Question

Course: Financial Reporting Case Analysis Assignment Streaming Inc. (SI) is a 25-year-old company in the content streaming business. It sells monthly subscriptions, which allow access

Course: Financial Reporting

Case Analysis Assignment

Streaming Inc. (SI) is a 25-year-old company in the content streaming business. It sells monthly subscriptions, which allow access to its library of original content shows and movies as well as licensed content. The company recently went public on the National Stock Exchange. Members can watch the shows and movies as many times as they want and for as long as they want. Revenues have been steadily growing due to a recent and pervasive pandemic. Many governments have imposed "social isolation" requirements as a means to slow down the spread of the virus and so many people are making greater use of streaming services. There is growing interest in the industry in general by investors looking to invest.

Increasingly, new entrants into the marketplace are threatening to take customers away. Just after year-end, one of the large tech companies announced that it was launching a new division that will be in direct competition with SI's core business. This is a concern for SI since the big tech company has a significant amount of ready cash that it will use to develop content and market its new product.

According to the company's financial statements "streaming content obligations include amounts related to the acquisition, licensing and production of streaming content including commitments under various contracts". Obligations for the acquisition and licensing of content are incurred when the company enters into an agreement to obtain future titles. Certain agreements include obligations to license rights for unknown future titles (where the quantity or fees are not yet determinable). These are not recognized yet as obligations but are worth about $11 billion. The company is increasingly gathering significant amounts of data that may help them estimate these. They have just hired a new CPA who has a computer science background to work on algorithms that will help gather and analyze data. The question is - what data is relevant and how much should they gather?

SI is in the process of developing a new show, which is planned to have 20 episodes. Costs incurred in developing the show include the following:

-Idea generation

-Market testing of concepts before locking into an idea/theme

-Script writing and editing

-Filming

-Payroll for actors, film crew, editing crew

-Payroll for supervisors (on set and in head office)

Costs are mounting and reaching the point where SI is unsure as to whether they will be able to recover them from future revenues (the costs incurred to date are more than for any show previously developed). Nonetheless, the preliminary and advance marketing of the concept has received very positive reviews and the show is almost ready to be launched. The company is planning a share issue to raise some additional funding to cover the costs of this and other new shows.

Once a show is launched, SI starts to depreciate the amounts capitalized to date. Many shows have about a 5-year life but about 20% of the shows are considered "classics" in that they continue to be watched well past that point. When a show is just launched, it is difficult to know if it will become a "classic" or not. As a rule, new shows are watched more in the early years than later on although "classic" shows tend to be watched more evenly over time. SI is finding that more and more of its shows are seen as "classics" - especially in the last three years. This may be due to a new targeted marketing campaign using AI that was initiated in 2018. Depreciation expense in included in "cost of revenues" and was $9.2 billion in 2019.

Some of the "classic" shows from the early years of the company have started to get some negative publicity due to content that is no longer culturally or socially acceptable by some groups. The company at this point has decided to keep these shows in the library but is watching things closely to see if the negative publicity may hurt their future growth. The shows are still accessed and watched by a substantial portion of the subscriber base but SI has started to see a decline in the number of times accessed.

The company sells memberships in Canada as well as the United States. U.S. customers pay in $U.S. and this segment has been growing rapidly in the past 5 years. Given that the $U.S. currency has been strengthening in the past couple of years, SI had decided not to hedge the $U.S. revenue stream. Currently however, it looks like the Canadian dollar has begun to strengthen against the $U.S. primarily due to political instability in the U.S. The company is planning to enter into a hedge using derivatives and is not sure whether to use hedge accounting.

