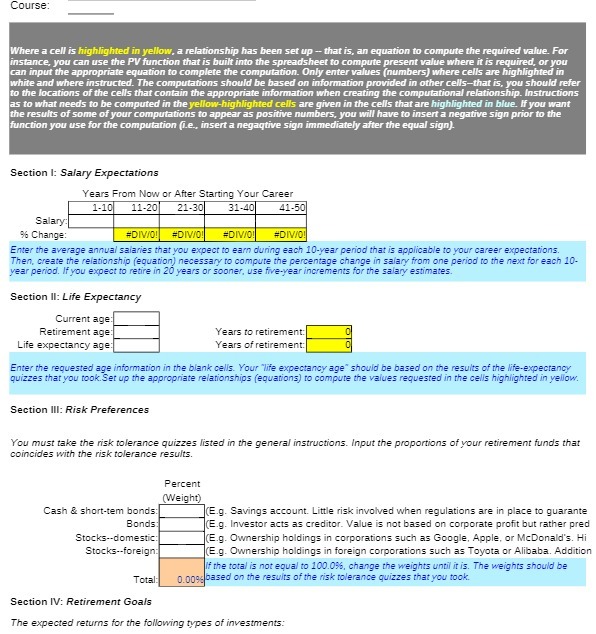

Course: Where a cell is highlighted in yellow. a relationship has been set up -- that is, an equation to compute the required value. For instance, you can use the PV function that is built into the spreadsheet to compute present value where it is required, or you can input the appropriate equation to complete the computation. Only enter values (numbers) where cells are highlighted in white and where instructed. The computations should be based on information provided in other cells-that is, you should refer to the locations of the cells that contain the appropriate information when creating the computational relationship. Instructions as to what needs to be computed in the yellow-highlighted cells are given in the cells that are highlighted in blue. If you want the results of some of your computations to appear as positive numbers, you will have to insert a negative sign prior to the function you use for the computation (ie., insert a negaqtive sign immediately after the equal sign). Section 1: Salary Expectations Years From Now or After Starting Your Career 1-10 11-20 21-30) 31-40 41-50 Salary % Change: #DIVO! #DIVO! #DIV/O! #DIVO! Enter the average annual salaries that you expect to earn during each 10-year period that is applicable to your career expectations. Then, create the relationship (equation) necessary to compute the percentage change in salary from one period to the next for each 10- year period. If you expect to retire in 20 years or sooner, use five-year increments for the salary estimates. Section II: Life Expectancy Current age: Retirement age Years to retirement: Life expectancy age Years of retirement: Enter the requested age information in the blank cells. Your "life expectancy age" should be based on the results of the life-expectancy quizzes that you took. Set up the appropriate relationships (equations) to compute the values requested in the cells highlighted in yellow. Section Ill: Risk Preferences You must take the risk tolerance quizzes listed in the general instructions. Input the proportions of your retirement funds that coincides with the risk tolerance results. Percent (Weight) Cash & short-tem bonds: (E.g. Savings account. Little risk involved when regulations are in place to guarante Bonds: (E.g. Investor acts as creditor. Value is not based on corporate profit but rather pred Stocks--domestic: E.g. Ownership holdings in corporations such as Google, Apple, or Mcdonald's. Hi Stocks--foreign: (E.g. Ownership holdings in foreign corporations such as Toyota or Alibaba. Addition If the total is not equal to 100.096, change the weights until it is. The weights should be Total: 0. oose based on the results of the risk tolerance quizzes that you took. Section IV: Retirement Goals The expected returns for the following types of investments