Answered step by step

Verified Expert Solution

Question

1 Approved Answer

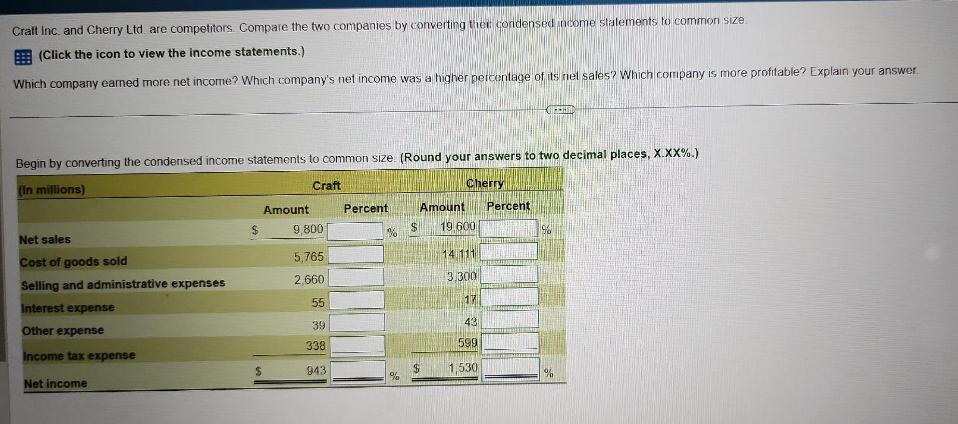

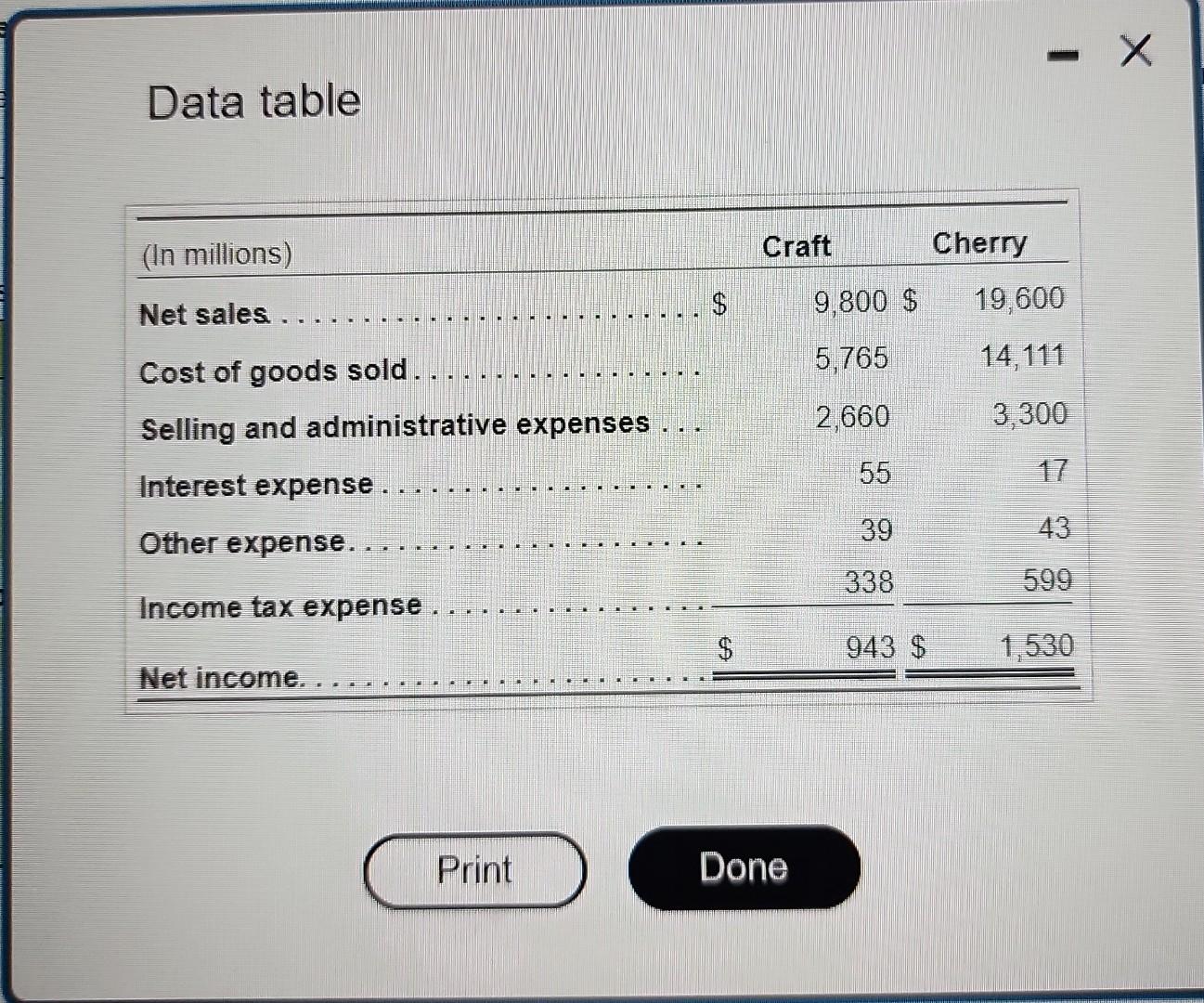

Craft Inc. and Cherry Ltd are competitors. Compare the two companies by converting their condensed income statements to common size (Click the icon to

Craft Inc. and Cherry Ltd are competitors. Compare the two companies by converting their condensed income statements to common size (Click the icon to view the income statements.) Which company earned more net income? Which company's net income was a higher percentage of its net sales? Which company is more profitable? Explain your answer Begin by converting the condensed income statements to common size. (Round your answers to two decimal places, X.XX%.) (In millions) Net sales Cost of goods sold Selling and administrative expenses Interest expense Other expense Income tax expense Net income $ S Amount Craft 9,800 5,765 2,660 55 39 338 943 Percent % Cherry Amount Percent $ 19.600 14 111 3,300 17 43 599 1,530 --HOID % 196 Data table (In millions) Net sales... Cost of goods sold.. Selling and administrative expenses.. Interest expense. Other expense. Income tax expense. Net income. Print $ Craft Done 9,800 5,765 2,660 55 39 338 943 $ $ Cherry - 19,600 14,111 3,300 17 43 599 1,530 X

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started