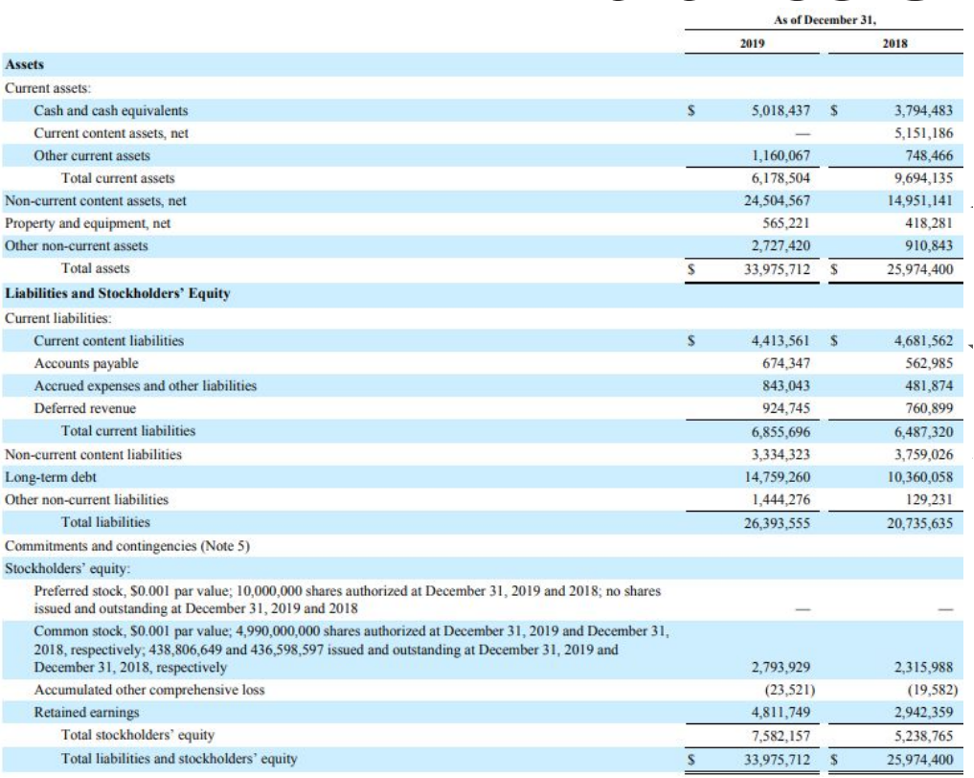

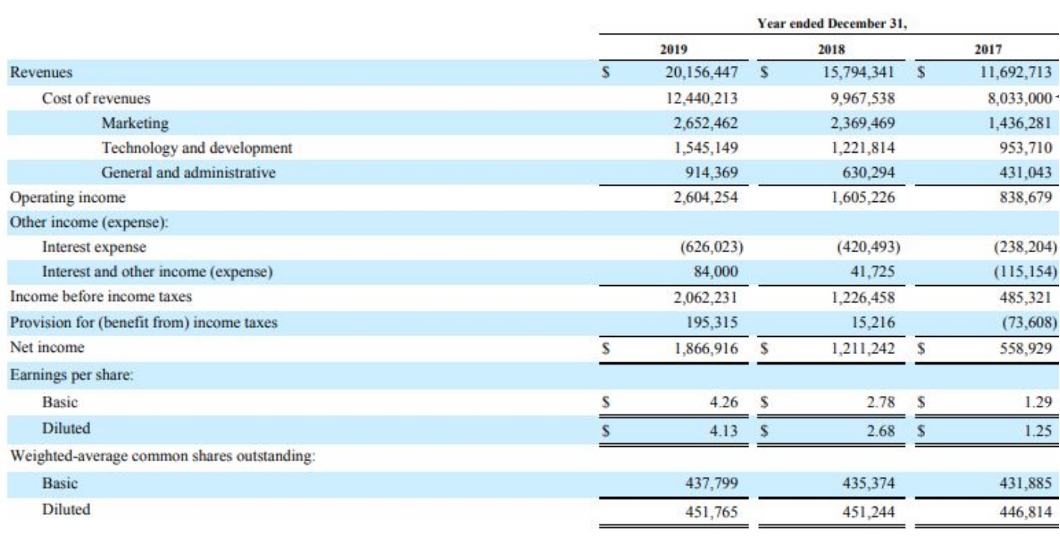

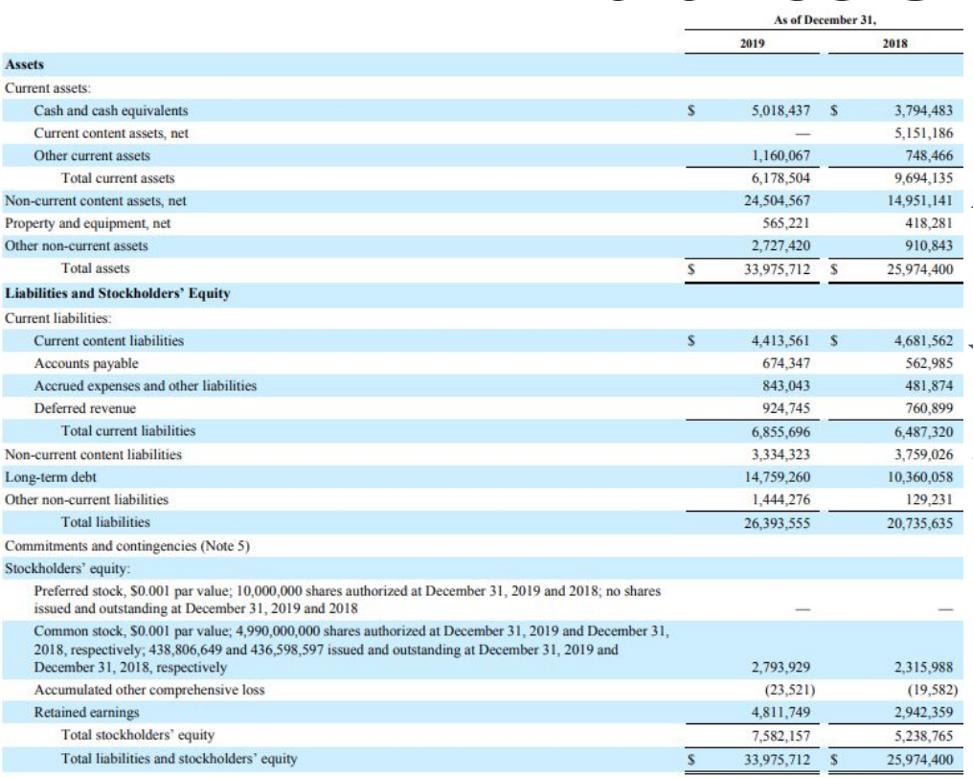

