Answered step by step

Verified Expert Solution

Question

1 Approved Answer

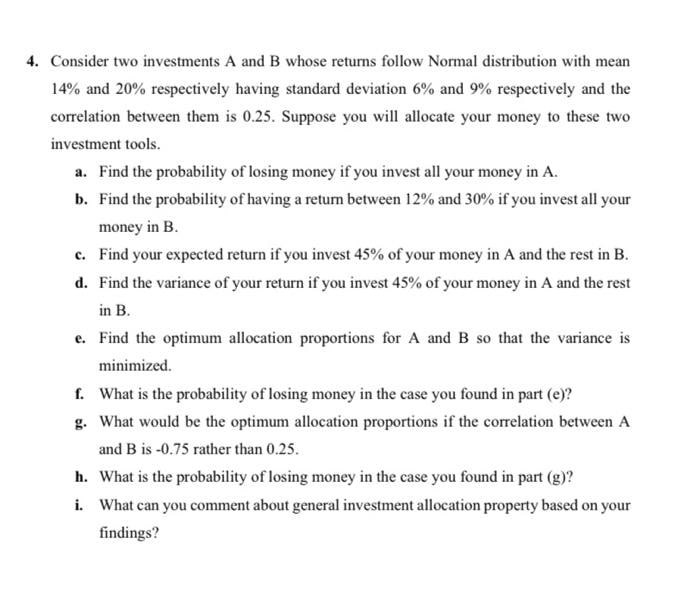

4. Consider two investments A and B whose returns follow Normal distribution with mean 14% and 20% respectively having standard deviation 6% and 9%

4. Consider two investments A and B whose returns follow Normal distribution with mean 14% and 20% respectively having standard deviation 6% and 9% respectively and the correlation between them is 0.25. Suppose you will allocate your money to these two investment tools. a. Find the probability of losing money if you invest all your money in A. b. Find the probability of having a return between 12% and 30% if you invest all your money in B. c. Find your expected return if you invest 45% of your money in A and the rest in B. d. Find the variance of your return if you invest 45% of your money in A and the rest in B. e. Find the optimum allocation proportions for A and B so that the variance is minimized. f. What is the probability of losing money in the case you found in part (e)? g. What would be the optimum allocation proportions if the correlation between A and B is -0.75 rather than 0.25. h. What is the probability of losing money in the case you found in part (g)? i. What can you comment about general investment allocation property based on your findings?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Portfolio Optimization with 2 Normally Distributed Investments Lets analyze the investment scenario for these two assets A and B a Probability of losi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started