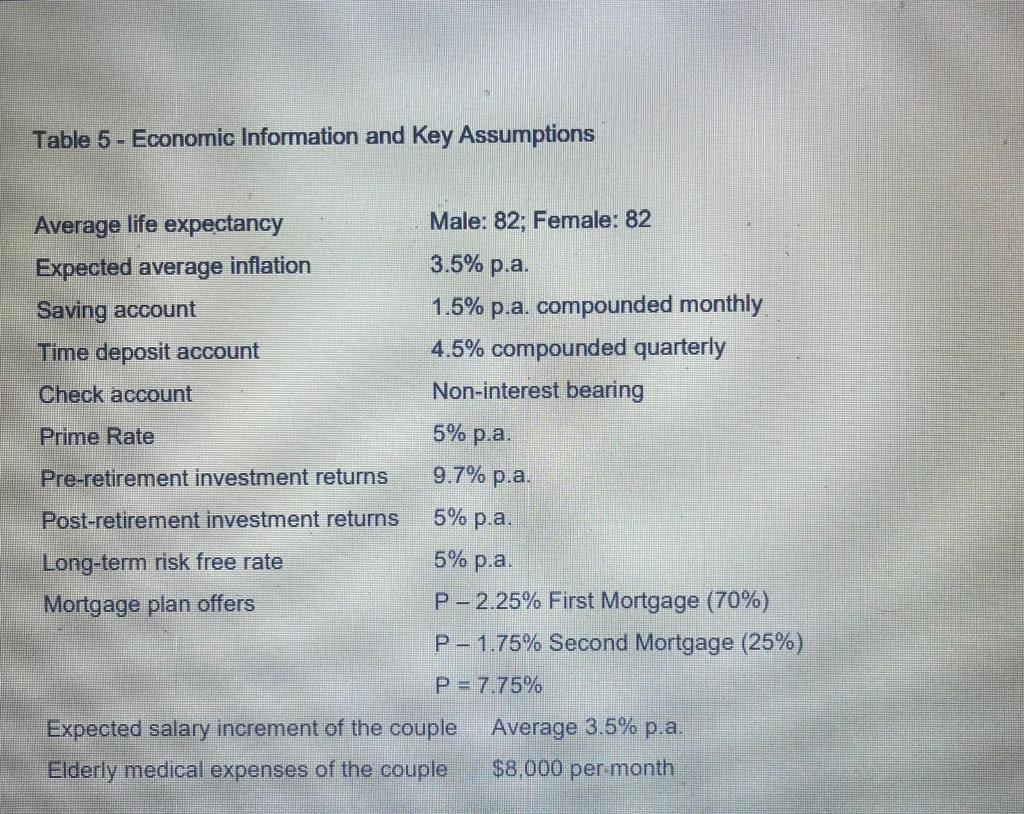

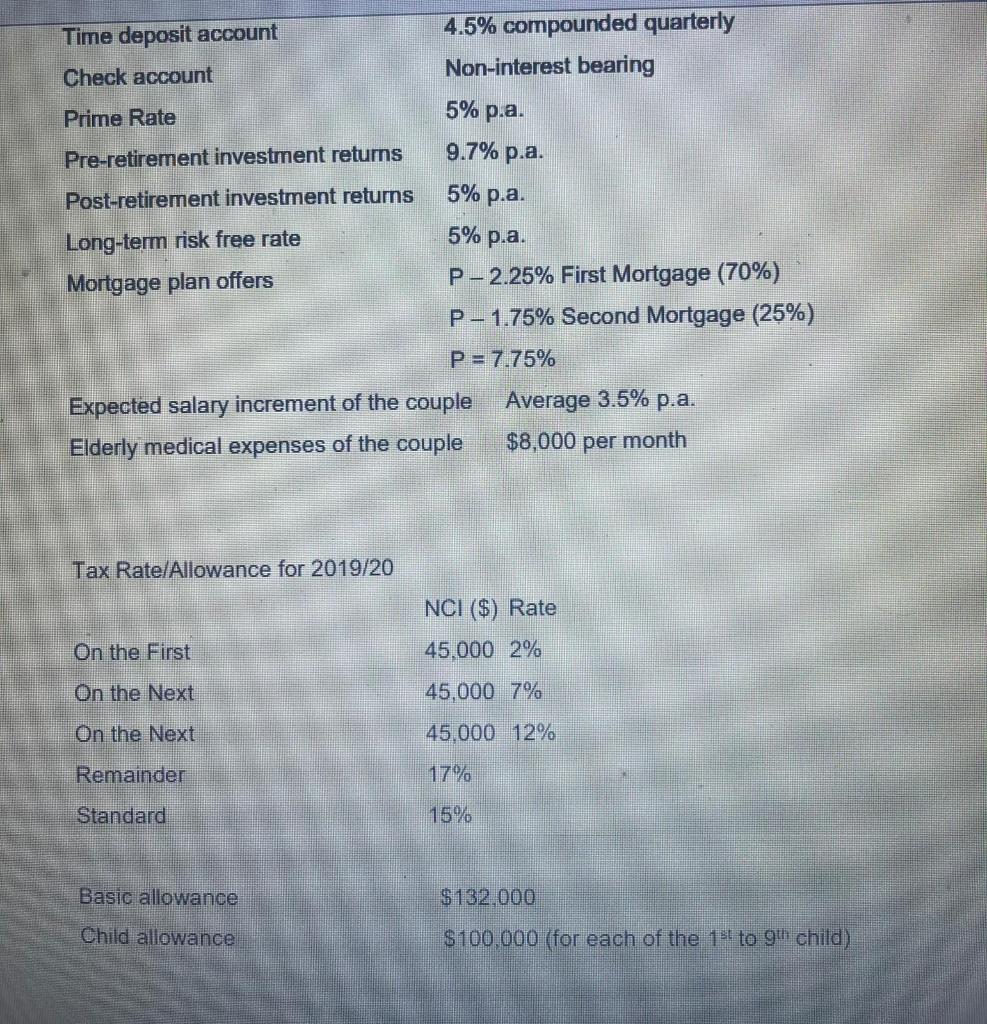

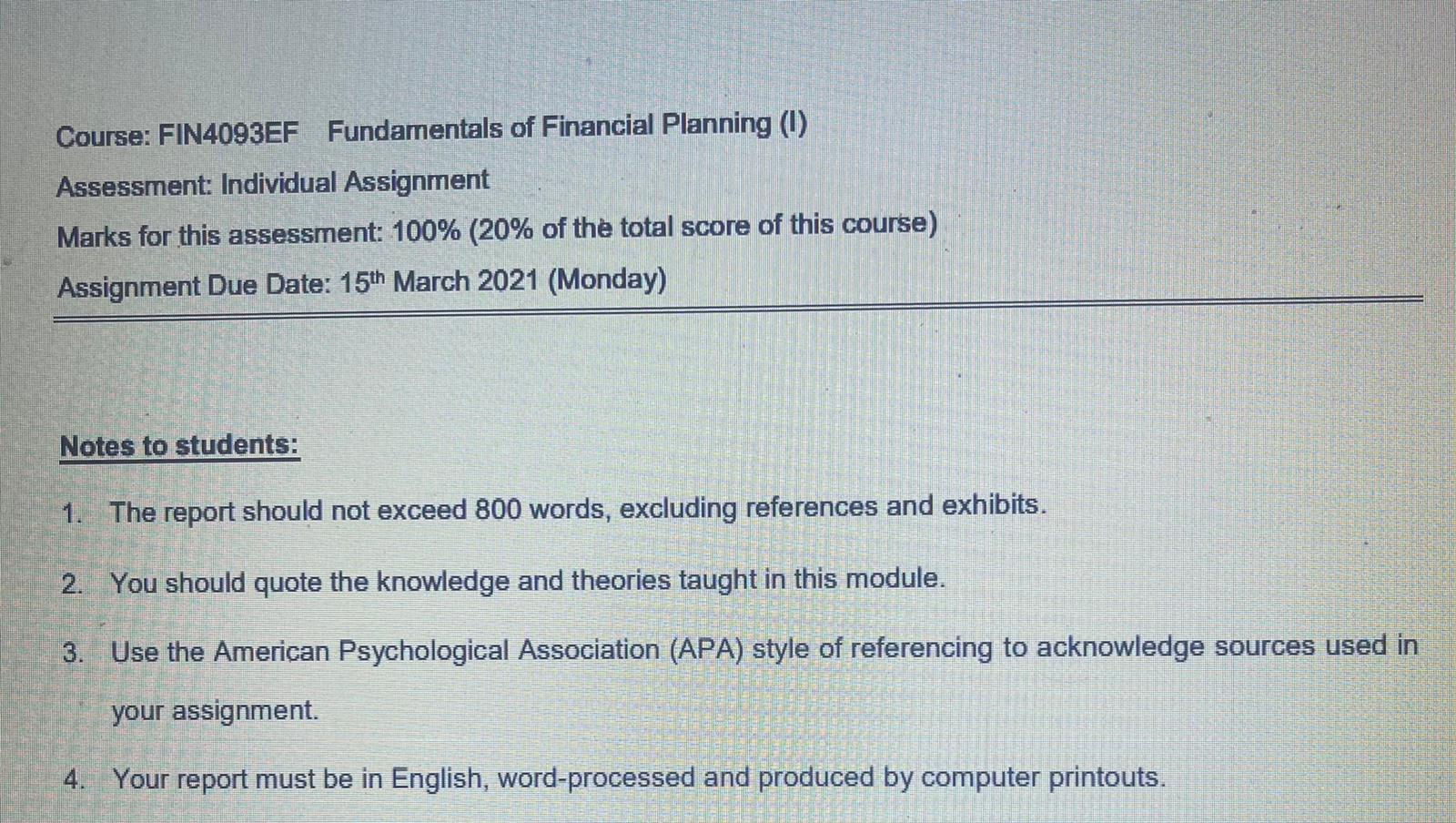

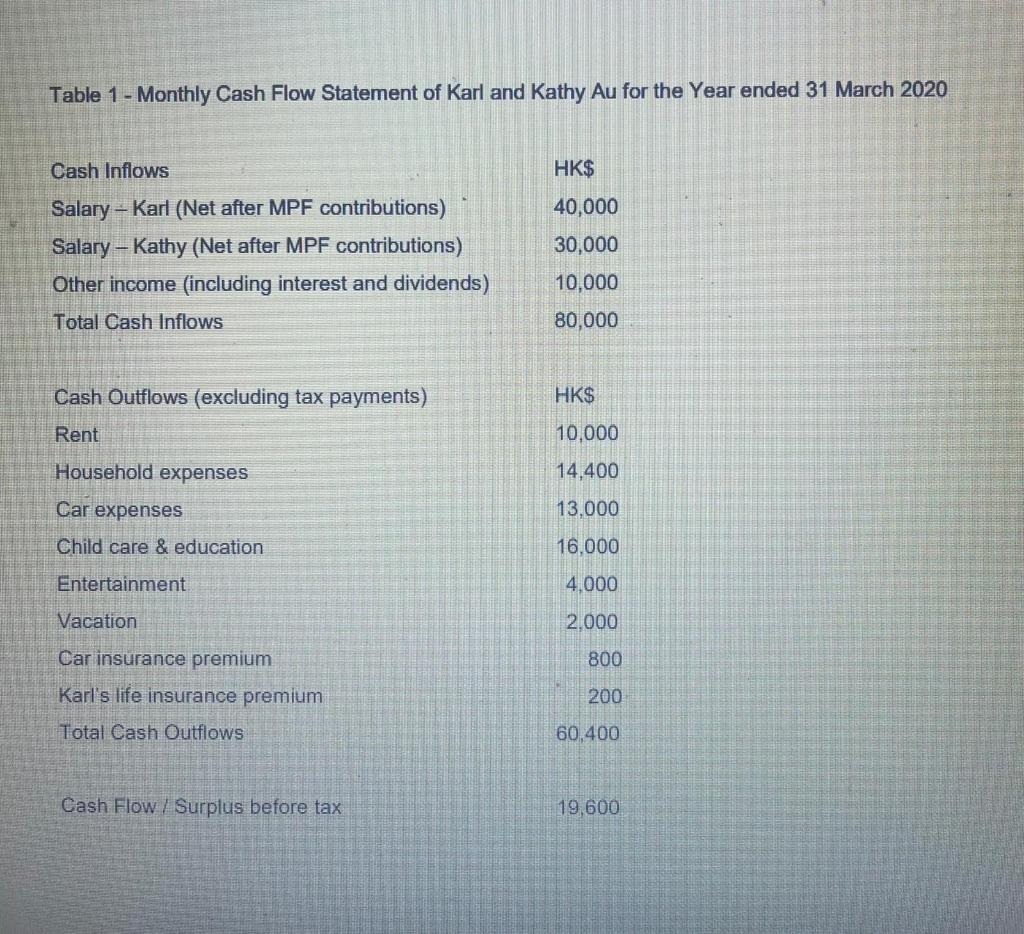

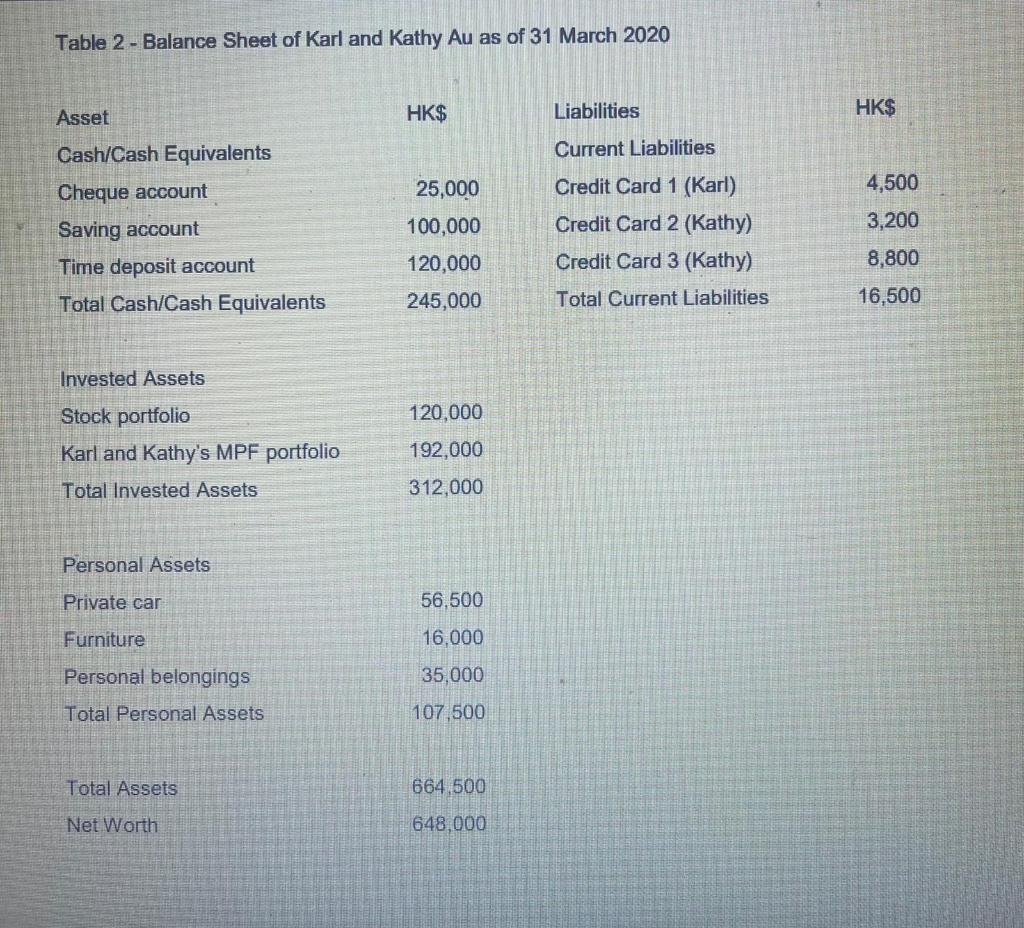

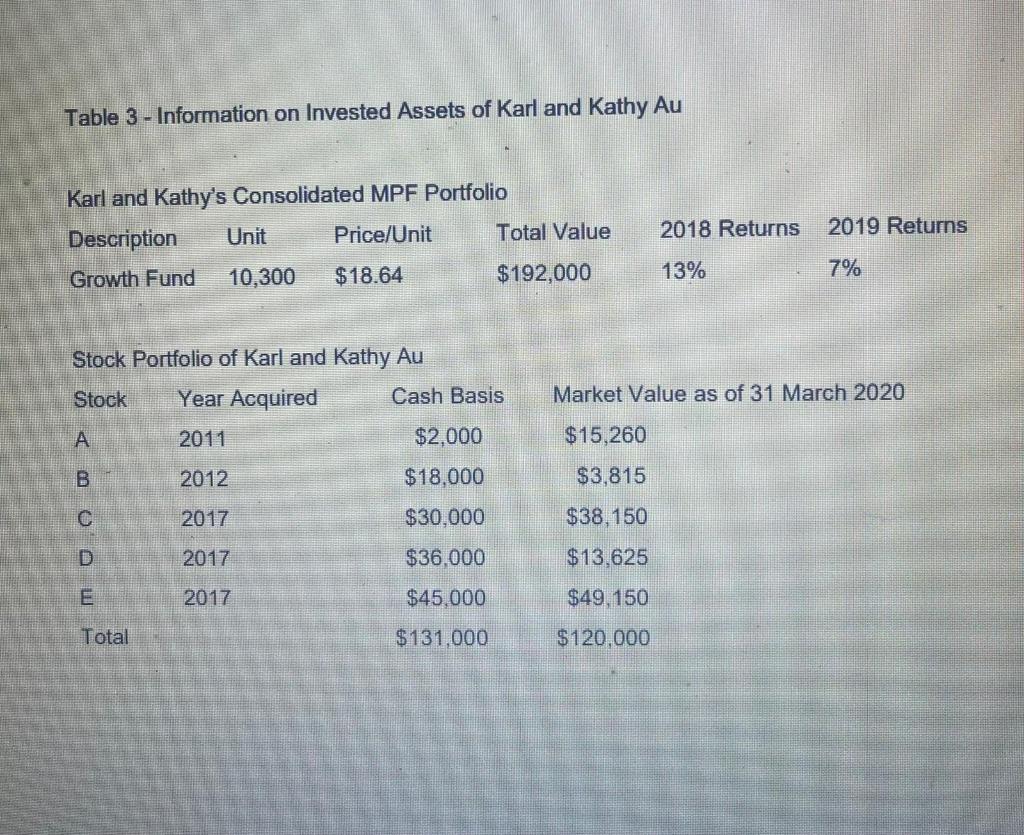

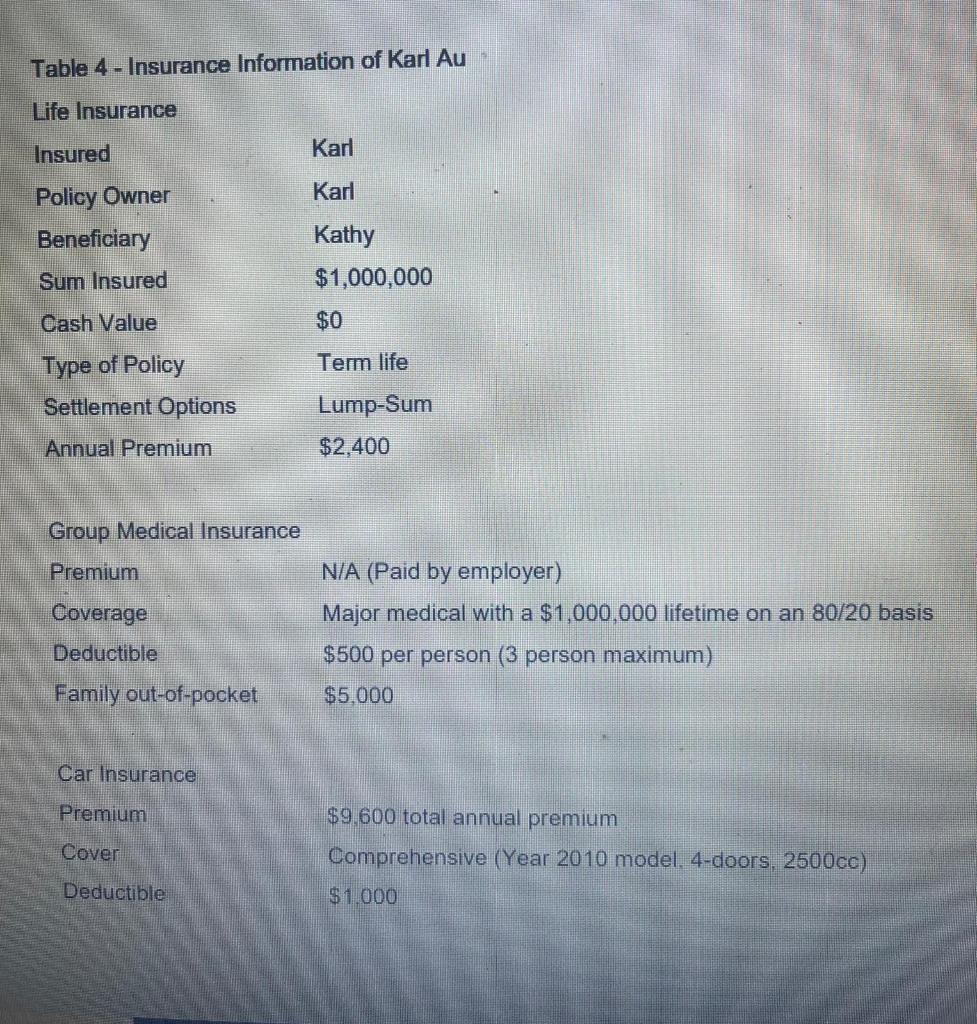

Course: FIN4093EF Fundamentals of Financial Planning (1) Assessment: Individual Assignment Marks for this assessment: 100% (20% of the total score of this course) Assignment Due Date: 15th March 2021 (Monday) Notes to students: 1. The report should not exceed 800 words, excluding references and exhibits. 2. You should quote the knowledge and theories taught in this module. 3. Use the American Psychological Association (APA) style of referencing to acknowledge sources used in your assignment 