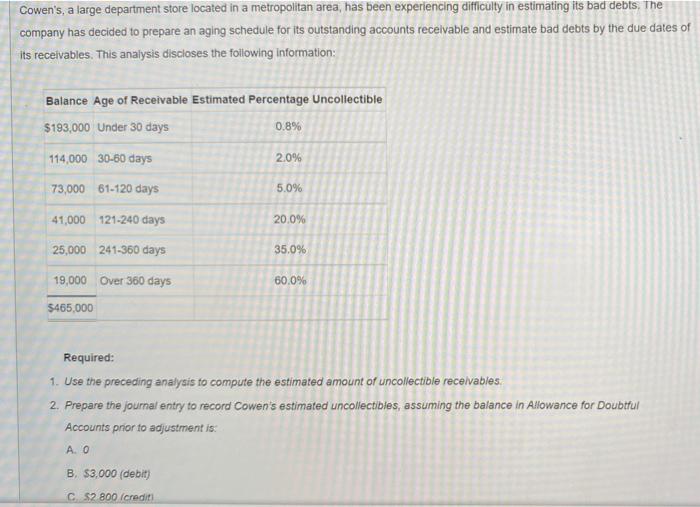

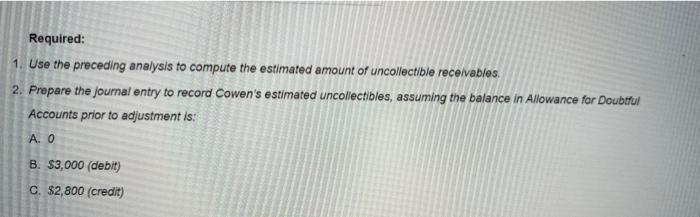

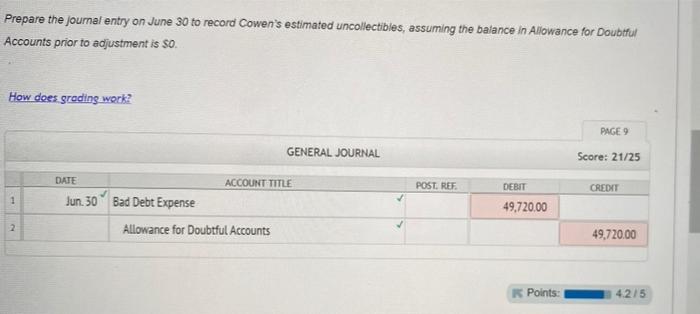

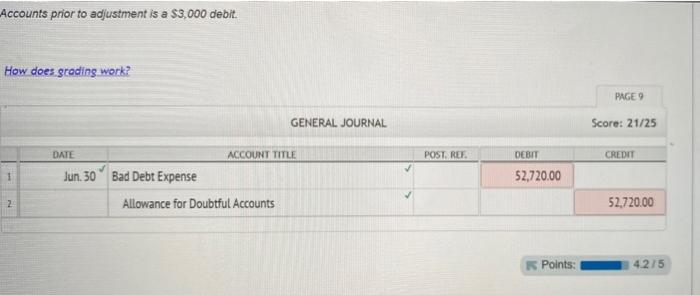

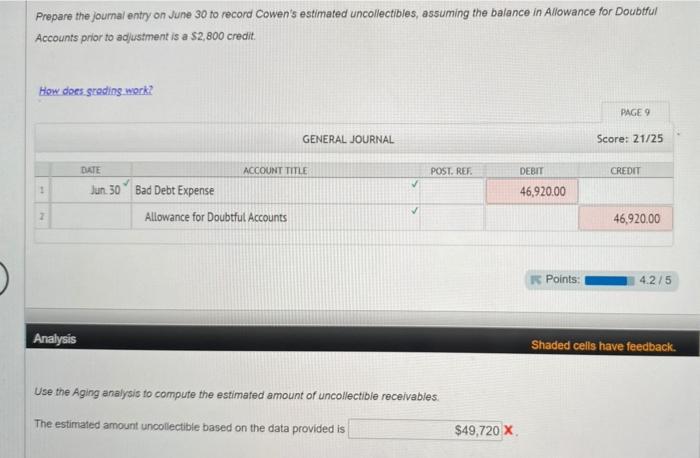

Cowen's, a large department store located in a metropolitan area, has been experiencing difficulty in estimating its bad debts, The company has decided to prepare an aging schedule for its outstanding accounts receivable and estimate bad debts by the due dates of its receivables. This analysis discloses the following information: Balance Age of Receivable Estimated Percentage Uncollectible $193,000 Under 30 days 0.8% 114,000 30-60 days 2.0% 73,000 61-120 days 5.0% 41,000121-240 days 20.0% 25,000 241-360 days 35.0% 19,000 Over 360 days 60.0% $465,000 Required: 1. Use the preceding analysis to compute the estimated amount of uncollectible receivables. 2. Prepare the journal entry to record Cowen's estimated uncollectibles, assuming the balance in Allowance for Doubtful Accounts prior to adjustment is: A. O B. $3.000 (debit) CS2 800 (credit Required: 1. Use the preceding analysis to compute the estimated amount of uncollectible receivables. 2. Prepare the journal entry to record Cowen's estimated uncollectibles, assuming the balance in Allowance for Doubtful Accounts prior to adjustment is: A. O B. $3,000 (debit) C. $2,800 (credit) Prepare the journal entry on June 30 to record Cowen's estimated uncollectibles, assuming the balance in Allowance for Doubtful Accounts prior to adjustment is $0. How does grading work? PAGE 9 GENERAL JOURNAL Score: 21/25 POST. REF: CREDIT 1 DATE ACCOUNT TITLE Jun 30 Bad Debt Expense Allowance for Doubtful Accounts DEBIT 49,720.00 2 49,720.00 Points: 4.215 Accounts prior to adjustment is a $3.000 debit. How does grading work? PAGE 9 GENERAL JOURNAL Score: 21/25 DATE ACCOUNT TITLE POST. REF DEBIT CREDIT 1 52,720.00 Jun 30 Bad Debt Expense Allowance for Doubtful Accounts 2 52.720.00 Points: 42/5 Prepare the journal entry on June 30 to record Cowen's estimated uncollectibles, assuming the balance in Allowance for Doubtful Accounts prior to adjustment is a $2,800 credit. a How does.sreding work? PAGE 9 GENERAL JOURNAL Score: 21/25 DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT . Jun 50 Bad Debt Expense 46,920.00 2 Allowance for Doubtful Accounts 46,920.00 Points: 4.2/5 Analysis Shaded cells have feedback. Use the Aging analysis to compute the estimated amount of uncollectible receivables. The estimated amount uncollectible based on the data provided is $49,720 X