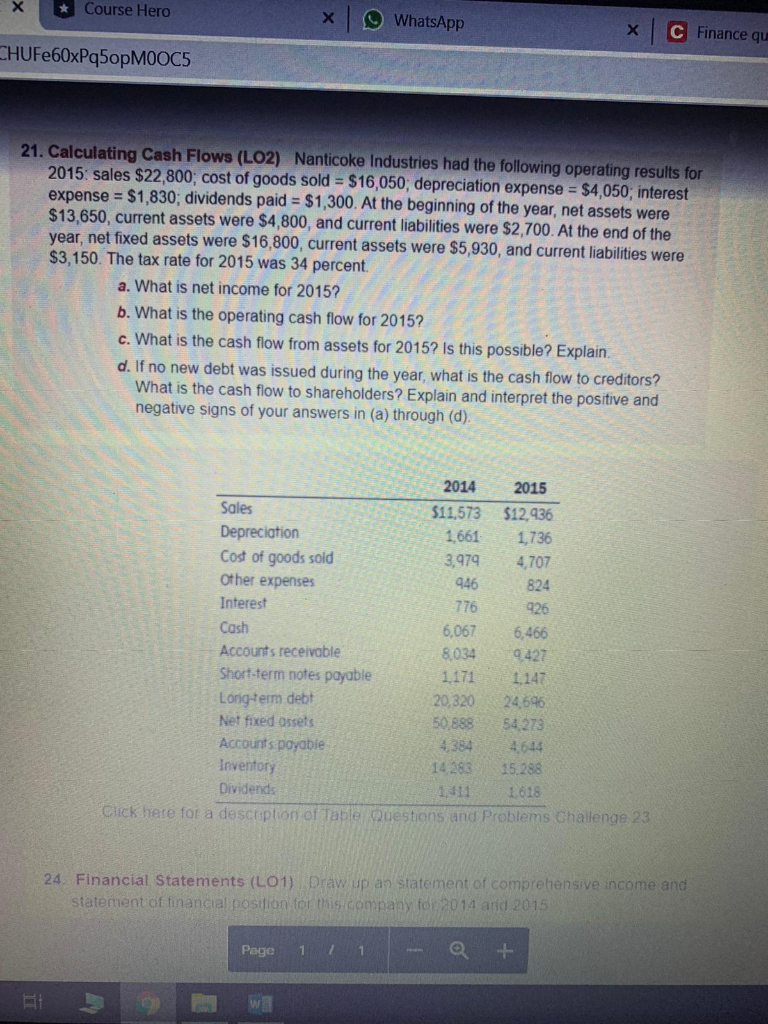

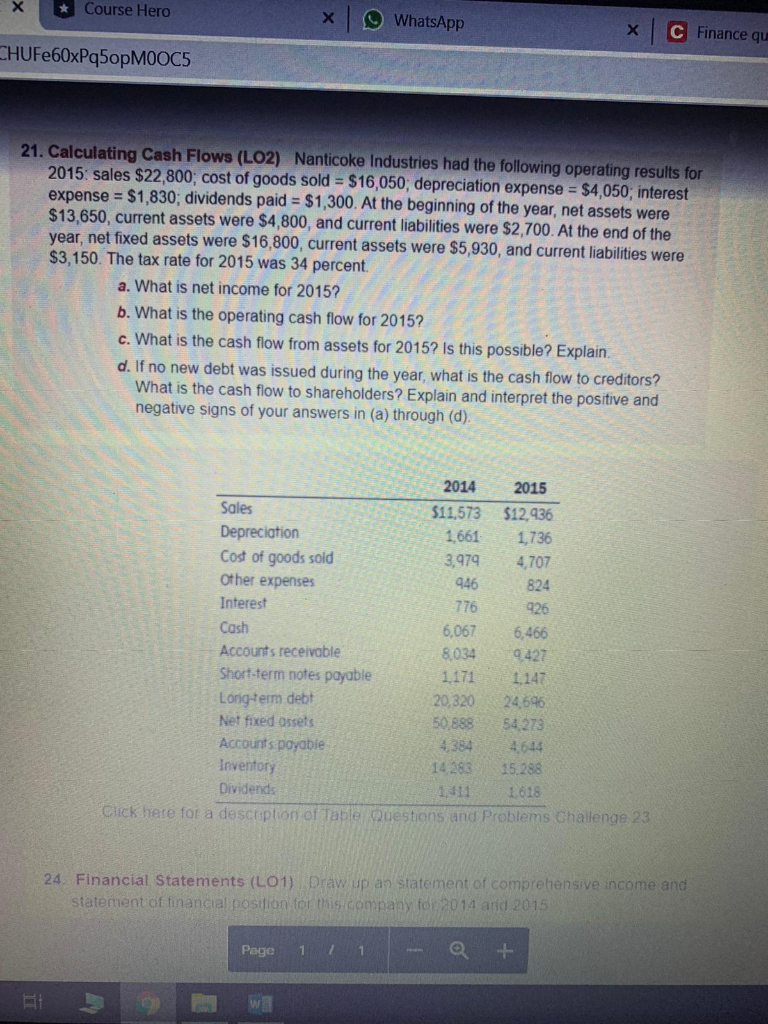

Course Hero 9 WhatsApp C Finance qu CHUFE60xPq5opMOOC5 21. Calculating Cash Flows (LO2) Nanticoke Industries had the following operating results for 2015: sales $22,800; cost of goods sold = $16,050; depreciation expense = $4,050, interest expense = $1,830; dividends paid = $1,300. At the beginning of the year, net assets were $13,650, current assets were $4,800, and current liabilities were $2,700. At the end of the year, net fixed assets were $16,800, current assets were $5,930, and current liabilities were $3,150. The tax rate for 2015 was 34 percent. a. What is net income for 2015? b. What is the operating cash flow for 2015? c. What is the cash flow from assets for 2015? Is this possible? Explain. d. If no new debt was issued during the year, what is the cash flow to creditors? What is the cash flow to shareholders? Explain and interpret the positive and negative signs of your answers in (a) through (d). 2014 2015 Sales $11,573 $12,936 Depreciation 1,661 1,736 Cost of goods sold 3,979 4,707 Other expenses 946 824 Interest 776 926 Cash 6,067 6,466 Accounts receivable 8,034 9427 Short-term notes payable 1.171 1.147 Longterm debt 20,320 24 696 Net fixed assets 50,889 54,273 Accounts payable 4384 4.644 Inventory 14283 15.288 Dividends 1018 Click here for a description of Table Questions and Problems Challenge 23 24. Financial Statements (L01) Draw up an statement of comprehensive income and statement of financial position for this