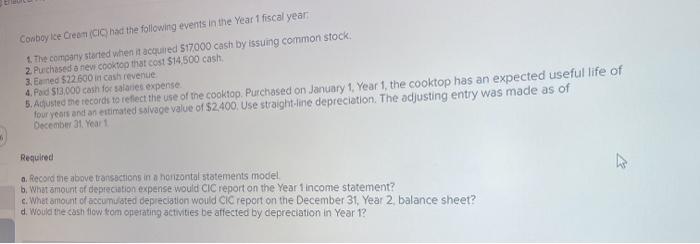

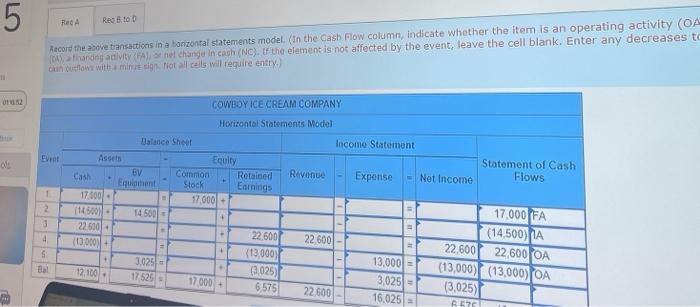

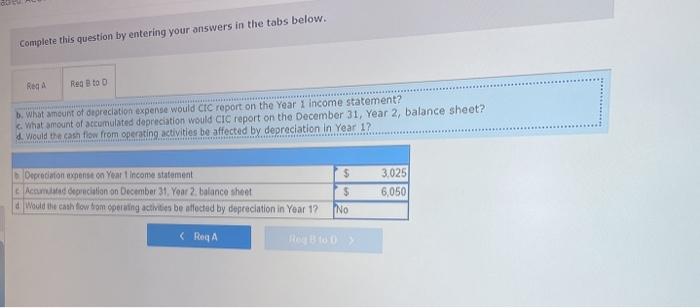

Cowboy Ice Cream (CC) had the following events in the Year 1 fiscal year 1 The comany started when it acquired 517000 cash by issuing common stock, 2 Purchased a new cooktop that cost $14.500 cash 3. Bened $22.600 in cash revenue 4. Paid $13.000 cash for salaries expense 5. Acusted we records to reflect the use of the cooktop, Purchased on January 1 Year 1, the cooktop has an expected useful life of four years and an estimated salvage value of $2,400. Use straight-line depreciation. The adjusting entry was made as of December 31. Yeart Required a. Record me above transactions in a horizontal statements model b. What amount of depreciation expense would CIC report on the Year 1 income statement? c. What amount of accumulated depreciation would Cic report on the December 31, Year 2 balance sheet? d. Would the cash flow from operating activities be affected by depreciation in Year 12 5 Red Roto Record the above transactions in a horizontal statements model in the Cash Flow column, indicate whether the item is an operating activity (OA finding ad vit net change in cash (NC). If the element is not affected by the event, leave the cell blank. Enter any decreases to can cution with minit din total cells will require entry) COWBOY ICE CREAM COMPANY Horizontal Statements Model Income Statement Et Statement of Cash Flows Cash Revenue Expense - Net Income 1 2 3 4 17.000 (74500 22.500 (13000) Balance Sheet Equity Common Retained Equiment Stock Earnings 17.000- 14 500 22.600 (13.000 3,025 - 0.025 6575 11 22.600 S 17.000FA (14,500) 22.600 22,600 OA (13,000) (13,000) COA (3,025) 57 12.100 17525 13,000 3,025) = 16,025 - 17.000 + 22.600 Complete this question by entering your answers in the tabs below. Reg Rea B to D b. What amount of deprecation expense would CIC report on the Year 1 income statement? What amount of accumulated depreciation would CIC report on the December 31, Year 2, balance sheet? would the cash flow from operating activities be affected by depreciation In Year 1? $ Deprecaton expenst on Year Income statement Accu precation on December 31. Yoar 2 balance sheet Would the cath flow from operating activities be affected by depreciation in Yoar 1? 3.025 6,050 $ No & RoqA