4. Your report must be in English, word-processed and produced by computer printouts. Case Introduction Clients: A dual income young married couple, Karl and Kathy Au, with a 1-year-old daughter. Personal Background Karl Au Age: 28 Nationality: Hong Kong Occupation: Chartered accountant Employment history: Local medium size accountancy firm for 5 years Monthly salary: $40,000 (net after employee's MPF contribution) Kathy Au Age: 28 Nationality: Singaporean Occupation: Fashion designer Employment history: Local garment manufacturer Monthly salary: $40,000 (net after employee's MPF contribution) Karl and Kathy have been married for 2 years and have 1-year-old daughter, Kristy. Karl's parents are quite well-off and live in the United States. The Au couple lives in a rented flat but wants to buy a flat in the price range of around $3 million. They expect Karl's parents to give them a sum of $300,000 as a gift as part of the down payment, or to offer them a maximum loan of $2.1 million at an interest rate of 3 %. Karl and Kathy are also prepared to obtain mortgage financing from a bank. Karl plans to advance himself in his current job. In the long-term, however, he wants to open a firm similar to his current employer's in 7 years' time and experts to need $1 million in today's dollars to start the business. Kathy is happy with her job and experts it to be very stable for a long time. The couple does not wish to have another child, and wishes to send Kristy to complete her tertiary education overseas after finishing secondary school education in Hong Kong. Both Kar and