company for 2014 and 2015 Page 1 1 1 bu WE Course Hero 9 WhatsApp C Finance qu CHUFE60xPq5opMOOC5 21. Calculating Cash Flows (LO2) Nanticoke Industries had the following operating results for 2015: sales $22,800; cost of goods sold = $16,050; depreciation expense = $4,050, interest expense = $1,830; dividends paid = $1,300. At the beginning of the year, net assets were $13,650, current assets were $4,800, and current liabilities were $2,700. At the end of the year, net fixed assets were $16,800, current assets were $5,930, and current liabilities were $3,150. The tax rate for 2015 was 34 percent. a. What is net income for 2015? b. What is the operating cash flow for 2015? c. What is the cash flow from assets for 2015? Is this possible? Explain. d. If no new debt was issued during the year, what is the cash flow to creditors? What is the cash flow to shareholders? Explain and interpret the positive and negative signs of your answers in (a) through (d). 2014 2015 Sales $11,573 $12,936 Depreciation 1,661 1,736 Cost of goods sold 3,979 4,707 Other expenses 946 824 Interest 776 926 Cash 6,067 6,466 Accounts receivable 8,034 9427 Short-term notes payable 1.171 1.147 Longterm debt 20,320 24 696 Net fixed assets 50,889 54,273 Accounts payable 4384 4.644 Inventory 14283 15.288 Dividends 1018 Click here for a description of Table Questions and Problems Challenge 23 24. Financial Statements (L01) Draw up an statement of comprehensive income and statement of financial position for this company for 2014 and 2015 Page 1 1 1 bu WE