Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. (a) Suppose that the current exchange rate between the U.S. dollar ($) and the pound sterling () is S/$ = 0.75 (i.e. $1

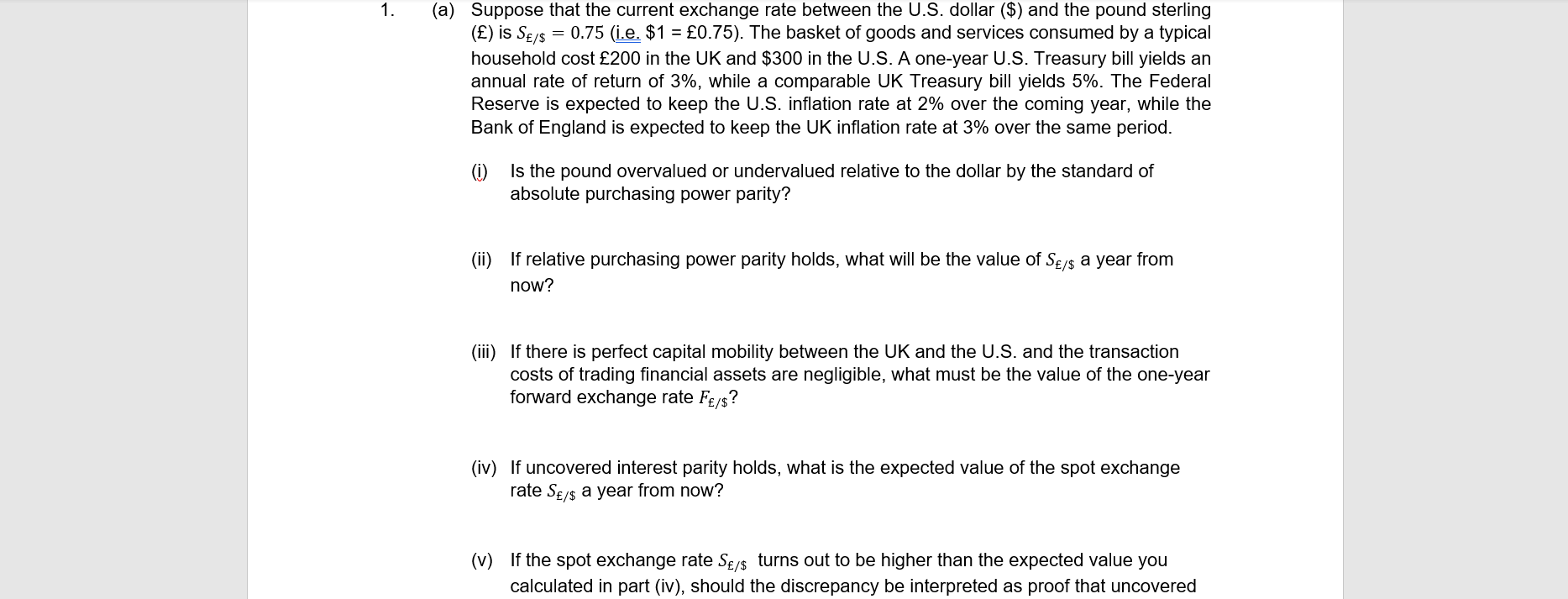

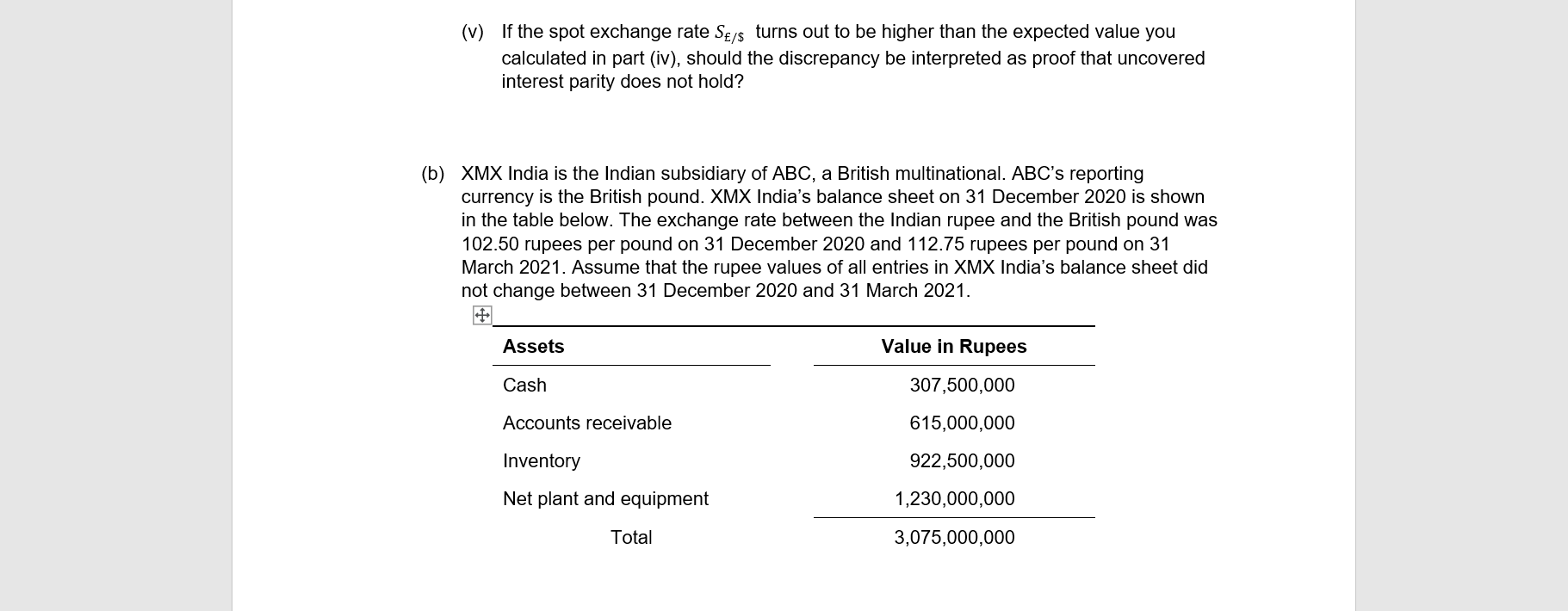

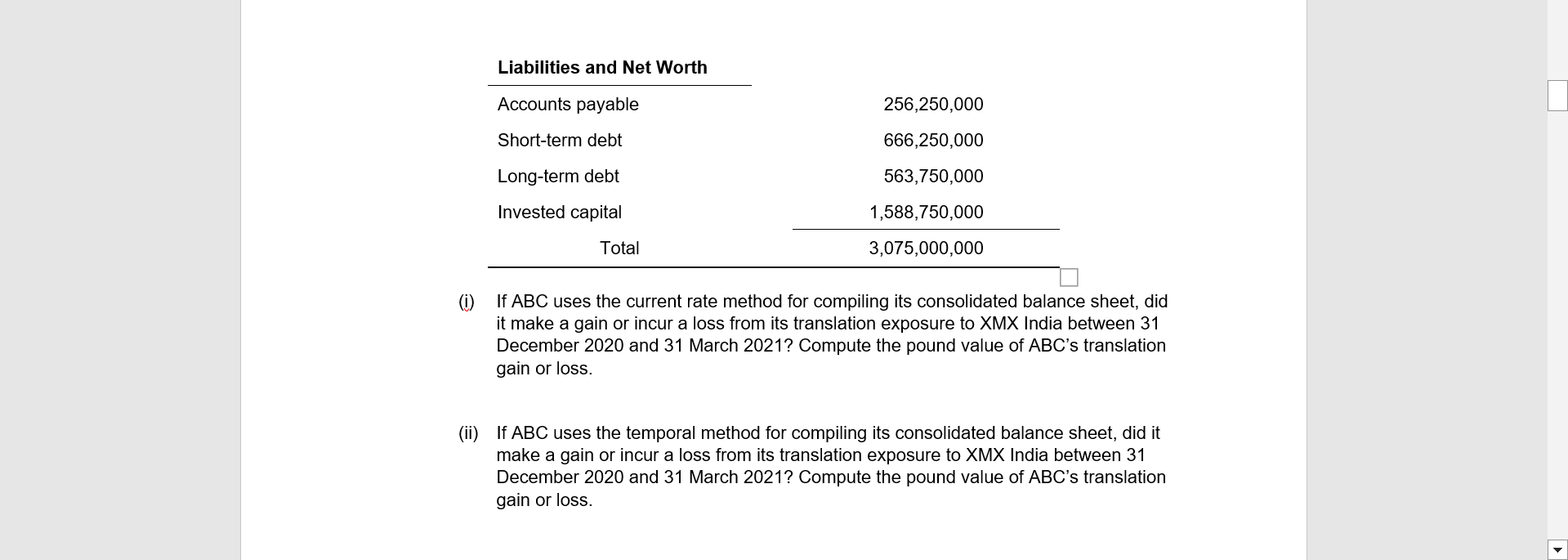

1. (a) Suppose that the current exchange rate between the U.S. dollar ($) and the pound sterling () is S/$ = 0.75 (i.e. $1 = 0.75). The basket of goods and services consumed by a typical household cost 200 in the UK and $300 in the U.S. A one-year U.S. Treasury bill yields an annual rate of return of 3%, while a comparable UK Treasury bill yields 5%. The Federal Reserve is expected to keep the U.S. inflation rate at 2% over the coming year, while the Bank of England is expected to keep the UK inflation rate at 3% over the same period. (i) Is the pound overvalued or undervalued relative to the dollar by the standard of absolute purchasing power parity? (ii) If relative purchasing power parity holds, what will be the value of S/$ a year from now? (iii) If there is perfect capital mobility between the UK