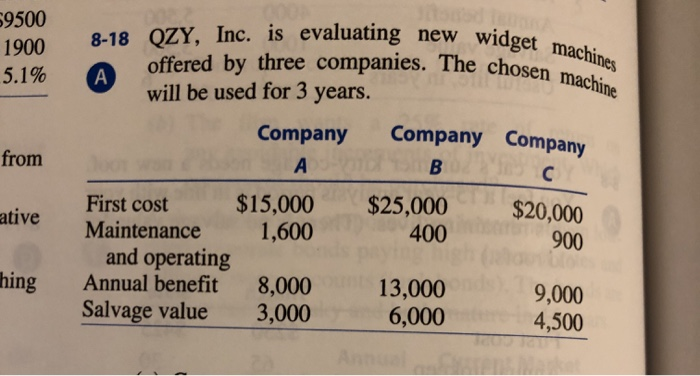

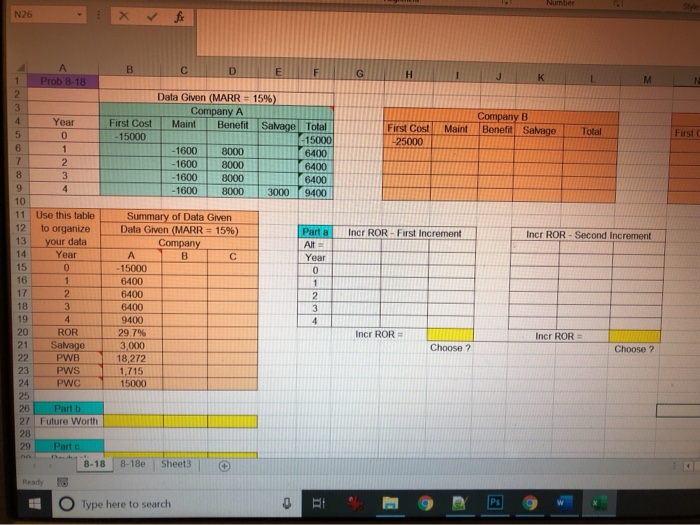

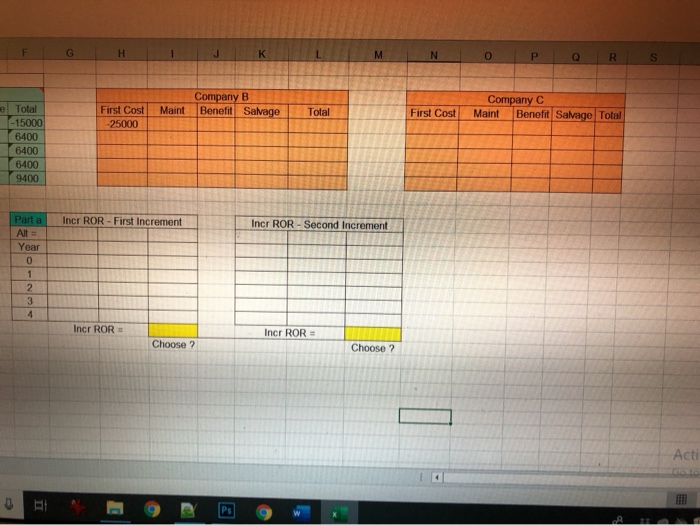

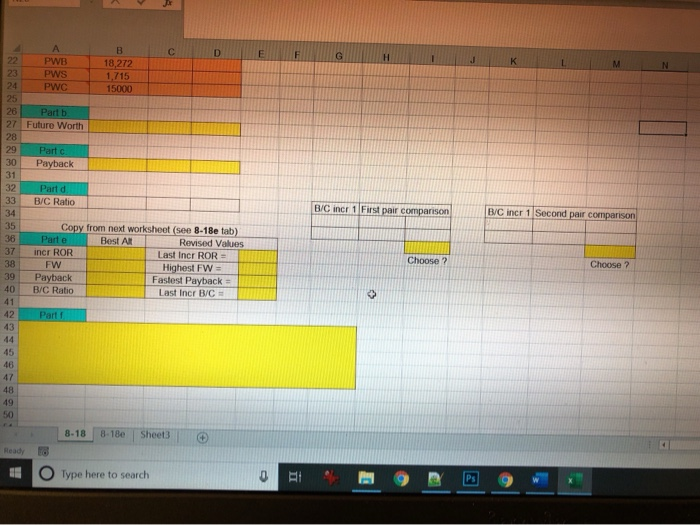

Courses Assignments Problem 8-18 (10 points) - Ignore parts a & b of the problem shown in the text. Instead, answer parts a thru e below. Also, change the analysis period from 3 years to 4 years. Basically you will solve this problem four different times using the following four analysis methods using the numbering below you will see on the template. Then you will duplicate the analysis following instructions in part e after changing a value for one of the alternatives: a. Incremental ROR (Chapter 8) b. Future Worth Analysis (Chapter 9) c. Payback Period (Chapter 9) d. Benefit Cost Ratio Analysis (Chapter 9) e. Now, copy and paste your first worksheet onto the second page of the worksheet. Change the First Cost for Company B to $35,000 and re-calculate your answers for alternatives a d above. Show your new answers in the fields shown on sheet 1 for part e. (a hint of sensitivity analysis here) f. Analyze your results from parts a thru e and summarize what you learned about these four methods 3. Submit as usual - Step 1: enter your homework answers using the Homework Input Quiz in Blackboard before the deadline shown on the schedule. You will get instant points for correct answers. Step 2: save your spreadsheet ting new widget machine 69500 1900 The chosen machine 5.1% from 8-18 OZY, Inc. is evaluating new wi offered by three companies. The chose will be used for 3 years. Company Company Company on First cost $15,000 $25,000 Maintenance 1,600 400 and operating Annual benefit 8,000 13,000 9,000 Salvage value 3,000 3,000 6,000 6,000 4,500 ative $20,000 900 hing N26 PX fx HIJ K L 1 Prob 18 Year Company B Bone Samage Main Total 0 First Cost 25000 Data Given (MARR = 15%) Company A First Cost Maint Benefit Salvage Total -15000 -15000 -1600 8000 6400 -1600 8000 6400 -1600 8000 6400 -1600 8000 3000 9400 Parta Incr RORF Increment Incr ROR - Second increment Use this table to organize your data Year 0 2 Summary of Data Given Data Given (MARR = 15%) Company BC - 150.00 6400 6400 6400 9400 29.7% 3,000 18272 1,715 15.000 Incr ROR Incr ROR = Choose Choose ? ROR Salvage PWB PWS PWC Part 27 Future Worth 28 Part 8-18 8-18e Sheet3 Type here to search F G H I J K N O P Q R S Company B Benefit Salvage Company C Maint Benefit Salvage Total Maint Total First Cost First Cost -25000 Total -15000 6400 6400 6400 9400 Part a Incr ROR - First Increment Incr ROR - Second Increment Year N- Incr ROR E Incr ROR Choose ? Choose ? Act. J K L M PWB PWS PWC 18,272 1,715 15000 Part b 27 Future Worth 30 Part Payback Pard B/C Ratio B/Ciner 1 First pair comparison B/C incr 1 Second pair comparison 33 34 35 36 37 38 39 40 Copy from next worksheet (see 8-18e tab) Parte Best All Revised Values incr ROR Last Incr ROR = FW Highest FW = Payback Fastest Payback = B/C Ratio Last Incr B/C - Choose ? Choose ? 