Question

CPA, the relevant costing information that you need to perform your analysis is noted below for the semi-conductor chips. Feel free to refer to Appendix

CPA, the relevant costing information that you need to perform your analysis is noted below for the semi-conductor chips. Feel free to refer to Appendix I for actual sales and budgeted sales information for the semi-conductor chips.

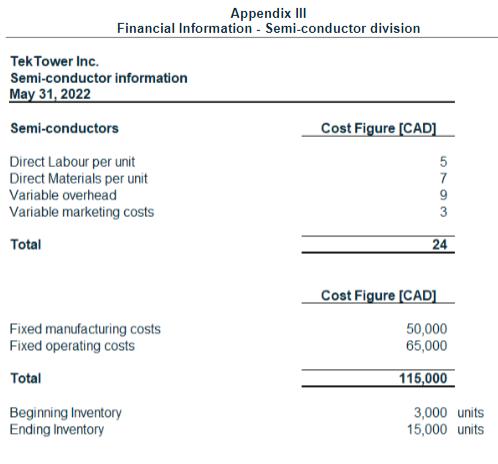

This year, we implemented management bonus plan for the semi-conductor division, where the supervisors are rewarded based on gross margin under absorption costing. Ever since we announced this bonus plan, we noted an abnormal amount of build-up in our semi-conductor chip inventory. Can you determine what our operating income would be between absorption costing and variable costing? Is there a reason why there is an inventory build-up? How can this be rectified? I have provided you the information in Appendix III.

Appendix III Financial Information - Semi-conductor division Tek Tower Inc. Semi-conductor information May 31, 2022 Semi-conductors Direct Labour per unit Direct Materials per unit Variable overhead Variable marketing costs Total Fixed manufacturing costs Fixed operating costs Total Beginning Inventory Ending Inventory Cost Figure [CAD] 5 7 9 3 24 Cost Figure [CAD] 50,000 65,000 115,000 3,000 units 15,000 units

Step by Step Solution

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started