Kathy enjoy taking vacation aboard. However, after the birth of Kristy, they have reduced their overseas travel to twice a year. They want to maintain this frequency and spend an average of $12,000 on each vacation per year. Other Information Investment Both Karl and Kathy have a high tolerance for investment risk. Their required rate of return for investments is the same as the Hang Seng Index. The respective employers of Karl and Kathy have the same MPF providers. Although their MPF plans offer a variety of mutual funds ranging from aggressive growth funds to guaranteed funds, both Karl and Kathy currently have 100% invested in aggressive growth funds. The couple also has a time deposit account and a stock portfolio managed by Karl. They own 3 credit cards in total, each with outstanding loans. Insurance Only Karl's employer provides a medical insurance scheme that covers employees' spouses and children. He also maintains a term life insurance with a sum insured of $1 million and has arranged comprehensive insurance cover on his car. Apart from the above, neither Karl nor Kathy has any other kind of insurance. Retirement The couple plans to retire at the age of 60. Estate Plan Karl and Kathy have each made a simple handwritten will leaving all probate assets to each other. Advice Wanted Karl and Kathy Au wish to achieve their priority of purchasing their own home as soon as possible. Their secondary financial goals are to provide for their daughter, as well as their retirement. You are required to prepare a comprehensive financial plan with considerations for