and the U.S. and the transaction costs of trading financial assets are negligible, what must be the value of the one-year forward exchange rate F/$? (iv) If uncovered interest parity holds, what is the expected value of the spot exchange rate SE/$ a year from now? (v) If the spot exchange rate SE/$ turns out to be higher than the expected value you calculated in part (iv), should the discrepancy be interpreted as proof that uncovered (v) If the spot exchange rate SE/$ turns out to be higher than the expected value you calculated in part (iv), should the discrepancy be interpreted as proof that uncovered interest parity does not hold? (b) XMX India is the Indian subsidiary of ABC, a British multinational. ABC's reporting currency is the British pound. XMX India's balance sheet on 31 December 2020 is shown in the table below. The exchange rate between the Indian rupee and the British pound was 102.50 rupees per pound on 31 December 2020 and 112.75 rupees per pound on 31 March 2021. Assume that the rupee values of all entries in XMX India's balance sheet did not change between 31 December 2020 and 31 March 2021. Assets Cash Accounts receivable Inventory Net plant and equipment Total Value in Rupees 307,500,000 615,000,000 922,500,000 1,230,000,000 3,075,000,000 Liabilities and Net Worth Accounts payable Short-term debt Long-term debt Invested capital Total 256,250,000 666,250,000 563,750,000 1,588,750,000 3,075,000,000 (i) If ABC uses the current rate method for compiling its consolidated balance sheet, did it make a gain or incur a loss from its translation exposure to XMX India between 31 December 2020 and 31 March 2021? Compute the pound value of ABC's translation gain or loss. (ii) If ABC uses the temporal method for compiling its consolidated balance sheet, did it make a gain or incur a loss from its translation exposure to XMX India between 31 December 2020 and 31 March 2021? Compute the pound value of ABC's translation gain or loss.

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a i To determine if the pound is overvalued or undervalued relative to the dollar by the standard of absolute purchasing power parity we need ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started