Answered step by step

Verified Expert Solution

Question

1 Approved Answer

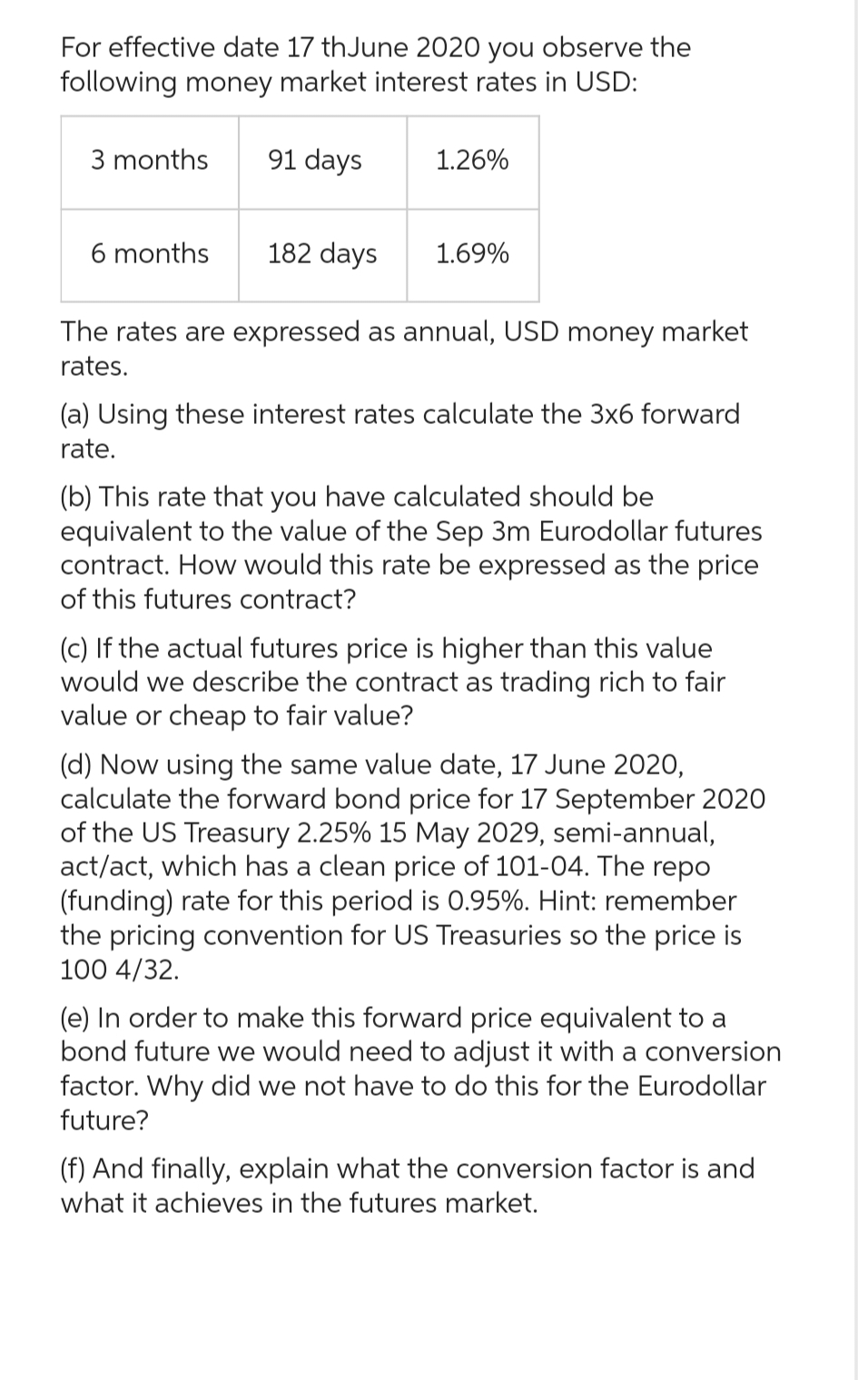

For effective date 17 th June 2020 you observe the following money market interest rates in USD: 3 months 91 days 6 months 182

For effective date 17 th June 2020 you observe the following money market interest rates in USD: 3 months 91 days 6 months 182 days 1.26% 1.69% The rates are expressed as annual, USD money market rates. (a) Using these interest rates calculate the 3x6 forward rate. (b) This rate that you have calculated should be equivalent to the value of the Sep 3m Eurodollar futures contract. How would this rate be expressed as the price of this futures contract? (c) If the actual futures price is higher than this value would we describe the contract as trading rich to fair value or cheap to fair value? (d) Now using the same value date, 17 June 2020, calculate the forward bond price for 17 September 2020 of the US Treasury 2.25% 15 May 2029, semi-annual, act/act, which has a clean price of 101-04. The repo (funding) rate for this period is 0.95%. Hint: remember the pricing convention for US Treasuries so the price is 100 4/32. (e) In order to make this forward price equivalent to a bond future we would need to adjust it with a conversion factor. Why did we not have to do this for the Eurodollar future? (f) And finally, explain what the conversion factor is and what it achieves in the futures market.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Using the 3m and 6m rates the 3x6 forward rate is 1266312 x 1696612 1 1729 b As an annualized rat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started