Answered step by step

Verified Expert Solution

Question

1 Approved Answer

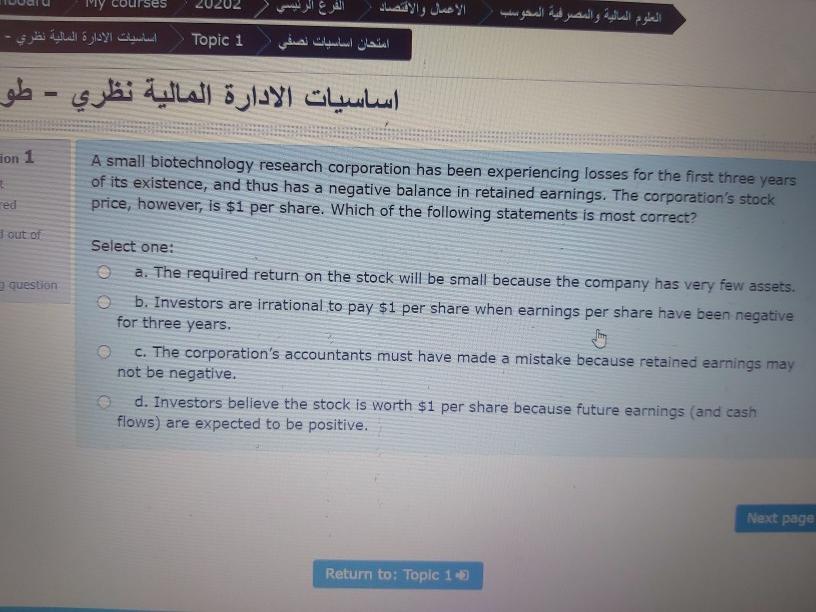

courses - Topic 1 - on 1 A small biotechnology research corporation has been experiencing losses for the first three years of its existence, and

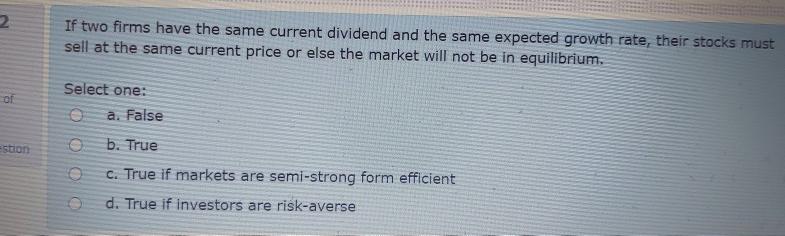

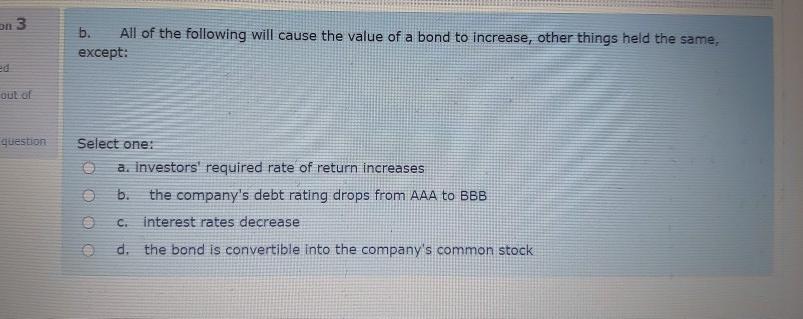

courses - Topic 1 - on 1 A small biotechnology research corporation has been experiencing losses for the first three years of its existence, and thus has a negative balance in retained earnings. The corporation's stock price, however, is $1 per share. Which of the following statements is most correct? ed out of question Select one: : a. The required return on the stock will be small because the company has very few assets. b. Investors are irrational to pay $1 per share when earnings per share have been negative for three years. C. The corporation's accountants must have made a mistake because retained earnings may not be negative. d. Investors believe the stock is worth $1 per share because future earnings (and cash flows) are expected to be positive. Next page Return to: Topic 15 2 If two firms have the same current dividend and the same expected growth rate, their stocks must sell at the same current price or else the market will not be in equilibrium. Select one: a. False estion b. True OO c. True if markets are semi-strong form efficient d. True if investors are risk-averse on 3 b. All of the following will cause the value of a bond to increase, other things held the same, except: out of question Select one: a. Investors' required rate of return increases b. the company's debt rating drops from AAA to BBB c. interest rates decrease d. the bond is convertible into the company's common stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started