the major financial needs of Karl and Kathy. Table 1 - Monthly Cash Flow Statement of Karl and Kathy Au for the Year ended 31 March 2020 Cash Inflows HK$ 40,000 30,000 Salary - Karl (Net after MPF contributions) Salary-Kathy (Net after MPF contributions) Other income (including interest and dividends) Total Cash Inflows 10,000 80,000 Cash Outflows (excluding tax payments) HK$ Rent 10,000 Household expenses 14,400 Car expenses 13,000 Child care & education 16,000 Entertainment 4,000 Vacation 2.000 800 Car insurance premium Karl's life insurance premium 200 Total Cash Outflows 60,400 Cash Flow / Surplus before tax 19,600 Table 2 - Balance Sheet of Karl and Kathy Au as of 31 March 2020 Asset HK$ Liabilities HK$ Current Liabilities 4,500 Cash/Cash Equivalents Cheque account Saving account Time deposit account Total Cash/Cash Equivalents 3,200 25,000 100,000 120,000 245,000 Credit Card 1 (Karl) Credit Card 2 (Kathy) Credit Card 3 (Kathy) Total Current Liabilities 8,800 16,500 Invested Assets Stock portfolio Karl and Kathy's MPF portfolio Total Invested Assets 120,000 192,000 312,000 Personal Assets Private car 56,500 Furniture 16,000 Personal belongings 35,000 Total Personal Assets 107,500 Total Assets 664.500 Net Worth 648,000 Table 3 - Information on Invested Assets of Karl and Kathy Au Karl and Kathy's Consolidated MPF Portfolio Description Unit Price/Unit Total Value Growth Fund 10,300 $18.64 $ 192,000 2018 Returns 2019 Returns 13% 7% Stock Portfolio of Karl and Kathy Au Stock Year Acquired Cash Basis 2011 $2,000 Market Value as of 31 March 2020 $15,260 2012 $3,815