8.18 8-180 Sheet3 @ Ready u O Type here to search t w Courses Assignments Problem 8-18 (10 points) - Ignore parts a & b of the problem shown in the text. Instead, answer parts a thru e below. Also, change the analysis period from 3 years to 4 years. Basically you will solve this problem four different times using the following four analysis methods using the numbering below you will see on the template. Then you will duplicate the analysis following instructions in part e after changing a value for one of the alternatives: a. Incremental ROR (Chapter 8) b. Future Worth Analysis (Chapter 9) c. Payback Period (Chapter 9) d. Benefit Cost Ratio Analysis (Chapter 9) e. Now, copy and paste your first worksheet onto the second page of the worksheet. Change the First Cost for Company B to $35,000 and re-calculate your answers for alternatives a d above. Show your new answers in the fields shown on sheet 1 for part e. (a hint of sensitivity analysis here) f. Analyze your results from parts a thru e and summarize what you learned about these four methods 3. Submit as usual - Step 1: enter your homework answers using the Homework Input Quiz in Blackboard before the deadline shown on the schedule. You will get instant points for correct answers. Step 2: save your spreadsheet ting new widget machine 69500 1900 The chosen machine 5.1% from 8-18 OZY, Inc. is evaluating new wi offered by three companies. The chose will be used for 3 years. Company Company Company on First cost $15,000 $25,000 Maintenance 1,600 400 and operating Annual benefit 8,000 13,000 9,000 Salvage value 3,000 3,000 6,000 6,000 4,500 ative $20,000 900 hing N26 PX fx HIJ K L 1 Prob 18 Year Company B Bone Samage Main Total 0 First Cost 25000 Data Given (MARR = 15%) Company A First Cost Maint Benefit Salvage Total -15000 -15000 -1600 8000 6400 -1600 8000 6400 -1600 8000 6400 -1600 8000 3000 9400 Parta Incr RORF Increment Incr ROR - Second increment Use this table to organize your data Year 0 2 Summary of Data Given Data Given (MARR = 15%) Company BC - 150.00 6400 6400 6400 9400 29.7% 3,000 18272 1,715 15.000 Incr ROR Incr ROR = Choose Choose ? ROR Salvage PWB PWS PWC Part 27 Future Worth 28 Part 8-18 8-18e Sheet3 Type here to search F G H I J K N O P Q R S Company B Benefit Salvage Company C Maint Benefit Salvage Total Maint Total First Cost First Cost -25000 Total -15000 6400 6400 6400 9400 Part a Incr ROR - First Increment Incr ROR - Second Increment Year N- Incr ROR E Incr ROR Choose ? Choose ? Act. J K L M PWB PWS PWC 18,272 1,715 15000 Part b 27 Future Worth 30 Part Payback Pard B/C Ratio B/Ciner 1 First pair comparison B/C incr 1 Second pair comparison 33 34 35 36 37 38 39 40 Copy from next worksheet (see 8-18e tab) Parte Best All Revised Values incr ROR Last Incr ROR = FW Highest FW = Payback Fastest Payback = B/C Ratio Last Incr B/C - Choose ? Choose ? 8.18 8-180 Sheet3 @ Ready u O Type here to search t w