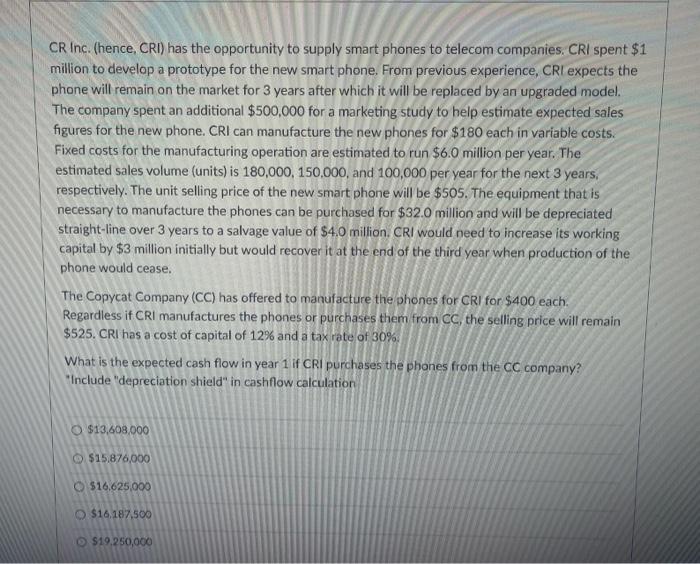

CR Inc. (hence, CRI) has the opportunity to supply smart phones to telecom companies. CRI spent $1 million to develop a prototype for the new smart phone. From previous experience, CRI expects the phone will remain on the market for 3 years after which it will be replaced by an upgraded model. The company spent an additional $500,000 for a marketing study to help estimate expected sales figures for the new phone. CRI can manufacture the new phones for $180 each in variable costs. Fixed costs for the manufacturing operation are estimated to run $6.0 million per year. The estimated sales volume (units) is 180,000, 150,000, and 100,000 per year for the next 3 years, respectively. The unit selling price of the new smart phone will be $505. The equipment that is necessary to manufacture the phones can be purchased for $32.0 million and will be depreciated straight-line over 3 years to a salvage value of $4.0 million. CRI would need to increase its working capital by $3 million initially but would recover it at the end of the third year when production of the phone would cease. The Copycat Company (CC) has offered to manufacture the phones for CRI for $400 each. Regardless if CRI manufactures the phones or purchases them from CC, the selling price will remain $525. CRI has a cost of capital of 12% and a tax rate of 30% What is the expected cash flow in year 1 if CRI purchases the phones from the CC company? "Include "depreciation shield" in cashflow calculation $13,608.000 $15,876,000 O $16,625,000 $16,187,500 $19.250,000 CR Inc. (hence, CRI) has the opportunity to supply smart phones to telecom companies. CRI spent $1 million to develop a prototype for the new smart phone. From previous experience, CRI expects the phone will remain on the market for 3 years after which it will be replaced by an upgraded model. The company spent an additional $500,000 for a marketing study to help estimate expected sales figures for the new phone. CRI can manufacture the new phones for $180 each in variable costs. Fixed costs for the manufacturing operation are estimated to run $6.0 million per year. The estimated sales volume (units) is 180,000, 150,000, and 100,000 per year for the next 3 years, respectively. The unit selling price of the new smart phone will be $505. The equipment that is necessary to manufacture the phones can be purchased for $32.0 million and will be depreciated straight-line over 3 years to a salvage value of $4.0 million. CRI would need to increase its working capital by $3 million initially but would recover it at the end of the third year when production of the phone would cease. The Copycat Company (CC) has offered to manufacture the phones for CRI for $400 each. Regardless if CRI manufactures the phones or purchases them from CC, the selling price will remain $525. CRI has a cost of capital of 12% and a tax rate of 30% What is the expected cash flow in year 1 if CRI purchases the phones from the CC company? "Include "depreciation shield" in cashflow calculation $13,608.000 $15,876,000 O $16,625,000 $16,187,500 $19.250,000