Cowboy Oil Company (COC): The company has purchased $4,500,000 worth of equipment that required $500,000 in shipping and installation costs. In addition, the firm's

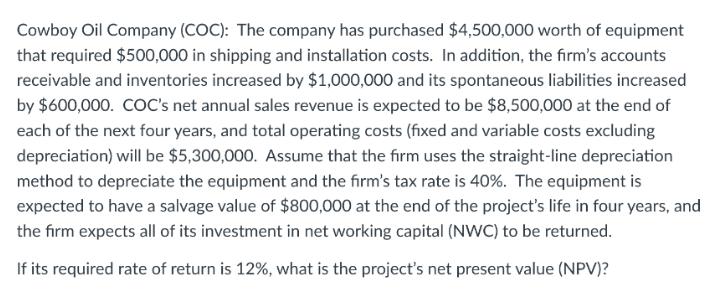

Cowboy Oil Company (COC): The company has purchased $4,500,000 worth of equipment that required $500,000 in shipping and installation costs. In addition, the firm's accounts receivable and inventories increased by $1,000,000 and its spontaneous liabilities increased by $600,000. COC's net annual sales revenue is expected to be $8,500,000 at the end of each of the next four years, and total operating costs (fixed and variable costs excluding depreciation) will be $5,300,000. Assume that the firm uses the straight-line depreciation method to depreciate the equipment and the firm's tax rate is 40%. The equipment is expected to have a salvage value of $800,000 at the end of the project's life in four years, and the firm expects all of its investment in net working capital (NWC) to be returned. If its required rate of return is 12%, what is the project's net present value (NPV)?

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net present value NPV we need to determine the cash flows for each year and discoun...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started