Answered step by step

Verified Expert Solution

Question

1 Approved Answer

course....cost control please provide full explanation. 2. (This question is worth 2 points.) The owner does not approve the budget in question (1). The owner

course....cost control please provide full explanation.

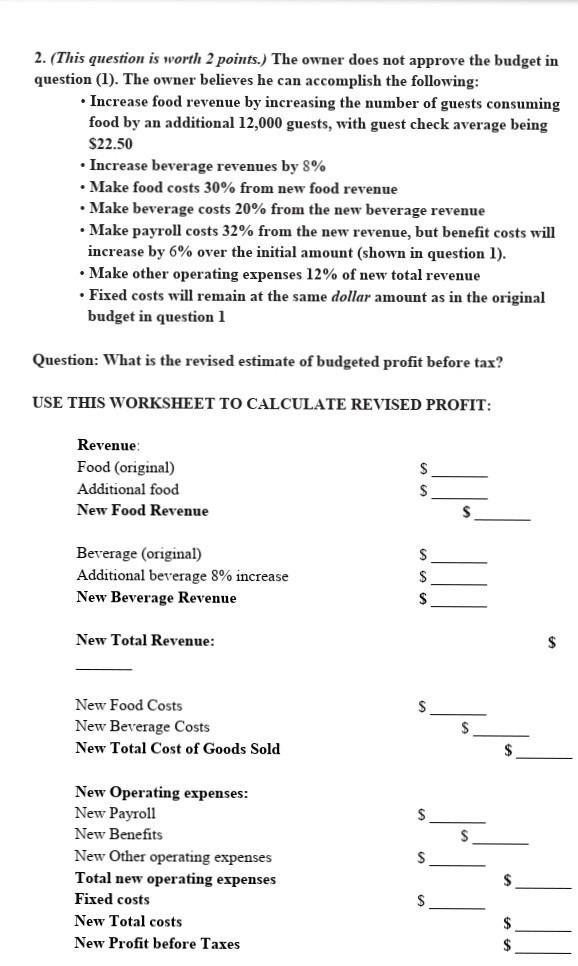

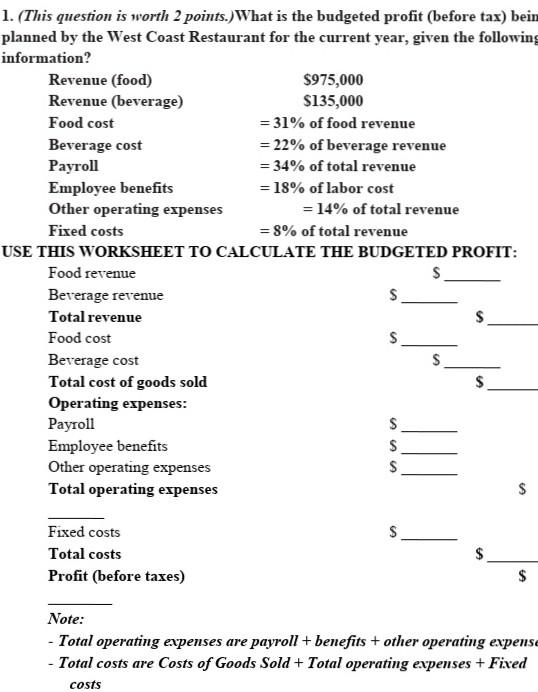

2. (This question is worth 2 points.) The owner does not approve the budget in question (1). The owner believes he can accomplish the following: Increase food revenue by increasing the number of guests consuming food by an additional 12,000 guests, with guest check average being $22.50 Increase beverage revenues by 8% Make food costs 30% from new food revenue Make beverage costs 20% from the new beverage revenue Make payroll costs 32% from the new revenue, but benefit costs will increase by 6% over the initial amount (shown in question 1). Make other operating expenses 12% of new total revenue Fixed costs will remain at the same dollar amount as in the original budget in question 1 Question: What is the revised estimate of budgeted profit before tax? USE THIS WORKSHEET TO CALCULATE REVISED PROFIT: Revenue: Food (original) Additional food New Food Revenue $ $ $ Beverage (original) Additional beverage 8% increase New Beverage Revenue S $ $ New Total Revenue: $ S New Food Costs New Beverage Costs New Total Cost of Goods Sold $ $ S New Operating expenses: New Payroll New Benefits New Other operating expenses Total new operating expenses Fixed costs New Total costs New Profit before Taxes $ $ $ 1. (This question is worth 2 points.)What is the budgeted profit (before tax) bein planned by the West Coast Restaurant for the current year, given the following information? Revenue (food) $975,000 Revenue (beverage) $135,000 Food cost = 31% of food revenue Beverage cost = 22% of beverage revenue Payroll = 34% of total revenue Employee benefits = 18% of labor cost Other operating expenses = 14% of total revenue Fixed costs = 8% of total revenue USE THIS WORKSHEET TO CALCULATE THE BUDGETED PROFIT: Food revenue $ Beverage revenue $ Total revenue Food cost Beverage cost S Total cost of goods sold Operating expenses: Payroll S Employee benefits S Other operating expenses $ Total operating expenses $ $ $ $ Fixed costs Total costs Profit (before taxes) $ $ Note: - Total operating expenses are payroll + benefits + other operating expense - Total costs are Costs of Goods Sold + Total operating expenses + Fixed costsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started