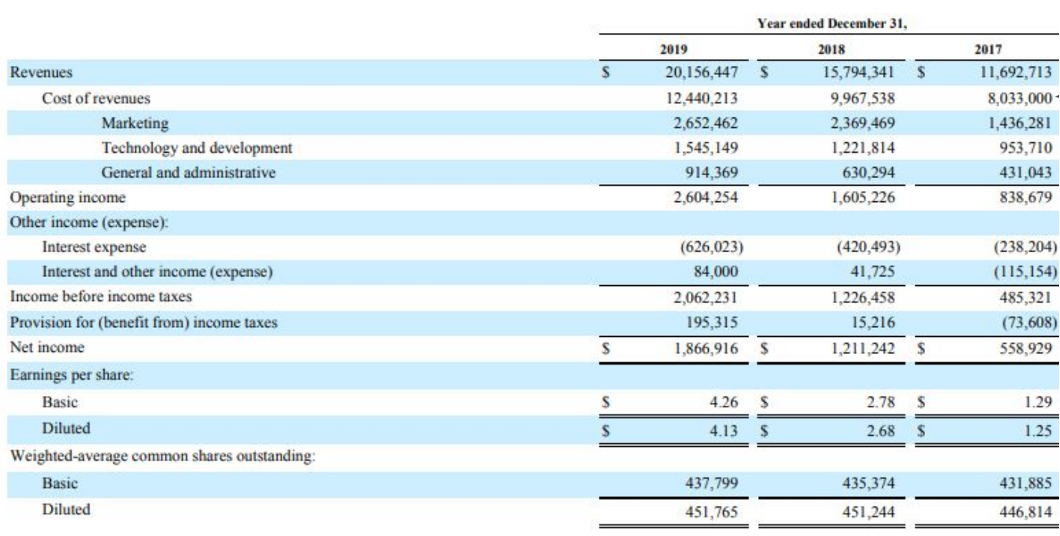

Excerpts from the financial statements follow. Numbers are all in thousands of dollars ('000s").

