Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 12 XYZ Corp. is considering an investment in Project Maverick. This new project requires a $11,000,000 initial investment and will produce annual net

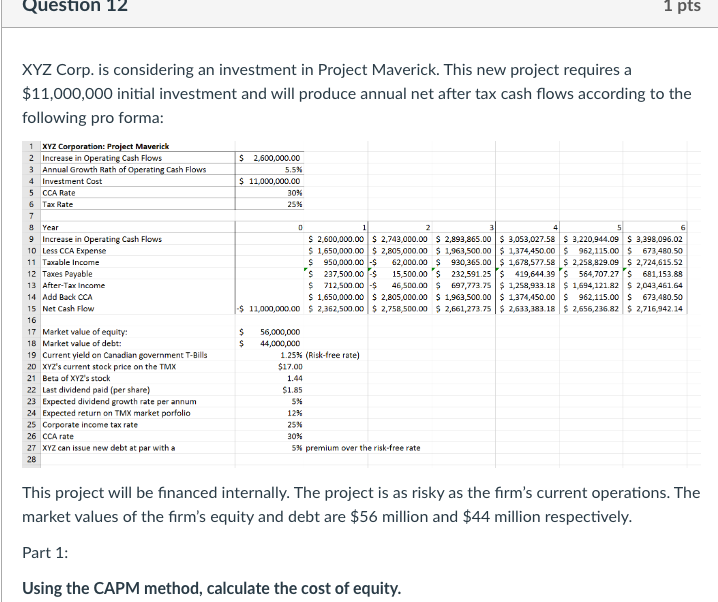

Question 12 XYZ Corp. is considering an investment in Project Maverick. This new project requires a $11,000,000 initial investment and will produce annual net after tax cash flows according to the following pro forma: 1 XYZ Corporation: Project Maverick 2 Increase in Operating Cash Flows 3 Annual Growth Rath of Operating Cash Flows 4 Investment Cost 5 CCA Rate 6 Tax Rate 7 8 Year 9 Increase in Operating Cash Flows 10 Less CCA Expense 11 Taxable Income 12 Taxes Payable 13 After-Tax Income 14 Add Back CCA 15 Net Cash Flow 16 17 Market value of equity: 18 Market value of debt: 19 Current yield on Canadian government T-Bills 20 XYZ's current stock price on the TMX 21 Beta of XYZ's stock 22 Last dividend paid (per share) 23 Expected dividend growth rate per annum 24 Expected return on TMX market porfolio 25 Corporate income tax rate 26 CCA rate 27 XYZ can issue new debt at par with a 28 $ 2,600,000.00 5.5% $ 11,000,000.00 $ $ 30% 25% -$11,000,000.00 4 0 2 5 1 $ 2,600,000.00 $ 2,743,000.00 $ 2,893,865.00 $3,053,027.58 $ 3,220,944.09 $ 3,398,096.02 $1,650,000.00 $ 2,805,000.00 $ 1,963,500.00 $ 1,374,450.00 $ 962,115.00 $ 673,480.50 $ 950,000.00 -$ 62,000.00 $ 930,365.00 $1,678,577.58 $2,258,829.09 $ 2,724,615.52 $ 237,500.00-$ 15,500.00 $ 232,591.25 $ 419,644.39 $ 564,707.27 $ 681,153.88 $ 712,500.00 -$ 46,500.00 $ 697,773.75 $ 1,258,933.18 $ 1,694,121.82 $2,043,461.64 $ 1,650,000.00 $ 2,805,000.00 $ 1,963,500.00 $ 1,374,450.00 $ 962,115.00 $ 673,480.50 $ 2,362,500.00 $2,758,500.00 $ 2,661,273.75 $ 2,633,383.18 $ 2,656,236.82 $ 2,716,942.14 56,000,000 44,000,000 1 pts 1.25% (Risk-free rate) $17.00 1.44 $1.85 5% 12% 25% 30% 5% premium over the risk-free rate 6 This project will be financed internally. The project is as risky as the firm's current operations. The market values of the firm's equity and debt are $56 million and $44 million respectively. Part 1: Using the CAPM method, calculate the cost of equity.

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the cost of equity using the Capital As...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started