Question

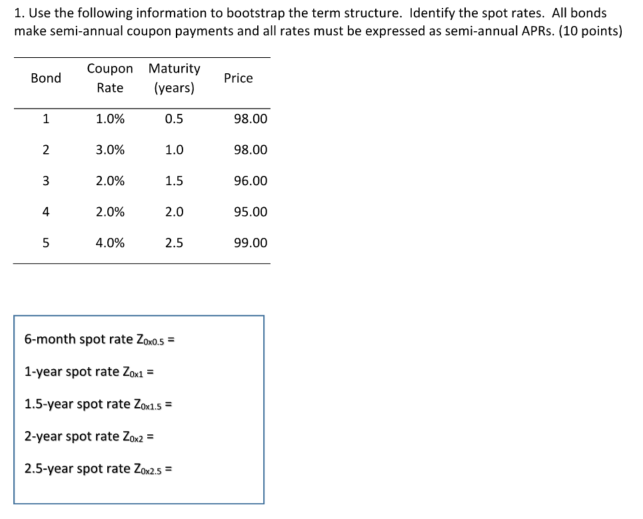

1. Use the following information to bootstrap the term structure. Identify the spot rates. All bonds make semi-annual coupon payments and all rates must

1. Use the following information to bootstrap the term structure. Identify the spot rates. All bonds make semi-annual coupon payments and all rates must be expressed as semi-annual APRs. (10 points) Bond 1 2 3 4 5 Coupon Maturity Rate (years) 1.0% 0.5 3.0% 2.0% 2.0% 4.0% 1.0 1.5 2.0 2.5 6-month spot rate Zoxo.5 = 1-year spot rate Zox1 = 1.5-year spot rate Zox1.5 = 2-year spot rate Zox2 = 2.5-year spot rate Zox2.5 = Price 98.00 98.00 96.00 95.00 99.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Bond 1 Coupon rate 10 Maturity 05 years Price 98 Using the bond price formula Price Future Value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Loren A. Nikolai, John D. Bazley, Jefferson P. Jones

11th edition

978-0538467087, 9781111781262, 538467088, 1111781265, 978-0324659139

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App