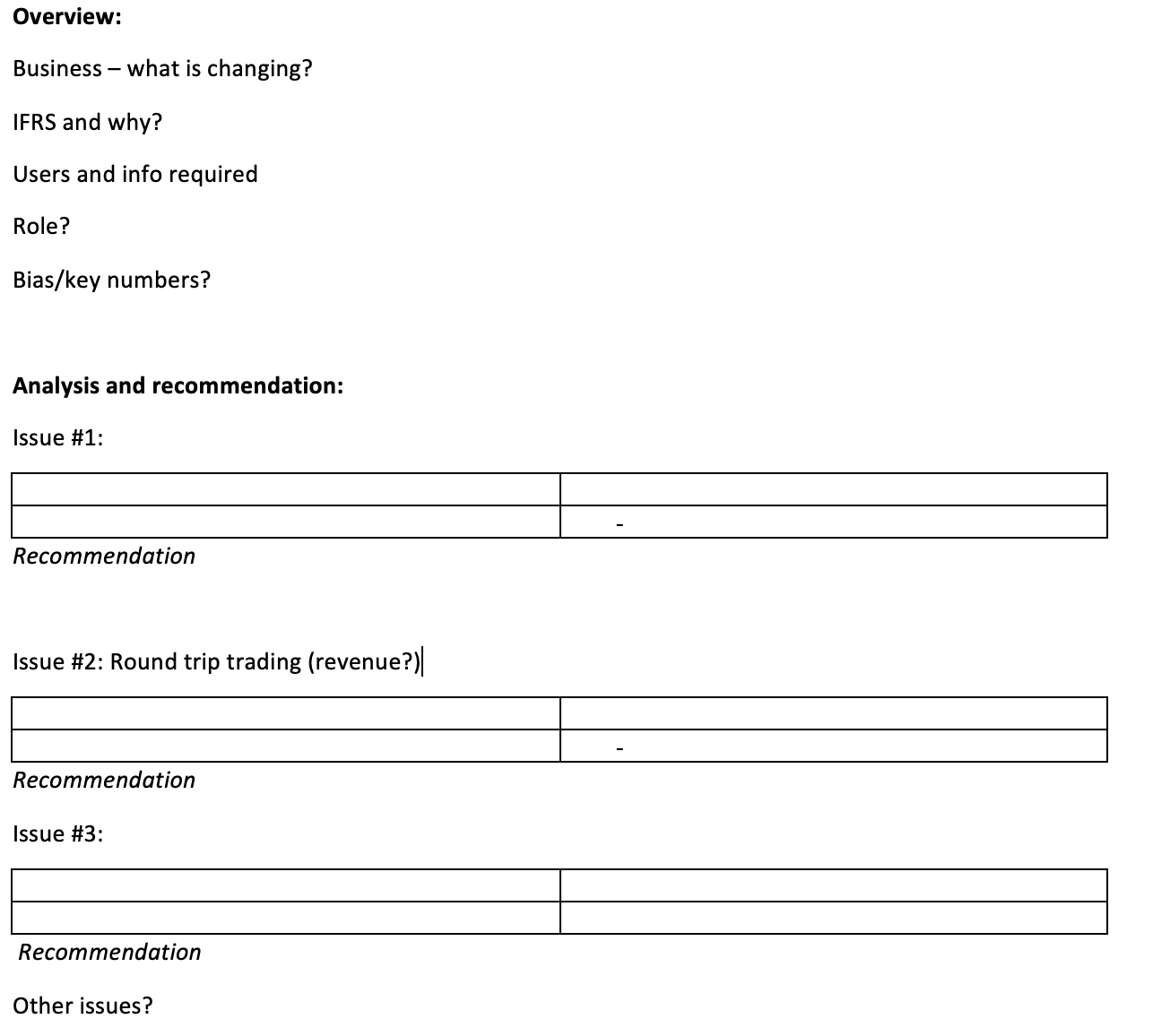

Required:

Assume the role of the company's auditors and analyze the financial reporting issues. Use the case analysis approach as shown below.

Financial Statements:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started