Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Brewer Manufacturing and Wiley Furnishings are competitors in the furniture market. The two firms have agreed to invest $5 million each to create a

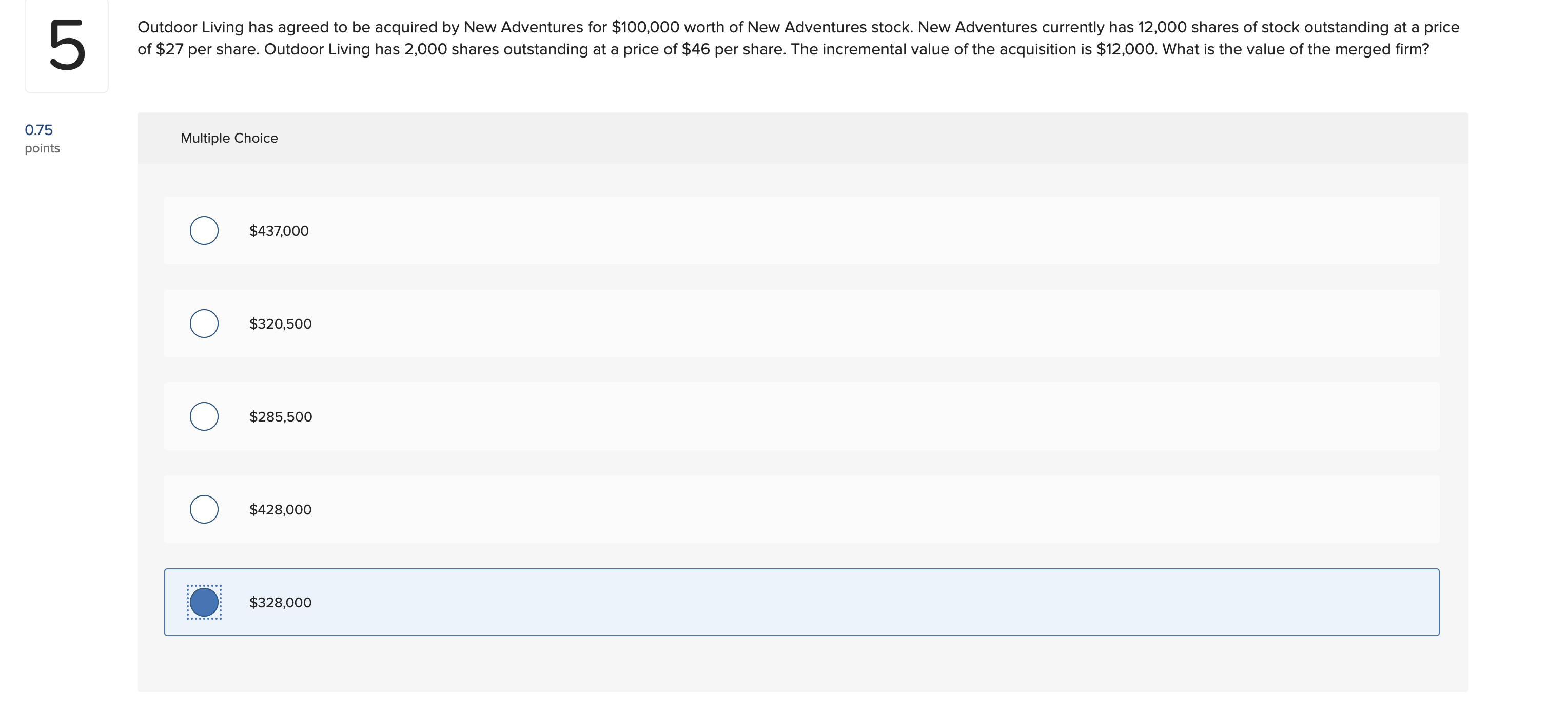

Brewer Manufacturing and Wiley Furnishings are competitors in the furniture market. The two firms have agreed to invest $5 million each to create a new firm, Transformiture, which will manufacture folding furniture for apartment dwellers. This new firm is defined as a: Multiple Choice O O merged alliance. joint venture. takeover project. strategic alliance. consolidation. DeLeon Networks has decided to sell its production operations in order to focus solely on its consulting activities. The sale is referred to as a(n): Multiple Choice O O O liquidation. merger. divestiture. restructuring. allocation. Which one of the following generally has a flip-in provision that significantly increases the cost to a shareholder who is attempting to gain control over a firm? Multiple Choice O O Golden parachute Poison pill Standstill agreement Greenmail White knight 4 The shareholders of Imade Company have voted in favor of a buyout offer from Lan Corporation. Imade has a price-earnings ratio of 6, earnings of $230,000, and 60,000 shares outstanding. Lan has a price-earnings ratio of 12, earnings of $660,000, and 125,000 shares outstanding. Imade's shareholders will receive one share of Lan stock for every three shares they hold in Imade. Assume the NPV of the acquisition is zero. What will the post-merger PE ratio be for Lan? 0.5 points Multiple Choice O O 9.84 10.76 11.21 9.20 10.32 5 Outdoor Living has agreed to be acquired by New Adventures for $100,000 worth of New Adventures stock. New Adventures currently has 12,000 shares of stock outstanding at a price of $27 per share. Outdoor Living has 2,000 shares outstanding at a price of $46 per share. The incremental value of the acquisition is $12,000. What is the value of the merged firm? 0.75 points Multiple Choice $437,000 $320,500 $285,500 $428,000 $328,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Merged alliance This is the most accura...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started