Answered step by step

Verified Expert Solution

Question

1 Approved Answer

RED DRAGON plc is financed by equities and bonds, where bonds constitute 30% of the firm's market value. The bonds' coupon interest rate is

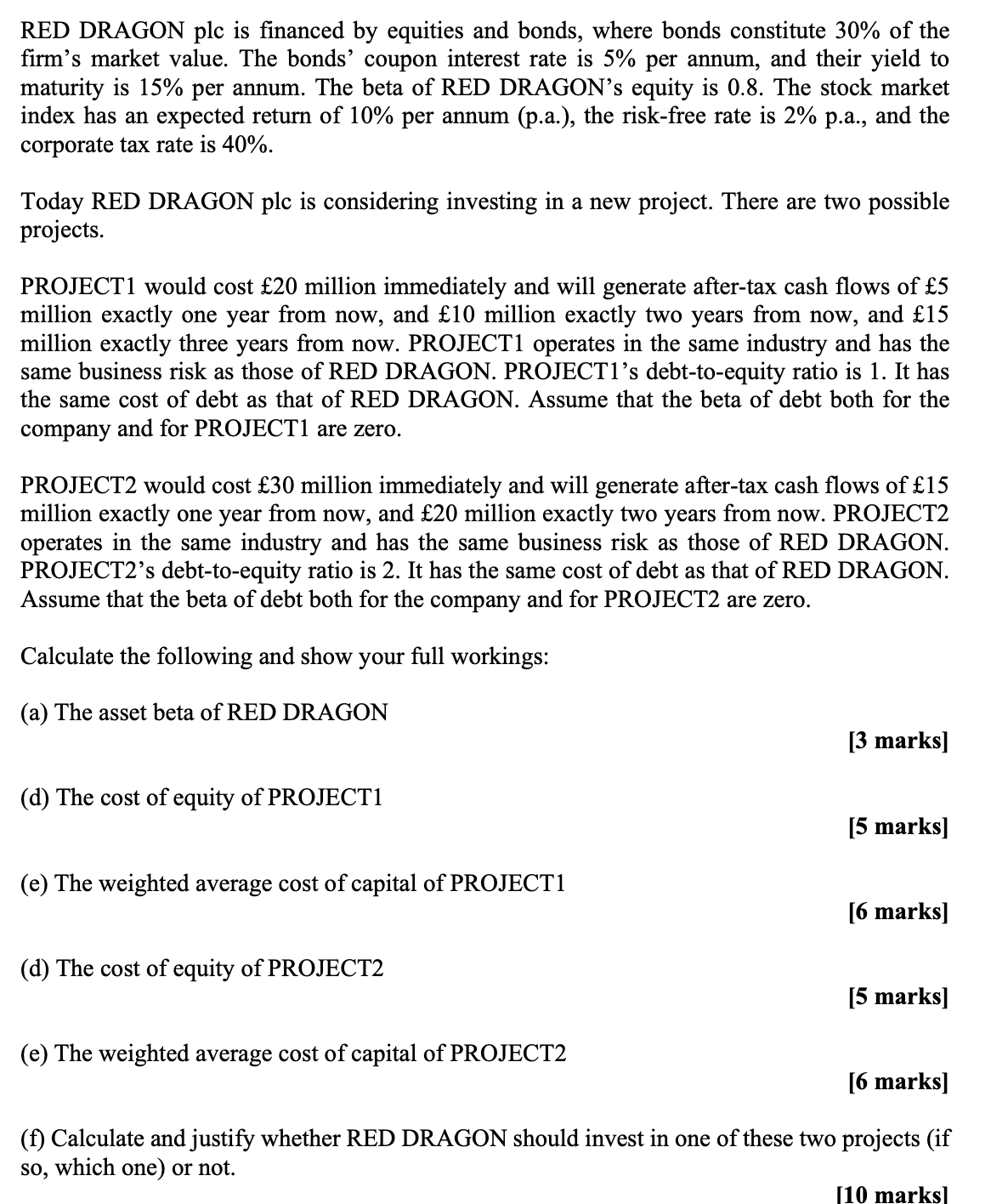

RED DRAGON plc is financed by equities and bonds, where bonds constitute 30% of the firm's market value. The bonds' coupon interest rate is 5% per annum, and their yield to maturity is 15% per annum. The beta of RED DRAGON's equity is 0.8. The stock market index has an expected return of 10% per annum (p.a.), the risk-free rate is 2% p.a., and the corporate tax rate is 40%. Today RED DRAGON plc is considering investing in a new project. There are two possible projects. PROJECT1 would cost 20 million immediately and will generate after-tax cash flows of 5 million exactly one year from now, and 10 million exactly two years from now, and 15 million exactly three years from now. PROJECT1 operates in the same industry and has the same business risk as those of RED DRAGON. PROJECT1's debt-to-equity ratio is 1. It has the same cost of debt as that of RED DRAGON. Assume that the beta of debt both for the company and for PROJECT1 are zero. PROJECT2 would cost 30 million immediately and will generate after-tax cash flows of 15 million exactly one year from now, and 20 million exactly two years from now. PROJECT2 operates in the same industry and has the same business risk as those of RED DRAGON. PROJECT2's debt-to-equity ratio is 2. It has the same cost of debt as that of RED DRAGON. Assume that the beta of debt both for the company and for PROJECT2 are zero. Calculate the following and show your full workings: (a) The asset beta of RED DRAGON (d) The cost of equity of PROJECT1 (e) The weighted average cost of capital of PROJECT1 (d) The cost of equity of PROJECT2 (e) The weighted average cost of capital of PROJECT2 [3 marks] [5 marks] [6 marks] [5 marks] [6 marks] (f) Calculate and justify whether RED DRAGON should invest in one of these two projects (if so, which one) or not. [10 marks]

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Asset beta of RED DRAGON Given Equity beta 08 Bonds constitute 30 of firm value Bond yield 15 Beta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started